(Reuters, 24.Jul.2024) — Griselda Ascanio keeps an improvised wood-burning stove ready in her backyard in Maracay, 120 kilometers (75 miles) from Venezuela's capital, for the frequent gas-supply interruptions that make it difficult...

(IsoEnergy, 22.Jul.2024) — IsoEnergy Ltd. has completed the sale (the "Transaction") to Jaguar Uranium Corp. of 100% of the issued and outstanding shares (the "Target Shares") of a wholly-owned subsidiary of...

(Woodside, 23.Jul.2024) — Woodside Energy reported quarterly production of 44.4 MMboe (488 Mboe/day), down 1% from Q1 2024 due to planned maintenance activities, weather impacts at North West Shelf and unplanned...

(Flowserve, 23.Jul.2024) — Flowserve Corporation acquired the intellectual property and in-process R&D related to cryogenic Liquefied Natural Gas (LNG) submerged pump technology, systems and packaging from NexGen Cryogenic Solutions, Inc.,...

(Glenfarne, 23.Jul.2024) — Texas LNG Brownsville LLC, a four million tonnes per annum (mtpa) liquefied natural gas (LNG) export terminal to be constructed in the Port of Brownsville, Texas, and...

(Atlas Energy, 23.Jul.2024) — Atlas Energy Solutions Inc. and Kodiak Robotics, Inc. announced that the two companies have entered into an agreement whereby Kodiak will outfit new Atlas high-capacity trucks...

(New Fortress, 17.Jul.2024) — New Fortress Energy Inc. announced that after successfully producing LNG at its first FLNG unit (“FLNG 1”), the company has closed its previously announced $700mn loan for...

(Woodside, 22.Jul.2024) — Woodside Energy Group Limited held an investor call to discuss its $900mn all-cash acquisition of Tellurian, Inc., which is developing Driftwood LNG. woodside-to-acquire-tellurian-transcriptDownload ____________________

(Frontera, 22.Jul.2024) — Frontera Energy Corporation announced that its subsidiary, Sociedad Portuaria Puerto Bahía S.A. and Gasco Soluciones Logísticas y Energéticas S.A.S. have entered into a Framework Collaboration Agreement (the "Agreement") to...

(Occidental, 19.Jul.2024) — Occidental announced that it has commenced a private exchange offer to certain eligible holders (the “Exchange Offer”) for any and all outstanding 5.000% Senior Notes due 2029 (the...

(Tellurian, 21.Jul.2024) — Tellurian Inc. has entered into a definitive agreement with subsidiaries of Woodside Energy Group Ltd pursuant to which Woodside will acquire all the outstanding shares of Tellurian...

(Woodside, 22.Jul.2024) — Woodside has entered into a definitive agreement to acquire all issued and outstanding common stock of Tellurian including its owned and operated US Gulf Coast Driftwood LNG development...

(Ecopetrol, 19.Jul.2024) — Ecopetrol S.A. informs that it is engaged in conversations with Occidental Petroleum Corp. (OXY) oriented to consider the potential acquisition by Ecopetrol of a certain percentage of assets...

(Bloomberg, 18.Jul.2024) — Exxon Mobil Corp. took the first step toward its seventh oil project in Guyana, a clear signal the supermajor intends to expand crude output from the South American...

(World Bank, 17.Jul.2024) — The World Bank Group released a study on “Scenarios for Offshore Wind Development in Brazil” conducted by DNV, the global independent energy expert and assurance provider. This report...

(Kinder Morgan, 17.Jul.2024) — Kinder Morgan, Inc.’s board of directors today approved a cash dividend of $0.2875 per share for the second quarter ($1.15 annualized), payable on 15 Aug. 2024...

(S&P, 16.Jul.2024) — Given the large amount of unconventional hydrocarbon resources found in Mexico and how much fracking technology has advanced, the country cannot afford to neglect their exploitation without a...

