(New Fortress, 17.Jul.2024) — New Fortress Energy Inc. announced that after successfully producing LNG at its first FLNG unit (“FLNG 1”), the company has closed its previously announced $700mn loan for...

(S&P, 16.Jul.2024) — Given the large amount of unconventional hydrocarbon resources found in Mexico and how much fracking technology has advanced, the country cannot afford to neglect their exploitation without a...

(AP, 11.Jul.2024) — From climate change to species loss and pollution, humans have etched their impact on the Earth with such strength and permanence since the middle of the 20th...

(Vista, 11.Jul.2024) – Vista Energy, S.A.B. de C.V. reported financial and operational results corresponding to Q2 2024. Q2 2024 highlights: Total production in Q22024 was 65,288 boe/d, a 40% increase compared...

(Eni, 8.Jul.2024) — Eni announces a new discovery on the Yopaat-1 EXP exploration well in Block 9, approximately 63 kilometers off the coast in the mid-deep water of the Cuenca Salina...

(Port of Corpus Christi, 8.Jul.2024) — In response to the impacts of Hurricane Beryl, the Port of Corpus Christi Authority has now fully transitioned to Post-Storm Recovery in accordance with the...

(Asian Energy Capital, 8.Jul.2024) — A significant step towards sustainable energy production and environmental preservation was taken by Aslan Energy Capital by signing an MOU for the acquisition of 35,000 hectares...

(Grupo Carso, 20.Jun.2024) — Grupo Carso, S.A.B. de C.V., following its notice dated 18 Dec. 2023, informs the investor public that since the stipulated conditions have been met and the...

(Ndustrial, 18.Jun.2024) — Ndustrial, the AI-powered energy intensity platform for industry, is expanding its presence throughout Latin America to meet strong customer demand to drive down industrial energy costs and emissions. The company...

(Reuters, 17.Jun.2024) — Mexico's President Andres Manuel Lopez Obrador said on Friday that businessman Carlos Slim is interested in participating in the country's first deepwater natural gas project, working alongside...

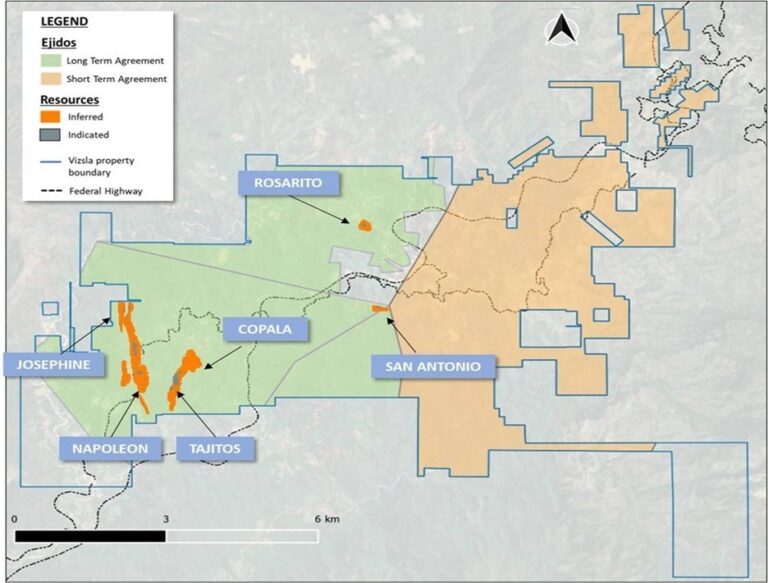

(17.Jun.2024) — Vizsla Silver Corp. announced that Vizsla Silver shareholders ("Shareholders") approved the plan of arrangement (the "Arrangement") with Vizsla Royalties Corp. ("Spinco") at the special meeting of Shareholders held...

(Energy Analytics Institute, 14.Jun.2024) — New Fortress Energy (NFE) updated the timing of its first LNG expectation for its first Fast LNG unit located offshore Altamira, Mexico. The company has...

