(Capstone Copper, 25.Jun.2024) — Capstone Copper Corp. (TSX:CS) (ASX:CSC) announced that the first saleable copper concentrate was produced at its Mantoverde Development Project (“MVDP”) in Chile, as the mine advances commissioning...

(Capstone, 25.Jun.2024) — Capstone Copper Corp. (TSX:CS) (ASX:CSC) announced that first saleable copper concentrate was produced at its Mantoverde Development Project (“MVDP”) in Chile, as the mine advances commissioning and ramps...

(Ndustrial, 18.Jun.2024) — Ndustrial, the AI-powered energy intensity platform for industry, is expanding its presence throughout Latin America to meet strong customer demand to drive down industrial energy costs and emissions. The company...

(Golden Arrow, 23.May.2024) — Golden Arrow Resources Corporation (TSXV: GRG) (FSE: G6A) (OTCQB: GARWF) provided an update on its exploration activities in Chile and Argentina. Highlights: Multiple magnetite mantos that correlate with similar bodies in adjacent holes,...

(Sandstone Gold, 2.May.2024) — Sandstorm Gold Ltd. (NYSE: SAND) (TSX: SSL) has released its financial results for the first quarter ended 31 Mar. 2024 (all figures in U.S. dollars). First Quarter Highlights Revenue of $42.8 million (Q1...

(EECL, 15.Apr.2024) — ENGIE Energía Chile S.A. (EECL) said its previously announced cash tender offer (the "Tender Offer") for any and all of its outstanding 4.500% Notes due 2025 (the "Notes")...

(Beijing Review, 13.Apr.2024) — The Spanish edition of Xi Jinping on the Belt and Road Initiative is helping Latin American countries better understand and participate in the China-proposed Belt and...

(AES Andes, 15.Mar.2024) — AES Andes S.A., a sociedad anónima abierta, or a publicly traded open stock corporation, organized under the laws of the Republic of Chile announced: the early results of...

(YPF, 7.Mar.2024) — YPF SA reported total hydrocarbon production averaged 514 Kboe/d in 2023 (+2% vs. 2022) and 511 Kboe/d in 4Q23 (-2% q/q but +2% y/y), mainly boosted by...

(Atlas Renewable Energy, 6.Mar.2024) — Atlas Renewable Energy, an international renewable energy company, signed a power purchase agreement (PPA) with Codelco, the state-owned Chilean mining company and the world's largest...

(Golden Arrow, 9.Feb.2024) — Golden Arrow Resources Corporation (TSXV: GRG) (FSE: G6A) (OTCQB: GARWF) reported on the status of the option granted to Sociedad de Servicios Andinos SpA (SSA) in respect to...

(Summit Nanotech, 5.Feb.2024) — Summit Nanotech and Cobax Mining, a Chilean-based exploration company, signed an agreement to develop an exploration and development program at the Salar de La Isla that prioritizes community,...

(Energy Analytics Institute, 17.Jan.2024) — Cochilco expects its average copper price to reach $3.85 per pound (lb) in 2024. This compares to $3.80/lb in 2023, the company announced 17 Jan....

(Golden Arrow, 12.Jan.2024) — Golden Arrow Resources Corporation (TSXV: GRG) (FSE: G6A) (OTCQB: GARWF) announced that New Golden Explorations Chile SpA (NGE), a wholly-owned subsidiary of the company, has entered into an option...

(Volvo, 20.Dec.2023) — Volvo Trucks has delivered eight heavy electric trucks to customers in Brazil, Chile and Uruguay. These orders represent Volvo's first sales of zero-exhaust emission trucks to Latin America....

(WoodMac, 30.Nov.2023) — Driven by advances in batteries and lower costs, solar will outpace wind growth rates and become the leading technology for expansion over the next ten years in...

(Vortex Metals, 20.Nov.2023) — Vortex Metals Inc. (TSXV: VMS) (FSE: DM8) (OTCQB: VMSSF) signed the definitive agreement with "Windows Minerals SCM and SLM Rio 27 De Farellon Sánchez" (Jointly the optionors)...

(Mainstream, 16.Nov.2023) — Members of Mainstream’s Chilean team recently honored local indigenous tradition by taking part in a centuries-old ceremony against the backdrop of Tchamma wind farm’s turbines, in the...

(Mainstream, 14.Nov.2023) — Reference is made to previous announcements by Aker Horizons ASA regarding the initiation by Mainstream Renewable Power of Judicial Reorganization Proceedings for Condor Energía SpA and Huemul Energía...

