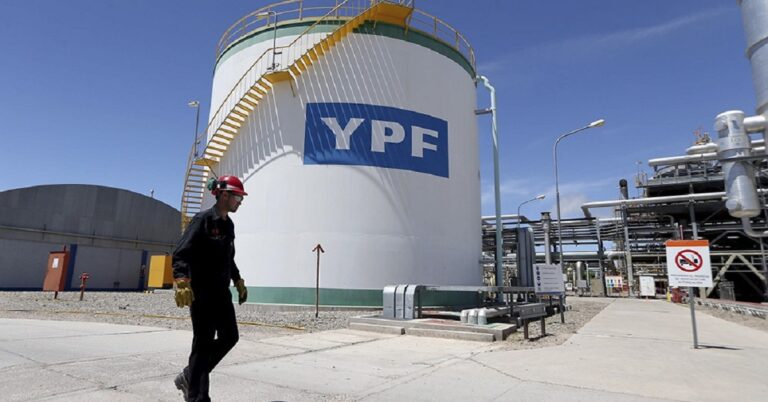

(YPF, 10.May.2024) — YPF SA said it achieved a new quarterly record high in operational efficiencies, delivering positive evolution in shale oil production. Unknown-2Download UnknownDownload ypf-1q24-results-webcastDownload Unknown-4Download YPF also released...

(YPF, 7.Mar.2024) — YPF SA reported total hydrocarbon production averaged 514 Kboe/d in 2023 (+2% vs. 2022) and 511 Kboe/d in 4Q23 (-2% q/q but +2% y/y), mainly boosted by...

(Energy Workforce & Technology Council, 29.Feb.2024) — Promising drastic change to Argentina’s government and economy, President Javier Milei has run into political speed bumps impacting the oil and gas industry...

(YPF, 6.Feb.2024) — YPF Sociedad Anónima announced the expiration and final results as of 5:00 p.m. (New York City time) on 5 Feb. 2024 of its previously announced cash tender...

(Energy Analytics Institute, 26.Jan.2024) — Argentina's state-owned energy giant YPF SA announced the appointment of Horacio Daniel Marin as president of the company. argentina-ypf-ceoDownload ____________________ By Aaron Simonsky. © Energy...

(Bloomberg, 10.Jan.2024) — Argentina’s state-owned oil driller YPF SA tapped international investors with a new dollar bond to help finance a buyback of existing debt, according to people familiar with...

(WooMac, 28.Nov.2023) — Addressing the election of Javier Milei as President of Argentina, Adrian Lara, principal analyst, said “Elected President Javier Milei and his advisors are signalling the importance the...

(YPF, 9.Nov.2023) — Argentina’s YPF SA reported total hydrocarbon production averaged 520 Kboe/d in the third quarter 2023, up 1% sequentially and up 3% on a year-on-year basis, mainly boosted...

(Energy Analytics Institute, 30.Jun.2023) — Energy briefs as well as others related to finance and projects during June 2023 including YPF and Petronas updating on their joint plans to develop...

(Reuters, 24.May.2023) — The Argentine government has asked oil companies to finance their own imports for 90 days due to the shortage of foreign currency at the country's central bank,...

(YPF, 12.May.2023) — YPF SA announced the its combined production averaged 511,000 boe/d in the first quarter of 2023. YPF-1Q23-Earnings-Webcast-Presentation-argentinaDownload YPF-Nota-de-Resultados-1T23Download EEFF-YPF-Consolidado-Marzo-23Download ____________________

(Reuters, 8.May.2023) — Chilean state oil company National Petroleum Company (ENAP) said on Monday it has signed a temporary agreement with Argentine oil firm YPF (YPFD.BA) to import crude through the Trasandino...

(Energy Analytics Institute, 13.Feb.2023) — ENARGAS announced that Argentina’s gross natural gas production is mainly concentrated in four operators: YPF, Total Austral, Tecpetrol and Pan American Energy (PAE), which in...