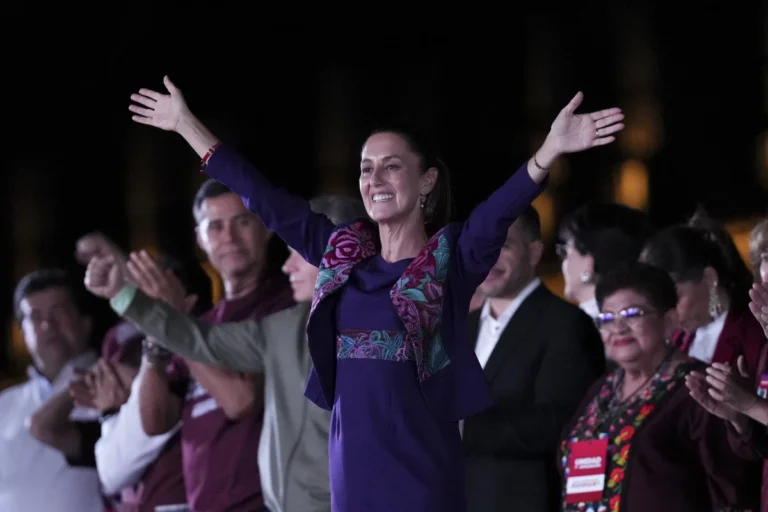

(Reuters, 12.Jun.2024) — Mexico's former foreign minister, the scion of a legendary political family, and a party boss are in contention for top energy-related jobs in President-elect Claudia Sheinbaum's government,...

(Industrial Info Resources, 6.Jun.2024) — Claudia Sheinbaum, Mexico's president-elect, will inherit "a number of headaches" when she is inaugurated later this year, a longtime observer of Mexican affairs told Industrial...

(AP, 3.Jun.2024) — Mexico’s projected presidential winner Claudia Sheinbaum will become the first female president in the country’s 200-year history. Sheinbaum, the favored successor of outgoing President Andrés Manuel López Obrador, vowed to...

(AP, 3.Jun.2024) — Claudia Sheinbaum, who will be Mexico’s first woman leader in the nation’s more than 200 years of independence, captured the presidency by promising continuity. The 61-year-old former Mexico City mayor and lifelong...

(PEMEX, 23.May.2024) — The CEO of Petróleos Mexicanos (PEMEX), Octavio Romero Oropeza, concluded a three-day round of working sessions held in Villa Hermosa, Tabasco, and in Ciudad del Carmen, Campeche,...

(GoGold, 23.May.2024) — GoGold Resources Inc. (TSX: GGD) (OTCQX: GLGDF) presented its fourth annual Sustainability Report that sets out the company's performance and achievements with respect to its environmental, social and governance (ESG) practices. ...

(AP, 22.May.2024) — As she runs to replace outgoing President Andrés Manuel López Obrador, Claudia Sheinbaum is struggling to construct her own image, leaving many wondering whether she can escape the...

(PEMEX, 22.May.2024) — The CEO of Petróleos Mexicanos (PEMEX), Octavio Romero Oropeza, currently on a working tour of the southeastern part of the country, is holding a series of meetings...

(Reuters, 21.May.2024) — A Mexican energy developer is seeking U.S. permission to export gas to Mexico, turn it into liquefied natural gas (LNG) and send it to countries with U.S. free-trade...

(Reuters, 17.May.2024) — Mexican state energy company Pemex started sending 16,300 barrels per day (bpd) of crude oil to its new Olmeca refinery this week, less than 5% of its total capacity, internal...

(S&P, 15.May.2024) — There is still a lot of private and international interest in developing the oil and natural gas resources in Mexico despite the shift towards state control by...

(Vista, 6.May.2024) — Vista Energy (NYSE: VIST) and Nabors Industries (NYSE: NBR) announced today the official signing of the contract to add a third drilling rig, aiming to accelerate Vista´s...

(PEMEX, 3.May.2024) — During the morning press conference held by the President of Mexico, Andrés Manuel López Obrador, the CEO of Petróleos Mexicanos (PEMEX), Octavio Romero Oropeza, described the operational,...

(Luca Mining, 30.Apr.2024) — Luca Mining Corp. (TSXV: LUCA) (OTCQX: LUCMF) (Frankfurt: Z68) is pleased to announce financial results for the three and twelve months ended 31Dec. 2023.Production Fourth Quarter 2023 Total production...

(Energy Analytics Institute, 30.Apr.2024) — Energy briefs as well as others related to finance and projects during April 2024 including ExxonMobil, Hess and CNOOC announcing a $12.7bn FID for their...