(Franco-Nevada, 8.Nov.2023) — "Our core precious metal assets anchored the quarter, resulting in increased revenue and earnings over the prior year period," stated Paul Brink, CEO. We are looking forward...

(Aker Horizons, 2.Nov.2023) — Aker Horizons ASA (OSE: AKH), a developer of green energy and industry, today announced results for the third quarter of 2023. Aker Horizons' net asset value stood...

(Sungrow, 19.Sep.2023) — Sungrow, the global inverter and energy storage system supplier, signed a contract with the Investment Fund WEG-4 to supply 60MW/132MWh of its liquid cooled energy storage system...

(Aramco, 15.Sep.2023) — Aramco, one of the world's leading integrated energy and chemicals companies, has agreed to purchase a 100% equity stake in Esmax Distribusción SpA from Southern Cross Group,...

(Energy Analytics Institute, 31.Aug.2023) — Energy briefs as well as others related to finance and projects during August 2023 including Petrobras commenting on divestment process related to the LUBNOR refinery;...

(SQM, 16.Aug.2023) — Sociedad Química y Minera de Chile S.A. (SQM) (NYSE: SQM; Santiago Stock Exchange: SQM-B, SQM-A) reported earnings for the six months ended 30 June 2023 of $1,330.1mn ($4.66 per ADR),...

(Franco-Nevada, 8.Aug.2023) — "Our portfolio continues to generate strong cash flows and high margins. The second quarter's results benefited from our core assets returning to normal production and deliveries caught...

(Scala Data Centers, 7.Aug.2023) — Scala Data Centers, the leading Latin American platform of sustainable data centers in the Hyperscale market, announces the start of the SSCLCR01 data center operations,...

(S&P Global, 4.Aug.2023) — Argentina, the world's fourth largest lithium producer, second in resources, has been cast as the promising supplier to leapfrog Chile in the short term, as it...

(Hot Chili Limited, 3.Aug.2023) ) — Hot Chili Limited (ASX: HCH) (TSXV: HCH) (OTCQX: HHLKF) announced that drilling has re-commenced across the western extension of the Cortadera porphyry resource, part of...

(Mainstream Renewable Power, 20.Jul.2023) — Mainstream Renewable Power confirms it has initiated Judicial Reorganisation Proceedings for Huemul Energía SpA and Condor Energía SpA (the “Energía Companies”), which are part of...

(SOLEK, 31.May.2023) — Solar energy group SOLEK closed a $379mn financing for its portfolio in Chile, consisting of solar photovoltaic utility-scale and PMGD plants located in the Central Region. The fast-growing company in...

(SQM, 22.May.2023) — Sociedad Química y Minera de Chile S.A. (SQM) (NYSE: SQM; Santiago Stock Exchange: SQM-B, SQM-A) and Ford Motor Company have announced a long-term strategic agreement to secure the...

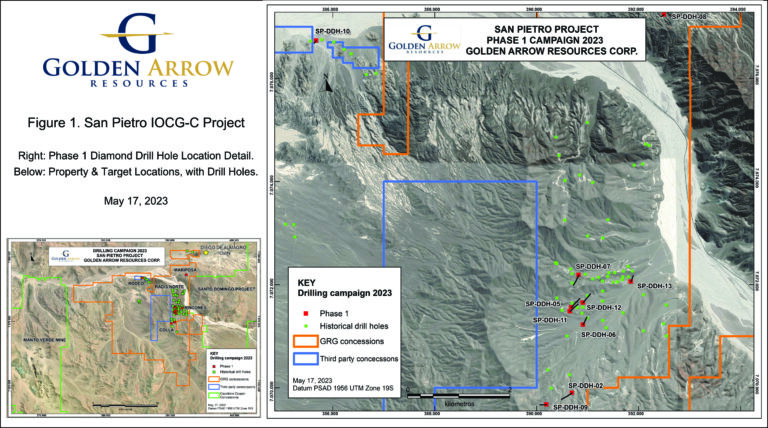

(Golden Arrow, 18.May.2023) — Golden Arrow Resources Corporation (TSXV: GRG) (FSE: G6A) (OTCQB: GARWF) has increased the size of its first diamond drilling program at the Company's flagship San Pietro Iron-Copper-Gold-Cobalt Project in Chile from 2,650-metre...

(Aediles Capital Inc., 18.May.2023) — AEDILES supported BlackRock GRP III in the closing of the acquisition of 97MWp of Distributed Solar Energy Projects in Chile, which was developed by RRG Capital...

(Reuters, 8.May.2023) — Chilean state oil company National Petroleum Company (ENAP) said on Monday it has signed a temporary agreement with Argentine oil firm YPF (YPFD.BA) to import crude through the Trasandino...

