(AP, 11.Jul.2024) — From climate change to species loss and pollution, humans have etched their impact on the Earth with such strength and permanence since the middle of the 20th...

(Energy Chamber, 9.Jul.2024) — The Energy Chamber of Trinidad & Tobago warmly welcomes the news that the final investment decision (FID) has been taken by Shell for the development of the...

(Shell, 9.Jul.2024) — Shell Trinidad and Tobago Ltd., a subsidiary of Shell plc, announced that it has taken Final Investment Decision (FID) on the Manatee project, an undeveloped gas field...

(Black & Veatch, 7.Jun.2024) — Global liquefied natural gas (LNG) infrastructure solutions leader Black & Veatch has completed a feasibility study for the planned Andes Energy Terminal, LNG regasification terminal and...

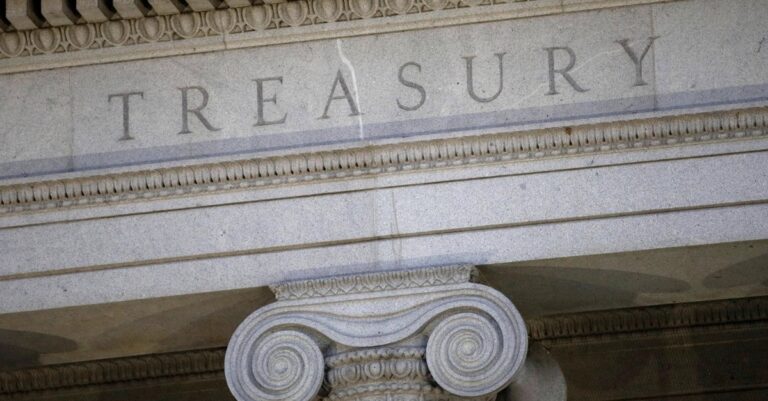

(Reuters, 23.May.2024) — The U.S. has received up to 50 requests for individual licenses from companies aiming to do business in Venezuela's oil industry, following the expiration of a general authorization granted last year...

(Reuters, 14.May.2024) — A Swiss unit of Polish refiner Orlen paid two Dubai-based intermediary companies $330 million for Venezuelan oil, but Venezuela's state oil company PDVSA never received the money,...

(Citgo, 9.May.2024) — Citgo Petroleum Corporation reported its 2024 first quarter financial and operational results. Historically favorable refining margins and strong asset reliability led to first quarter net income of $410mn,...

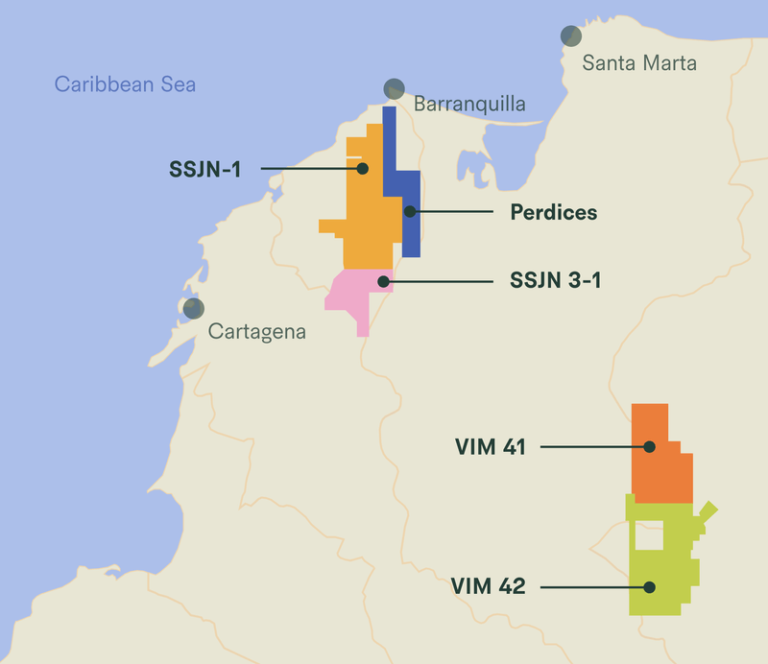

(LNG Group, 30.Apr.2024) — LNG Energy Group Corp. (TSXV: LNGE) (TSXV: LNGE.WT) (OTCQB: LNGNF) (FRA: E26) announced its financial and operating results for the year ended on 31 Dec. 2023. On...

