(Bloomberg, 18.Jul.2024) — Exxon Mobil Corp. took the first step toward its seventh oil project in Guyana, a clear signal the supermajor intends to expand crude output from the South American...

(DPI, 16.Jul.2024) — The Environmental Protection Agency (EPA) has commenced the review of an application from ExxonMobil Guyana to develop a seventh oil project at the Hammerhead field in the Stabroek...

(EPA, 15.Jul.2024) — Produced Formation Water (PFW), sometimes called Produced Water (PW) is water trapped in underground formations that is brought to the surface during oil and gas extraction. This...

(AP, 11.Jul.2024) — From climate change to species loss and pollution, humans have etched their impact on the Earth with such strength and permanence since the middle of the 20th...

(Reuters, 20.Jun.2024) — A contract arbitration panel that could block or green-light the $53 billion sale of Hess Corp to Chevron remains incomplete three months after the case was filed, stalling a decision...

(Reuters, 20.Jun.2024) — U.S. firm Fulcrum LNG was selected to help Guyana develop a plan to design, finance, construct and operate a natural gas processing facility in the South American...

(SEOGS, 3.Jun.2024) — Taking place from 4-7 Jun. 2024, SEOGS will be hosted by Staatsolie under the theme: The Next Stage of Success. SEOGS is the market leading energy and offshore event in Suriname and...

(Hess Corporation, 28.May.2024) — Hess Corporation (NYSE: HES) has received the necessary approval of its stockholders for closing the company’s merger with Chevron Corporation. At the special meeting of Hess stockholders held...

(Go Integrated Group, 26.May.2024) — MODEC recently announced that the keel laying for the FPSO Errea Wittu hull has been completed five weeks ahead of schedule. This is an important...

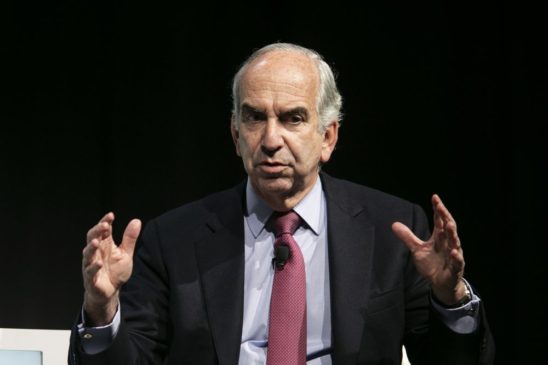

(Bloomberg, 22.May.2024) — John Hess, the boss of the oil company that bears his family name, is talking to directly with shareholders in a last-ditch effort to ensure enough support...

(Hess, 20.May.2024) — Hess Corporation (NYSE: HES) announced that independent proxy voting and corporate governance advisory firm Glass, Lewis & Co. has recommended that Hess shareholders vote FOR the proposed merger with Chevron. In...

(Aris Mining, 16.May.2024) — Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) reports voting results from its Annual General Meeting of shareholders held earlier today. AGM Voting Results Shareholders holding 46,147,782 shares,...

(CNOOC, 25.Apr.2024) — CNOOC Limited (SEHK: 00883 (HKD Counter) and 80883 (RMB Counter), SSE: 600938) announced its operating results for the first quarter of 2024. In the first quarter, the company...

(Hess, 25.Apr.2024) — Hess Corporation reported that is net Guyana production was 190,000 b/d in the first quarter of 2024, up 70% from 112,000 b/d in the first quarter of...

(G Mining, 22.Apr.2024) — G Mining Ventures Corp. (GMIN) (TSX: GMIN) (OTCQX: GMINF) and Reunion Gold Corporation (RGD) (TSXV: RGD) (OTCQX: RGDFF) entered into a definitive agreement to combine the two companies, setting the stage for...

(SBM, 12.Apr.2024) — SBM Offshore announced that ExxonMobil Guyana Limited (EMGL) has confirmed the award of contracts for the Whiptail development project located in the Stabroek Block in Guyana. Under...

(ExxonMobil, 12.Apr.2024) — ExxonMobil has made a final investment decision for the Whiptail development offshore Guyana, after receiving the required government and regulatory approvals. Whiptail, the sixth project on the...

