(Energy Analytics Institute, 6.Apr.2022) — Energy briefs including Caracas-based Econanalitica is forecasting Venezuela’s oil production and oil income will grow in 2022 vs 2021 under three different scenarios; Argentina’s Economic Minister Martín Guzmán meeting with the Argentine Ambassador in Bolivia Ariel Basteiro to discuss issues related to a bilateral agenda and energy issues; and social unrest in Peru yet to impact Peru LNG and its exports.

LATIN AMERICA AND THE CARIBBEAN

Argentina

— Argentina’s Economic Minister Martín Guzmán meet w/ the Argentine Ambassador in Bolivia Ariel Basteiro to discuss issues related to a bilateral agenda between Argentina and Bolivia w/ “a focus on energy issues on which we have been working,” Guzmán said 6 Apr. 2022 on Twitter.

Ecuador

— Ecuador’s oil production reached 497,081 b/d on 6 Apr. 2022, the country’s Ministry of Energy and Non-Renewable Natural Resources (MENRNR) revealed on its website. Of the figures, 386,823 b/d was from state entity EP PetroEcuador w/ the remaining 110,258 b/d coming from private cos. Additionally, Ecuador was also shipping 488,511 b/d via its two pipelines (SOTE w/ 334,811 b/d and OCP w/ 153,700 b/d)

Peru

— Social unrest in Peru has yet to impact Peru LNG and its exports.

Venezuela

— Caracas-based Econanalitica is forecasting that Venezuela’s oil production and oil income will grow in 2022 vs 2021 under three different scenarios and an oil price assumption of $71.52/bbl across all scenarios:

1) Under scenario 1 (status quo), production could reach 830 Mb/d in 2022, up 31% vs 635 Mb/d in 2021 w/ estimated oil income of $21.7bn, up 205% vs $7.1bn in 2021.

2) Under scenario 2 (moderate), production could reach 984 Mb/d, up 55% vs 2021 w/ estimated oil income of $25.7bn, up 261% vs 2021.

3) Under scenario 3 (optimistic), production could reach 1,212 Mb/d, up 91% vs 2021 w/ estimated oil income of $31.6bn, up 345% vs 2021.

Venezuela’s Oil Production and Income Scenarios

| 2020 | 2021 | 2022 SQ | 2022 M | 2022 O | |

| Mb/d | 558 | 635 | 830 | 984 | 1,212 |

| $/bbl | $28.04 | $30.66 | $71.52 | $71.52 | $71.52 |

| Income | $5.7bn | $7.1bn | $21.7bn | $25.7bn | $31.6bn |

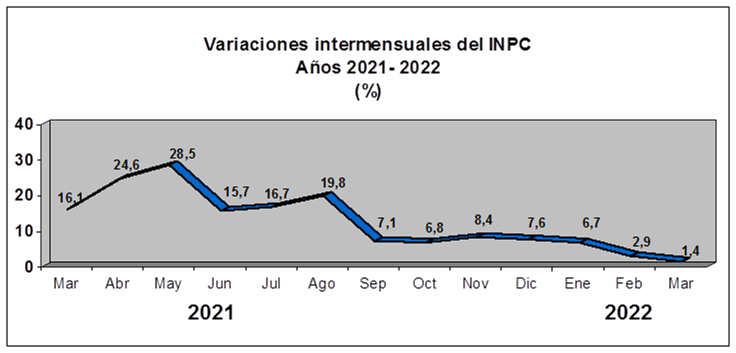

— Venezuela’s Central Bank (BCV by its Spanish acronym) reported inflation of 1.4% in Mar. 2022 vs 2.9% in Feb. 2022, the institution said 6 Apr. 2022 on its website. It’s the lowest rate observed in the last 115 mths or since Aug. 2012 when the rate was 1.1%.

EUROPE

Norway

— Capella Minerals Ltd. (TSXV: CMIL) (OTCQB: CMILF) (FRA: N7D2) inked an Exploration and Exploitation Agreement (“EEA”) w/ Hessjøgruva AS for the purchase of a 100% interest in the advanced exploration-stage Hessjøgruva Copper-Zinc-Cobalt (“Cu-Zn-Co”) project in central Norway. Hessjøgruva is ~20km SW of the co.’s 100%-owned Kjøli Cu-Zn-Co project and has a current mineral inventory (non-Canadian National Instrument NI 43-101 compliant mineral resource) of 3MT @ 1.7% Cu + 1.4% Zn1,2 (or 2.2% Cu equivalent3) based on a total of 12,139m / 68 holes of historical diamond drilling. Hessjøgruva provides Capella w/ a potential near-term development asset which complements the co.’s ongoing exploration activities at the adjacent Kjøli project. Both Hessjøgruva AS and local gov’t/communities “will benefit directly from the successful advancement and development of the Hessjøgruva project, with copper and cobalt also being key metals required for zero-carbon energy transmission and for battery/energy storage,” the co. announced 6 Apr. 2022 in an official stmt.

____________________

By Ian Silverman, Aaron Simonsky and Piero Stewart. © Energy Analytics Institute (EAI). All Rights Reserved.