(Petrobras, 25.Jul.2024) — This week, Petrobras sold a marine fuel with renewable content (the VLS B24) to supply ships off the Brazilian coast. Petrobras is the country's first company to deliver a...

(Petrobras, 19.Jul.2024) — Petrobras has successfully finished a series of industrial-scale tests to produce a Light Hydrocarbon Stream (LHR) rich in ethylene, incorporating renewable content. Over the past year, this project, in...

(Petrobras, 19.Jul.2024) — Petrobras, following up on the release disclosed on 17 June 2024, informs that obtained the approval of partners in E&P consortiums for reimbursement to Petrobras related to adherence to...

(World Bank, 17.Jul.2024) — The World Bank Group released a study on “Scenarios for Offshore Wind Development in Brazil” conducted by DNV, the global independent energy expert and assurance provider. This report...

(Petrobras, 15.Jul.2024) — In the second quarter of this year, the Presidente Bernardes Refinery (RPBC) in Cubatão (SP) recorded a record in the production of S-10 diesel. It produced 990,000 m³,...

(Petrobras, 11.Jul.2024) — Petrobras obtained authorization from the National Agency of Petroleum, Natural Gas and Biofuels (ANP) to market maritime fuel with renewable content. The company is the first in...

(AP, 11.Jul.2024) — From climate change to species loss and pollution, humans have etched their impact on the Earth with such strength and permanence since the middle of the 20th...

(Petrobras, 9.Jul.2024) — Petrobras has signed a Master Agreement with Yara Brasil Fertilizantes S.A. as a next step in its negotiations to structure potential business partnerships in the fertilizer segment, production...

(3R, 5.Jul.2024) — 3R PETROLEUM ÓLEO E GÁS S.A. and Enauta Participações S.A., under the terms of CVM Resolution No. 44, 23 Aug. 2021, regarding the transaction involving the merger...

(Petrobras, 5.Jul.2024) — Petrobras, in continuity to the Material Fact disclosed on 22 May 2024, informs that the Court of the Administrative Council for Economic Defense (CADE) and Petrobras signed an...

(Petrobras, 3.Jul.2024) — Petrobras, in continuity to the Material Fact disclosed on May 22, 2024, informs that the Court of the Administrative Council for Economic Defense (CADE) and Petrobras signed an addendum to...

(Enauta, 1.Jul.2024) — Enauta Participações, considering the Material Fact disclosed on 21 Dec. 2023, informs that it has notified MODEC of the termination of the contract to acquire FPSO Cidade...

(Petrobras, 1.Jul.2024) — Petrobras, following up on the release disclosed on 23 Feb. 2024, in which it reported the signing of the contract for the sale of its 18.8% stake in...

(Energy Analytics Institute, 30.Jun.2024) — Energy briefs as well as others related to finance and projects during June 2024 including Wintershall Dea and its partners from TotalEnergies and Pan American...

(Petrobras, 28.Jun.2024) — Petrobras, following up on the releases disclosed on 29 Dec. 2023 and 5 Feb. 2024, informs that the contract for Industrialization to Order (Tolling) signed with Unigel Group,...

(Petrobras, 28.Jun.2024) — The Petrobras Board of Directors elected the following members to the company's executive board in a meeting held this Friday (06/28): Renata Baruzzi (Executive Director of Engineering, Technology,...

(Petrobras, 21.Jun.2024) — Petrobras, Gerdau, and Naturgy have signed contracts for the supply of natural gas in the free market environment to serve Cosigua, Gerdau's long steel production unit located in...

(Petrobras, 19.Jun.2024) — Petrobras said the FPSO Maria Quitéria is currently en route to Brazil. The platform ship departed from China in May and is expected to arrive at its...

(Ndustrial, 18.Jun.2024) — Ndustrial, the AI-powered energy intensity platform for industry, is expanding its presence throughout Latin America to meet strong customer demand to drive down industrial energy costs and emissions. The company...

(Petrobras, 18.Jun.2024) — Petrobras, on 18 Jun. 2024, signed a Protocol of Intentions with the Government of the State of Rio de Janeiro to carry out joint studies to feasibility...

(Petrobras, 18.Jun.2024) — This month, June, in London, the International Maritime Organization (IMO), connected with the UN through its Sub-Committee on Navigation, Communications and Search and Rescue (NCSR), recommended approving the...

