(GoldMining, 16.May.2024) — GoldMining Inc. (TSX: GOLD) (NYSE: GLDG) announced that at its annual general meeting held on 16 May 2024, all nominees listed in its management information circular dated 25 Mar. were elected as directors...

(U Power Limited, 16.May.2024) — U Power Limited recently embarked on a collaborative pilot test with a Peruvian mining firm to evaluate electric heavy-duty vehicles on an established haulage route. This...

(GoldMining, 29.Apr.2024) — GoldMining Inc. (GLDG) announced that the company, through a wholly owned subsidiary, has completed a transaction with Compañía de Minas Buenaventura S.A.A. to reduce an existing third-party royalty...

(Energy Analytics Institute, 30.Sep.2023) — Energy briefs as well as others related to finance and projects during Sep. 2023 including Petrobras saying that in regards the process of divestment of...

(Energy Analytics Institute, 31.Aug.2023) — Energy briefs as well as others related to finance and projects during August 2023 including Petrobras commenting on divestment process related to the LUBNOR refinery;...

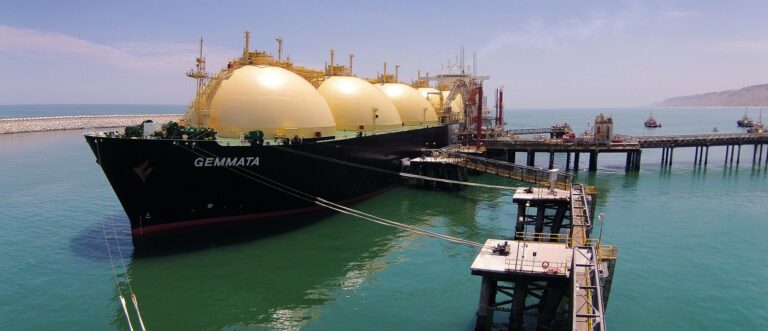

(IGU, 20.Jul.2023) — The International Gas Union (IGU) presented its 14th annual edition of the IGU World LNG report. IGU-LNG2023-World-LNG-ReportDownload ____________________

(PetroTal, 6.Jul.2023) — PetroTal Corp. (TSX: TAL, AIM: PTAL and OTCQX: PTALF) announce the following operational and corporate update. Record Q2 2023 Production PetroTal achieved a record production of 19,031 barrels of...

(IGU, OLADE, ARPEL, 17.Apr.2023) — The world needs to transition to low-carbon economies to reduce global warming while continuing to promote sustainable socioeconomic development for a growing global population. Achieving...

(Frontera, 15.Feb.2023) — Frontera Energy Corporation (TSX: FEC) announced that its fourth quarter 2022 results will be released after markets close on Wednesday, 1 March 2023. A conference call for investors...

(Mantaro, 13.Feb.2023) — Mantaro Precious Metals Corp. (TSXV: MNTR) (OTCQB: MSLVF) (FSE: 9TZ) announced a non-brokered private placement of up to 7,000,000 units (each a "Unit") at a price of $0.05 per Unit for gross...

(The New York Times, 22.Jan.2023) — President Pedro Castillo borrowed from history when he attempted a coup in Peru. Thirty years ago, another president asserted authoritarian control. But this time, there was...

(Al Jazeera, 7.Jan.2023) — Dozens of anti-government protesters have clashed with police in southern Peru amid renewed unrest in the wake of the removal and detention of former President Pedro Castillo. The...

(AP, 7.Dec.2022) — The president of Peru was ousted by Congress and arrested on a charge of rebellion Wednesday after he sought to dissolve the legislative body and take unilateral...

(Simón Bolívar Foundation Inc., 17.Nov.2022) — Simón Bolívar Foundation Inc., the 501(c)(3) nonprofit private foundation of Citgo Petroleum Corporation, is awarding up to $1.68mn in grant funding to seven qualified charitable organizations...

(Energy Analytics Institute, 13.Jul.2022) — Energy briefs including Latin American gas producers Trinidad and Tobago and Peru reporting reduced LNG exports to the tune of 3.9 million tons per annum...

(Reuters, 31.May.2022) — As liquefied natural gas (LNG) producers try to take advantage of a global energy shift triggered by Europe’s move to become independent from Russian gas, Latin America’s...

