(Reuters, 24.Jul.2024) — Griselda Ascanio keeps an improvised wood-burning stove ready in her backyard in Maracay, 120 kilometers (75 miles) from Venezuela's capital, for the frequent gas-supply interruptions that make it difficult...

(IsoEnergy, 22.Jul.2024) — IsoEnergy Ltd. has completed the sale (the "Transaction") to Jaguar Uranium Corp. of 100% of the issued and outstanding shares (the "Target Shares") of a wholly-owned subsidiary of...

(Woodside, 23.Jul.2024) — Woodside Energy reported quarterly production of 44.4 MMboe (488 Mboe/day), down 1% from Q1 2024 due to planned maintenance activities, weather impacts at North West Shelf and unplanned...

(New Fortress, 17.Jul.2024) — New Fortress Energy Inc. announced that after successfully producing LNG at its first FLNG unit (“FLNG 1”), the company has closed its previously announced $700mn loan for...

(Woodside, 22.Jul.2024) — Woodside Energy Group Limited held an investor call to discuss its $900mn all-cash acquisition of Tellurian, Inc., which is developing Driftwood LNG. woodside-to-acquire-tellurian-transcriptDownload ____________________

(Frontera, 22.Jul.2024) — Frontera Energy Corporation announced that its subsidiary, Sociedad Portuaria Puerto Bahía S.A. and Gasco Soluciones Logísticas y Energéticas S.A.S. have entered into a Framework Collaboration Agreement (the "Agreement") to...

(Ecopetrol, 19.Jul.2024) — Ecopetrol S.A. informs that it is engaged in conversations with Occidental Petroleum Corp. (OXY) oriented to consider the potential acquisition by Ecopetrol of a certain percentage of assets...

(Bloomberg, 18.Jul.2024) — Exxon Mobil Corp. took the first step toward its seventh oil project in Guyana, a clear signal the supermajor intends to expand crude output from the South American...

(World Bank, 17.Jul.2024) — The World Bank Group released a study on “Scenarios for Offshore Wind Development in Brazil” conducted by DNV, the global independent energy expert and assurance provider. This report...

(S&P, 16.Jul.2024) — Given the large amount of unconventional hydrocarbon resources found in Mexico and how much fracking technology has advanced, the country cannot afford to neglect their exploitation without a...

(DPI, 16.Jul.2024) — The Environmental Protection Agency (EPA) has commenced the review of an application from ExxonMobil Guyana to develop a seventh oil project at the Hammerhead field in the Stabroek...

(EPA, 15.Jul.2024) — Produced Formation Water (PFW), sometimes called Produced Water (PW) is water trapped in underground formations that is brought to the surface during oil and gas extraction. This...

(Petrobras, 15.Jul.2024) — In the second quarter of this year, the Presidente Bernardes Refinery (RPBC) in Cubatão (SP) recorded a record in the production of S-10 diesel. It produced 990,000 m³,...

(Petrobras, 11.Jul.2024) — Petrobras obtained authorization from the National Agency of Petroleum, Natural Gas and Biofuels (ANP) to market maritime fuel with renewable content. The company is the first in...

(AP, 11.Jul.2024) — From climate change to species loss and pollution, humans have etched their impact on the Earth with such strength and permanence since the middle of the 20th...

(Vista, 11.Jul.2024) – Vista Energy, S.A.B. de C.V. reported financial and operational results corresponding to Q2 2024. Q2 2024 highlights: Total production in Q22024 was 65,288 boe/d, a 40% increase compared...

(Energy Chamber, 9.Jul.2024) — The Energy Chamber of Trinidad & Tobago warmly welcomes the news that the final investment decision (FID) has been taken by Shell for the development of the...

(Petrobras, 9.Jul.2024) — Petrobras has signed a Master Agreement with Yara Brasil Fertilizantes S.A. as a next step in its negotiations to structure potential business partnerships in the fertilizer segment, production...

(Shell, 9.Jul.2024) — Shell Trinidad and Tobago Ltd., a subsidiary of Shell plc, announced that it has taken Final Investment Decision (FID) on the Manatee project, an undeveloped gas field...

(MEEI, 9.Jul.2024) — The Honourable Stuart R. Young SC, MP, Minister of Energy and Energy Industries and Minister in the Office of the Prime Minister, along with Ms. Sandra Fraser, Permanent...

(Eni, 8.Jul.2024) — Eni announces a new discovery on the Yopaat-1 EXP exploration well in Block 9, approximately 63 kilometers off the coast in the mid-deep water of the Cuenca Salina...

(Port of Corpus Christi, 8.Jul.2024) — In response to the impacts of Hurricane Beryl, the Port of Corpus Christi Authority has now fully transitioned to Post-Storm Recovery in accordance with the...