(Petrobras, 17.Jun.2024) — Petrobras, in continuity to the notice to the market disclosed on 8 Apr. 2024, informs that the Board of Directors approved, with 10 (ten) votes in favor,...

(Trendsetter, 13.Jun.2024) — Trendsetter Engineering has been awarded a significant contract by Trident Energy do Brasil to deliver two six-slot production subsea manifolds for the Bonito and Bicudo Fields in...

(Petrobras, 13.Jun.2024) — Petrobras, in continuity with the Material Fact disclos ed on 27 Oct. 2022, informs that, observing the applicable internal governance, the closure of the competitive process for...

(Petrobras, 12.Jun.2024) — Petrobras informs that the Superior Labor Court (TST) ratified, on 12 Jun. 2024, the agreement for the recall of approximately 250 workers by Araucária Nitrogenados S/A (ANSA),...

(Petrobras, 11.Jun.2024) — Petrobras, following the Material Fact of 13 May 2024, informs that, as a result of the share buyback program, there was a change in the number of...

(Oceaneering, 10.Jun.2024) — Oceaneering International, Inc. (NYSE:OII) announced that its Manufactured Products segment has secured two significant contracts with Petroleo Brasileiro S.A. (Petrobras) through a competitive bidding process. The expected...

(Petrobras, 10.Jun.2024) — Petrobras published its 2023 Sustainability Report. The document reports on progress in the company's sustainability commitments and consolidates indicators related to environmental, social and governance (ESG) issues. This...

(Energy Analytics Institute, 7.Jun.2024) — Petrobras´ Board of Directors decided by majority not to accept the shareholders' requests to call an Extraordinary General Meeting ("EGM"), due to the failure to...

(Petrobras, 6.Jun.2024) — To improve the efficiency and safety of deep-water oil and gas activities, Petrobras and Curtiss-Wright have entered into a technological cooperation agreement to design a fully electric, highly...

(Petrobras, 6.Jun.2024) — Petrobras’ Executive Board approved the resumption of operating activities of fertilizer plant Araucária Nitrogenados S.A. (ANSA), a wholly-owned subsidiary of the company. The plant, located in the...

(Petrobras, 5.Jun.2024) — Petrobras signed a Memorandum of Understanding (MoU) with the Chinese Export Credit Agency, Sinosure. The agreement aims to evaluate investment and cooperation opportunities in low-carbon and green...

(Subsea7, 3.Jun.2024) — Subsea7 announced, after a competitive tender process, the award by Petrobras of four long-term day-rate contracts for pipelay support vessels (PLSVs) commencing in 2025. The contracts have a...

(Mitsubishi, 1.Jun.2024) — The consortium formed by Mitsubishi Power Americas, Inc. and CONSAG Engenharia – an Andrade Gutierrez company (CONSAG) – recently signed an agreement with Portocem Geração de Energia...

(Petrobras, 31.May.2024) — Petrobras has received correspondence from minority shareholders of the company requesting the convening of an Extraordinary General Meeting ("EGM") for the election of members of the Board...

(Subsea7, 30.May.2024) — Subsea7 announced the award of a super-major1 contract by Petrobras, after winning a competitive tender, for the development of the Búzios 9 field located approximately 180 kilometres off the...

(TotalEnergies, 27.May.2024) — TotalEnergies, together with the operator Petrobras and their partners in the Atapu and Sépia consortiums, have taken the Final Investment Decision (FID) for the second development phase...

(Petrobras, 27.May.2024) — The platform ship Marechal Duque de Caxias arrived in Brazil on 27 May 2024, from China, heading for the Mero field in the pre-salt Santos Basin. The platform...

(Paratus Energy Services Ltd., 24.May.2024) — Paratus Energy Services Ltd. announced a trading update for the first quarter 2024 and updates on Paratus, its subsidiaries and associated companies ("Paratus Group" or...

(Petrobras, 24.May.2024) — Petrobras, following up on the release published on 22 May 2024, informs that its Board of Directors, at a meeting held today, appointed Magda Chambriard as a member...

(Petrobras, 24.May.2024) — Petrobras signed on 24 May 2024, contracts with Seatrium O&G Americas Limited to acquire the P-84 and P-85 vessel platforms. Both units will be self-owned and installed in...