(Pan American Silver Corp., 5.May.2022) — Pan American Silver Corp. (NASDAQ: PAAS) (TSX: PAAS) released its 2021 Sustainability Report, describing Pan American's efforts and performance in the areas of environment, social and governance. A...

(Hunt Oil, 2.May.2022) — Hunt Oil Company of Peru L.L.C., Sucursal del Perú (HOCP) received the consents necessary to effect the Amendments to the indenture governing its 6.375% Trust Enhanced...

(Energy Analytics Institute, 24.Apr.2022) — Energy and political briefs including Emmanuel Macron winning France’s second round presidential run off against Marine Le Pen; and ~68% of Peruvian citizens defending the...

(Energy Analytics Institute, 19.Apr.2022) — Energy briefs including Argentina’s government issuing Decree 195/2022 to extend a hydrocarbon exploitation concession in the offshore Austral Basin granted in 1994 and which was...

(Hunt Oil, 18.Apr.2022) — Hunt Oil Company of Peru L.L.C., Sucursal del Perú (HOCP) commenced a consent solicitation with respect to its 6.375% Trust Enhanced Senior Notes due 2028 (CUSIP...

(Energy Analytics Institute, 7.Apr.2022) — Energy briefs including Petrobras releasing its Climate Change Supplement as part of its dialogue with its stakeholders; Petrobras reaffirming “its stake in Braskem is part...

(Energy Analytics Institute, 6.Apr.2022) — Energy briefs including Caracas-based Econanalitica is forecasting Venezuela’s oil production and oil income will grow in 2022 vs 2021 under three different scenarios; Argentina’s Economic...

(Energy Analytics Institute, 5.Apr.2022) — Energy briefs including Mantaro Precious Metals Corp. (TSXV: MNTR) (OTCQB: MSLVF) (FSE: 9TZ) naming Craig Hairfield to the position of CEO; Argentine agriculture sector worried about a...

(Energy Analytics Institute, 4.Apr.2022) — Energy briefs including ExxonMobil, Hess and CNOOC taking a final investment decision (FID) for their fourth development offshore Guyana called Yellowtail, cos.’ biggest yet w/...

(Honeywell, 31.Mar.2022) — Honeywell (Nasdaq: HON) announced that Petróleos del Perú S.A. (Petroperú), the largest hydrocarbon producer, refiner and distributor in Peru, has implemented Honeywell Forge Workforce Competency solutions to train its industrial workforce...

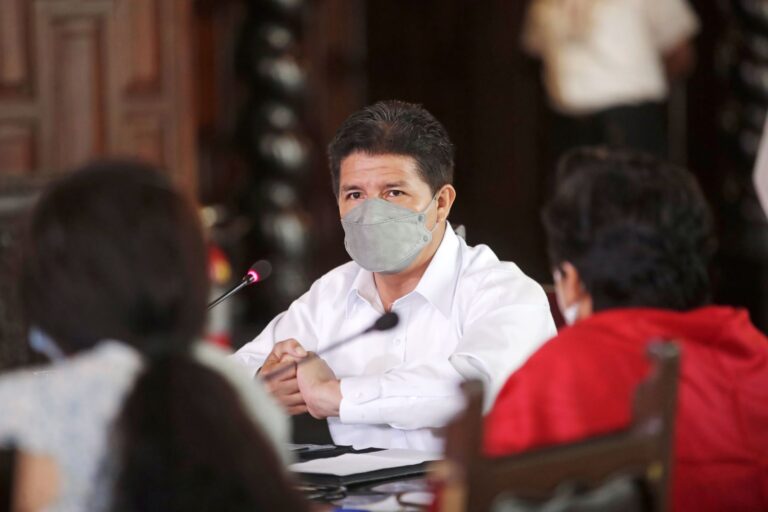

(Andina, 30.Mar.2022) — The President of the Republic Pedro Castillo on Thursday affirmed that the reshuffle of Petroperu's board of directors will enable the State-run company to strengthen its operational capacity for...

(Al Jazeera, 28.Mar.2022) — Peru’s President Pedro Castillo avoided impeachment by the country’s opposition-dominated legislature on Monday after a parliamentary debate lasting more than eight hours. Fifty-five legislators voted in favour of...

(Energy Analytics Institute, 8.Mar.2022) — Energy briefs including Cameron LNG announcing that Whitney "Whit" Fairbanks has been named president of the co. effective 9 Mar. 2022; a webinar on 7 Apr....

