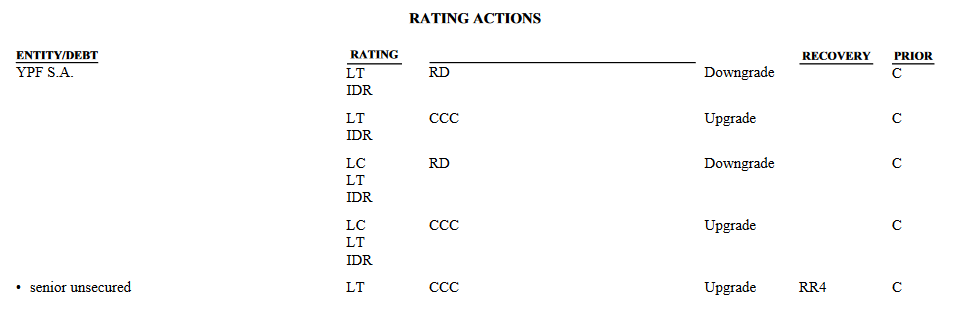

(Fitch Ratings, 18.Feb.2021) — Fitch Ratings has downgraded YPF S.A.‘s Long-Term Foreign and Local Currency Issuer Default Ratings (IDRs) to ‘RD’ from ‘C’, due to the conclusion of its announced exchange offer. Fitch has simultaneously upgraded YPF’s Long-Term Local and Foreign Currency IDRs to ‘CCC’ from ‘RD’, and upgraded the company’s senior unsecured notes to ‘CCC’/‘RR4’ from ‘C’/‘RR4’. The stand-alone credit profile was revised to ‘b’ from ‘c’.

The downgrade and simultaneous upgrade reflect the completion of the announced exchange for its seven outstanding international bonds totaling $6.2 billion notes. Per Fitch’s “Distressed Debt Exchange Criteria,” the IDRs are downgraded to ‘RD’ upon completion and re-rated as the exchange resulted in a material reduction in the original terms of the bonds, evidenced by the extension of maturities and discounted coupon payment for two-years from issuance of the new notes.

On Feb. 11, 2021, YPF announced the results of the exchange offer. YPF received 59.79% acceptance to exchange the outstanding March 2021 notes for the new senior secured 2026 notes, which are secured by a reserve and payment account, and with 50% of YPF’s stake in YPF Luz pledged as collateral. Hold-out bond holders received the cash payment for the outstanding 40.21%, which was approved by the Central Bank of Argentina and has been settled. YPF also announced that it received 43.12% exchange for its April 2024 notes, 37.15% for its March 2025, 24.55% for its July 2025, 19.07% for its July 2027, 20.21% for its June 2029, and 28.45% for its 2047.

Collectively when including the 2021 exchange offer, YPF successfully exchanged $2.0 billion of its $6.2 billion outstanding bonds. The $2.0 billion exchange was allocated among three bonds. First, $775 million for the senior secured 2026 notes, which will have a coupon of 4.0% for the first two years through December 2022, and 9% thereafter, with a quarterly amortization payment made equally beginning in 2023. Second, $748 million for the senior unsecured bond due 2029 was issued with a coupon of 2.5% for the first two years through December 2022, and 9% thereafter with equal semiannual amortization payments beginning in 2026. Third, $576 million for the senior unsecured bond due 2033 with a coupon of 1.5% through 2022 and 7% thereafter with annual amortization beginning 2029.

Fitch estimates the exchange offer will save YPF approximately $105 million in interest expense annually through the end of 2022, which Fitch expects the company will allocate to upstream capex to ramp up production, increasing production by up to 40,000boed, when assuming that unconventional wells average cost is $5.5 million in Vaca Muerta and each new well produces on average 1,000boed. After 2022, Fitch estimates the company’s annual interest from its international bonds from 2023 through 2025 will be approximately $50 million higher before the exchange offer. On a consolidated basis, Fitch’s estimates YPF’s annual interest expense will average $700 million through 2023.

YPF ratings are in line with Fitch’s “Government Related Entities (GRE) Criteria.” YPF is majority owned by the government and strategically important to the country. YPF’s dominant market share in the supply of liquid fuels in Argentina, coupled with its large hydrocarbon production footprint in the country, could expose the company to government intervention through pricing policies or investment strategies. Argentina exerts strong control over YPF through energy regulations and/or its 51% economic interest in the company. Furthermore, Fitch believes Argentina would have strong incentives to support the company under a distress situation as a result of the strong socio-political and financial implications of a default.