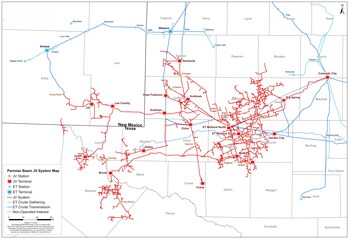

(Energy Transfer, 16.Jul.2024) – Energy Transfer LP and Sunoco LP announced the formation of a joint venture combining their respective crude oil and produced water gathering assets in the Permian Basin....

(TotalEnergies, 16.Jul.2024) — TotalEnergies and SSE have signed a binding agreement to create a joint venture to establish a new major player in EV charging infrastructure in the UK and Ireland,...

(JInkoSolar, 16.Jul.2024) – JinkoSolar Holding Co., Ltd. announced that its indirectly majority-owned subsidiary, JinkoSolar Middle East DMCC, has entered into a shareholders agreement (the "Agreement") with Renewable Energy Localization Company (RELC),...

(Aker, 16.Jul.2024) – Aker Horizons ASA announced results for the second quarter 2024. Aker Horizons' net capital employed stood at NOK 7.1bn, an increase of NOK 1.9bn from the first quarter, mainly driven by...

(DPI, 16.Jul.2024) — The Environmental Protection Agency (EPA) has commenced the review of an application from ExxonMobil Guyana to develop a seventh oil project at the Hammerhead field in the Stabroek...

(EPA, 15.Jul.2024) — Produced Formation Water (PFW), sometimes called Produced Water (PW) is water trapped in underground formations that is brought to the surface during oil and gas extraction. This...

(bp, 15.Jul.2024) – bp has been granted funding, provided jointly by BMWK and Lower-Saxony Government, as part of the European IPCEI Hy2Infra wave for a green hydrogen project in Germany. The...

(TGS, 15 July 2024) – TGS announces early access to a comprehensive carbon storage assessment dataset along the Texas and Louisiana Gulf Coast, covering the available GLO lease blocks. This...

(CNOOC, 15 July 2024) – CNOOC Limited has achieved a major exploration breakthrough in Mesozoic buried hill offshore Bohai Bay. Longkou 7-1 oilfield is located in eastern Bohai Bay, with...

(Petrobras, 15.Jul.2024) — In the second quarter of this year, the Presidente Bernardes Refinery (RPBC) in Cubatão (SP) recorded a record in the production of S-10 diesel. It produced 990,000 m³,...

(bp, 14.Jul.2024) – Audi and bp are joining forces in an extensive new strategic partnership in Formula 1. As Audi prepares to enter the pinnacle of motor racing in 2026, which...

(Petrobras, 11.Jul.2024) — Petrobras obtained authorization from the National Agency of Petroleum, Natural Gas and Biofuels (ANP) to market maritime fuel with renewable content. The company is the first in...

(AP, 11.Jul.2024) — From climate change to species loss and pollution, humans have etched their impact on the Earth with such strength and permanence since the middle of the 20th...

(Vista, 11.Jul.2024) – Vista Energy, S.A.B. de C.V. reported financial and operational results corresponding to Q2 2024. Q2 2024 highlights: Total production in Q22024 was 65,288 boe/d, a 40% increase compared...

(Woodside, 11.Jul.2024) — Woodside signed a sale and purchase agreement (SPA) with CPC Corporation, Taiwan (CPC) for the long-term supply of liquefied natural gas (LNG) to Taiwan. Under the SPA, Woodside...

(Air Products, 10.Jul.2024) — Honeywell and Air Products jointly announced that Honeywell has agreed to acquire Air Products' liquefied natural gas (LNG) process technology and equipment business for $1.81bn in an all-cash transaction. This represents...

(Energy Chamber, 9.Jul.2024) — The Energy Chamber of Trinidad & Tobago warmly welcomes the news that the final investment decision (FID) has been taken by Shell for the development of the...

(Petrobras, 9.Jul.2024) — Petrobras has signed a Master Agreement with Yara Brasil Fertilizantes S.A. as a next step in its negotiations to structure potential business partnerships in the fertilizer segment, production...

(Shell, 9.Jul.2024) — Shell Trinidad and Tobago Ltd., a subsidiary of Shell plc, announced that it has taken Final Investment Decision (FID) on the Manatee project, an undeveloped gas field...