(Energy Analytics Institute, 30.Apr.2024) — Energy briefs as well as others related to finance and projects during April 2024 including ExxonMobil, Hess and CNOOC announcing a $12.7bn FID for their...

(Rystad Energy, 29.Apr.2024) — For President Joe Biden, the situation in Venezuela remains a fly in the ointment, weighing on the administration’s energy and foreign policy. President Nicolas Maduro has...

(Chevron, 26.Apr.2024) — Chevron Corporation (NYSE: CVX) reported earnings of $5.5bn ($2.97/share - diluted) for first quarter 2024, compared with $6.6bn ($3.46/share - diluted) in first quarter 2023. Foreign currency effects...

(LNG Energy Group, 24.Apr.2024) — LNG Energy Group Corp. (TSXV: LNGE) (TSXV: LNGE.WT) (OTCQB: LNGNF) (FRA: E26) announced that its wholly-owned subsidiary, LNGEG Growth I Corp. (LNG Venezuela), entered into...

(AP, 24.Apr.2024) — A company started by a Texas billionaire oilman announced a deal Wednesday with Venezuela’s state-owned oil company to rehabilitate five aging oil fields, days after the Biden...

(BTU Analytics, 23.Apr.2024) — Historically, more than half of Mexico’s heavy sour crude oil exports, mostly Maya blend, end up in the U.S., which is key for refining along the...

(Argus, 17.Apr.2024) — The US administration today reimposed sanctions targeting Venezuela's oil exports and energy sector investments and set a deadline of 31 May for most foreign companies to wind...

(Reuters, 17.Apr.2024) — The expiration of the widest U.S. license so far granted to Venezuela's oil and gas industry will put a ceiling on the South American country's slow crude production...

(Argus, 17.Apr.2024) — Bidders for Citgo's US refining assets have until 11 June to submit offers for the company's 805,000 b/d of refining capacity and associated assets, with a tentative...

(Energy Analytics Institute, 17.Apr.2024) — The U.S. Office of Foreign Assets Control (OFAC) issued General License 44A, which supersedes and replaces General License 44, and authorizes the wind down of...

(S&P Global, 17.Apr.2024) — A few hours before the expiration of a temporary oil and gas sanctions relief license, the governments of Venezuela and the United States continue to negotiate...

(Reuters, 15.Apr.2024) — The U.S. will not renew a temporary license set to expire on Thursday that widely eased sanctions on Venezuela's oil and gas sector, a State Department spokesperson...

(Reuters, 8.Apr.2024) — BP is close to an agreement to sell some of its Trinidad and Tobago oil and gas assets to Anglo-French oil company Perenco, according to three people familiar...

(Rystad Energy, 4.Apr.2024) — As the deadline for US sanctions relief on Venezuela ends on 18 Apr. 2024, the outlook for the South American nation’s oil industry appears uncertain. If...