(Reuters, 3.Feb.2022) — New Peruvian Prime Minister Hector Valer said on Thursday the country was facing a fuel shortage due to a government decree that forbids Repsol SA (REP.MC) from unloading any...

(AP, 2.Feb.2022) — Turmoil in Peru’s government boiled even more Friday as President Pedro Castillo announced plans for a fourth Cabinet shakeup in six months, moving just three days after...

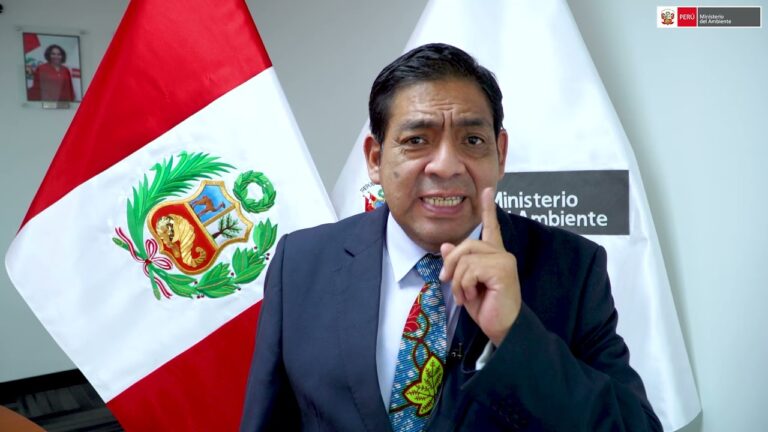

(Reuters, 31.Jan.2022) — Peru Environment Minister Ruben Ramirez said on Monday the government will temporarily suspend Repsol's (REP.MC) offshore oil unloading operations following a spill of over 10,000 barrels that has caused...

(Energy Analytics Institute, 26.Jan.2022) — Energy briefs including Chile’s Enap planning to invest $111.2mn in its Aconcagua Refinery; Guyana's budget speech for the fiscal year 2022 by Dr. Ashni K....

(Reuters, 26.Jan.2022) — Peru's Prime Minister Mirtha Vásquez said on Monday the government was looking at sanctioning a major local refinery owned by Spanish energy firm Repsol after an oil...

(Forte Minerals, 24.Jan.2022) — Forte Minerals Corp. (CSE:CUAU) completed its initial public offering of 9,583,332 units at a price of $0.30 per unit, which included the exercise in full of an over-allotment...

(Energy Analytics Institute, 24.Dec.2021) — Energy briefs including Venezuela supposedly reaching the 1 MMb/d oil production mark; and SSR Mining Inc. (NASDAQ: SSRM) (TSX: SSRM) (ASX: SSR) commencing commissioning and ramping...

(Argus, 16.Dec.2021) — State oil company Petroperu has reached an agreement with protesters to end a two-and-a-half month takeover of its 200,000 b/d North Peruvian oil pipeline (ONP), a senior...

(Solaris, 6.Dec.2021) — Solaris Resources Inc. (TSX: SLS) (OTCQB: SLSSF) announces its intention to transfer its non-core assets held in Ecuador, Peru, Chile and Mexico into a newly incorporated wholly-owned subsidiary of Solaris named Solaris Exploration Inc....

(Reuters, 4.Nov.2021) — Dutch lender ING will not finance the trading of oil and gas in Peru amid concern about the impact of the industry on indigenous people in the...

(Energy Analytics Institute, 1.Nov.2021) — Energy briefs including YPF’s President Pablo González saying the national government would be revealing details "within a few days" regarding a new gas pipeline project...

(Energy Analytics Institute, 27.Oct.2021) — Energy briefs including the Liza Unity FPSO reaching Guyana’s prolific Stabroek Block; liquefied petroleum gas (LPG) reaching approximately 12mn users across Colombia; and more. LATIN...

(Reuters, 25.Oct.2021) — Peru's socialist president, Pedro Castillo, urged Congress on Monday to draft a bill for the "nationalization" of Peru's natural gas sector, undoing previous statements in which he...

(Energy Analytics Institute, 1.Oct.2021) — Energy briefs including Mantaro Silver Corp. changing its name to Mantaro Precious Metals Corp.; Golden Arrow Resources Corp. commencing a diamond drilling program in Paraguay;...

