(IsoEnergy, 22.Jul.2024) — IsoEnergy Ltd. has completed the sale (the "Transaction") to Jaguar Uranium Corp. of 100% of the issued and outstanding shares (the "Target Shares") of a wholly-owned subsidiary of...

(AP, 11.Jul.2024) — From climate change to species loss and pollution, humans have etched their impact on the Earth with such strength and permanence since the middle of the 20th...

(Vista, 11.Jul.2024) – Vista Energy, S.A.B. de C.V. reported financial and operational results corresponding to Q2 2024. Q2 2024 highlights: Total production in Q22024 was 65,288 boe/d, a 40% increase compared...

(Energy Analytics Institute, 30.Jun.2024) — Energy briefs as well as others related to finance and projects during June 2024 including Wintershall Dea and its partners from TotalEnergies and Pan American...

(IGU, 26.Jun.2024) — Despite lower price, the growing global LNG market stays tight amid supply constraints, according to the 2024 IGU World LNG Report. Released today, the IGU’s 15th annual...

(Golden Arrow, 23.May.2024) — Golden Arrow Resources Corporation (TSXV: GRG) (FSE: G6A) (OTCQB: GARWF) provided an update on its exploration activities in Chile and Argentina. Highlights: Multiple magnetite mantos that correlate with similar bodies in adjacent holes,...

(GeoPark, 15.May.2024) — GeoPark Limited (NYSE: GPRK) reports its consolidated financial results for the three-month period ended 31 Mar. 2024 (“First Quarter” or “1Q2024”). A conference call to discuss these...

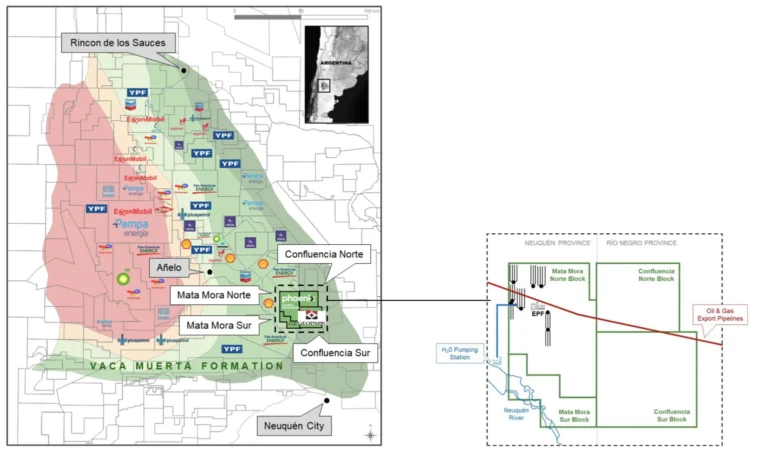

(GeoPark, 13.May.2024) — GeoPark Limited (NYSE: GPRK) signed an Asset Purchase Agreement with Phoenix Global Resources (PGR), a subsidiary of Mercuria Energy Trading, for the acquisition of non-operated working interest (WI)...

(YPF, 10.May.2024) — YPF SA said it achieved a new quarterly record high in operational efficiencies, delivering positive evolution in shale oil production. Unknown-2Download UnknownDownload ypf-1q24-results-webcastDownload Unknown-4Download YPF also released...

(Vista, 6.May.2024) — Vista Energy (NYSE: VIST) and Nabors Industries (NYSE: NBR) announced today the official signing of the contract to add a third drilling rig, aiming to accelerate Vista´s...

(Petrobras, 29.Apr.2024) — In 1Q24, average production of oil, NGL and natural gas reached 2,776 MMboed, increase of 3.7% when comparing with the same period last year (1Q23). Among the main...

(Energy Analytics Institute, 25.Apr.2024) — On 18 Apr. 2024, Petrobras inked a Memorandum of Understanding (MOU) with the Argentina state energy company Enarsa to study partnerships in the natural gas...

(Golden Arrow, 11.Apr.2024) — Golden Arrow Resources Corporation (TSXV: GRG) (FSE: G6A) (OTCQB: GARWF) reported on the status of the option granted to Sociedad de Servicios Andinos SpA (SSA) in respect to the...

(PetroTal, 11.Apr.2024) — PetroTal Corp. (TSX: TAL, AIM: PTAL and OTCQX: PTALF) announces the following operational, financial and corporate updates. All amounts are in US dollars unless stated otherwise. Q1 2024...

