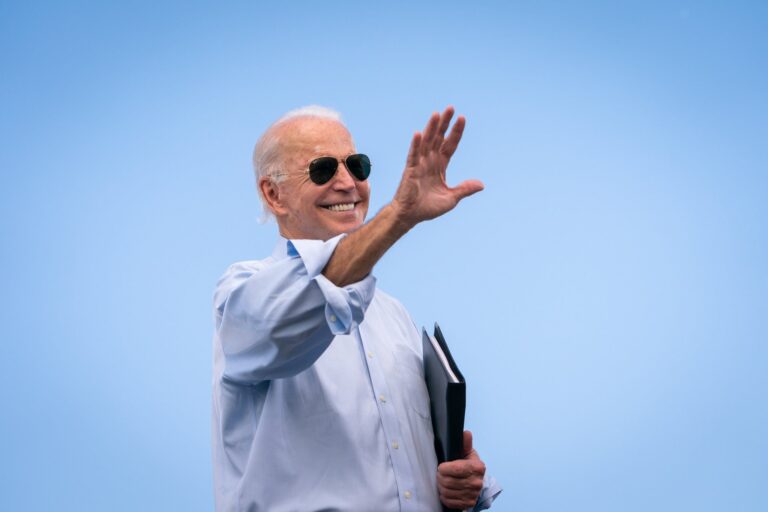

(Rystad Energy, 29.Apr.2024) — For President Joe Biden, the situation in Venezuela remains a fly in the ointment, weighing on the administration’s energy and foreign policy. President Nicolas Maduro has...

(AP, 16.Mar.2024) — It’s her choice — but one on which the hopes of millions of Venezuelans fighting to restore their democracy depends. Barred from running for office, opposition leader...

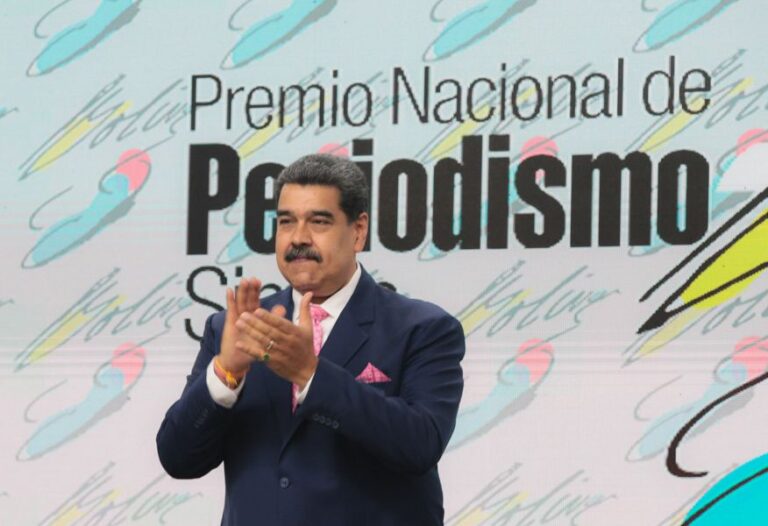

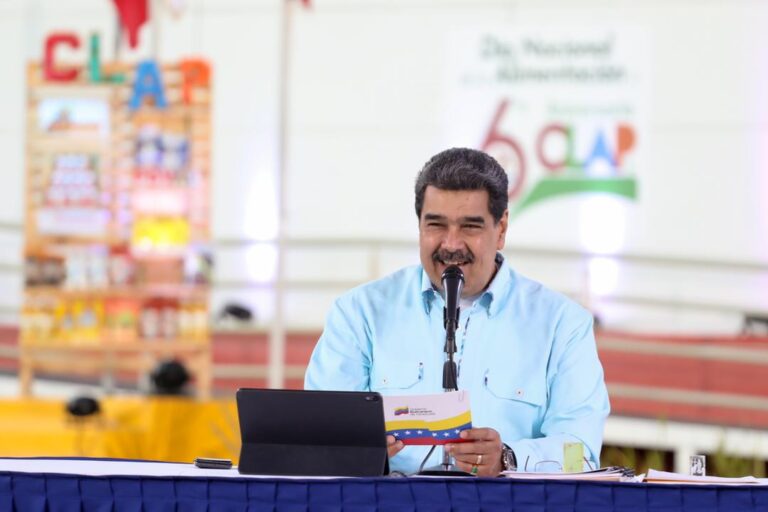

(Energy Analytics Institute, 28.Feb.2024) — Venezuela’s President Nicolás Maduro said he expects the economy of the Opec country to grow 8% in 2024. The president made the comments during a...