(Fitch, 29.Sep.2021) — Fitch Ratings has placed the ratings for Hunt Oil Company of Peru L.L.C., Sucursal del Peru's (HOCP) on Rating Watch Negative (RWN), including the 'BBB' Long-Term Foreign...

(Reuters, 26.Sep.2021) — Peruvian Prime Minister Guido Bellido on Sunday said that companies which exploit natural gas in Peru will need to agree to pay higher taxes or else face...

(Reuters, 26.Aug.2021) — Peru's Congress on Thursday pushed back to Friday a key vote to confirm or reject a new leftist Cabinet nominated by President Pedro Castillo, extending the uncertainty...

(Gold Fields, 30.Jul.2021) — Gold Fields Limited (JSE: GFI) (NYSE: GFI) advises that basic earnings per share for the six months ended 30 June 2021 (H1 2021) are expected to be...

(Solaris, 23.Jul.2021) — Solaris Resources Inc. (TSX: SLS) (OTCQB: SLSSF) announces the filing of a technical report for La Verde further to its news release of 12 May 2021. As...

(Business Korea, 16.Jul.2021) — Korea National Oil Corp. (KNOC), POSCO International and SK Innovation paid a fine of billions of won to the Peruvian government in withdrawing from Block 8 for...

(Solaris, 29.Jun.2021) — Solaris Resources Inc. (TSX: SLS) (OTCQB: SLSSF) announces that all matters presented for approval at Solaris' annual meeting of shareholders held today, as more particularly set out...

(Open International, 21.Jun.2021) — Gasnorp, a subsidiary of Promigas, undertook the challenge of deploying its distribution operations in the provinces of Piura, Talara, Sullana, Paita and Sechura, which will benefit...

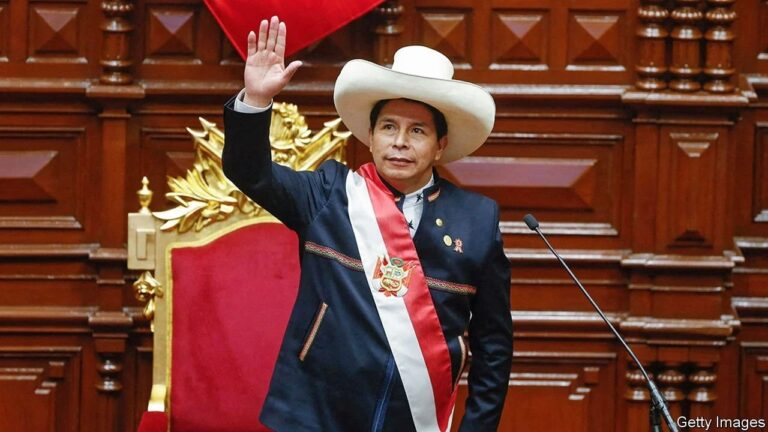

(Mining.com, 14.Jun.2021) — Peru, the world’s second-largest copper-producing country, could see mining output decrease as socialist candidate Pedro Castillo emerges as the winner of the presidential elections, with 99.6% of...

(Energy Analytics Institute, 8.Jun.2021) — Energy briefs from the Latin America and Caribbean region including: Peruvian elections results now showing Free Peru (Politico Nacional Peru Libre) leftist candidate Pedro Castillo...

(Energy Analytics Institute, 7.Jun.2021) — Energy briefs from the Latin America and Caribbean region including: Westmount Energy Ltd. updating on its activities in Guyana-Suriname and Peru elections results showing Keiko...

(Argus, 24.May.2021) — One of Peru's top natural gas distributors is rationing supply and exploring options after the early May outage of the Peru LNG liquefaction complex on which it...

(Argus, 22.Apr.2021) — Peru could nationalize natural gas and mining assets if little-known presidential candidate Pedro Castillo wins a 6 June run-off ballot. Castillo, a far-left rural school teacher who...

(Energy Analytics Institute, 5.Apr.2021) — Energy briefs from the Latin America and Caribbean region including: Venezuela’s President Nicolas Maduro announces the start of another 7+7 quarantine rotation and Peru eyes...

(PetroPerú, 23.Mar.2021) — Maintenance of the Pampa Melchorita plant will not affect natural gas users in the cities of Arequipa, Moquegua, Ilo and Tacna. Thinking about the well-being of its...

(Argus, 22.Mar.2021) — Natural gas is a central theme among Peru's top presidential candidates looking to distinguish themselves ahead of 11 April general elections. None of 18 candidates — spanning...

