(Argus, 5.Jan.2021) — Peru’s oil and gas industry is hoping for a rebound in 2021 following a year marred by the COVID-19 pandemic, violent indigenous protests and political instability.

With oil and gas fields, and the 200,000 b/d North Peruvian oil pipeline, shut down repeatedly by social conflicts and a three-month lockdown, Peru’s government is now focused on jumpstarting its economy, which is estimated to grow 10% in 2021 following a 13% contraction in 2020.

Many of the projects on track to come on line in 2021, including three copper mines and the $5 billion Talara oil refinery expansion, are expected to spur oil imports, which currently average 150,000 b/d.

State contracting agency Perupetro is preparing two E&P bid rounds for 2021, while the government is also dusting off plans to call a tender for the $5 billion southern natural gas pipeline contract formerly managed by scandal-plagued Brazilian construction firm Odebrecht.

Upcoming elections

President Francisco Sagasti, an industrial engineer who took office in November as a caretaker leader through July 2021, has pledged to fully reopen the economy and lend support to investment projects.

Sagasti’s other main task will be to oversee general elections in April. Peru, whose bitterly-divided political scenario has seen four presidents since 2018, is expected to hold a second-round presidential run-off in June, whereupon a 130-member Congress and the new president begin their five-year mandate on July 28.

Currently leading the polls are moderates Harold Forsyth and Julio Guzman, while Keiko Fujimori, the investor-friendly daughter of former President Alberto Fujimori, is also in the running. Mr. Fujimori privatized the country’s oil and gas industry and drafted the Hydrocarbons Law in the 1990s.

The oil industry is counting on the new Congress to amend the Hydrocarbons Law to introduce more flexible investment commitments and lower royalties. Peru’s oil production has dwindled to under 40,000 b/d from a peak of 200,000 b/d in the early 1990s as other countries in the region such as Colombia and Argentina implemented more competitive investor policies amidst slumping oil prices.

S&P Global Platts Analytics is currently forecasting output to decline to under 30,000 b/d by 2031.

“It’s urgent that we update the law so as to adapt to the new world oil order,” said Carlos Gonzales, head of consultant firm Enerconsult. “If we maintain current contractual conditions, investment will continue to go to other countries and our reserves and production will continue to fall.”

New bid rounds

Perupetro, which hasn’t held a bid round since 2010, now plans to offer 10 oil blocks in 2021 – six on the north coast and four in the northern jungle. The areas include local firm GMP’s onshore blocks in the Piura region, which were producing a combined 4,000 b/d before the coronavirus lockdown.

The agency will also be looking for new operators for Geopark’s Block 64, Frontera’s Block 192 and Pluspetrol’s Block 8 operations in the Maranon Basin after the companies announced plans to withdraw. Blocks 192 and 8 were Peru’s top-producing oil fields until 2018.

The start-up of Calgary-based PetroTal’s Block 95 in 2018 helped boost the country’s production to a six-year high of 63,738 b/d by the end of 2019. Perupetro seeks to increase that to 100,000 b/d by 2023 by attracting around $4 billion in investment in areas including UK firm Perenco’s Block 67.

“Despite the critical situation of the industry, we still expect crude prices will recover,” said Felipe Cantuarias, head of the Peruvian Hydrocarbons Society. “Peru should also create conditions to enable us to return to full production of 60,000-70,000 b/d.”

Petroperu refinery project

State company Petroperu remains on target to finish up an expansion of its 62,000 b/d Talara refinery to 90,000 b/d by late 2021, having lined up financing from a $2 billion bond sale and a $600 million loan from Spain’s export credit agency Cesce.

The company is also looking to award an $800 million repair contract for its aging pipeline, built in the 1970s and further damaged by community protests in 2020. The repeated shutdowns of the pipeline and oil fields in the Maranon Basin mean Talara will need to import more crude, according to Cesar Gutierrez, a consultant and former CEO of Petroperu.

Petroperu’s third-quarter domestic fuel sales climbed to 124,500 b/d from 123,800 b/d a year ago, while exports dropped to 13,000 b/d from 21,100 b/d a year earlier.

The company slashed crude purchases to 35,800 b/d in the third quarter from 84,100 b/d a year earlier, while refined gasoline purchases rose to 76,600 b/d from 63,000 b/d.

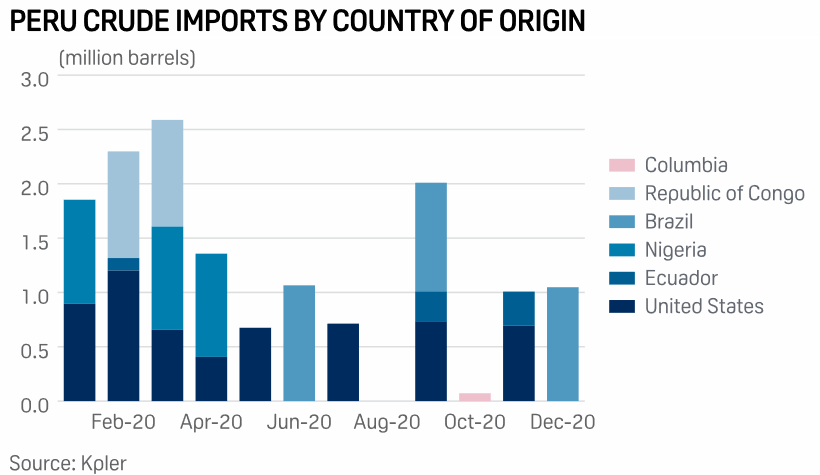

Peru imports the bulk of its refined products from the United States, but has diversified its crude purchases. Since the middle of 2020, Peru has imported crude primarily from the United States, Ecuador and Brazil, Kpler data shows.

__________

By Alex Emery