(Energy Analytics Institute, 30.Jan.2024) — US State Department spokesperson Matthew Miller said there’s still time for the Nicolás Maduro regime in Venezuela to change course but said that if they...

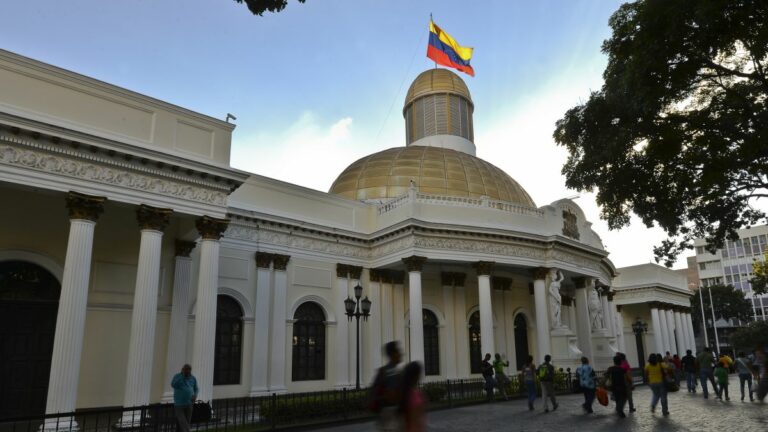

(Al Jazeera, 27.Jan.2024) — Venezuela’s Supreme Justice Tribunal has upheld a ban which prevents presidential candidate Maria Corina Machado from holding office, upending the opposition’s plans for elections planned for...

(US State Department, 23.Jan.2024) — The United States is deeply concerned by the issuance of arrest orders and detentions against at least 33 Venezuelans, including members of the democratic opposition,...

(Reuters, 14.Dec.2023) — Guyana and Venezuela on Thursday agreed to avoid any use of force and to not escalate tensions in their long-running dispute over the oil-rich Esequibo area after...

(US Department of State, 18.Oct.2023) — Senior US Departement of States administration officials held a teleconference to discuss political advancements in Venezuela. MODERATOR: Good evening, everyone, and thank you so...

(Reuters, 16.Oct.2023) — Venezuela's government and the country's opposition will return to political negotiations, the two sides said on Monday, while sources said the United States has reached a preliminary...

(Reuters, 16.Oct.2023) — Oil futures fell on Monday on reports that the U.S. had agreed a deal to ease sanctions on Venezuela, while investors continued to mull the potential impact...

(Miami Herald, 16.Jun.2023) — It’s official: The Venezuelan regime will pick a new electoral tribunal to oversee the 2024 presidential elections, and — guess what! — its members will be effectively...

(NewsWeek, 25.Apr.2023) — As a multinational conference commences in Colombia, Venezuela is looking to make progress in talks not only with the country's political opposition, but also the United States,...

(AP, 3.Apr.2023) — The new representative of Venezuela’s opposition in the U.S. is urging the Biden administration to relax crippling oil sanctions on Nicolas Maduro’s government or risk seeing the...

(AP, 5.Jan.2023) — Venezuela’s opposition has selected an all-female team of mostly unknown exiled former lawmakers to replace the beleaguered Juan Guaidó as the face of its faltering efforts to...

(Reuters, 1.Dec.2022) — Chevron Corp is unlikely to add investment in Venezuela in the next six months despite a recent U.S. license to allow it to expand its operations in...

(Anadolu Agency, 1.Dec.2022) — Venezuelan President Nicolas Maduro said Wednesday that licenses and authorizations granted so far by the US to ease sanctions it imposed on Venezuela are "headed in...

(AFP, 30.Nov.2022) — Venezuelan President Nicolas Maduro said the easing of an oil embargo on his country by the United States was not enough, and called Wednesday for the total...

(Al Jazeera, 26.Nov.2022) — The Biden administration on Saturday eased some oil sanctions on Venezuela after the government of Nicolas Maduro and the opposition signed a broad ‘social accord’ to...