KEY RATING DRIVERS

Links to Sovereign: YPF is closely linked to the Republic of Argentina due to its ownership structure, as well as recent government interventions. Argentina controls the company through its 51% stake, and provincial government officials serve on the company’s board of directors. In addition, the republic sometimes governs the company’s strategy and business decisions. The Argentine government has a history of significant interference in the oil and gas sector. For example, via Decree No. 1277, the government set regulations related to investment levels in the oil and gas sector and domestic price reference points.

In 2019, the government issued Decree 566/19, which negatively affected YPF’s cash flows. Although YPF is a leading energy company in Argentina, government policies continue to present challenges, inhibiting its business strategy.

Moderate Leverage: Fitch believes YPF has a moderate leverage profile mostly due to a high total debt/1P and weak EBITDA/interest expense ratio in 2020, which is expected to improve over the rated horizon. Fitch estimates YPF’s total debt/EBITDA will be 3.6x in 2020 and improve to an average of 2.3x over the rated horizon; however, YPF’s total debt/1P is high, estimated to be USD8.00 per boe, and consistent with the ‘b’ category. Furthermore, Fitch estimates YPF’s EBITDA to interest expense will be 2.6x in 2020 and improve to an average 4.0x thereafter.

High Production Cost Profile: Fitch’s rating case assumes production will remain flat averaging 515,000boed over the rated horizon. YPF’s cost of production is slightly lower than the guaranteed price under Barril Criollo between May and mid-August 2020 and Fitch’s assumed Brent price for 2021 of USD48.00boe. Fitch estimates YPF’s half-cycle costs of USD26.5boe and full-cycle cost of USD41.5boe, which are both high and above average for players in the region.

The company’s high cost is mostly attributed to higher than average lifting cost of USD13.5boe and high interest cost per barrel of USD5.0boe in 2019, estimated by Fitch. The company’s full-cycle break-even implied prices were above weighted average realization prices for oil and gas, primarily as a result of decreasing domestic gas prices and high level of gas production, which accounts for approximately 49% of total production during 2019 (Crude oil production comprised 44% and natural gas liquids 7%).

Volatile Operating Environment: The volatile economic environment in Argentina has inhibited YPF from implementing its business strategy, i.e. unconventional development in Vaca Muerta. Pandemic-related quarantine measures have further stressed the company, as demand for fuels has decreased, gasoline volumes dropped by 70% and diesel by 34%, jet fuel 95%, with a total demand decrease of 50% in April 2020, compared with the previous year. Volumes appear to have recovered but remain below historical averages.

Fitch estimates Argentina’s real GDP will contract by 11.2% in 2020, after negative average growth rate over the last three years. Inflation is expected to average 47% between 2020 and 2022, and government debt/GDP ratio is estimated to be 102% in 2020 and 105% in 2021, with a majority of government debt being external 75%-80% over the same time frame.

DERIVATION SUMMARY

YPF’s linkage to the sovereign is similar in nature to its Latin American national oil companies (NOCs) peers, namely PEMEX (BB-/Stable), Petrobras (BB-/Negative) and Ecopetrol (BBB-/Negative), and government-owned entities ENAP (A-/Stable), and Petroperu (BBB+/Negative). These companies all have strong linkage to their respective sovereigns given their strategic importance to each country and the potentially significant negative social and financial implication a default could have at a national level.

YPF’s upstream business closest peers are Pemex, Petrobras and Ecopetrol. YPF’s total production averaged 514,000boed, and the reserve life was 5.7 years, most comparable with Ecopetrol with a 2019 production of 725,000boed and a reserve life of 7.8 years, but less than Petrobras’ production of 2.6 million boed and a reserve life of 10 years and Pemex’s production at 2.8 million boed and a reserve life of 9.5 years.

YPF has a strong capital structure reporting a gross leverage ratio defined as total debt/EBITDA of 2.4x in 2019 and total debt/1P of USD7.67 per boe compared with Ecopetrol at 1.1x in 2019 and USD5.80 total debt/1P, Petrobras at 2.3x and USD6.60 per boe and Pemex at 6.2x and USD14.70 per boe.

Unlike its peers ENAP, Petrobras, Pemex and Petroperu, YPF is not the sole provider of refined fuels in Argentina. In 2019, the company had nearly a 60% market share. YPF is an integrated energy company, similar to Petrobras and Pemex, offering the company more financial flexibility, while ENAP is predominately a refining company that sells to marketers.

