(Al Jazerra, 22.May.2023) — It was a Sunday in late February, and Eduardo Mendúa was doing what he was famous for: organising against the oil drilling that had transformed his ancestral...

(Energy Analytics Institute, 7.Jul.2022) — EP PetroEcuador will spend $321mn to import 2,240,000 barrels of Premium Diesel from Trafigura Pte. Ltd., which presented a differential of +$5.62 per barrel in...

(Energy Analytics Institute, 1.Jul.2022) — Energy briefs including Ecuador’s state oil giant EP PetroEcuador eying recovery by the end of July 2022 of all the production lost at its fields...

(Energy Analytics Institute, 25.Jun.2022) — Ongoing social unrest, which started on 13 June 2022, in Ecuador’s Amazon region has led to the closure of oil wells and consequently has led...

(Energy Analytics Institute, 20.Jun.2022) — Social unrest in Ecuador is again impacting the operations of state owned EP PetroEcuador in the Amazon region of the South American country. After eight...

(Reuters, 18.Jun.2022) — Ecuador's state-owned oil company Petroecuador declared force majeure late on Saturday over the impact of protests against the government's social and economic policies in the Andean country,...

(Reuters, 17.Jun.2022) — Ecuador oil company Petroecuador says it is working to shut down gas flares in the Amazon to comply with a court-imposed deadline, but progress is too slow...

(Energy Analytics Institute, 9.Jun.2022) — Ecuador’s state-owned EP PetroEcuador is eying a bidding process to select a strategic partner to develop Block 6 in the Gulf of Guayaquil. PetroEcuador is...

(Energy Analytics Institute, 18.Apr.2022) — Energy briefs including Mexico's Chamber of Deputies approving the Mining Law reform, which reserves exploration, exploitation and use of lithium to the state; Argentina’s inflation...

(Energy Analytics Institute, 9.Apr.2022) — Energy briefs including Argentina granting the El Trapial Este hydrocarbon concession to Chevron; and EP PetroEcuador reporting average production of 372,609 b/d in 2021. LATIN...

(Energy Analytics Institute, 6.Apr.2022) — Energy briefs including Caracas-based Econanalitica is forecasting Venezuela’s oil production and oil income will grow in 2022 vs 2021 under three different scenarios; Argentina’s Economic...

(Energy Analytics Institute, 31.Mar.2022) — Energy briefs including the US Energy Department saying it is ready to execute the president of the United States’ authorization of an immediate release of...

(Frontera, 24.Mar.2022) — Frontera Energy Corporation (TSX: FEC) has discovered 27.2 degree API light crude oil at the Tui-1 exploration well on the Perico block (Frontera 50% W.I. and operator)...

(Bloomberg, 16.Mar.2022) — U.S. refiners Valero Energy Corp and Marathon Petroleum Corp., along with Shell Plc’s trading unit Shell Western Supply and Trading, are rushing to secure Ecuadorian barrels after America banned imports...

(Energy Analytics Institute, 10.Mar.2022) — Energy briefs including Ecuador’s state-owned EP PetroEcuador laying out plans for investments of $12bn to almost double production to 804,323 boe/d by2026; Venezuela’s VP Delcy...

(Energy Analytics Institute, 4.Feb.2022) — Energy briefs including Colombia signing a MOU w/ The Netherlands to create a hydrogen export channel; Venezuela’s President Nicolás Maduro saying there will be no...

(Energy Analytics Institute, 3.Feb.2022) — Energy briefs including Grupo Energía Bogotá commencing assembly of the first tower of its north project in Chocontá (Cundinamarca); Argentina’s President Alberto Fernandez visiting Russia...

(Energy Analytics Institute, 31.Jan.2022) — Energy briefs including EP PetroEcuador and Abastecedora Ecuatoriana de Combustibles S.A. (ABASTIBLES S.A.) signing a petroleum products contract; shares of Frontera Energy and CGX Energy...

(Reuters, 19.Jan.2022) — Ecuador's state-owned oil company, Petroecuador, is targeting average output of 425,000 barrels of oil equivalent per day (boed) by the end of 2022, manager Italo Cedeno said...