(LatAm Investor, 20.Jan.2023) — Most international investors keep clear of Argentina. It has an unenviable record of default and expropriations while successive governments seem unable to manage the country’s incredible...

(ANCAP, 26.Dec.2022) — As a result of the Open Uruguay Round process approved by Decree 111/019, three bids for the exploration and production of hydrocarbons for two offshore areas of...

(Seeking Alpha, 10.Nov.2022) — Executives with Argentina’s state oil giant YPF Sociedad Anónima (NYSE:YPF) held a third quarter of 2022 earnings conference call with analysts. What follows is a transcript...

(Petronas, 1.Sep.2022) — Petronas signed a Memorandum of Understanding (MoU) with Argentina’s largest integrated oil and gas company YPF to pursue collaboration in Argentina in an integrated LNG project and...

(Reuters, 11.Aug.2022) — Argentine national oil company YPF is increasing its forecast 2022 capital expenditures by some 10% to $4 billion, on inflationary pressures and above-expected activity, executives said on Thursday. The...

(Energy Analytics Institute, 22.Jul.2022) — Energy briefs including Argentina’s state-owned oil and gas producer YPF reporting combined production of 504,000 boe/d in the 2Q:22. LATIN AMERICA AND THE CARIBBEAN Argentina...

(FT, 2.Jun.2022) — Can the EU’s ban this week on most Russian oil imports breathe new life into a dead cow in Patagonia? Argentina’s president Alberto Fernández thinks so. He...

(Energy Analytics Institute, 11.May.2022) — Energy briefs including Argentina’s state-owned YPF delivering strong results during the 1Q:22 and again achieving higher hydrocarbon production; Ecopetrol CEO Felipe Bayón saying the Colombian...

(Energy Analytics Institute, 2.May.2022) — Energy briefs including FMC Corp.’s LatAm sales rising 31% YOY in 1Q:22 "driven by robust volume growth in soybean, corn and sugarcane as well as...

(Energy Analytics Institute, 20.Apr.2022) — Argentina's state-owned oil giant YPF Sociedad Anónima reported total production of 470 thousand equivalent barrels per day (Mboe/d) in 2021, up 1% versus 467 Mboe/d...

(Energy Analytics Institute, 21.Apr.2022) — Energy briefs including Vista Oil & Gas, S.A.B. de C.V. planning to have an extraordinary shareholders' meeting on 26 April 2022; Argentina’s Energy Secretariat Dario...

(Energy Analytics Institute, 16.Apr.2022) — The recovery of Argentina’s state oil giant YPF some 10 years ago was an act of sovereignty that changed the dynamics of the sector and...

(Bloomberg, 31.Mar.2022) — Only 14 months ago Argentina’s YPF SA was a nightmare for investors caught out by a $6 billion distressed debt restructuring. Now, in a swift turnaround, the...

(S&P Global, 30.Mar.2022) — YPF, the biggest oil producer and refiner in Argentina, said late March 29 that it is taking steps to meet farmers' diesel demand during the spring...

(Energy Analytics Institute, 4.Mar.2022) — Energy briefs including Argentina’s state-owned entity YPF reporting a major reduction in gross debt; officials from CARICOM and SICA coming together at a summit in...

(Reuters, 3.Mar.2022) — Argentine state oil company YPF on Thursday posted a $247 million net profit in the fourth quarter 2021, a 54% drop compared to the year-ago period. The...

(Energy Analytics Institute, 2.Mar.2022) — Energy briefs including Frontera spudding its first exploration well in the Espejo Block in Ecuador; Argentina's YPF holding its 4Q:21 and FY:21 webcast to discuss...

(Energy Analytics Institute, 24.Feb.2022) — Energy briefs including Argentina’s state oil entity YPF revealing details of 4Q:21 and YE:21 results conference call on 4 Mar. 2022; Ecopetrol S.A. releasing details...

(Energy Analytics Institute, 19.Jan.2022) — Argentina’s state owned YPF combined drilling operations at two wells in late December 2021 in the Aguada del Chañar area. The first well, Adch 1001,...