Historically, YPF has operated autonomously with periodic controls of fuel prices and crude, which are currently in effect. Similar to Pemex and Petrobras, YPF has administered an import-parity pricing policy, but is evidence of government intervention with Decree 466/19 and other price controls in 2018 to tame inflation, which is projected to be 50% in 2020. Until recently, YPF has had success in tightening the spread between import parity and local prices.

When compared with downstream-focused entities ENAP and Petroperu, YPF has a lower total debt/EBITDA ratio of 2.4x in 2019 compared with ENAP at 6.7x and Petroperu at 18.0x. Petroperu’s elevated leverage is explained by its investment plan to increase capacity by 2021, while ENAP has maintained a higher leverage profile for an extended period of time, but the company is highly strategic for the Chilean governments, and thus it rating is aligned as a result.

KEY ASSUMPTIONS

Fitch’s Key Assumptions Within its Rating Case for the Issuer

• Average gross production of 515,000boe from 2020-2023;

• YPF will be able to increase domestic prices in pesos somewhat but not enough to fully reflect the impact from the recent peso depreciation and international hydrocarbon price increase;

• Criollo barrel of USD45/bbl in place from May through Mid-August 2020 and applied Fitch’s price deck thereafter;

• Natural gas prices decrease to USD2.70/MMBTU in 2020, USD3.00/MMBTU in 2021, USD3.25/MMBTU in 2022 and USD3.57/MMBTU in 2023;

• Capex cut to be FCF positive over the rated horizon due to refinancing risk;

• Downstream sales volume follow Real GDP forecasts;

• USD111 million of net proceeds associated with the sale of 11% stake in Bandurria Sur to Equinor and Shell; and a 50% stake in offshore area CAN_100 to Equinor in 2Q20;

• Fitch ARS/USD forecasts for year average and end of period during 2020-2022;

• Reflects exchange offer with coupon adjustment period per bond;

• Annual average capex of $2.5 billion from 2021-2024.

RATING SENSITIVITIES

Factors that could, individually or collectively, lead to positive rating action/upgrade:

• The Foreign Currency IDR is linked to the sovereign rating of Argentina and thus an upgrade can only occur if there is an upgrade of the country ceiling of Argentina.

Factors that could, individually or collectively, lead to negative rating action/downgrade:

• Argentina’s sovereign rating is currently at the lowest level (CCC) allowed under Fitch’s sovereign criteria; therefore, a downgrade of Foreign and Local Currency IDR would reflect Fitch’s belief that a default of some kind appears probable, or a default or default-like process has begun for the corporate, which will be represented by a ‘CC’ or ‘C’ rating.

BEST/WORST CASE RATING SCENARIO

International scale credit ratings of Non-Financial Corporate issuers have a best-case rating upgrade scenario (defined as the 99th percentile of rating transitions, measured in a positive direction) of three notches over a three-year rating horizon; and a worst-case rating downgrade scenario (defined as the 99th percentile of rating transitions, measured in a negative direction) of four notches over three years. The complete span of best- and worst-case scenario credit ratings for all rating categories ranges from ‘AAA’ to ‘D’. Best- and worst-case scenario credit ratings are based on historical performance. For more information about the methodology used to determine sector-specific best- and worst-case scenario credit ratings, visit https://www.fitchratings.com/site/re/10111579.

LIQUIDITY AND DEBT STRUCTURE

Adequate Liquidity: YPF reported USD1.3 billion in cash and cash equivalents in 3Q20. Per Fitch’s estimates, this covers roughly two years of interest expense. The company’s debt maturity profile did improve after the completion of its exchange particularly the exchange of its 2021 notes to 2026. Fitch expects YPF will continue to roll-over short term bank and trade financing debt over the rated horizon, and its first international bond maturity is in April 2024.

REFERENCES FOR SUBSTANTIALLY MATERIAL SOURCE CITED AS KEY DRIVER OF RATING

The principal sources of information used in the analysis are described in the Applicable Criteria.

ESG CONSIDERATIONS YPF has an ESG Relevance Score of ‘4’ for Governance Structure due to Argentina federal government’s majority ownership in YPF, which has a negative impact on the credit profile, and is relevant to the rating in conjunction with other factors.

Unless otherwise disclosed in this section, the highest level of ESG credit relevance is a score of ‘3’. This means ESG issues are credit-neutral or have only a minimal credit impact on the entity, either due to their nature or the way in which they are being managed by the entity. For more information on Fitch’s ESG Relevance Scores, visit www.fitchratings.com/esg.

____________________