(ENAP, 26.Apr.2023) — Empresa Nacional del Petróleo (ENAP) has commenced a cash tender offer, on the terms and subject to the conditions set forth in the company's offer to purchase...

(IGU, OLADE, ARPEL, 17.Apr.2023) — The world needs to transition to low-carbon economies to reduce global warming while continuing to promote sustainable socioeconomic development for a growing global population. Achieving...

(AES, 27.Feb.2023) — The AES Corporation (NYSE: AES) today reported financial results for the year ended 31 December 2022. "2022 was another record year for AES, one in which we delivered on...

(Mandalay, 24.Feb.2023) — Mandalay Resources Corporation (TSX: MND) (OTCQB: MNDJF) announced its financial results for the fourth quarter and year ended December 31, 2022. The company's audited consolidated financial results for...

(Golden Arrow, 14.Feb.2023) — Golden Arrow Resources Corporation (TSXV: GRG) (FSE: G6A) (OTCQB: GARWF) announced a new diamond drilling program has commenced at the company's flagship San Pietro Iron-Copper-Gold-Cobalt Project in Chile. The 2,650-metre,...

(KBR, 6.Feb.2023) — KBR (NYSE: KBR) announced that its green ammonia technology, K-GreeN®, has been selected by Enaex, S.A. for its innovative HyEx green ammonia project in Chile. The HyEx project will...

(GoldHaven, 5.Jan.2023) — GoldHaven Resources Corp. (CSE: GOH) (OTCQB: GHVNF) (FSE: 4QS) entered into a Letter of Intent (the "LOI") dated December 21, 2022, to assess a Plan of Arrangement (the "POA") with Oro...