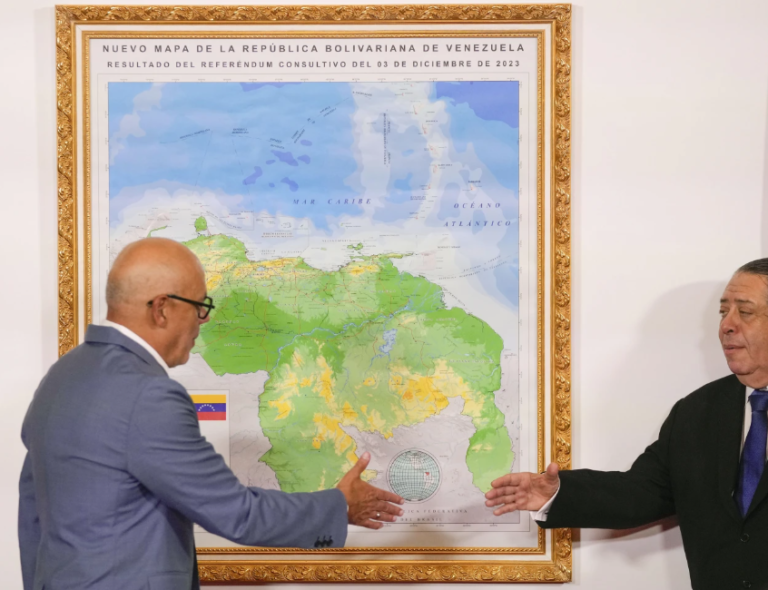

(AFP, 23.Mar.2024) — Caracas has long laid claim to Essequibo, which makes up about two-thirds of Guyana's territory, but started taking active steps to retrieve the land after massive offshore oil...

(AP, 23.Mar.2024) — A former fighter pilot jailed in Venezuela in February for his ties to a prominent human rights attorney is an employee of U.S. oil firm Chevron, The...

(Reuters, 21.Mar.2024) — The government of Trinidad and Tobago has begun talks with the U.S. for a license that would allow the joint development of a natural gas project shared...

(AP, 16.Mar.2024) — It’s her choice — but one on which the hopes of millions of Venezuelans fighting to restore their democracy depends. Barred from running for office, opposition leader...

(Energy Analytics Institute, 14.Mar.2024) — Parties from Trinidad and Tobago and Venezuela met in Caracas, Venezuela on 13 Mar. 2024 to commence engagement, discussions and negotiations related to the cross...

(Hess, 7.Mar.2024) — Today, ExxonMobil announced that it is filing for arbitration regarding the applicability of a right of first refusal (ROFR) / pre-emption provision in the Stabroek joint operating agreement....

(Reuters, 6.Mar.2024) — Exxon Mobil Corp on Wednesday said it filed a contract arbitration claim related to Hess Corp's proposed sale of its Guyana oil properties, and suggested it may counter...

(Energy Analytics Institute, 29.Feb.2024) — The mixed company Petrowarao, S.A. reactivated the A-162 gas condensate well in Zuila state in western Venezuela. The achievement was possible due to major maintenance work...

Energy Analytics Institute, 29.Feb.2024) — Executives with state-owned Petróleos de Venezuela, S.A. (PDVSA) and Chevron Venezuela supervised safety operations at the PDVSA Petropiar, S.A. joint venture as part of scheduled visits...

(Energy Analytics Institute, 28.Feb.2024) — Venezuela’s President Nicolás Maduro said he expects the economy of the Opec country to grow 8% in 2024. The president made the comments during a...

(Energy Analytics Institute, 22.Feb.2024) — Repsol CEO Josu Jon Imaz commented on the Spanish company's operations in Venezuela under Washington's most recent OFAC license. "We are putting the same metrics we...

(Repsol, 22.Feb.2024) — "Over the next four years we will stay the course on the strategy we presented in our previous plan to address the energy transition and we will...

(MEEI, 20.Feb.2024) — In accordance with the National Oil Spill Contingency Plan (NOSCP), the Ministry of Energy and Energy Industries (MEEI) continues to collaborate with the Tobago House of Assembly...

(Energy Analytics Institute, 18.Feb.2024) — Venezuela’s state-owned oil giant Petróleos de Venezuela (PDVSA), which has a total processing capacity of 1.303 million b/d from its six domestic refineries – Amuay,...

(AP, 7.Feb.2024) — ExxonMobil said it plans to explore for oil and gas in a disputed area off South America’s coast where the Venezuelan military had previously expelled two U.S....

(OFAC, 2.Feb.2024) — Actions by Maduro and his representatives in Venezuela, including the arrest of members of the democratic opposition and the barring of candidates from competing in this year’s...

(Energy Analytics Institute, 31.Jan.2024) — Energy briefs as well as others related to finance and projects during Jan. 2024 including Washington reviewing its sanctions policy on Venezuela; QatarEnergy confirming that...