(MEEI, 8.Jul.2024) — The Honourable Stuart R. Young SC, MP, Minister of Energy and Energy Industries and Minister in the Office of the Prime Minister, along with Ms. Sandra Fraser, Permanent...

(Asian Energy Capital, 8.Jul.2024) — A significant step towards sustainable energy production and environmental preservation was taken by Aslan Energy Capital by signing an MOU for the acquisition of 35,000 hectares...

(MEEI, 6.Jul.2024) — In response to the devastating impact of Hurricane Beryl on the islands of Grenada and Carriacou, the Government of the Republic of Trinidad and Tobago, through the Ministry...

(3R, 5.Jul.2024) — 3R PETROLEUM ÓLEO E GÁS S.A. and Enauta Participações S.A., under the terms of CVM Resolution No. 44, 23 Aug. 2021, regarding the transaction involving the merger...

(Petrobras, 5.Jul.2024) — Petrobras, in continuity to the Material Fact disclosed on 22 May 2024, informs that the Court of the Administrative Council for Economic Defense (CADE) and Petrobras signed an...

(Petrobras, 3.Jul.2024) — Petrobras, in continuity to the Material Fact disclosed on May 22, 2024, informs that the Court of the Administrative Council for Economic Defense (CADE) and Petrobras signed an addendum to...

(Enauta, 1.Jul.2024) — Enauta Participações, considering the Material Fact disclosed on 21 Dec. 2023, informs that it has notified MODEC of the termination of the contract to acquire FPSO Cidade...

(Petrobras, 1.Jul.2024) — Petrobras, following up on the release disclosed on 23 Feb. 2024, in which it reported the signing of the contract for the sale of its 18.8% stake in...

(Energy Analytics Institute, 30.Jun.2024) — Energy briefs as well as others related to finance and projects during June 2024 including Wintershall Dea and its partners from TotalEnergies and Pan American...

(MEEi, 29.Jun.2024) — The Ministry of Energy and Energy Industries advises that on 28 June 2024, the De-Inventory Phase of operations has been completed. All safely recoverable hydrocarbons from the wreck...

(Ecopetrol, 28.Jun.2024) — Ecopetrol S.A. informs that the Board of Directors, at its meeting held on 28 June 2024, appointed independent Director Gonzalo Hernández Jiménez as a member of the Audit and...

(Petrobras, 28.Jun.2024) — Petrobras, following up on the releases disclosed on 29 Dec. 2023 and 5 Feb. 2024, informs that the contract for Industrialization to Order (Tolling) signed with Unigel Group,...

(Ecopetrol, 26.Jun.2024) — Ecopetrol S.A. informs that the Board of Directors, in its meeting held on 28 June 2024 adopted the following decisions: As part of the implementation of the new organizational structure,...

(IGU, 26.Jun.2024) — Despite lower price, the growing global LNG market stays tight amid supply constraints, according to the 2024 IGU World LNG Report. Released today, the IGU’s 15th annual...

(Capstone Copper, 25.Jun.2024) — Capstone Copper Corp. (TSX:CS) (ASX:CSC) announced that the first saleable copper concentrate was produced at its Mantoverde Development Project (“MVDP”) in Chile, as the mine advances commissioning...

(Capstone, 25.Jun.2024) — Capstone Copper Corp. (TSX:CS) (ASX:CSC) announced that first saleable copper concentrate was produced at its Mantoverde Development Project (“MVDP”) in Chile, as the mine advances commissioning and ramps...

(Petrobras, 28.Jun.2024) — The Petrobras Board of Directors elected the following members to the company's executive board in a meeting held this Friday (06/28): Renata Baruzzi (Executive Director of Engineering, Technology,...

(Petrobras, 21.Jun.2024) — Petrobras, Gerdau, and Naturgy have signed contracts for the supply of natural gas in the free market environment to serve Cosigua, Gerdau's long steel production unit located in...

(Reuters, 20.Jun.2024) — A contract arbitration panel that could block or green-light the $53 billion sale of Hess Corp to Chevron remains incomplete three months after the case was filed, stalling a decision...

(Reuters, 20.Jun.2024) — U.S. firm Fulcrum LNG was selected to help Guyana develop a plan to design, finance, construct and operate a natural gas processing facility in the South American...

(Grupo Carso, 20.Jun.2024) — Grupo Carso, S.A.B. de C.V., following its notice dated 18 Dec. 2023, informs the investor public that since the stipulated conditions have been met and the...

(Petrobras, 19.Jun.2024) — Petrobras said the FPSO Maria Quitéria is currently en route to Brazil. The platform ship departed from China in May and is expected to arrive at its...

(Ndustrial, 18.Jun.2024) — Ndustrial, the AI-powered energy intensity platform for industry, is expanding its presence throughout Latin America to meet strong customer demand to drive down industrial energy costs and emissions. The company...

