(Energy Analytics Institute, 5.Aug.2021) — Energy briefs from the Latin America and Caribbean region including: Argentina’s YPF Sociedad Anónima repurchasing Class XII Notes, YPFB and Ambar Energía Ltda. inking a gas deal and Shell Brazil Holding B.V. marking the start of trading in shares of Raízen S.A., the renewable energy joint venture.

Argentina

— Argentina’s YPF repurchased Class XII Notes (YMCDO) for a total amount of Ps.338,520,000 Argentine pesos equivalent to a par value of $3.5mn, which will be held in its portfolio, the company announced 2 August 2021 in an official statement. The Class XII Notes, which mature in June 2022, were issued by the company in June 2020, under the company’s frequent issuer regime. The repurchase has been made at an average price with accrued interest equivalent to 100.34% of their nominal value.

— Argentina’s state entity YPF will host a second quarter 2021 conference call with analysts and investors on 11 August 2021, the company reported.

Bolivia

— Bolivia’s Vice Minister of Industrialization, Marketing, Transportation and Storage of Hydrocarbons William Donaire asked sugarcane producers to comply with a pre-agreement reached on 7 July 2021, which established delivery of 100 million liters of ethanol and a gradual increase in volumes, the daily La Razón reported 3 August 2021. Sugarcane producers blocked access to the offices of the Ministry of Hydrocarbons and Energies to demand that state owned Yacimiento Petroliferos Fiscales Bolivianos (YPFB) increase the volume of delivered ethanol to 150 million liters, while also demanding payment fulfilled from May for ethanol amounts already delivered to the state company.

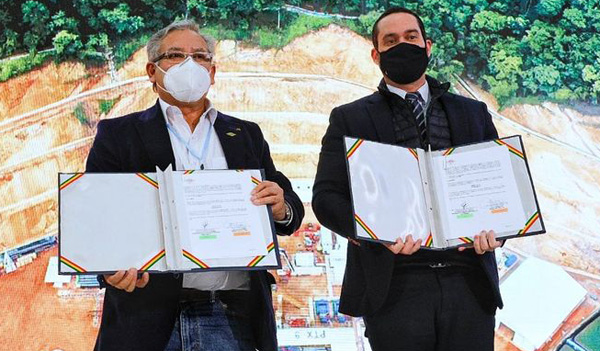

— Bolivia’s state-owned Yacimientos Petrolifos Fiscales Bolivianos (YPFB) President Wilson Zelaya and his counterpart Marcelo Zanatta with Brazil’s Ambar Energía Ltda. Zanatta signed a contract for the sale-purchase of 2.24 million cubic meters per day (MMcm/d) of natural gas from October 2021 to April 2022 with renewal possibilities for one year, the daily La Razón reported 30 July 2021.

— Bolivia launched its 2021 Upstream Reactivation Plan, which entails finding 5 trillion cubic feet (Tcf) of natural gas with estimated investment of $1.4bn, the daily La Razón reported 30 July 2021.

Brazil

— Shell Brazil Holding B.V. marks the start of trading in shares of Raízen S.A., the renewable energy joint venture between Shell and Brazilian energy company Cosan, on the São Paulo Stock Exchange (B3), following the successful execution of an initial public offering (IPO). Under the IPO, 810,811,000 preference shares have been made available to investors, at a price of R$7.40. The IPO has raised R$6.0bn ($1.15bn) to fund Raízen’s growth program.

Ecuador

— EP PetroEcuador issued the ‘Environmentally Responsible Public Procurement’ regulation which aims to develop mandatory compliance instructions for the procurement of goods, construction work and services, including consulting services, carried out by the state oil company. The regulation is mandatory and has two objectives: to make the company more profitable and boost opportunities in an increasingly competitive market and to fulfill Safety, Health and Environment requirements for contractors and the Sustainable Development Goals (ODS), promoted by the United Nations, PetroEcuador reported on 2 August 2021 in an official statement, citing General Manager Pablo Luna.

____________________

By Ian Silverman and Piero Stewart. © Energy Analytics Institute (EAI). All Rights Reserved.