(Energy Analytics Institute, 30.Jan.2024) — US State Department spokesperson Matthew Miller said there’s still time for the Nicolás Maduro regime in Venezuela to change course but said that if they...

(Energy Analytics Institute, 29.Jan.2024) — The US Department of the Treasury's Office of Foreign Assets Control (OFAC) issued Venezuela-related General License 43A on 29 Jan. 2024, which relates to "Authorizing...

(Energy Analytics Institute, 28.Jan.2024) — If the US experiences the return of Donald Trump as president, or if in Venezuela Maria Corina Machado's handpicked successor wins, or both, no one...

(Al Jazeera, 27.Jan.2024) — Venezuela’s Supreme Justice Tribunal has upheld a ban which prevents presidential candidate Maria Corina Machado from holding office, upending the opposition’s plans for elections planned for...

(US State Department, 23.Jan.2024) — The United States is deeply concerned by the issuance of arrest orders and detentions against at least 33 Venezuelans, including members of the democratic opposition,...

(Reuters, 22.Jan.2024) — Trinidad and Tobago has begun talks with some European countries on the supply of liquefied natural gas (LNG) produced from Venezuelan gas, Prime Minister Keith Rowley said...

(Reuters, 19.Jan.2024) — A U.S. court on Friday approved claims by 17 Venezuela-linked creditors, including ConocoPhillips, Rusoro Mining and Koch Industries, to get proceeds from a coming auction of shares...

(Energy Analytics Institute, 16.Jan.2024) — The US Office of Foreign Assets Control (OFAC) authorized certain transactions related to state-owned Petróleos de Venezuela, S.A.'s 2020 8.5% bond on or after 16...

(Reuters, 8.Jan.2023) — A U.S. judge on Monday granted a large group of Venezuela-linked creditors rights to participate and receive proceeds from a coming auction of shares in the parent...

(Reuters, 3.Jan.2023) — Venezuela has agreed to give some oil to India's ONGC Videsh to help it recoup its pending $600 million dividend for a stake in a project in...

(Reuters, 3.Jan.2023) — Venezuela's oil exports increased 12% last year to almost 700,000 barrels per day (bpd) as the United States eased sanctions imposed since 2019 on the OPEC country's...

(Energy Analytics Institute, 31.Dec.2023) — Energy briefs as well as others related to finance and projects during Dec. 2023 including why Venezuela wants to annex the Essequibo; Petrobras acquiring 29...

(Trinidad and Tobago Energy Chamber, 22.Dec.2023) — The Ministry of Energy and Energy Industries has announced that the Bolivarian Republic of Venezuela has granted the license for the Dragon Gas...

(Trinidad and Tobago Ministry of Energy and Energy Industries, 22.Dec.2023) — Historic and unprecedented energy deals for Trinidad and Tobago that provide us with positive outlooks for our future, the...

(National Press Club, 21.Dec.2023) — Following is a statement via the National Press Club from the family of long-detained journalist Austin Tice, on the release of 10 imprisoned Americans in a...

(Energy Analytics Institute, 20.Dec.2023) — The National Gas Company of Trinidad and Tobago (NGC) and Shell were granted a license for the exploration and exploitation of non-associated gas in the...

(CELAC, 14.Dec.2023) — On Thursday, 14 Dec. 2023, in Argyle, Saint Vincent and the Grenadines, His Excellency Irfaan Ali, President of the Co-operative Republic of Guyana and His Excellency Nicolas...

(Reuters, 14.Dec.2023) — Guyana and Venezuela on Thursday agreed to avoid any use of force and to not escalate tensions in their long-running dispute over the oil-rich Esequibo area after...

(AP, 9.Dec.2023) — A century-old territorial dispute deepened by the discovery of oil is boiling over between neighbors Guyana and Venezuela. Steeped in patriotism, the Venezuelan government is seizing on the fight...

(Reuters, 6.Dec.2023) — Venezuela's attorney general on Wednesday said there are arrest warrants for three people involved in the campaign of opposition presidential nominee Maria Corina Machado, for crimes including...