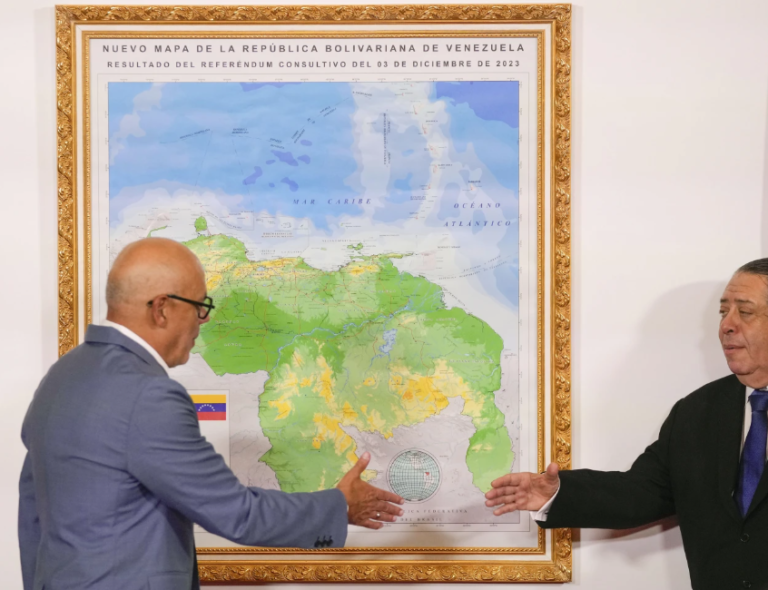

(AFP, 23.Mar.2024) — Caracas has long laid claim to Essequibo, which makes up about two-thirds of Guyana's territory, but started taking active steps to retrieve the land after massive offshore oil...

(ExxonMobil, 15.Mar.2024) — ExxonMobil Guyana announced a discovery at Bluefin in the Stabroek block offshore Guyana, the company’s first discovery of 2024. The Bluefin well encountered approximately 197 feet (60...

(Hess, 7.Mar.2024) — Today, ExxonMobil announced that it is filing for arbitration regarding the applicability of a right of first refusal (ROFR) / pre-emption provision in the Stabroek joint operating agreement....

(Reuters, 6.Mar.2024) — Exxon Mobil Corp on Wednesday said it filed a contract arbitration claim related to Hess Corp's proposed sale of its Guyana oil properties, and suggested it may counter...

(Energy Analytics Institute, 29.Feb.2024) — Energy briefs as well as others related to finance and projects during Feb. 2024 including Exxon Mobil and CNOOC considering their pre-emption rights to Hess...

(Reuters, 28.Feb.2024) — Exxon Mobil's surprise challenge to Chevron's acquisition of Hess through a dispute over a stake in a major Guyana oil field could prove fruitful for the U.S....

(Reuters, 28.Feb.2024) — Guyana's vice president Bharrat Jagdeo on Wednesday said the country will accept whatever is the result from discussions between Exxon Mobil Corp, Chevron Corp and Hess Corp regarding participation in...

(MarketWatch, 27.Feb.2024) — Chevron warned it may not complete its planned buyout of Hess as Exxon Mobil and the China National Offshore Oil Corporation are saying the planned deal would...

(The New York Times, 27.Feb.2024) — America’s two largest energy companies, Exxon Mobil and Chevron, are jousting over a prized new source of oil in the waters off Guyana, in...

(Energy Analytics Institute, 26.Feb.2024) — Chevron Corporation believes that the $53bn merger with Hess Corporation presents the California-based energy giant with the opportunity to diversify its portfolio by acquiring Hess’ 30%...

(Reuters, 20.Feb.2024) — Guyana will delay until 2025 its biggest effort to capitalize on its energy bounty, a $1.9 billion gas-to-power project that was to start this year, using untapped...

(Bloomberg, 15.Feb.2024) — Guyana has undergone a huge transformation in the near decade since a massive oil discovery off its shores. That’s on full display at the Georgetown Marriott hotel. By sundown,...

(Frontera, 15.Feb.2024) — Frontera Energy Corporation (TSX: FEC) announced its full year 2024 capital and production guidance, provides an update on its estimated fourth quarter 2023 and full year average...

(Energy Analytics Institute, 15.Feb.2024) — Modec's profits increased significantly due to good progress in the construction work of new EPCI projects and improved asset integrity of old Brazil FPSO vessels, the...

DeepOcean, 14.Feb.2024) — Ocean services provider DeepOcean has been awarded a contract by ExxonMobil Guyana for the provision of subsea construction and IMR (inspection, maintenance, and repair) services offshore Guyana,...

(AP, 7.Feb.2024) — ExxonMobil said it plans to explore for oil and gas in a disputed area off South America’s coast where the Venezuelan military had previously expelled two U.S....

(Exxon, 2.Feb.2024) — Exxon Mobil Corporation announced fourth-quarter 2023 earnings of $7.6bn, or $1.91 per share assuming dilution. Fourth-quarter results included unfavorable identified items of $2.3bn including a $2bn impairment...

(Energy Analytics Institute, 31.Jan.2024) — Energy briefs as well as others related to finance and projects during Jan. 2024 including Washington reviewing its sanctions policy on Venezuela; QatarEnergy confirming that...