(CNN, 16.Aug.2022) — A growing number of US citizens are being detained in Venezuela -- and though exactly how many is unknown, the detentions could give authoritarian leader Nicolas Maduro leverage in...

(MEEI, 6.Aug.2022) — The Honourable Stuart R Young, M.P., minister of Ministry of Energy and Energy Industries (MEEI) in the Office of the Prime Minister visited Caracas, Venezuela on 5...

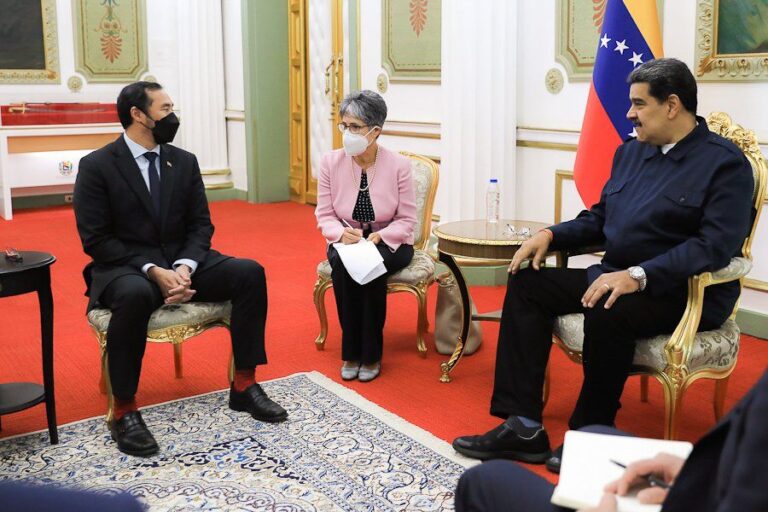

(AP, 27.Jun.2022) — Senior U.S. government officials have quietly traveled to Caracas in the latest bid to bring home detained Americans and rebuild relations with the South American oil giant...

(Reuters, 24.May.2022) — The U.S. Treasury Department is getting ready to renew in the coming days Chevron Corp's license to operate in Venezuela, but likely without the greatly expanded terms...

(Energy Analytics Institute, 23.May.2022) — Energy briefs including Venezuela’s President Nicolás Maduro warning citizens of the OPEC country to be on “maximum alert” in the face of what he called...

(CNN, 17.May.2022) — The Biden administration will begin to ease some energy sanctions on Venezuela to encourage ongoing political discussions between President Nicolas Maduro and the opposition, two senior administration officials told...

(Energy Analytics Institute, 12.May.2022) — Energy briefs including Venezuela’s President Nicolás Maduro looking to offer between 5%-10% of the shares of public companies and “empresas mixtas” for national and international...

(Energy Analytics Institute, 7.May.2022) — OPEC (Organization of Petroleum Exporting Countries) Secretary General Mohammad Barkindo arrived in Caracas, Venezuela, on 6 May 2022 for a working visit to the South...

(AFP, 3.May.2022) — Iran's oil minister has paid an official visit to ally Venezuela to meet President Nicolas Maduro and discuss ways to "overcome" the effects of US sanctions against...

(Energy Analytics Institute, 1.May.2022) — Venezuelan workers from across various sectors together with workers from the still important petroleum sector marched to Miraflores Presidential Palace in Caracas to celebrate international...

(Energy Analytics Institute, 14.Apr.2022) — Colombia’s President Iván Duque talked about Colombia's oil production potential, coal production, and Colombia’s relationship with the US during a televised interview with Bloomberg during...

(Miami Herald, 12.Apr.2022) — Divisions within the Biden administration over whether to continue talks with President Nicolás Maduro in Venezuela have deepened since a senior U.S. delegation met with him...

(Energy Analytics Institute, 18.Mar.2022) — Datanalisis President Luis Vicente León commented on social media about the rumors around an easing of US sanctions on Venezuela as well as why Venezuela’s...

(Bloomberg, 15.Mar.2022) — A more realistic policy toward the Maduro regime would free up oil supplies and weaken Russian influence. In a bid to ease pressure on global energy supplies,...