(MEEI, 9.Jul.2024) — The Honourable Stuart R. Young SC, MP, Minister of Energy and Energy Industries and Minister in the Office of the Prime Minister, along with Ms. Sandra Fraser, Permanent...

(Pennybacker Capital, 9.Jul.2024) — Pennybacker Capital Management, LLC, a real assets investment manager, has entered into a definitive agreement to acquire a small-scale LNG business (Miami Facility) based in Miami, Florida, from...

(Eni, 8.Jul.2024) — Eni announces a new discovery on the Yopaat-1 EXP exploration well in Block 9, approximately 63 kilometers off the coast in the mid-deep water of the Cuenca Salina...

(Reuters, 8.Jul.2024) — Exxon Mobil said on Monday lower natural gas prices and refining margins are expected to hit the oil major's second-quarter earnings. The oil major would be reporting its...

(Port of Corpus Christi, 8.Jul.2024) — In response to the impacts of Hurricane Beryl, the Port of Corpus Christi Authority has now fully transitioned to Post-Storm Recovery in accordance with the...

(Equinor, 8.Jul.2024) — Equinor and its partners Petoro, Vår Energi, and TotalEnergies EP Norge started production from the first Lavrans well in the Kristin South area on 7 July. The...

(Devon Energy, 8.Jul.2024) — Devon Energy has entered into a definitive purchase agreement to acquire the Williston Basin business of Grayson Mill Energy in a transaction valued at $5bn, consisting...

(MEEI, 8.Jul.2024) — The Honourable Stuart R. Young SC, MP, Minister of Energy and Energy Industries and Minister in the Office of the Prime Minister, along with Ms. Sandra Fraser, Permanent...

(Asian Energy Capital, 8.Jul.2024) — A significant step towards sustainable energy production and environmental preservation was taken by Aslan Energy Capital by signing an MOU for the acquisition of 35,000 hectares...

(ExxonMobil, 7.Jul.2024) — As we prepare for severe weather that may impact our Gulf of Mexico operations, our primary focus is the safety of our workforce and communities in the...

(MEEI, 6.Jul.2024) — In response to the devastating impact of Hurricane Beryl on the islands of Grenada and Carriacou, the Government of the Republic of Trinidad and Tobago, through the Ministry...

(3R, 5.Jul.2024) — 3R PETROLEUM ÓLEO E GÁS S.A. and Enauta Participações S.A., under the terms of CVM Resolution No. 44, 23 Aug. 2021, regarding the transaction involving the merger...

(Port of Corpus Christi, 5.Jul.2024) — Anticipating the landfall of Hurricane Beryl on the Texas Gulf Coast, the Port of Corpus Christi has increased its Hurricane Readiness Status to Hurricane Readiness Level...

(Petrobras, 5.Jul.2024) — Petrobras, in continuity to the Material Fact disclosed on 22 May 2024, informs that the Court of the Administrative Council for Economic Defense (CADE) and Petrobras signed an...

(SLB, 3.Jul.2024) — SLB has announced the award of a contract by TotalEnergies to its OneSubsea™ joint venture for a 13-well Subsea Production System scope, including associated equipment and services,...

(Kosmos Energy, 3.Jul.2024) — Kosmos Energy Ltd. announced the successful start-up of oil production at the Winterfell development in the Green Canyon area of the U.S. Gulf of Mexico. Winterfell (Kosmos 25.04% working interest)...

(Petrobras, 3.Jul.2024) — Petrobras, in continuity to the Material Fact disclosed on May 22, 2024, informs that the Court of the Administrative Council for Economic Defense (CADE) and Petrobras signed an addendum to...

(SLB, 2.Jul.2024) — SLB and TotalEnergies announced a 10-year partnership to co-develop scalable digital solutions for enabling access to energy resources, with improved performance and efficiency. The partnership establishes a...

(Energy Analytics Institiute, 2.Jul.2024) — SLB and ChampionX have each received a request for additional information, a second request, from the U.S. Department of Justice (DoJ) in connection with the...