(Hess, 31.Jan.2024) — Hess Corporation (NYSE: HES) reported net income of $413mn, or $1.34 per share, in the fourth quarter of 2023, compared with net income of $497mn, or $1.61...

(Enverus, 23.Jan.2024) — Enverus Intelligence Research (EIR), a subsidiary of Enverus, is releasing its summary of Q4 and full-year 2023 upstream merger and acquisition (M&A) activity. Q4 recorded a massive...

(Guyana’s Finance Ministry, 15.Jan.2024) — Guyana’s Finance Minister Dr. Ashni K. Singh, M.P presenting the South American country’s budget for 2024, highlighting the nascent oil and gas sector, which continues...

(Reuters, 5.Jan.2024) — India approved signing a 5-year memorandum of understanding (MoU) with Guyana to cooperate in the hydrocarbon sector as the South Asian nation looks to diversify its oil...

(Energy Analytics Institute, 31.Dec.2023) — Energy briefs as well as others related to finance and projects during Dec. 2023 including why Venezuela wants to annex the Essequibo; Petrobras acquiring 29...

(S&P Global, 14.Dec.2023) — Analysts at S&P Global Commodity Insights, an independent provider of information, data, analysis, benchmark prices and workflow solutions for the commodities, energy and energy transition markets,...

(CELAC, 14.Dec.2023) — On Thursday, 14 Dec. 2023, in Argyle, Saint Vincent and the Grenadines, His Excellency Irfaan Ali, President of the Co-operative Republic of Guyana and His Excellency Nicolas...

(Reuters, 14.Dec.2023) — Guyana and Venezuela on Thursday agreed to avoid any use of force and to not escalate tensions in their long-running dispute over the oil-rich Esequibo area after...

(AP, 9.Dec.2023) — A century-old territorial dispute deepened by the discovery of oil is boiling over between neighbors Guyana and Venezuela. Steeped in patriotism, the Venezuelan government is seizing on the fight...

(US Treasury, 6.Dec.2023) — Secretary of State Antony J. Blinken spoke with Guyanese President Dr. Mohamed Irfaan Ali to reaffirm the United States’ unwavering support for Guyana’s sovereignty. The Secretary...

(Voice of America, 6.Dec.2023) — Venezuelan President Nicolas Maduro has ordered state-owned oil, gas and mining companies to “immediately” begin operations in a wide territory controlled by neighboring Guyana. Maduro...

(BBC, 6.Dec.2023) — Venezuelan President Nicolás Maduro is plunging ahead with its plans to take over Essequibo, the oil-rich region controlled by neighbouring Guyana. He has ordered the state oil...

(ExxonMobil, 6.Dec.2023) — ExxonMobil gave an update to its Corporate Plan through 2027, reflecting continued execution of its strategy to provide the products society needs and to lower emissions, both its own...

(Reuters, 5.Dec.2023) — Venezuelan President Nicolas Maduro said on Tuesday he would authorize oil exploration in an area subject to a dispute with Guyana, which said it would report his...

(CGX, 4.Dec.2023) — CGX Energy Inc. (TSXV: OYL) and Frontera Energy Corporation (TSX: FEC), joint venture partners in the Petroleum Prospecting License for the Corentyne block offshore Guyana, announced today that...

(Energy Analytics Institute, 4.Dec.2023) — Venezuelans voted in fair a referendum claiming sovereignty over the Essequibo region, a disputed area on Venezuela's eastern border with Guyana. The region spans roughly...

(AP, 4.Dec.2023) — Venezuelan President Nicolás Maduro got the victory he sought in a weekend referendum on whether to claim sovereignty over an oil-rich area of neighboring Guyana. But lackluster...

(CNBC, 4.Dec.2023) — Venezuelans on Sunday voted to claim sovereignty over a large swathe of their oil-rich neighbor Guyana, marking the latest escalation in a long-standing territorial dispute between the...

(AP, 1.Dec.2023) — The United Nations’ top court on Friday ordered Venezuela not to take any action that would alter Guyana’s control over a disputed territory, but did not specifically ban Venezuela...

(WoodMac, 24.Nov.2023) — With nearly 15 billion barrels worth of varied resources discovered in the region since the turn of the decade, the future looks bright for upstream oil and...

(SBM Offshore, 14.Nov.2023) — SBM Offshore announce that FPSO Prosperity has produced first oil as of 14 Nov. 2023 and is formally on hire. The FPSO Prosperity utilizes a design that largely replicates the...

(Exxon Mobil, 14.Nov.2023) — ExxonMobil started production today at Payara, Guyana’s third offshore oil development on the Stabroek Block, bringing total production capacity in Guyana to approximately 620,000 barrels per...