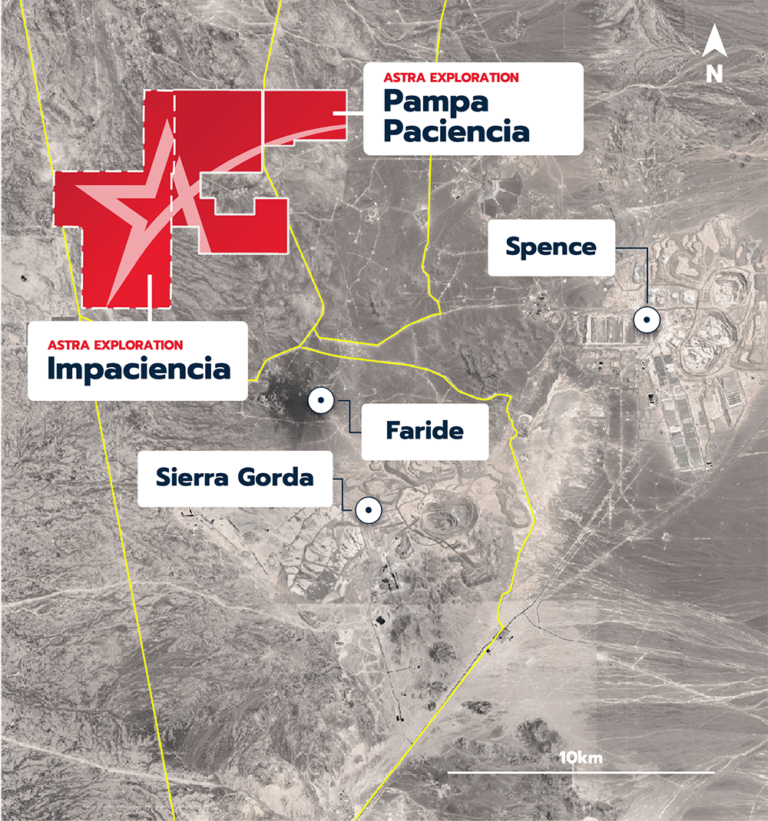

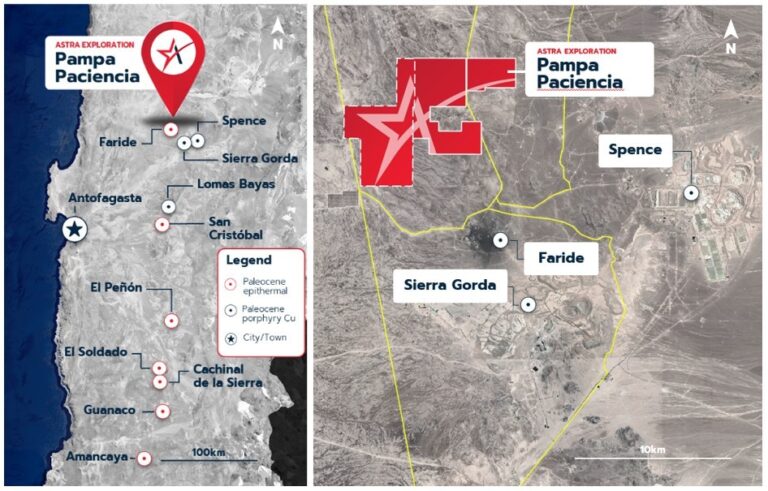

(Astra Exploration, 3.Nov.2022) — Astra Exploration Inc. (TSXV: ASTR) (OTCQB: ATEPF) has entered into a definitive purchase agreement with Sociedad Quimica y Minera de Chile S.A. (the "Seller") with respect to...

(Enel Américas S.A., 2.Nov.2022) — Enel Américas S.A. intends to file Form 15F with the U.S. Securities and Exchange Commission (SEC) today to voluntarily deregister from Section 12(g) of the...

(Canadian Solar, 1.Sep.2022) — Canadian Solar Inc. (NASDAQ: CSIQ) was awarded a 253 MWp solar plus 1,000 MWh battery energy storage project ("Zaldivar Project") in Chile's public tender CNE 2022/01 held by Chile's Energy National...

(Caterpillar, 30.Aug.2022) — BHP Group Limited (NYSE: BHP), Caterpillar Inc. (NYSE: CAT), and Finning International Inc. (TSX: FTT) announced an agreement to replace BHP's entire haul truck fleet at the Escondida mine,...

(Astra Exploration, 23.Aug.2022) — Astra Exploration Inc. (TSX-V: ASTR, OTCQB: ATEPF) has completed 3,976 metres of RC drilling in 15 holes at its Pampa Paciencia Project located in Northern Chile....

(Energy Analytics Institute, 16.Aug.2022) — LONGi, involved in the manufacture of mono-crystalline photovoltaic modules and cells, has joined the network of associates of the Chilean Association of Solar Energy A.C....

(Energy Analytics Institute, 21.Jul.2022) — Energy briefs including Bristow Helicopters Ltd (NYSE: VTOL) signing a £1.6bn 10-year contract for the Second-Generation Search and Rescue Aviation program; Golden Arrow Resources Corporation (TSXV: GRG)...

(BHP, 19.Jul.2022) — BHP provided a detailed operational review for the year ended 30 June 2022. BHP Chief Executive Officer, Mike Henry: “BHP produced a strong fourth quarter to cap...

(LONGi, 14.Jul.2022) — EUPD Research awarded LONGi the "Top Brand PV 2022" seal for the Mexican, Chilean and Latin American markets. The Chinese brand received this recognition at Solar Power...

(Enel Américas, 1.Jul.2022) — Enel Américas S.A. (NYSE: ENIAY) announced that its Board of Directors has unanimously approved the voluntary delisting of its outstanding 4.00% Notes due 25 October 2026 (NYSE: ENIA26A) and 6.60%...

(HIF Global, 19.May.2022) — HIF Global, HIF Chile and Uniper Global Commodities signed a Letter of Intent (the "eFuels LOI") to negotiate binding offtake agreements for the sale and purchase...

(Energy Analytics Institute, 19.May.2022) — Energy briefs including Sociedad Química y Minera de Chile S.A. (SQM) (NYSE: SQM; Santiago Stock Exchange: SQM-B, SQM-A) holding a conference call to discuss its 1Q;22...

(SQM, 19.May.2022) — Sociedad Química y Minera de Chile S.A. (SQM) (NYSE: SQM; Santiago Stock Exchange: SQM-B, SQM-A) reported earnings for the three months ended 31 March 2022 of US$796.1 million (US$2.79 per share), an increase...

(Energy Analytics Institute, 4.May.2022) — Energy and political briefs including Marathon Oil reporting 1Q:22 production from Equatorial Guinea of 64 net Mboe/d; the US providing over $6mn in additional humanitarian...

(Astra Exploration, 2.May.2022) — Astra Exploration Inc. (TSXV: ASTR) provided results from the first 11 of 30 completed drill holes at the Pampa Paciencia gold-silver project in northern Chile. PPRC-22-12: 14.48 grams...

(Enel Chile, 28.Apr.2022) — Enel Chile (NYSE: ENIC) announced that it filed its 2021 annual report on Form 20–F with the US Securities and Exchange Commission (SEC) on 28 April 2022. Enel...

(Aker Clean Hydrogen, 26.Apr.2022) — Aker Clean Hydrogen has a portfolio of industrial clean hydrogen projects and prospects has a total capacity of 1.8 GW under development, and an additional...