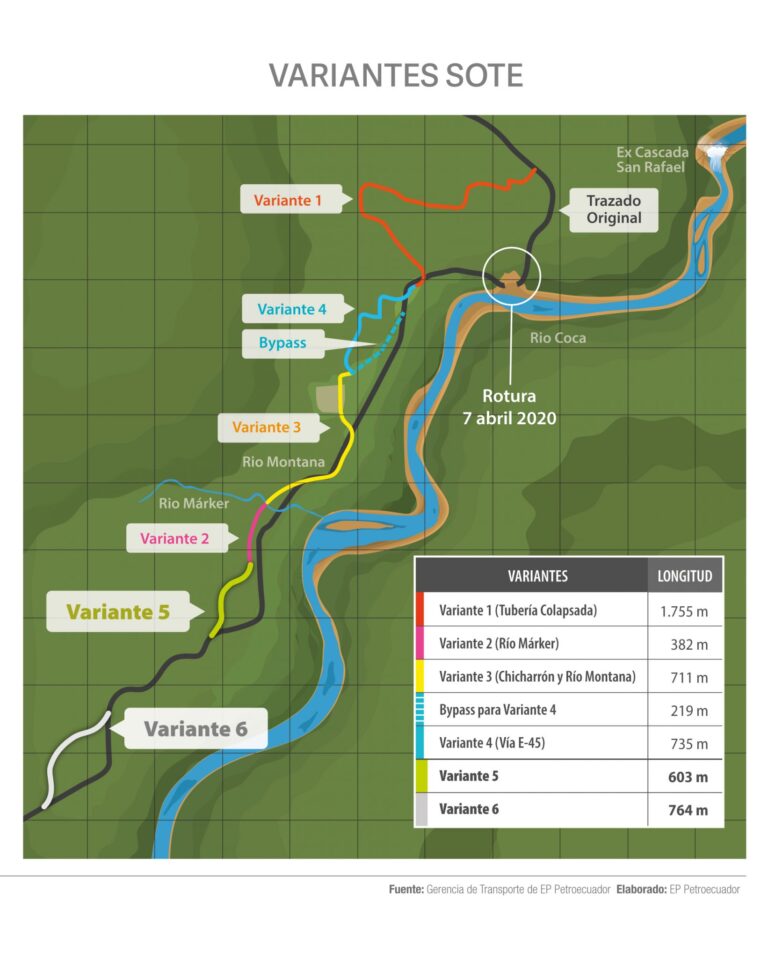

(Energy Analytics Institute, 15.Jan.2022) — EP PetroEcuador continues with work on a seventh bypass for the Trans-Ecuadorian Oil Pipeline System (SOTE) aimed at protecting the infrastructure and avoiding further stoppages...

(Energy Analytics Institute, 6.Jan.2022) — Energy briefs including Bolivia’s urea production gaining mkt shr in Argentina, Brazil and Peru in less than 4 mths; Chile building more than 6,600MW of...

(Energy Analytics Institute, 6.Jan.2022) — Ecuador’s oil production has returned to 93% of levels seen before preventive stoppages were executed at the country’s oil and product pipelines in early-December 2021...

(S&P Global Platts, 3.Jan.2022) — Ecuador's oil and gas industry is on track for a busy year of privatization and E&P contract overhauls in 2022 as President Guillermo Lasso seeks...

(Energy Analytics Institute, 14.Dec.2021) — Energy briefs including EP PetroEcuador announcing it has sufficient fuel supplies at all its terminals despite transport issues impacting Ecuador’s two oil pipelines and one...

(Bloomberg, 13.Dec.2021) — Ecuador declared force majeure on all oil contracts, including exports and imports, as the threat of soil erosion forced the shutdown of the country’s two pipelines that...

(Energy Analytics Institute, 13.Oct.2021) — Energy briefs including the IMF advising Argentina to lower its deficit and estimating Venezuela’s inflation at 2,700% this yr, Colombia’s mines and energy minister Diego...

(Energy Analytics Institute, 6.Oct.2021) — Energy briefs including Brazil’s ANP holding its 17th bid round; Ecuador’s oil production holding steady; Panama’s Generadora Gatún natural gas power plant expecting to start...

(Energy Analytics Institute, 9.Aug.2021) — Energy briefs from the Latin America and Caribbean region including: Argentina fining Edesur and Edenor; Transportadora de Gas Internacional (TGI) eyes developing Colombia’s second liquefied...

(Energy Analytics Institute, 5.Aug.2021) — Energy briefs from the Latin America and Caribbean region including: Argentina’s YPF Sociedad Anónima repurchasing Class XII Notes, YPFB and Ambar Energía Ltda. inking a...

(Energy Analytics Institute, 5.Jul.2021) — Energy briefs from the Latin America and Caribbean region including: plans to reactivate 77 wells in Argentina’s Río Negro region, EP PetroEcuador and Repsol Ecuador...

(Reuters, 1.Jul.2021) — Two dozen workers using six excavators cleared a strip of heavy forest in the foothills of Ecuador's Reventador volcano on an overcast June morning, rushing to carve...

(Reuters, 30.Jun.2021) — Swiss prosecutors said on Wednesday they are investigating whether bribery, money laundering or other crimes linked to Ecuador oil trading were committed in Switzerland following a U.S....