(Frontera, 9.Nov.2023) — Frontera Energy Corporation (TSX: FEC) reported financial and operational results for the third quarter ended 30 Sep. 2023. All financial amounts in this news release are in United States dollars,...

(Frontera, 9.Nov.2023) — CGX Energy Inc. (TSXV: OYL) and Frontera Energy Corporation (TSX: FEC), the majority shareholder of CGX and joint venture partner of CGX in the Petroleum Prospecting License...

(SBM, 9.Nov.2023) — SBM Offshore and ExxonMobil Guyana Limited, an affiliate of ExxonMobil Corporation, have completed the transaction related to the purchase of FPSO Liza Unity, a few months ahead of...

(Energy Analytics Institute, 31.Oct.2023) — Energy briefs as well as others related to finance and projects during October 2023 including Vista's third quarter 2023 earnings presentation; the long-awaited Citgo Petroleum...

(AFP, 27.Oct.2023) — The new find, as well as some of the drilling concessions, are in a disputed area whose possible annexation Venezuela is putting to a national referendum. Guyana, much smaller...

(WoodMac, 26.Oct.2023) — ExxonMobil’s and Chevron’s belief in the durability of upstream could hardly be better demonstrated by the game-changing acquisitions of two flagship US Independents. It’s a pivotal moment...

(Hess, 25.Oct.2023) — Hess Corporation (NYSE: HES) reported net income of $504mn, or $1.64 per share, in the third quarter of 2023, compared with net income of $515mn, or $1.67...

(CARICOM, 25.Oct.2023) — The Caribbean Community (CARICOM) notes the decision of the Venezuelan National Assembly to conduct a popular referendum on defending Venezuela’s claim of the Essequibo. CARICOM further notes...

(Energy Analytics Institute, 23.Oct.2023) — US-based Chevron Corporation will acquire Hess Corporation for US$60bn (including net debt), the second giant transaction of Oct. 2023 following the $65bn move by ExxonMobil...

(Chevron, 23.Oct.2023) — Chevron Corporation (NYSE: CVX) has entered into a definitive agreement with Hess Corporation (NYSE: HES) to acquire all of the outstanding shares of Hess in an all-stock...

(Energy Analytics Institute, 30.Sep.2023) — Energy briefs as well as others related to finance and projects during Sep. 2023 including Petrobras saying that in regards the process of divestment of...

(Reuters, 28.Sep.2023) — U.S. oil producers Exxon Mobil (XOM.N) and Hess Corp (HES.N) have withdrawn from exploring the Kaieteur block in Guyana’s deepwaters, Exxon said on Thursday, after disappointing exploration results. The exit comes...

(Hess, 15.Sep.2023) — Hess Corporation announced that the special limited Collector's Edition Ocean Explorer toy, commemorating Hess Corporation's 90th anniversary, is now on sale exclusively at HessToyTruck.com for $59.99 with free standard shipping and Energizer® batteries...

(Reuters, 13.Sep.2023) — Guyana has received offers for eight of 14 offshore oil and gas blocks in a bidding round, including from consortiums of oil majors like Exxon Mobil, Hess...

(Energy Analytics Institute, 31.Aug.2023) — Energy briefs as well as others related to finance and projects during August 2023 including Petrobras commenting on divestment process related to the LUBNOR refinery;...

(Reuters, 23.Aug.2023) — Guyana has gained a larger share of Europe's oil market this year, vessel monitoring data showed, driven by rising output by a consortium led by Exxon Mobil (XOM.N) and strong...

(Reuters, 21.Aug.2023) — Exxon Mobil Corp (XOM.N) and partners plan to spend $12.93 billion to develop their sixth offshore oil project in Guyana, according to a filing published on Monday by the...

(CNOOC, 17.Aug.2023) — CNOOC Limited announces its 2023 interim results for the six months ended June 30, 2023. In the first half of the year, the company continued to pursue high-quality...

![ExxonMobil Announces 2023 Results, Updates on Guyana [PDF Downloads]](https://energy-analytics-institute.org/wp-content/uploads/2022/10/usa-exxon-building-source-energy-analytics-institute-a-768x510.jpeg)

![Hess Reports 4Q:23 Results, Updates on Payara [PDF Download]](https://energy-analytics-institute.org/wp-content/uploads/2023/04/guyana-fpso-prosperity-arrival-to-stabroek-source-sbm-1b-768x443.jpg)

![Guyana’s Finance Minister Presents 2024 Budget [PDF Download]](https://energy-analytics-institute.org/wp-content/uploads/2024/01/guyana-presupuesto-2024-source-guyana-govt.png)