(Petrobras, 18.Jun.2024) — Petrobras, on 18 Jun. 2024, signed a Protocol of Intentions with the Government of the State of Rio de Janeiro to carry out joint studies to feasibility...

(Petrobras, 18.Jun.2024) — This month, June, in London, the International Maritime Organization (IMO), connected with the UN through its Sub-Committee on Navigation, Communications and Search and Rescue (NCSR), recommended approving the...

(Reuters, 17.Jun.2024) — Mexico's President Andres Manuel Lopez Obrador said on Friday that businessman Carlos Slim is interested in participating in the country's first deepwater natural gas project, working alongside...

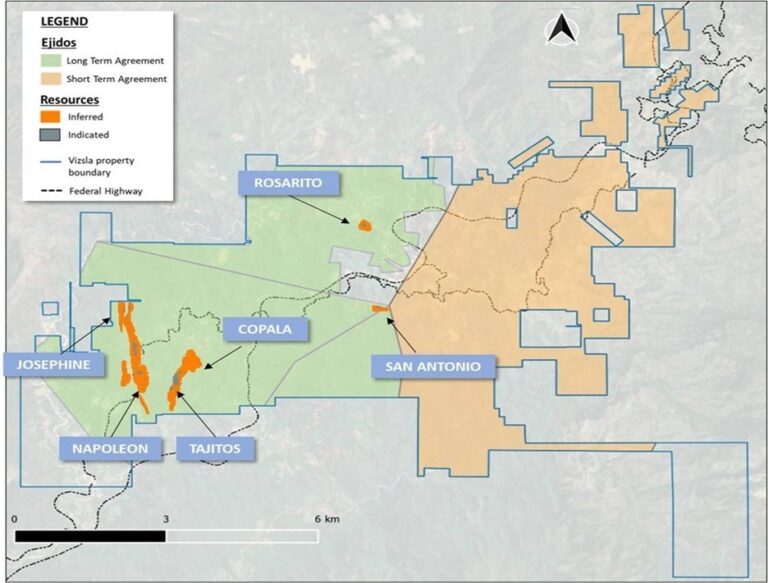

(17.Jun.2024) — Vizsla Silver Corp. announced that Vizsla Silver shareholders ("Shareholders") approved the plan of arrangement (the "Arrangement") with Vizsla Royalties Corp. ("Spinco") at the special meeting of Shareholders held...

(Ecopetrol, 17.Jun.2024) — Ecopetrol S.A. (BVC: ECOPETROL; NYSE: EC) informs that through Resolution 1671 of 14 Jun. 2024, the Ministry of Finance and Public Credit (MHCP) authorized Ecopetrol to execute a loan agreement for...

(Petrobras, 17.Jun.2024) — Petrobras, in continuity to the notice to the market disclosed on 8 Apr. 2024, informs that the Board of Directors approved, with 10 (ten) votes in favor,...

(Energy Analytics Institute, 14.Jun.2024) — New Fortress Energy (NFE) updated the timing of its first LNG expectation for its first Fast LNG unit located offshore Altamira, Mexico. The company has...

(Trendsetter, 13.Jun.2024) — Trendsetter Engineering has been awarded a significant contract by Trident Energy do Brasil to deliver two six-slot production subsea manifolds for the Bonito and Bicudo Fields in...

(Petrobras, 13.Jun.2024) — Petrobras, in continuity with the Material Fact disclos ed on 27 Oct. 2022, informs that, observing the applicable internal governance, the closure of the competitive process for...

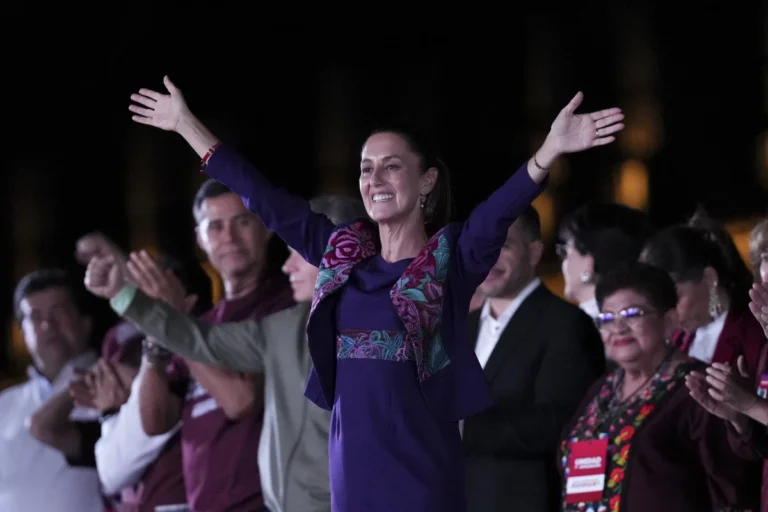

(Reuters, 12.Jun.2024) — Mexico's former foreign minister, the scion of a legendary political family, and a party boss are in contention for top energy-related jobs in President-elect Claudia Sheinbaum's government,...