(AP, 24.Apr.2024) — A company started by a Texas billionaire oilman announced a deal Wednesday with Venezuela’s state-owned oil company to rehabilitate five aging oil fields, days after the Biden...

(BTU Analytics, 23.Apr.2024) — Historically, more than half of Mexico’s heavy sour crude oil exports, mostly Maya blend, end up in the U.S., which is key for refining along the...

(S&P Global Ratings, 15.Apr.2024) — Mexico's relationship with state-owned oil giant Pemex will remain a fiscal challenge for the country's next presidential administration, said S&P Global Ratings in "Pemex Will...

(Bendito Resources, 2.Apr.2024) — Bendito Resources Inc. has entered into a Membership Interest Purchase Agreement with Waterton Nevada Splitter, LLC and Waterton Nevada Splitter II, LLC (collectively, the "Vendor") pursuant...

(Energy Analytics Institute, 31.Mar.2024) — Energy briefs as well as others related to finance and projects during Mar. 2024 including Argentine inflation reaching 13.2% in Feb. 2024 and trailing 12-month...

(Steel Tube Institute, 14.Mar.2024) — The Steel Tube Institute (STI) – an organization that brings together key producers in the steel industry to advance the use of steel tubing – today declared...

(Kootenay Silver, 14.Mar.2024) — Kootenay Silver Inc. (TSXV: KTN) initiated its' Q1 diamond drilling program at Columba Silver Project in Chihuahua, Mexico. The proposed program includes 15-17 drillholes for a combined 5,000m...

(Sempra, 14.Mar.2024) — Sempra Infrastructure, a subsidiary of Sempra (NYSE: SRE) (BMV: SRE), reached a positive final investment decision for the development, construction and operation of the Cimarron wind project, the...

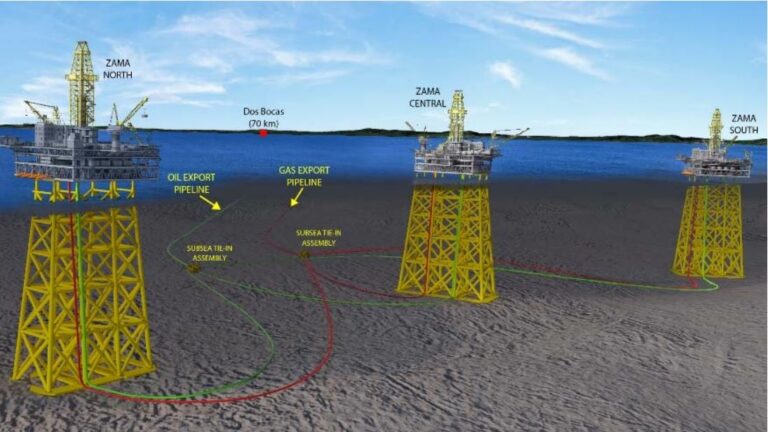

(Offshore staff, 12.Mar.2024) — The Zama offshore oilfield development project operated by state company Pemex has been “delayed for the right reasons,” according to Talos Energy Chief Executive Tim Duncan. ...

(Energy Analytics Institute, 29.Feb.2024) — Energy briefs as well as others related to finance and projects during Feb. 2024 including Exxon Mobil and CNOOC considering their pre-emption rights to Hess...

(Canary Media, 15.Feb.2024) — At least a half-dozen LNG export projects are underway in the country — but whether most are completed will depend on politics to the north. Environmental activists have...

(Woodside Energy, 13.Feb.2024) — Woodside announced the Trion oil and gas project has received approval for its Social Impact Assessment from the Mexican Ministry for Energy. The Social Impact Assessment...

(New Fortress, 29.Jan.2024) — New Fortress Energy Inc. (NASDAQ: NFE) (announced that U.S. Customs and Border Protection has issued a ruling confirming that the transportation of LNG produced at the company’s FLNG facility...

(Kootenay, 25.Jan.2024) — Kootenay Silver Inc. (TSXV: KTN) announced an updated Mineral Resource Estimate ("MRE") on its 100% owned La Cigarra Project, located in the Parral Silver District of Chihuahua State,...