(Chevron, 6.Dec.2023) — Chevron Corporation (NYSE: CVX) announced an expected organic capital expenditure range of $15.5bn to $16.5bn for consolidated subsidiaries (capex) and an affiliate capital expenditure (affiliate capex) budget...

(US Treasury, 6.Dec.2023) — Secretary of State Antony J. Blinken spoke with Guyanese President Dr. Mohamed Irfaan Ali to reaffirm the United States’ unwavering support for Guyana’s sovereignty. The Secretary...

(Voice of America, 6.Dec.2023) — Venezuelan President Nicolas Maduro has ordered state-owned oil, gas and mining companies to “immediately” begin operations in a wide territory controlled by neighboring Guyana. Maduro...

(BBC, 6.Dec.2023) — Venezuelan President Nicolás Maduro is plunging ahead with its plans to take over Essequibo, the oil-rich region controlled by neighbouring Guyana. He has ordered the state oil...

(Reuters, 5.Dec.2023) — Venezuelan President Nicolas Maduro said on Tuesday he would authorize oil exploration in an area subject to a dispute with Guyana, which said it would report his...

(Energy Analytics Institute, 4.Dec.2023) — Venezuelans voted in fair a referendum claiming sovereignty over the Essequibo region, a disputed area on Venezuela's eastern border with Guyana. The region spans roughly...

(AP, 4.Dec.2023) — Venezuelan President Nicolás Maduro got the victory he sought in a weekend referendum on whether to claim sovereignty over an oil-rich area of neighboring Guyana. But lackluster...

(CNBC, 4.Dec.2023) — Venezuelans on Sunday voted to claim sovereignty over a large swathe of their oil-rich neighbor Guyana, marking the latest escalation in a long-standing territorial dispute between the...

(AP, 1.Dec.2023) — The United Nations’ top court on Friday ordered Venezuela not to take any action that would alter Guyana’s control over a disputed territory, but did not specifically ban Venezuela...

(Energy Analytics Institute, 30.Nov.2023) — Energy briefs as well as others related to finance and projects during November 2023 including PDVSA and the French co. Maurel & Prom inking a...

(CSIS, 29.Nov.2023) — Over the last month, the Biden administration has presided over a sea change in U.S. policy toward Venezuela. The recent lifting of sanctions on the Maduro regime is the...

(WoodMac, 24.Nov.2023) — With nearly 15 billion barrels worth of varied resources discovered in the region since the turn of the decade, the future looks bright for upstream oil and...

(Energy Analytics Institute, 24.Nov.2023) — Vente Venezuela national coordinator and opposition leader María Corina Machado said the next president of the Opec country would be picked by its citizens, according...

(Reuters, 23.Nov.2023) — The suspension of U.S. sanctions on Venezuelan oil has rattled its biggest customers, China's independent refiners, who are now holding off on making new purchases amid wide...

(Reuters, 22.Nov.2023) — Venezuela is currently producing some 850,000 barrels per day (bpd) of oil and hopes to soon reach 1 million bpd, the country's deputy oil minister, Erick Perez,...

(Rafael Ramírez, 16.Nov.2023) — On 18 Oct., the US Office of Foreign Assets Control (OFAC)[1] issued Licenses 43 and 44,[2] lifting the sanctions on the Venezuelan oil and mining sector that had been in place...

![Repsol Reveals Strategic 2024-2027 Update [PDF Downloads]](https://energy-analytics-institute.org/wp-content/uploads/2022/05/53431_repsol-sede-cerca.jpg)

![Petroleum Sanctions in Venezuela [PDF Download]](https://energy-analytics-institute.org/wp-content/uploads/2020/04/pdvsa-960x640-venezuela-latamnrg-768x512.jpg)

![The Lifting of Sanctions and the Oil Collapse of Venezuela [PDF Download]](https://energy-analytics-institute.org/wp-content/uploads/2020/09/Venezuela-requests-the-extradition-of-former-PDVSA-president-Rafael-Ramirez.jpg)