(Energy Analytics Institute, 29.Jun.2021) — Energy briefs from the Latin America and Caribbean region including: Chile and Germany inking a green hydrogen deal, EP PetroEcuador reaching an agreement with the...

(Reuters, 28.Jun.2021) — Ecuador for the first time on Monday exported a cargo of one of its flagship crudes, Oriente, aboard a very large crude carrier (VLCC), following an upgrade...

(Energy Analytics Institute, 2.Jun.2021) — Energy briefs from the Latin America and Caribbean region including: EP PetroEcuador generating $768mn thru ten tenders of Oriente and Napo crude oil between January...

(Energy Analytics Institute, 2.Jun.2021) — EP PetroEcuador will hold two new spot sales on 3 June 2021, including one for the export of 2,160,000 barrels of Oriente crude oil and...

(Reuters, 15.May.2021) — An indigenous community in Ecuador's Amazon region is blocking access to one of state oil company Petroecuador's main fields in a protest over compensation, prompting the company...

(Energy Analytics Institute, 17.Apr.2021) — EP Petroecuador awarded Singapore’s Trafigura PTE. LTD. an export deal for 1,900,000 barrels of Fuel Oil No. 6. The volume offered will be exported in...

(Energy Analytics Institute, 15.Apr.2021) — EP PetroEcuador offered Ecuador’s attorney general's office access to all the necessary facilities it sees fit to collect any type of information requested as part...

(Energy Analytics Institute, 13.Apr.2021) — Energy briefs from the Latin America and Caribbean region including: Guillermo Lasso Mendoza winning Ecuador’s run-off election and Andean oil producer Ecuador pumping around 495,438...

(Bloomberg, 11.Apr.2021) — Ecuadorean bonds rallied after career banker Guillermo Lasso won the presidential election with a late surge in support, reassuring investors in the default-prone country and shoring up...

(Energy Analytics Institute, 11.Apr.2021) — EP PetroEcuador awarded the Thai company Tipco Asphalt Public Company Limited a deal for the export of 720,000 barrels of Napo crude. The barrels will...

(Energy Analytics Institute, 10.Apr.2021) — EP PetroEcuador awarded an export deal for 1,080,000 barrels of Oriente crude to Singapore company Trafigura PTE. LTD. The volume offered will be exported in...

(Energy Analytics Institute, 8.Apr.2021) — One year after the rupture of the Trans-Ecuadorian Pipeline System (SOTE), the Shushufindi-Quito Products Pipeline, operated by EP PetroEcuador, and the Heavy Crude Oil Pipeline...

(Energy Analytics Institute, 5.Apr.2021) — During the first quarter of 2021, EP PetroEcuador dispatched 516.72 million gallons of fuel including Super, Extra, Ecopaís, Artisanal Fishing and Diesel to Ecuador's automotive...

(Energy Analytics Institute, 24.Mar.2021) — Energy briefs from the Latin America and Caribbean region including: Argentina’s Cristina Kircher insisting the International Monetary Fund (IMF) give Argentina lower debt rates, the...

(Energy Analytics Institute, 21.Mar.2021) — Energy briefs from the Latin America and Caribbean region including: Venezuela state oil giant denouncing an attack on a pipeline in Monagas state and EP...

(Energy Analytics Institute, 10.Feb.2021) — Ecuador’s state oil company EP PetroEcuador announced details of its Energy Efficiency Program, which uses associated gas for electricity generation to optimize resources and minimize...

(Energy Analytics Institute, 5.Feb.2021) — EP PetroEcuador has commenced preventive work to protect the integrity of the Trans-Ecuadorian Pipeline System (SOTE) with construction of two additional variants to the four...

(Energy Analytics Institute, 4.Jan.2021) — The long awaited merger of Ecuador’s two state oil and gas entities EP PetroEcuador and PetroAmazonas EP was approved by the South American country’s President...

(Energy Analytics Institute, 8.Dec.2020) — Ecuador’s state entity EP PetroEcuador awarded Trafigura Pte. Ltd. a deal to import 2,800,000 barrels of premium diesel. Trafigura won the deal with a differential...

(Energy Analytics Institute, 6.Dec.2020) — EP PetroEcuador will exclude Vitol Inc. from its list of suppliers due to the recent corruption case under investigation in the United States with respect...

(Energy Analytics Institute, 5.Dec.2020) — Representatives of insurance companies Latina and Hispana resolved to join forces and present a single offer to safeguard the integrity and safety of the people,...

(Energy Analytics Institute, 2.Dec.2020) — Ecuador’s state entity EP PetroEcuador awarded Novum Energy Trading Corp. a deal to import 1,260,000 barrels of cutter stock. Novum won the deal with a...