(Reuters, 16.Jan.2024) — Mexico Pacific said on Tuesday it had reached a deal to supply Exxon Mobil with an additional 1.2 million tonnes per annum of liquefied natural gas, clearing...

(Mexico Pacific, 16.Jan.2024) — Mexico Pacific signed a third long-term Sales and Purchase Agreement (SPA) with ExxonMobil LNG Asia Pacific (EMLAP) for an additional 1.2 million tonnes per annum (MTPA)...

(Wood, 8.Jan.2023) — Wood, a global consulting and engineering, has secured a contract from HD Hyundai Heavy Industries for detailed engineering of the topsides facilities on Woodside Energy's Trion Floating...

(Luca Mining, 21.Dec.2023) — Luca Mining Corp. (TSXV: LUCA) (OTCQX: LUCMF) (Frankfurt: Z68) closed the CAD $2mn non-brokered private placement (announced on 6 Dec. 2023. In total, the company sold an aggregate of...

(GoGold, 19.Dec.2023) — GoGold Resources Inc. (TSX: GGD) (OTCQX: GLGDF) announces the financial results for the year ending 30 Sep. 2023, with Parral generating $30mn (all amounts are in U.S. dollars) from the sale of 1.4...

(Energy Analytics Institute, 30.Nov.2023) — Energy briefs as well as others related to finance and projects during November 2023 including PDVSA and the French co. Maurel & Prom inking a...

(Energy Analytics Institute, 25.Nov.2023) — Vista Energy provided an update on its assets in Argentina and Mexcio while also providing details about its near-term roadmap to achieve its net zero...

(WoodMac, 24.Nov.2023) — With nearly 15 billion barrels worth of varied resources discovered in the region since the turn of the decade, the future looks bright for upstream oil and...

(Sempra, 3.Nov.2023) — Sempra (NYSE: SRE) (BMV: SRE) announced third-quarter 2023 earnings of $721mn, or $1.14 per diluted share, compared to third-quarter 2022 earnings of $485mn, or $0.77 per diluted share. On an adjusted basis, the company's...

(Energy Analytics Institute, 31.Oct.2023) — Energy briefs as well as others related to finance and projects during October 2023 including Vista's third quarter 2023 earnings presentation; the long-awaited Citgo Petroleum...

(Pemex, 27.Oct.2023) —In the third quarter of 2023 (3Q23), Petróleos Mexicanos' operating performance was positive, supported by a responsible financial policy. In exploration and production, the strategy continued to favor...

(Silver Viper Minerals, 20.Oct.2023) — Silver Viper Minerals Corp. (TSXV: VIPR) (OTC: VIPRF) announced that, further to its press release April 6, 2023, it has amended the terms of the Rubi-Esperanza...

(SKF, 4.Oct.2023) — SKF inaugurated its new facility in Monterrey, Mexico, a greenfield factory investment totaling SEK 700mn. This will support SKF's strategic development in the Americas and meet customer needs as...

(Energy Analytics Institute, 30.Sep.2023) — Energy briefs as well as others related to finance and projects during Sep. 2023 including Petrobras saying that in regards the process of divestment of...

(Sempra, 27.Sep.2023) — Sempra Infrastructure, a subsidiary of Sempra (NYSE: SRE) (BMV: SRE), today announced that Tania Ortiz Mena has been appointed president of Sempra Infrastructure. In this role, Ortiz Mena will lead the company's three business...

(Talos, 27.Sep.2023) — Talos Energy Inc. (NYSE: TALO) and its Mexican subsidiary Talos Mexico announced the closing of the sale of a 49.9% interest in Talos Mexico to Zamajal, S....

(Energy Analytics Institute, 26.Sep.2023) — Vista Energy provided an update on its assets in Argentina and Mexico during its 26 Sep. 2023 investor day. arg-mex-investor-day-26sep2023-vistaDownload ____________________ By Aaron Simonsky. ©...

(Reuters, 22.Sep.2023) — The last major piece of infrastructure needed to start production at Mexico's first floating liquefied natural gas (LNG) plant is set to depart from a Texas shipyard...

(Orex Minerals, 22.Sep.2023) — Orex Minerals Inc. (TSXV: REX) (OTCQB: ORMNF) announced that, effective 27 September 2023, the company will consolidate its issued and outstanding common shares at a ratio of ten...