(S&P Global Platts, 10.Jan.2022) — Argentina's state-backed energy company YPF expects its first offshore project in years to produce up to 200,000 b/d, helping to increase exports, chairman Pablo Gonzalez...

(Energy Analytics Institute, 9.Jan.2022) — Argentina’s government approved in late December 2021 an environmental license for state owned YPF together with Equinor and Shell to move forward with seismic activities...

(AFP, 5.Jan.2022) — Thousands marched Tuesday along the beaches of Argentina's Mar del Plata to protest an oil exploration project off the Atlantic coast. Carrying placards reading, "Oil is death",...

(Energy Analytics Institute, 28.Dec.2021) — Argentina’s Energy Secretariat authorized six companies -- YPF, Total, PAE, Vista, Pampa and Tecpetrol -- to carryout gas exports from the Neuquén basin to Chile...

(Platts, 13.Dec.2021) — YPF, the biggest oil and natural gas producer in Argentina, is doing preliminary studies to prepare for building LNG export capacity as gas production grows in the...

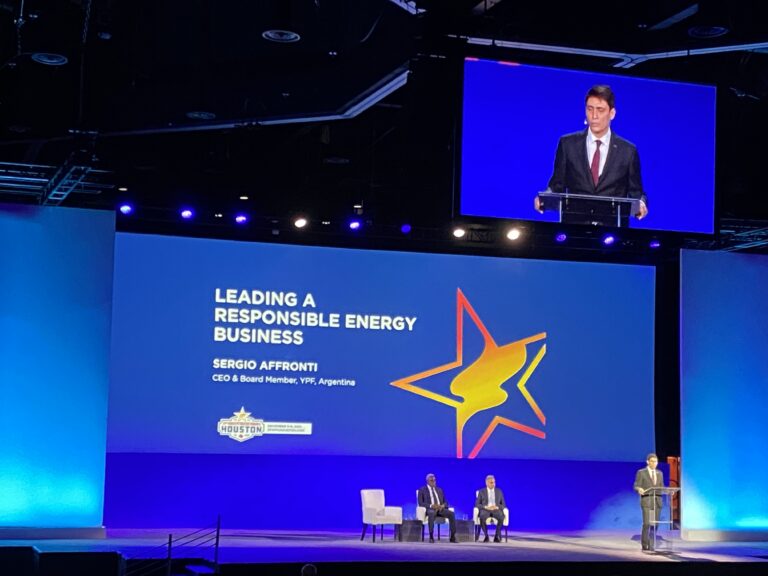

(Energy Analytics Institute, 8.Dec.2021) — YPF’s CEO Sergio Affronti said the state oil producer was looking at “unlocking the Vaca Muerta’s full shale gas potential,” during the 23rd World Petroleum...

(Energy Analytics Institute, 8.Dec.2021) — Energy briefs including Argentina aspiring to produce 1 MMb/d in five yrs; Trinidad and Tobago looking to reveal details of a new Ryder Scott gas...

(YPF, 10.Nov.2021) — YPF reported another quarter with strong profitability amid continuous recovery in O&G production, while maintaining positive free cash flow leading to further deleveraging. MAIN HIGHLIGHTS OF THE...

(S&P Global, 10.Nov.2021) — YPF, the biggest oil producer in Argentina, expects to post higher-than-expected oil production growth this year as it steps up drilling in the Vaca Muerta shale...

(Energy Analytics Institute, 9.Nov.2021) — Energy briefs including YPF’s BODs accepting the resignation of Ms. Elizabeth Dolores Bobadilla, as director for Class D shares; Avino Silver & Gold Mines Ltd....

(Energy Analytics Institute, 3.Nov.2021) — Energy briefs including Shell Argentina and YPF looking to commence development of the Bajada de Añelo area w/ an anticipated investment of around $300mn; Ecuador's...