(Argus, 5.Jan.2021) — Peru's oil and gas industry is hoping for a rebound in 2021 following a year marred by the COVID-19 pandemic, violent indigenous protests and political instability. With...

(Energy Analytics Institute, 23.Nov.2020) — Peru’s hydrocarbon sector is on the verge of collapse due to the fall in the price of oil, the Covid-19 pandemic and persistent conflicts impacting...

(Energy Analytics Institute, 15.Nov.2020) — Congressional President Manuel Merino De Lama resigned as Peru’s interim presidency within less than a week of assuming the power void created by the impeachment...

(Energy Analytics Institute, 11.Nov.2020) — Operations at Peru LNG, the company that runs South America’s first gas liquefaction plant located in Pampa Melchorita, have yet to be affected by the...

(Energy Analytics Institute, 9.Nov.2020) — Peru’s Congress is eyeing presidential elections in 2021 amid turmoil created by the impeachment of President Martín Vizcarra Cornejo owing to corruption allegations. Peru’s Congress...

(Energy Analytics Institute, 9.Nov.2020) — Peru’s President Martín Vizcarra was impeached over the weekend after a vote over corruption allegations. Manuel Merino, the head of Peru’s Congress, will assume the...

(Karoon Energy, 26.Oct.2020) — Karoon Energy Ltd announced Dr Julian Fowles has been appointed as Chief Executive Officer and Managing Director. Dr Fowles will commence with Karoon immediately following the...

(Fitch, 10.Sep.2020) — Fitch Ratings has affirmed Peru LNG S.R.L's (PLNG) Long-Term Foreign and Local Currency Issuer Default Ratings (IDRs) at 'BB-'. The Rating Watch Negative has been removed, and...

(Argus, 25.Aug.2020) — Canadian independent PetroTal is waiting for Peru's government to implement an accord with indigenous communities so it can reopen its 10,000 b/d block in the northern jungle....

(Energy Analytics Institute, 13.Aug.2020) — PetroPerú S.A. agreed to accept the transfer of GeoPark Peru S.A.C.’s 75% interest in the license agreement for Block 64; thus, obtaining 100% of the...

(Energy Analytics Institute, 7.Aug.2020) — Camisea has reportedly contributed $10.45bn in terms of royalties during the 16 years it has been operating in Peru, website La República reported 7 August...

(Tullow, 17.Jul.2020) — Tullow is also working closely with the government to secure additional licenses. The Marina-1, non-operated exploration well, drilled in block Z-38 offshore Peru in Q1 2020 did...

(Amazon Watch, 18.May.2020) — Today, JPMorgan Chase – the largest bank in the United States and the largest banker of fossil fuels worldwide – will hold its Annual General Meeting....

(PetroTal, 7.May.2020) — PetroTal Corp. announces that the Northern Oil Pipeline (“ONP”) operated by Petroperu S.A. has been shut down by a public health directive from the Peruvian government, thereby...

(Argus, 6.May.2020) — PetroPeru's 12,000 b/d Iquitos refinery in the northern jungle is currently closed. Its 553,200 bl of storage is full. The 15,500 b/d Conchan refinery in Lima was...

(Sempra, 10.Apr.2020) — Sempra Energy received all required governmental authorizations for the sale of the company's equity interests in its Peruvian businesses. The sale to China Yangtze Power International (Hongkong)...

![IGU 2023 World LNG Report [PDF Download]](https://energy-analytics-institute.org/wp-content/uploads/2023/07/igu-2023-rpt-cover-768x590.png)

![NatGas in Transition to Low-Carbon Economies [PDF Download]](https://energy-analytics-institute.org/wp-content/uploads/2023/04/latam-white-paper-cover-768x407.png)

![NRGBriefs: Petrobras Releases Climate Change Supplement [PDF Download]](https://energy-analytics-institute.org/wp-content/uploads/2022/04/BRA_petrobras-climate-change-supplement-768x477.png)

![NRGBriefs: Guyana Budget Speech; Peru Oil Leak [PDF Download]](https://energy-analytics-institute.org/wp-content/uploads/2022/01/GUY_budget-2022-speech-header.jpg)

![LatAm Briefs: Westmount Drilling Update [PDF Download], Peru Election Results](https://energy-analytics-institute.org/wp-content/uploads/2021/06/000_9BC4DK-768x512.jpg)