(GeoPark, 11.Apr.2024) — GeoPark Limited (NYSE: GPRK) has submitted a binding offer to acquire a non-operated working interest (WI) in unconventional blocks in the Neuquen Basin in Argentina. As of...

(Rystad Energy, 4.Apr.2024) — As the deadline for US sanctions relief on Venezuela ends on 18 Apr. 2024, the outlook for the South American nation’s oil industry appears uncertain. If...

(Energy Analytics Institute, 31.Mar.2024) — Energy briefs as well as others related to finance and projects during Mar. 2024 including Argentine inflation reaching 13.2% in Feb. 2024 and trailing 12-month...

(Energy Analytics Institute, 22.Mar.2024) — The CERAWeek by S&P Global, held 18-22 Mar. 2024 in Houston, Texas, boasted in attendance 8,100+ delegates (9,400+ when counting staff, vendors etc), a record...

(YPF, 7.Mar.2024) — YPF SA reported total hydrocarbon production averaged 514 Kboe/d in 2023 (+2% vs. 2022) and 511 Kboe/d in 4Q23 (-2% q/q but +2% y/y), mainly boosted by...

(Energy Analytics Institute, 29.Feb.2024) — Energy briefs as well as others related to finance and projects during Feb. 2024 including Exxon Mobil and CNOOC considering their pre-emption rights to Hess...

(Energy Workforce & Technology Council, 29.Feb.2024) — Promising drastic change to Argentina’s government and economy, President Javier Milei has run into political speed bumps impacting the oil and gas industry...

(YPF, 6.Feb.2024) — YPF Sociedad Anónima announced the expiration and final results as of 5:00 p.m. (New York City time) on 5 Feb. 2024 of its previously announced cash tender...

(Energy Analytics Institute, 26.Jan.2024) — Argentina's state-owned energy giant YPF SA announced the appointment of Horacio Daniel Marin as president of the company. argentina-ypf-ceoDownload ____________________ By Aaron Simonsky. © Energy...

(Golden Arrow, 12.Jan.2024) — Golden Arrow Resources Corporation (TSXV: GRG) (FSE: G6A) (OTCQB: GARWF) announced that New Golden Explorations Chile SpA (NGE), a wholly-owned subsidiary of the company, has entered into an option...

(Al Jazeera, 11.Jan.2024) — Argentina and the International Monetary Fund (IMF) have finalised an agreement to release $4.7bn as part of a debt restructuring plan for the troubled South American nation. Latin...

(Bloomberg, 10.Jan.2024) — Argentina’s state-owned oil driller YPF SA tapped international investors with a new dollar bond to help finance a buyback of existing debt, according to people familiar with...

(IMF, 10.Jan.2024) — An International Monetary Fund (IMF) team, led by Luis Cubeddu, Deputy Director of the Western Hemisphere Department and Ashvin Ahuja, Mission Chief for Argentina, issued the following...

(Energy Analytics Institute, 31.Dec.2023) — Energy briefs as well as others related to finance and projects during Dec. 2023 including why Venezuela wants to annex the Essequibo; Petrobras acquiring 29...

(Energy Analytics Institute, 26.Dec.2023) — Argentina’s president Javier Milei published a decree that prohibits the renewal of jobs of public workers hired in 2023. The decision is part of adjustments...

(Energy Analytics Institute, 4.Dec.2023) — Argentina’s Vaca Muerta shale formation contains an estimated 308 trillion cubic feet (Tcf) of recoverable shale resources and is important for continued economic development of...

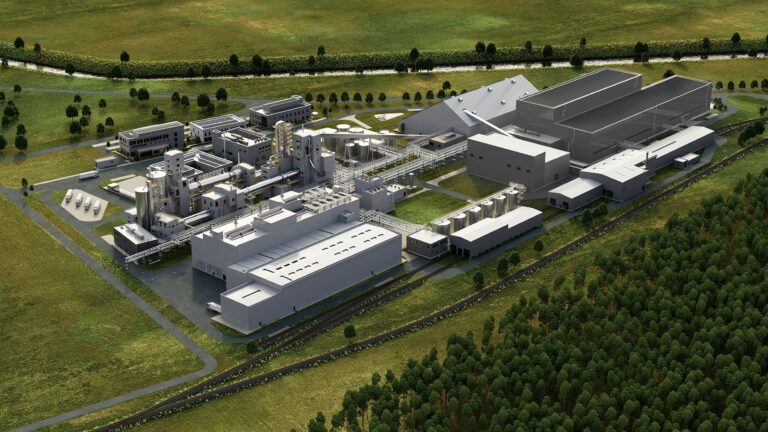

(Rock Tech, 4.Dec.2023) — Rock Tech Lithium Inc. (TSXV: RCK) (OTCQX: RCKTF) (FWB: RJIB) (WKN: A1XF0V) has received a binding feedstock supply offer from Castelburg Industrie GmbH. Castelburg, a renowned supplier in the...