(Energy Analytics Institute, 1.Nov.2021) — Energy briefs including YPF’s President Pablo González saying the national government would be revealing details "within a few days" regarding a new gas pipeline project...

(New York Times, 14.Oct.2021) — After years of pumping more oil and gas, Western energy giants like BP, Royal Dutch Shell, Exxon Mobil and Chevron are slowing down production as...

(Energy Analytics Institute, 30.Sep.2021) — Energy briefs including Argentina’s YPF announcing details of its 3Q:21 webcast, Petrobras Global Finance B.V. (PGF) on settlement of early redemption of global notes, and...

(Energy Analytics Institute, 13.Sep.2021) — Argentina’s state owned YPF acquired Class XI Notes (YMCBO) between 1-10 September 2021 for a total amount of Ps. 677,691,518.80 Argentine Peso ($7,037,920 or $7mn)...

(Energy Analytics Institute, 23.Aug.2021) — In compliance with requirements of article 3, item 9, Chapter I, Title XII of the Rules of the Argentine Securities and Exchange Commission, state owned...

(Baker Institute, 17.Aug.2021) — Shale oil’s short-cycle production protects foreign investors from the risk of expropriation — government taking private property for public use — providing an opportunity for the...

(Energy Analytics Institute, 13.Aug.2021) — Energy briefs from the Latin America and Caribbean region including: YPF reducing its total debt, Petrobras’ tax collections to the government, Exxon’s Liza Unity FPSO...

(Energy Analytics Institute, 9.Aug.2021) — Energy briefs from the Latin America and Caribbean region including: Argentina fining Edesur and Edenor; Transportadora de Gas Internacional (TGI) eyes developing Colombia’s second liquefied...

(Energy Analytics Institute, 30.Jul.2021) — Argentina’s state entity YPF Sociedad Anónima announced several changes in the first level of its senior management structure. YPF revealed the details on 30 July...

(Energy Analytics Institute, 5.Jul.2021) — Energy briefs from the Latin America and Caribbean region including: plans to reactivate 77 wells in Argentina’s Río Negro region, EP PetroEcuador and Repsol Ecuador...

(Energy Analytics Institute, 29.Jun.2021) — Energy briefs from the Latin America and Caribbean region including: Chile and Germany inking a green hydrogen deal, EP PetroEcuador reaching an agreement with the...

(Argus, 7.Jun.2021) — Argentina will funnel $580 million collected from a new wealth tax to projects for rebuilding natural gas production from a recent slump, a key to averting shortages...

(Energy Analytics Institute, 3.Jun.2021) — Pursuant to the Regulations of the National Securities Commission (Comisión Nacional de Valores in Spanish) and the terms of Article 73 of Law No. 26,831,...

(Excelerate, 2.Jun.2021) — Excelerate Energy L.P. announced, the company's floating storage and regasification unit (FSRU) the Exemplar has begun operations in Bahia Blanca, a port city located 400 miles south...

(Seeking Alpha, 12.May.2021) — Argentina’s state entity YPF SA (NYSE:YPF) hosted a 1Q:21 earnings conference call with analysts on 12 May 2021. What follows is the transcript from the call....

(Energy Analytics Institute, 3.May.2021) — Energy briefs from the Latin America and Caribbean region including: Latin America’s wind generation capacity expands between 2000-2019, production from Argentina’s Vaca Muerta formation continues...

(Argus, 28.Apr.2021) — Protesters in Argentina have lifted roadblocks that had crippled shale oil and gas activity and thwarted fuel distribution for almost three weeks. Healthcare workers started blocking roads...

(Argus, 21.Apr.2021) — Argentina's shale oil and gas production is starting to decline and fuel shortages are worsening because of prolonged roadblocks by healthcare workers in Argentina's southwestern province of...

(Energy Analytics Institute, 20.Apr.2021) — Oil and gas production from Argentina’s prolific Vaca Muerta formation have been impacted by nearly two weeks of protests and road blockages by health care...

