(BTU Analytics, 23.Apr.2024) — Historically, more than half of Mexico’s heavy sour crude oil exports, mostly Maya blend, end up in the U.S., which is key for refining along the Gulf Coast, also known as PADD 3. However, recent reports suggest Mexico’s national oil company, Petróleos Mexicanos (Pemex), could cut more than 400 Mb/d of Maya blend crude exports to the U.S., Europe, and Asia over the next several months in a bid to boost the supply of refined products domestically. Together with the U.S.’ reintroduced sanctions on the Venezuelan oil and gas sector, these developments could force Gulf Coast refiners to source heavier crude from farther afield and likely add upward pressure on heavy sour crude prices.

Mexico production of heavy sour crude

Mexico plans to reduce exports of its heavy sour crude with the aim of increasing domestic supplies of petroleum products, a move that will be helped even more by the recently constructed Olmeca refinery coming online. According to the Mexican government, the Olmeca refinery can process up to 340 Mb/d of crude and started ramping up production in February 2024.

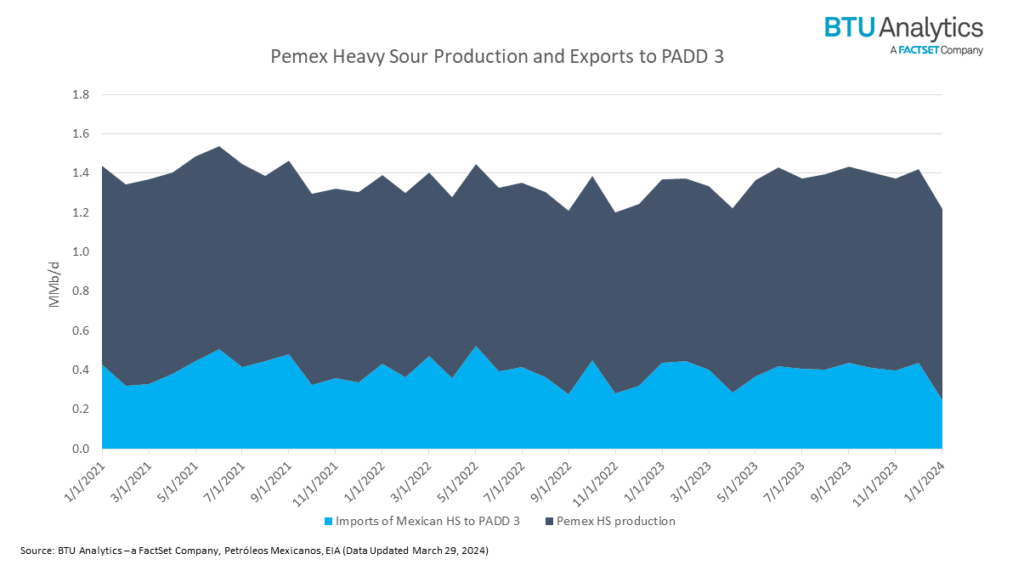

Production of heavy sour crude in Mexico has been on the decline since June 2023. Average production in February 2024 was down 43 Mb/d from the recent high of 1.0 MMb/d in June 2023, according to Pemex production data. Also, according to Pemex, the last time Mexico’s heavy sour crude production was above 1.0 MMb/d was July 2021.

The U.S. and heavy sour crude

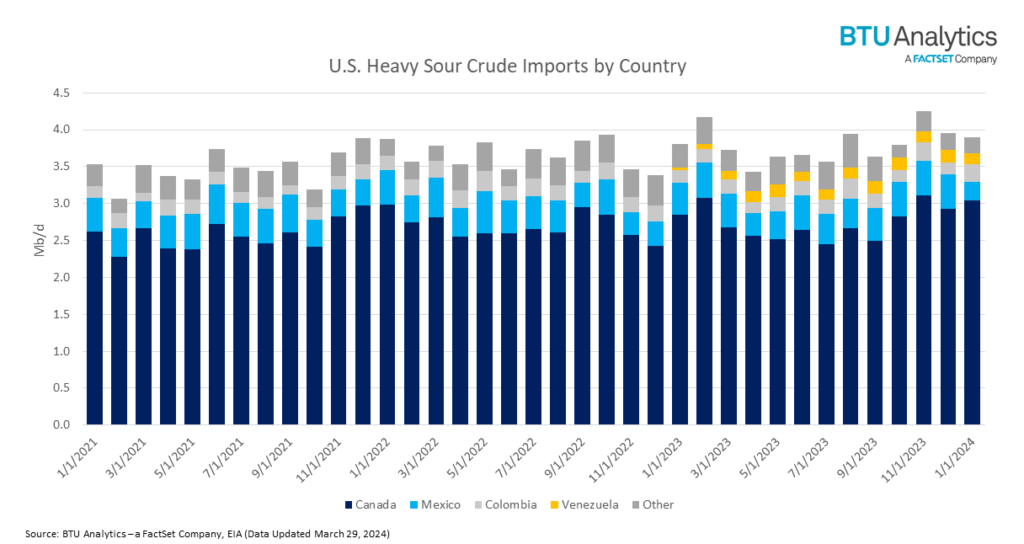

The U.S. imported an average of 3.7 MMb/d of heavy sour crude in 2023, according to the EIA. Of those volumes, the largest source was Canada, averaging 2.7 MMb/d, followed by Mexico at 431 Mb/d. However, Mexican exports of heavy sour crude to PADD 3 have been decreasing, with January 2024 showing a MoM decline of 188 Mb/d, the largest MoM decline going back to January 2021. Conversely, imports from Venezuela restarted in January 2023 and have increased to as much as 166 Mb/d in October 2023. Whether this trend continues though is unclear since on April 18, the U.S. Treasury’s Office for Foreign Asset Control put some sanctions back in place for the Venezuelan oil and gas sector. Although, Chevron’s license to operate in the country was excluded.

While the majority of Canadian heavy crude exported to the U.S. ends up in PADD 2 (the Midwest), imports to PADD 3 averaged 280 Mb/d in 2023, mostly via pipeline, but some also arrived by rail. PADD 3 imports of heavy sour crude from Mexico were down 188 Mb/d to 248 Mb/d in January 2024, and total PADD 3 imports of heavy sour crude were down 243 Mb/d for the same month.

If Mexican exports continue to be below “normal” levels, PADD 3 refiners will have to source heavy sour crude from other countries, leading to an increase in transportation costs paid. Increasing exports from Canada would be difficult given already constrained pipelines, and shipments by sea would not only be more costly, but face issues given the limitations in transiting the Panama Canal, which is how crude transported on the Trans Mountain expansion would arrive. All of this could put upward pressure on the price of heavy sour grades, such as Mars Blend (produced in the Gulf of Mexico), at least in the near term.

____________________

By Max Wheeler