(Blue Sky, 1.Dec.2023) — Blue Sky Uranium Corp. (TSXV: BSK) (FSE: MAL2) (OTC: BKUCF),has made an application to the TSX Venture Exchange to extend the term of the outstanding warrants as...

(WoodMac, 30.Nov.2023) — Driven by advances in batteries and lower costs, solar will outpace wind growth rates and become the leading technology for expansion over the next ten years in...

(WooMac, 28.Nov.2023) — Addressing the election of Javier Milei as President of Argentina, Adrian Lara, principal analyst, said “Elected President Javier Milei and his advisors are signalling the importance the...

(Energy Analytics Institute, 25.Nov.2023) — Vista Energy provided an update on its assets in Argentina and Mexcio while also providing details about its near-term roadmap to achieve its net zero...

(WoodMac, 24.Nov.2023) — With nearly 15 billion barrels worth of varied resources discovered in the region since the turn of the decade, the future looks bright for upstream oil and...

(AP, 23.Nov.2023) — Former President Donald Trump has told Argentina’s President-elect Javier Milei that he plans to travel to the South American country so the two can meet, Milei’s office said Thursday....

(S&P Global Ratings, 21.Nov.2023) — Economic imbalances in Argentina provide complex conditions for the Milei administration even before he takes office, S&P Global Ratings said in an article published today...

(YPF, 9.Nov.2023) — Argentina’s YPF SA reported total hydrocarbon production averaged 520 Kboe/d in the third quarter 2023, up 1% sequentially and up 3% on a year-on-year basis, mainly boosted...

(Energy Analytics Institute, 31.Oct.2023) — Energy briefs as well as others related to finance and projects during October 2023 including Vista's third quarter 2023 earnings presentation; the long-awaited Citgo Petroleum...

(TETRA, 30.Oct.2023) — TETRA Technologies, Inc. (NYSE:TTI) today announced third quarter 2023 financial results. Brady Murphy, TETRA President and Chief Executive Officer, stated, "In addition to another strong financial performance, in...

(Argentina Lithium & Energy Corporation, 23.Oct.2023) — Argentina Lithium & Energy Corp. (TSXV: LIT) (FSE: OAY3) (OTC: PNXLF) has entered into a services agreement with Resource Stock Digest (RSD), of 1020...

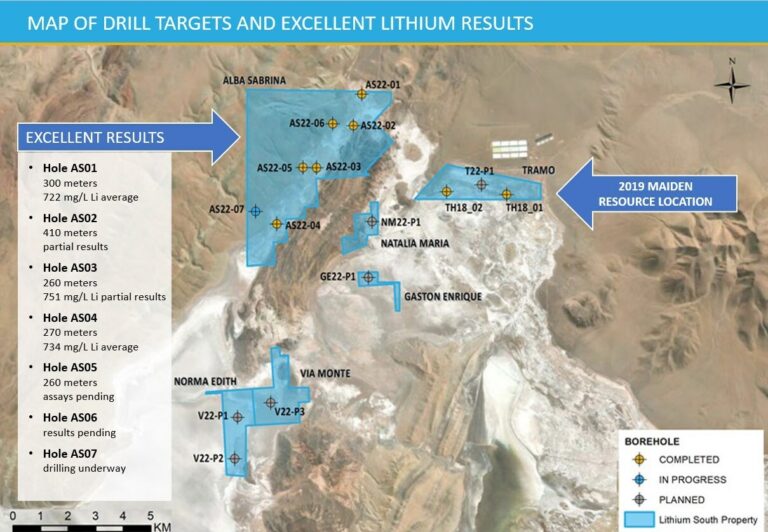

(Lithium South, 18.Oct.2023) — Lithium South Development Corporation (TSX-V: LIS) (OTCQB: LISMF) (Frankfurt: OGPQ) is pleased to announce that it has selected Knight Piésold Consulting (KP) and JDS Energy & Mining...