(Silver Valley Metals, 18.Sep.2023) — Silver Valley Metals Corp. (TSXV: SILV) (OTCQB: SVMFF), a brownfield exploration company with two potential high impact projects that comprise silver-zinc-lead located in north Idaho, USA and lithium...

(CarbonClear, 8.Sep.2023) — CarbonClear, a data-driven carbon credit standard, facilitated Uber Mexico's purchase of carbon credits from iluméxico through Apala Group. This landmark transaction signifies a significant step forward in...

(Arena Energy, 7.Sep.2023) — Arena Energy, LLC, an independent oil and gas exploration company focused on the Gulf of Mexico Shelf, and White Fleet Drilling, LLC, Arena's strategic partner created in...

(Energy Analytics Institute, 31.Aug.2023) — Energy briefs as well as others related to finance and projects during August 2023 including Petrobras commenting on divestment process related to the LUBNOR refinery;...

(Reuters, 10.Aug.2023) — Cuba has begun using its own tankers to ramp up crude imports from Mexico, which in the second quarter surpassed Russia as a key oil provider to...

(Talos, 8.Aug.2023) — Talos Energy Inc. (NYSE: TALO) announced its operational and financial results for fiscal quarter ended June 30, 2023. Key Highlights: Drilled a successful commercial discovery at the Talos-operated Sunspear...

(Energy Analytics Institute, 31.Jul.2023) — Energy briefs as well as others related to finance and projects during July 2023 including Dominion Energy (NYSE: D) concluding a sale process and executed...

(IGU, 20.Jul.2023) — The International Gas Union (IGU) presented its 14th annual edition of the IGU World LNG report. IGU-LNG2023-World-LNG-ReportDownload ____________________

(Transocean, 18.Jul.2023) — Transocean Ltd. (NYSE: RIG) announced that an independent operator awarded a 1,080-day contract for a high-specification seventh-generation, ultra-deepwater drillship in the Gulf of Mexico offshore Mexico. One of three drillships will be selected...

(Welligence Energy Analytics, 7.Jul.2023) — Our LNG outlook report, published this week to clients, reveals key insights into the industry's future. Can the LNG market overcome increasingly scarce supply, adapt to more concentrated production,...

(Mexico Pacific, 5.Jul.2023) — Zhejiang Energy International Limited and Mexico Pacific Limited signed a sales and purchase agreement for Zhejiang Energy to offtake 1.0 million tons per year (MTPA) of liquefied...

(Energy Analytics Institute, 30.Jun.2023) — Energy briefs as well as others related to finance and projects during June 2023 including YPF and Petronas updating on their joint plans to develop...

(Sempra, 29.Jun.2023) — Sempra (NYSE: SRE) (BMV: SRE) begins its 25th year of business, marking a quarter century of continued performance and progress toward its mission to be North America's premier energy infrastructure company. "Over the past...

(Maxeon Solar, 26.Jun.2023) — Maxeon Solar Technologies, Ltd. (NASDAQ: MAXN) hosted a ribbon cutting event in its recently expanded and renovated manufacturing plant in Mexicali, Baja California, Mexico. Maxeon was honored to welcome...

(Vehya, 26.Jun.2023) — Vehya, the dedicated marketplace platform for Electric Vehicle Supply Equipment (EVSE), announces a strategic partnership with Utilimaster, a go-to-market brand of The Shyft Group's Fleet Vehicles & Services...

![Vista Updates on LatAm Assets [PDF Download]](https://energy-analytics-institute.org/wp-content/uploads/2023/11/arg-mex-vista-768x491.png)

![Sempra Reports Strong 3Q:23 Earnings [PDF Downloads]](https://energy-analytics-institute.org/wp-content/uploads/2020/11/sempra-768x429.jpg)

![Pemex Reports 3Q:23 Results [PDF Downloads]](https://energy-analytics-institute.org/wp-content/uploads/2020/05/pemex-hq-cdmx-768x512.jpg)

![Vista Investor Day 2023 Presentation [PDF Download]](https://energy-analytics-institute.org/wp-content/uploads/2023/11/arg-mex-investor-day26sep2023-vista-768x379.png)

![IGU 2023 World LNG Report [PDF Download]](https://energy-analytics-institute.org/wp-content/uploads/2023/07/igu-2023-rpt-cover-768x590.png)