(BW LPG, 1.Jul.2024) — Reference is made to the stock exchange announcement made by BW LPG Limited on 21 June 2024 regarding the subsequent court hearing (the "Sanction Hearing") at...

(New Fortress, 1.Jul.2024) — New Fortress Energy Inc. has entered into a definitive agreement to sell its liquefaction and storage facility in Miami, Florida to a U.S. middle-market infrastructure fund....

(Reuters, 1.Jul.2024) — A federal judge on Monday dealt President Joe Biden's climate agenda a setback by blocking the Democrat's administration from continuing to pause the approval of applications to export liquefied natural...

(Enauta, 1.Jul.2024) — Enauta Participações, considering the Material Fact disclosed on 21 Dec. 2023, informs that it has notified MODEC of the termination of the contract to acquire FPSO Cidade...

(Petrobras, 1.Jul.2024) — Petrobras, following up on the release disclosed on 23 Feb. 2024, in which it reported the signing of the contract for the sale of its 18.8% stake in...

(NextDecade, 1.Jul.2024) — NextDecade Corporation’s subsidiary Rio Grande LNG, LLC issued $1.115bn of senior secured notes in a private placement. These senior secured notes will accrue interest at a fixed...

(Tellurian, 1.Jul.2024) — Tellurian Inc. closed the previously reported sale of its integrated upstream assets for $260mn to affiliates of Aethon Energy Management LLC, fulfilling a key objective outlined in...

(Aethon, 1.Jul.2024) — Aethon Energy Management LLC successfully closed on the acquisition of Tellurian’s integrated upstream assets. Aethon’s footprint across its Fund II and Fund III assets in the Haynesville...

(Energy Analytics Institute, 30.Jun.2024) — Energy briefs as well as others related to finance and projects during June 2024 including Wintershall Dea and its partners from TotalEnergies and Pan American...

(MEEi, 29.Jun.2024) — The Ministry of Energy and Energy Industries advises that on 28 June 2024, the De-Inventory Phase of operations has been completed. All safely recoverable hydrocarbons from the wreck...

(Ecopetrol, 28.Jun.2024) — Ecopetrol S.A. informs that the Board of Directors, at its meeting held on 28 June 2024, appointed independent Director Gonzalo Hernández Jiménez as a member of the Audit and...

(Petrobras, 28.Jun.2024) — Petrobras, following up on the releases disclosed on 29 Dec. 2023 and 5 Feb. 2024, informs that the contract for Industrialization to Order (Tolling) signed with Unigel Group,...

(Stena RoRo, 28.Jun.2024) — Stena RoRo has ordered another two E-Flexer RoPax vessels from the Chinese shipyard CMI Jinling (Weihai). The vessels will be delivered in 2027 to the Greek shipping company...

(Eni, 27.Jun.2024) — Eni inked a binding agreement with Hilcorp, one of the largest US private company with extensive experience operating in Alaska, for the sale of 100% of the Nikaitchuq...

(JinkoSolar, 27.Jun.2024) — JinkoSolar Holding Co., Ltd. announced that as of the date of this press release, the company has repurchased a total of 4,503,178 ADSs in an aggregate amount of...

(Venture Global, 27.Jun.2024) — Venture Global issued the following statement on the Federal Energy Regulatory Commission's (FERC) approval of CP2 LNG, the company's third export facility. "Venture Global applauds the Commission...

(Oceaneering, 27.Jun.2024) — Oceaneering International, Inc. announced that its Offshore Projects Group (OPG) segment has been awarded multiple contractual agreements for vessel services with global energy companies, covering operations in the...

(JordProxa, 27.Jun.2024) — JordProxa and Zelandez announced the signing of a partnership designed to speed up the supply of lithium from lithium brine mining companies in North and South America....

(Ecopetrol, 26.Jun.2024) — Ecopetrol S.A. informs that the Board of Directors, in its meeting held on 28 June 2024 adopted the following decisions: As part of the implementation of the new organizational structure,...

(TXO, 26.Jun.2024) — TXO Partners, L.P. (NYSE: TXO) announced the pricing of its public offering of 6,500,000 common units representing limited partner interests in TXO (the “common units”) at price to...