(Tecpetrol, 17.Oct.2023) — Tecpetrol Investments S.L. issued a reminder to shareholders of Alpha Lithium Corporation (NEO: ALLI) (OTC: APHLF) (German WKN: A3CUW1) to tender their shares in advance of the...

(Energy Analytics Institute, 26.Sep.2023) — Vista Energy provided an update on its assets in Argentina and Mexico during its 26 Sep. 2023 investor day. arg-mex-investor-day-26sep2023-vistaDownload ____________________ By Aaron Simonsky. ©...

(Tecpetrol, 22.Sep.2023) — Tecpetrol Investments S.L., a member of the Techint Group, announced has increased its all-cash offer (the "Offer") to acquire all of the issued and outstanding common shares...

(Energy Analytics Institute, 31.Aug.2023) — Energy briefs as well as others related to finance and projects during August 2023 including Petrobras commenting on divestment process related to the LUBNOR refinery;...

(Zelandez, 23.Aug.2023) — Zelandez, a provider of services to the lithium brine industry, today announced the availability of its new specialized lithium brine reinjection service. The innovative new service, believed...

(AES Argentina, 17.Aug.2023) — On 13 July 2023, AES Argentina Generación S.A. announced the commencement of its offer to exchange any and all of its outstanding 7.750% Senior Notes due 2024 for...

(Summit, 14.Aug.2023) — Summit Nanotech, a sustainable lithium extraction technology company, and Power Minerals (ASX: PNN), a mineral resources exploration company, announced they have entered into a binding term sheet...

(Orvana, 11.Aug.2023) — Orvana Minerals Corp. (TSX: ORV) reports consolidated financial and operational results for the quarter ended 30 June 2023. Q3 FY2023 Orovalle Highlights: Production of 13,398 gold equivalent ounces (1) (11,522 gold ounces, 0.8...

(Lithium South, 10.Aug.2023) — Lithium South Development Corporation (TSX-V: LIS) (OTCQB: LISMF) (Frankfurt OGPQ) has formalized a contract with Well Drilling of Salta, Argentina, for the provision of a two-phase program of...

(CSI, 7.Aug.2023) — CSI Compressco LP (NASDAQ: CCLP) announced second quarter 2023 results. Second Quarter 2023 Results: Total revenues were $96.8mn compared to $84.5mn in the second quarter 2022.Contract services revenue increased to $70.5mn compared to $64.3mn in the...

(S&P Global, 4.Aug.2023) — Argentina, the world's fourth largest lithium producer, second in resources, has been cast as the promising supplier to leapfrog Chile in the short term, as it...

(IGU, 20.Jul.2023) — The International Gas Union (IGU) presented its 14th annual edition of the IGU World LNG report. IGU-LNG2023-World-LNG-ReportDownload ____________________

(Reuters, 9.Jul.2023) — Argentina inaugurated on Sunday the first stage of a gas pipeline that will carry natural gas from the Vaca Muerta formation in western Argentina to Santa Fe...

(Bunge, 5.Jul.2023) — Bunge (NYSE: BG) and Chevron’s Renewable Energy Group Inc., a subsidiary of Chevron Corporation (NYSE: CVX), acquired Chacraservicios S.r.l., based in Argentina, from the Italian-based Adamant Group. This latest investment in novel seeds...

(Energy Analytics Institute, 30.Jun.2023) — Energy briefs as well as others related to finance and projects during June 2023 including YPF and Petronas updating on their joint plans to develop...

(Oz Lithium, 29.Jun.2023) — Oz Lithium Corporation (CSE: OZLI) (OTC: GRXXF) (Frankfurt: G0A) said evaluation work has begun at the Laguna Santa Maria Project, located in the northwest territory of the Province of Salta,...

(Tecpetrol, 19.Jun.2023) — Tecpetrol Investments S.L., a member of the Techint Group, announced the following updates to shareholders of Alpha Lithium Corporation with respect to its offer to acquire all of...

(Lithium South, 15.Jun.2023) — Lithium South Development Corporation (TSX-V: LIS) (OTCQB: LISMF) (Frankfurt: OGPQ) is providing an update on the recently completed exploration program and status of the updated Mineral Resource Estimate that...

(Rystad Energy, 31.May.2023) — Crude oil production from Argentina’s burgeoning shale patch, Vaca Muerta, could surge in the coming years and top 1 million barrels per day (bpd) by the...