(Petrobras, 12.Jun.2024) — Petrobras informs that the Superior Labor Court (TST) ratified, on 12 Jun. 2024, the agreement for the recall of approximately 250 workers by Araucária Nitrogenados S/A (ANSA),...

(Petrobras, 11.Jun.2024) — Petrobras, following the Material Fact of 13 May 2024, informs that, as a result of the share buyback program, there was a change in the number of...

(Oceaneering, 10.Jun.2024) — Oceaneering International, Inc. (NYSE:OII) announced that its Manufactured Products segment has secured two significant contracts with Petroleo Brasileiro S.A. (Petrobras) through a competitive bidding process. The expected...

(Petrobras, 10.Jun.2024) — Petrobras published its 2023 Sustainability Report. The document reports on progress in the company's sustainability commitments and consolidates indicators related to environmental, social and governance (ESG) issues. This...

(National Mining Agency, 9.Jun.2024) — Approximately 92% of coal production in Colombia is extracted in open-pit mining areas in the departments of Cesar and La Guajira, with thermal coal, which in general...

(AP, 8.Jun.2024)) — President Gustavo Petro announced on Saturday that his country will suspend coal exports to Israel over the war in Gaza, as relations sour between two countries that were once...

(Black & Veatch, 7.Jun.2024) — Global liquefied natural gas (LNG) infrastructure solutions leader Black & Veatch has completed a feasibility study for the planned Andes Energy Terminal, LNG regasification terminal and...

(Energy Analytics Institute, 7.Jun.2024) — Petrobras´ Board of Directors decided by majority not to accept the shareholders' requests to call an Extraordinary General Meeting ("EGM"), due to the failure to...

(SBM, 6.Jun.2024) — SBM Offshore announced that, in partnership with Technip Energies, and in line with the Front End Engineering and Design (FEED) studies for a Floating Production, Storage and...

(Industrial Info Resources, 6.Jun.2024) — Claudia Sheinbaum, Mexico's president-elect, will inherit "a number of headaches" when she is inaugurated later this year, a longtime observer of Mexican affairs told Industrial...

(Petrobras, 6.Jun.2024) — To improve the efficiency and safety of deep-water oil and gas activities, Petrobras and Curtiss-Wright have entered into a technological cooperation agreement to design a fully electric, highly...

(Petrobras, 6.Jun.2024) — Petrobras’ Executive Board approved the resumption of operating activities of fertilizer plant Araucária Nitrogenados S.A. (ANSA), a wholly-owned subsidiary of the company. The plant, located in the...

(Bloomberg, 6.Jun.2024) — Colombia’s trade ministry is calling for a restriction on coal sales to Israel in the latest bid to isolate the Jewish state as the death toll rises...

(TotalEnergies, 5.Jun.2024) — On the occasion of the 2024 Suriname Energy Oil and Gas Summit, Javier Rielo, Senior Vice President Americas, Exploration & Production for TotalEnergies (Paris:TTE) (LSE:TTE) (NYSE:TTE), and...

(Petrobras, 5.Jun.2024) — Petrobras signed a Memorandum of Understanding (MoU) with the Chinese Export Credit Agency, Sinosure. The agreement aims to evaluate investment and cooperation opportunities in low-carbon and green...

(SEOGS, 3.Jun.2024) — Taking place from 4-7 Jun. 2024, SEOGS will be hosted by Staatsolie under the theme: The Next Stage of Success. SEOGS is the market leading energy and offshore event in Suriname and...

(AP, 3.Jun.2024) — Mexico’s projected presidential winner Claudia Sheinbaum will become the first female president in the country’s 200-year history. Sheinbaum, the favored successor of outgoing President Andrés Manuel López Obrador, vowed to...

(AP, 3.Jun.2024) — Claudia Sheinbaum, who will be Mexico’s first woman leader in the nation’s more than 200 years of independence, captured the presidency by promising continuity. The 61-year-old former Mexico City mayor and lifelong...

(Subsea7, 3.Jun.2024) — Subsea7 announced, after a competitive tender process, the award by Petrobras of four long-term day-rate contracts for pipelay support vessels (PLSVs) commencing in 2025. The contracts have a...

(Mitsubishi, 1.Jun.2024) — The consortium formed by Mitsubishi Power Americas, Inc. and CONSAG Engenharia – an Andrade Gutierrez company (CONSAG) – recently signed an agreement with Portocem Geração de Energia...