(Shell, 1.Apr.2021) — Shell provided details in its 2020 annual report related to its operations in South America from Argentina, Brazil and Bolivia. What follows is a summary from the...

(Energy Analytics Institute, 1.Apr.2021) — Energy briefs from the Latin America and Caribbean region including: halting the slide a Point Lisas in Trinidad and YPF inaugurating a new petrol station...

(Energy Analytics Institute, 30.Mar.2021) — Energy briefs from the Latin America and Caribbean region including: Russia and Venezuela strengthening their cooperation and Argentina’s state oil producer YPF eyeing shareholders’ meeting...

(Energy Analytics Institute, 19.Mar.2021) — Energy briefs from the Latin America and Caribbean region including: Argentina eying the start up of the Cañadón wind farm as well as the government...

(Energy Analytics Institute, 17.Mar.2021) — Energy briefs from the Latin America and Caribbean regions Argentina, Colombia and Uruguay including: YPF’s investment plans in Chubut, Argentina’s economic minister’s plans to visit...

(Argus, 16.Mar.2021) — YPF, the biggest oil producer in Argentina, said March 16 that it hiked diesel and gasoline pump prices by 7%, helping to finance a $2.7 billion investment...

(Energy Analytics Institute, 15.Mar.2021) — Energy briefs from the Latin America and Caribbean regions Argentina, Colombia and Venezuela including: Tenaris snatches up Baker Hughes Argentina, YPF raises fuel prices again,...

(Bloomberg, 10.Mar.2021) — President Alberto Fernandez took to a makeshift stage in Argentina’s Vaca Muerta shale deposit in October to announce the nation was doubling down on fossil fuels. “Today...

(YPF, 19.Feb.2021) — In accordance with the requirements of the Argentine Securities Commission (CNV) Rules YPF informs that Fitch Ratings decided to raise the long-term issuer default rating of the...

(Bloomberg, 18.Feb.2021) — YPF SA, Argentina’s state-run oil company, needs to come up with more than $1 billion to spur drilling in Patagonia, where it’s leading development of the biggest...

(Fitch Ratings, 18.Feb.2021) — Fitch Ratings has downgraded YPF S.A.‘s Long-Term Foreign and Local Currency Issuer Default Ratings (IDRs) to ‘RD’ from ‘C’, due to the conclusion of its announced...

(The Ad Hoc Group of Argentina Exchange Bondholders, 17.Feb.2021) — The Ad Hoc Group of Argentina Exchange Bondholders today released the below statement containing its views on the current economic...

(Energy Analytics Institute, 11.Feb.2021) — Argentina’s oil and gas giant YPF plans to announce results of operations for the fourth quarter 2020 and full year 2020 on 5 March 2021....

![YPF Reports Rise in 3Q:23 Production [PDF Downloads]](https://energy-analytics-institute.org/wp-content/uploads/2023/11/ypf-3q23-source-ypf-768x215.png)

![YPF’s Production Averaged 511 Mboe/d in the 1Q:23 [PDF Downloads]](https://energy-analytics-institute.org/wp-content/uploads/2020/05/ypf-arg-flags.jpg)

![ENARGAS Releases September 2022 Gas Panorama [PDF Download]](https://energy-analytics-institute.org/wp-content/uploads/2023/02/arg-sep-2022-gas-panorama-source-enargas-768x434.png)

![NRGBriefs: YPF Produces 504,000 boe/d in 2Q:22 [PDF Downloads]](https://energy-analytics-institute.org/wp-content/uploads/2022/08/argentina-2q22-source-ypf-768x206.jpg)

![NRGBriefs: CARICOM and SICA Unite at Belize Summit [PDF Downloads]](https://energy-analytics-institute.org/wp-content/uploads/2022/03/caricom-sica-source-caricom-energy-analytics-institute-768x417.jpg)

![YPF Cites 3Q:21 Production Recovery [PDF Downloads]](https://energy-analytics-institute.org/wp-content/uploads/2021/01/ypf-source-bloomberg-a-768x511.jpg)