(Energy Analytics Institute, 18.May.2024) — In 2023, Petrobras was the 4th most profitable oil company. Saudi Arabia's Saudi Aramco remains the leader, on its own, according to Poder 360. Petrobras...

(3R, 15.May.2024) — 3R PETROLEUM ÓLEO E GÁS S.A.(B3: RRRP3), in compliance with the provisions of CVM Resolution No. 44, hereby, in reference to the news published by Pipeline Valor,...

(Bloomberg, 15.May.2024) — Shares of Brazil’s state-owned oil company Petroleo Brasileiro SA declined after President Luiz Inacio Lula da Silva fired Chief Executive Officer Jean Paul Prates following a dispute over dividend payments. Prates’s dismissal...

(Petrobras, 14.May.2024) — Petrobras informs that it received this evening from its CEO, Mr. Jean Paul Prates, a request that the company's Board of Directors meet to consider the early...

(Petrobras, 13.May.2024) — Petrobras informs that its Board of Directors, at a meeting held today, approved the payment of interim dividends and interest on own capital in the amount of...

(Petrobras, 13.May.2024) — In 1Q:24, Petrobras said its net revenue fell 12% compared to 4Q23, mainly influenced by lower revenue from diesel sales in the domestic market and exports. The...

(Petrobras, 13.May.2024) — Petrobras reported a 9% increase in tax payments in the first quarter of 2024 when compared to the same period of 2023, driven by higher ICMS (VAT)...

(Petro-Victory Energy Corp., 9.May.2024) — Petro-Victory Energy Corp. (TSXV: VRY) announced the results of its 2023 year-end reserves evaluation by GLJ, Ltd. The company holds 100% working interest in all forty-one...

(Petrobras, 6.May.2024) — Petrobras informs, according to the notices to the market published on 09/18/2023, 08/22/2023, 08/14/2023 and 07/10/2023, that it is conducting due diligence on Braskem for the possible...

(Petrobras, 29.Apr.2024) — In 1Q24, average production of oil, NGL and natural gas reached 2,776 MMboed, increase of 3.7% when comparing with the same period last year (1Q23). Among the main...

(Energy Analytics Institute, 25.Apr.2024) — On 18 Apr. 2024, Petrobras inked a Memorandum of Understanding (MOU) with the Argentina state energy company Enarsa to study partnerships in the natural gas...

(Petrobras, 22.Apr.2024) — Petrobras informs that it will release its 1Q:24 Production and Sales Report on 29 Apr. 2024, and its 1Q:24 Financial Performance Report on 13 May 2024, both...

(Petrobras, 22.Apr.2024) — Petrobras, in compliance with article 33, item XXXIII, of CVM Resolution 80/22, informs that it received from shareholders who jointly hold more than 5% (five percent) of...

(Petrobras, 22.Apr.2022) — Petrobras, following up on the communication from 20 Mar. 2024 and 3 Apr. 2024, informs that it has received correspondence from a minority shareholder holding preferred shares...

(Energy Analytics Institute, 18.Apr.2024) — Petrobras inked a memorandum of understanding with the China National Chemical Energy Company (CNCEC) covering several areas, especially renewable energies and energy transition. The partnership...

(Petrobras, 18.Apr.2022) — Petrobras, following up on the Material Fact disclosed on 4 Aug. 2023, informs, for the purposes of item 11 of Annex G of CVM Resolution 80/22, that...

(Petrobras, 17.Apr.2024) — Petrobras said its Executive Board approved the sale of its entire stake in the Cherne and Bagre fields, located in shallow waters in the Campos Basin, to...

(Energy Analytics Institute, 16.Apr.2024) — Brazilian energy giant Petrobras said the reporting judge of the 4th Panel of the Federal Regional Court of the 3rd Region issued a decision today...

(SLB, 15.Apr.2024) — SLB (NYSE: SLB) has been awarded three contracts by Petrobras (NYSE: PBR) for completion hardware and services for up to 35 subsea wells in the development of...

(Energy Analytics Institute, 11.Apr.2024) — Brazilian energy giant Petrobras said a precautionary decision was issued on 11 Apr. 2024 in the context of a popular action underway at the 21st...