(Blue Sky, 24.May.2023) — Blue Sky Uranium Corp. (TSXV: BSK) (FSE: MAL2) (OTC: BKUCF), "Blue Sky" or the "Company") is pleased to provide an update on exploration and development work carried out at...

(Reuters, 24.May.2023) — The Argentine government has asked oil companies to finance their own imports for 90 days due to the shortage of foreign currency at the country's central bank,...

(Interoil, 22.May.2023) — In March 2023, unfortunately Interoil’s average daily operated production decreased by 271 boepd where most of the lost production is related with operational issues in Argentina where...

(YPF, 12.May.2023) — YPF SA announced the its combined production averaged 511,000 boe/d in the first quarter of 2023. YPF-1Q23-Earnings-Webcast-Presentation-argentinaDownload YPF-Nota-de-Resultados-1T23Download EEFF-YPF-Consolidado-Marzo-23Download ____________________

(Pampa Energía, 10.May.2023) — Pampa Energía S.A. (NYSE: PAM; Buenos Aires Stock Exchange: PAMP), an independent company with active participation in Argentina's electricity and gas value chain, announces the results for the quarter ended...

(Reuters, 8.May.2023) — Chilean state oil company National Petroleum Company (ENAP) said on Monday it has signed a temporary agreement with Argentine oil firm YPF (YPFD.BA) to import crude through the Trasandino...

(WoodMac, 3.May.2023) — Latin America has significant gas resources that have not been prioritised for development. Natural gas demand in the region will continue to grow, however, driven by the...

(Pampa Energía, 28.Apr.2023) Pampa Energía S.A. (NYSE: PAM; Buenos Aires Stock Exchange: PAMP), an independent energy integrated companies in Argentina, with participation in the electricity and gas value chain, announces that on 28 April...

(IGU, OLADE, ARPEL, 17.Apr.2023) — The world needs to transition to low-carbon economies to reduce global warming while continuing to promote sustainable socioeconomic development for a growing global population. Achieving...

(Golden Arrow, 18.Apr.2023) — Golden Arrow Resources Corporation (TSXV: GRG) (FSE: G6A) (OTCQB: GARWF) reportws that it recently entered into an option agreement to acquire a 100% interest in the Espota Gold Project covering...

(Reuters, 5.Apr.2023) — The International Monetary Fund (IMF) has given Argentina something of break by easing economic targets in its $44 billion loan deal, but some rosier-than-reality program forecasts may...

(SSR Mining, 27.Mar.2023) — SSR Mining Inc. (NASDAQ/TSX: SSRM, ASX: SSR) announced results from 48 drill holes completed at the Puna project for the period of August to December 2022....

(Interoil, 13.Mar.2023) — In February 2023, Interoil’s average daily operated production increased by 573 boepd recovering most of the lost production from previous months. During February the production growth is...

![Argentina’s Vaca Muerta Formation: Fact Box [Videos]](https://energy-analytics-institute.org/wp-content/uploads/2019/11/vaca-muerta-nov-768x432.jpg)

![Vista Updates on LatAm Assets [PDF Download]](https://energy-analytics-institute.org/wp-content/uploads/2023/11/arg-mex-vista-768x491.png)

![YPF Reports Rise in 3Q:23 Production [PDF Downloads]](https://energy-analytics-institute.org/wp-content/uploads/2023/11/ypf-3q23-source-ypf-768x215.png)

![Vista Investor Day 2023 Presentation [PDF Download]](https://energy-analytics-institute.org/wp-content/uploads/2023/11/arg-mex-investor-day26sep2023-vista-768x379.png)

![IGU 2023 World LNG Report [PDF Download]](https://energy-analytics-institute.org/wp-content/uploads/2023/07/igu-2023-rpt-cover-768x590.png)

![Interoil’s Production Report, April 2023 [PDF Download]](https://energy-analytics-institute.org/wp-content/uploads/2022/02/Interoil-Exploration-and-Production-ASA.jpg)

![YPF’s Production Averaged 511 Mboe/d in the 1Q:23 [PDF Downloads]](https://energy-analytics-institute.org/wp-content/uploads/2020/05/ypf-arg-flags.jpg)

![NatGas in Transition to Low-Carbon Economies [PDF Download]](https://energy-analytics-institute.org/wp-content/uploads/2023/04/latam-white-paper-cover-768x407.png)

![SSR Mining Reports Positive Results at Puna [PDF Download]](https://energy-analytics-institute.org/wp-content/uploads/2023/03/argentina-puna-source-ssr-mining.png)