(Energy Analytics Institute, 26.Nov.2020) — EP PetroEcuador General Manager Ricardo Merino was appointed Chairman of the Board of the Association of Oil, Gas and Biofuel Companies in Latin America and...

(Energy Analytics Institute, 24.Nov.2020) — Maintenance work at the non-catalytic units #2 and #3 of the Las Esmeraldas Refinery included repair work on the static, rotating, and electrical equipment as...

(Energy Analytics Institute, 24.Nov.2020) — EP PetroEcuador general manager Ricardo Merino supervised scheduled maintenance work at the non-catalytic units 2 and 3 of the Esmeraldas Refinery. Work on the units...

(Energy Analytics Institute, 19.Nov.2020) — EP PetroEcuador general manager Ricardo Merino and Esmeraldas prefect Roberta Zambrano participated in the start of road rehabilitation work along the Vuelta Larga, Tabiazo and...

(Energy Analytics Institute, 12.Nov.2020) — Ecuador’s state oil and gas company EP PetroEcuador awarded an $54.8mn insurance to Hispana de Seguros to cover all oil risks as well as maritime...

(Energy Analytics Institute, 3.Nov.2020) — The CEOs of Ecuador state oil entities EP PetroEcuador, Ricardo Merino, and PetroAmazonas EP, Juan Carlos Bermeo, resigned within a 24-hour period over the weekend,...

(Reuters, 2.Nov.2020) — The chief executives of Ecuador’s two state-owned oil companies resigned over the weekend ahead of a planned merger of the two firms, the country’s energy ministry said...

(Energy Analytics Institute, 29.Oct.2020) — EP PetroEcuador conducted 14 crude oil spot sales between 2017 and 2020, daily newspaper El Universo reported 29 October 2020. Details from Ecuador’s Energy Ministry...

(Energy Analytics Institute, 29.Oct.2020) — Ecuador eyes suspending spot sales of crude oil during 2021 and 2022 with the aim of resuming them in 2023, daily newspaper El Universo reported...

(Energy Analytics Institute, 28.Oct.2020) — EP PetroEcuador finalized scheduled maintenance at the Shushufindi Gas Plant located in the Sucumbíos province. Work activities took place over 14 days and included an...

(Energy Analytics Institute, 18.Oct.2020) — EP PetroEcuador restarted operations at the 360,000 barrel per day capacity Trans-Ecuadorian Pipeline System (SOTE by its Spanish acronym) after completion of construction works on...

(Energy Analytics Institute, 12.Oct.2020) — EP PetroEcuador initiated the ISO 37001 certification process for an anti-bribery management system, which in its initial stage targets the contracting and purchasing processes at...

(Energy Analytics Institute, 7.Oct.2020) — Ecuador is suing CNO SA, formerly known as Construtura Norberto Odebrecht SA, for $281mn for breach of the construction contract for the pipeline Pascuales Cuenca...

(Bloomberg, 22.Sep.2020) — A former manager at Vitol Group, the world’s largest independent oil-trading firm, was indicted for allegedly bribing Ecuadorian government officials to get business for his firm with...

(Energy Analytics Institute, 17.Sep.2020) — Personnel from EP PetroEcuador participated in a fire drill conducted in the port of Jaramijó in Manabí. Source: EP PetroEcuador Source: EP PetroEcuador Source: EP...

(Energy Analytics Institute, 2.Sep.2020) — Ecuador’s Ministry of Energy and Non-Renewable Natural Resources (MENRNR) announced new appointments at EP PetroEcuador and SCAN. Merino Avendaño Appointed New EP PetroEcuador General Manger...

(Energy Analytics Institute, 1.Sep.2020) — South America’s Ecuador, formerly a member of the Organization of Petroleum Exporting Countries (OPEC), announced production of crude oil reached 512,439 barrels per day on...

(Energy Analytics Institute, 28.Aug.2020) — Ecuador’s state oil and gas entities EP PetroEcuador and PetroAmazonas EP have been given the go ahead for a merger that will go into effect...

(Energy Analytics Institute, 26.Aug.2020) — EP PetroEcuador held the last spot tender of the year, and in so doing awarded the export of 5,400,000 +/- 5% barrels of Napo crude...

(Energy Analytics Institute, 25.Aug.2020) — EP PetroEcuador awarded the importation of 2,950,000 barrels of High-Octane Naphtha (NAO) RON 93 to Trafigura Pte, which won the auction offering a differential of...

(Energy Analytics Institute, 15.Aug.2020) — EP PetroEcuador, through the Suez-Ecuambiente consortium, obtained cross-border permits from Panama and France, as well as authorization from the Ministry of the Environment and Water...