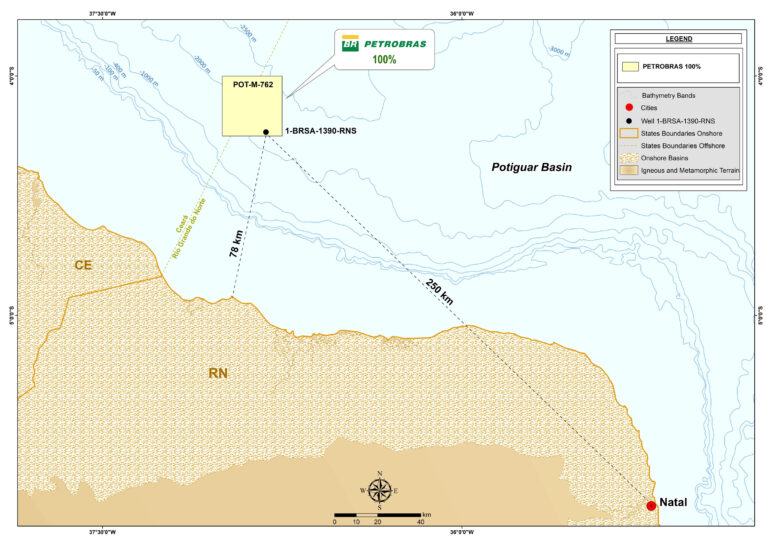

(Petrobras, 9.Apr.2024) — Petrobras has discovered an accumulation of oil in ultra-deep waters of the Potiguar Basin, in the Anhangá exploratory well, of Concession POT-M-762_R15. The 1-BRSA-1390-RNS (Anhangá) well is located...

(Energy Analytics Institute, 8.Apr.2024) — Petrobras said that on 5 Apr. 2024 a precautionary decision was published within the scope of a popular action in progress at the 21st Federal...

(Energy Analytics Institute, 8.Apr.2024) — Petrobras is technically evaluating the draft of the public call for tenders, as is its regular practice whenever alternatives are offered in relation to tax...

(Energy Analytics Institute, 6.Apr.2024) — Brazilian energy giant Petrobras, in regards to recent news published in by the local media in Brazil, clarifies that the payment of extraordinary dividends was...

(Energy Analytics Institute, 4.Apr.2024) — Rio de Janiero-based Petrobras, with regards to news published by the local Brazilian media about the payment of extraordinary dividends, said 4 Apr. 2024 in...

(Petrobras, 3.Apr.2024) — Petrobras, following up on the communication from 20 Mar. 2024, informs that it has received correspondence from minority shareholders holding common shares requesting the replacement of candidates...

(Energy Analytics Institute, 31.Mar.2024) — Energy briefs as well as others related to finance and projects during Mar. 2024 including Argentine inflation reaching 13.2% in Feb. 2024 and trailing 12-month...

(Westlawn Group, 22.Mar.2024) — Westlawn Group LLC and Westlawn Americas Offshore LLC (WAO), a portfolio company of Westlawn, signed a definitive Purchase and Sale Agreement to acquire a 20% working interest...

(Energy Analytics Institute, 22.Mar.2024) — The CERAWeek by S&P Global, held 18-22 Mar. 2024 in Houston, Texas, boasted in attendance 8,100+ delegates (9,400+ when counting staff, vendors etc), a record...

(Petrobras, 20.Mar.2024) — Petrobras, following up on the Material Facts of 11/09/2023, 11/21/2023 and 03/13/2024, announced it will pay today the second installment of dividends relating to the balance sheet...

(Petrobras, 20.Mar.2024) — Petrobras has so far received nominations from the Federal Government (Controlling Shareholder) and Minority Shareholders for the elections to the Board of Directors and Fiscal Council, to...

(Petrobras, 15.Mar.2024) — Petrobras, following up on the release disclosed on 22 Dec. 2023, informs that it is continuing discussions with Mubadala Capital regarding the formation of a downstream partnership...

(Petrobras, 15.Mar.2024) — Petrobras, regarding the article "Controversy puts dialogue between Petrobras and the market in check", published in Valor Econômico this Friday, reiterates that the company did not promise...

(Petrobras, 12.Mar.2024) — Petrobras, regarding the article "Presentation to analysts in NY would have signaled payment of dividends by Petrobras", published in Valor, clarifies that the company did not promise...