(Atlas, 20.Apr.2022) — Atlas Renewable Energy marks a new milestone with the development of its first wind power project with a long-term power purchase agreement (PPA) with Enel Generación Chile...

(HIF Global, 6.Apr.2022) — HIF Global, involved in eFuels development, secured approximately $260mn in equity investments to fund the global expansion of its decarbonization business. The capital will be used for the...

(Bloomberg, 8.Apr.2022) — Latin America’s central bankers are facing renewed pressure to extend aggressive interest-rate hikes after consumer prices stormed past estimates across the region, driven by soaring costs of...

(EIG, 28.Mar.2022) — EIG, an institutional investor to the global energy and infrastructure sectors, and Fluxys, an energy infrastructure company, announced they jointly will acquire an 80% equity stake in...

(Universities Space Research Association, 18.Mar.2022) — The Stratospheric Observatory for Infrared Astronomy (SOFIA) landed at the Santiago International Airport on 18 March 2022. Like other deployments to the Southern Hemisphere, SOFIA is a partnership between NASA...

(Golden Arrow Resources, 17.Mar.2022) — Golden Arrow Resources Corporation (TSXV: GRG) (FSE: G6A) (OTCQB: GARWF),through its wholly owned subsidiary New Golden Explorations Chile SPA, purchased a 100% interest in the San Pietro Iron-oxide...

(Sorcia Minerals, 16.Mar.2022) — Sorcia Minerals LLC hosted Universidad de Santiago de Chile (USACH) in the US for a tour of the newly completed International Batteries Metals (IBAT) direct lithium extraction (DLE) plant. USACH sent Dr. Alonso Arellano,...

(Energy Analytics Institute, 14.Mar.2022) — Energy briefs including Astra Exploration Inc. (TSXV: ASTR) providing an exploration update on Pampa Paciencia, its flagship gold-silver project in northern Chile; GoldMining Inc. (TSX: GOLD) (NYSE...

(Societe Generale, 4.Mar.2022) — Societe Generale was active bookrunner and joint sustainability structuring advisor of first-ever sustainability linked sovereign bond Societe Generale acted as an Active Bookrunner and Joint Sustainability...

(SQM, 2.Mar.2022) — Sociedad Química y Minera de Chile S.A. (SQM) (NYSE: SQM; Santiago Stock Exchange: SQM-B, SQM-A) reported net income for the twelve months ended December 31, 2021 of US$585.5mn (US$2.05 per ADR), an...

(Energy Analytics Institute, 1.Mar.2022) — Energy briefs including Venezuela’s President Nicolás Maduro chatting over the telephone with his Russian counterpart Vladimir Putin; Invenergy naming Mary King as Executive VP People &...

(Energy Analytics Institute, 17.Feb.2022) — Energy briefs including Atlas Renewable Energy securing financing with BNB for the construction of Lar do Sol – Casablanca II Solar Plant in Brazil; and...

(Energy Analytics Institute, 26.Jan.2022) — Energy briefs including Chile’s Enap planning to invest $111.2mn in its Aconcagua Refinery; Guyana's budget speech for the fiscal year 2022 by Dr. Ashni K....

(Astra, 24.Jan.2022) — Astra Exploration Inc. (TSXV: ASTR) (formerly Momentous Capital Corp.) closed its qualifying transaction and will commence trading on the TSX Venture Exchange (the "TSX-V") on 26 January...

(Energy Analytics Institute, 15.Jan.2022) — Energy briefs including Chile’s state oil and gas entity ENAP celebrating 66 yrs of operations at the Aconcagua Refinery; construction of Mexico’s Olmeca Refinery progressing...

(Alliance News, 14.Jan.2022) — Echo Energy PLC announced on Friday it had entered the Chilean solar energy market and reported a 71% increase in total liquid sales in its fourth...

![Ancient Thanksgiving to Pachamama [Photos]](https://energy-analytics-institute.org/wp-content/uploads/2023/11/PagoALaTierra_Header.jpg-768x328.webp)

![NatGas in Transition to Low-Carbon Economies [PDF Download]](https://energy-analytics-institute.org/wp-content/uploads/2023/04/latam-white-paper-cover-768x407.png)

![BHP’s Operational Review for the Year Ended 30 June 2022 [PDF Download]](https://energy-analytics-institute.org/wp-content/uploads/2022/07/220719_opreview_banner-768x261.webp)

![NRGBriefs: Guyana Budget Speech; Peru Oil Leak [PDF Download]](https://energy-analytics-institute.org/wp-content/uploads/2022/01/GUY_budget-2022-speech-header.jpg)