(Bloomberg, 11.Mar.2022) — Much has been written about the hurdles to a U.S.-Venezuela detente that would allow oil from the South American nation to start flowing more freely into international...

(Energy Analytics Institute, 10.Mar.2022) — Energy briefs including Washington courting Venezuela amid the Ukraine invasion by Russia and Venezuela's President Nicolás Maduro likely being the biggest benefactor amid high oil...

(Energy Analytics Institute, 9.Mar.2022) — “Rain, thunder or lightning, Venezuela will produce 2 million barrels per day in 2022,” the country’s President Nicolás Maduro proclaimed during a national television broadcast. “Now,...

(France24, 9.Mar.2022) — Venezuela released two jailed US citizens on Tuesday in an apparent goodwill gesture toward the Biden administration, which has reached out to the regime of Nicolas Maduro...

(Reuters, 6.Mar.2022) — U.S. and Venezuelan officials discussed the possibility of easing oil sanctions on Venezuela but made scant progress toward a deal in their first high-level bilateral talks in...

(Telesur, 4.Mar.2022) — Oil prices have risen this week due to supply concerns amid international sanctions directed at Russia for its military operation in Ukraine. Venezuelan President Nicolás Maduro announced...

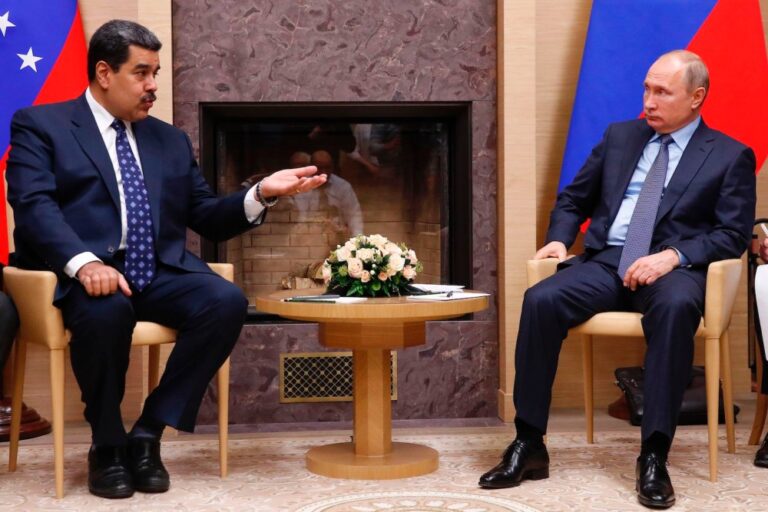

(Energy Analytics Institute, 1.Mar.2022) — Energy briefs including Venezuela’s President Nicolás Maduro chatting over the telephone with his Russian counterpart Vladimir Putin; Invenergy naming Mary King as Executive VP People &...

(Foreign Policy, 25.Feb.2022) — The highlights this week: how the war in Ukraine could prolong Venezuela’s political crisis, Colombia decriminalizes abortion, and a Mexican marathoner completes a cross-country journey. When Anti-Imperialism Meets Noninterference In the weeks...

(Energy Analytics Institute, 16.Feb.2022) — Venezuela and Russia signed an agreement of intent aimed at strengthening strategic alliances and comprehensive cooperation between the two countries under the context of a...

(Energy Analytics Institute, 4.Feb.2022) — Energy briefs including Colombia signing a MOU w/ The Netherlands to create a hydrogen export channel; Venezuela’s President Nicolás Maduro saying there will be no...

(Energy Analytics Institute, 15.Jan.2022) — Venezuela’s President Nicolás Maduro, during his 15 January 2022 annual address to the nation, said the OPEC country’s oil production goal in 2022 was to...

(Energy Analytics Institute, 26.Dec.2021) — Energy briefs including Venezuela’s President Nicolas Maduro talking in a special interview w/ Arab media house Al Mayadeen broadcast on Venezuelan national TV; Venezuela’s GDP...

(CNN, 26.Nov.2021) — The phone connection between a Venezuelan prison cell and Houston, Texas, crackles and fades. Jorge Toledo sounds tired. He's been held for four years, one of six...

(Bloomberg, 5.Nov.2021) — Venezuela’s state oil company slashed its output target by one-third as years of corruption, brain drain and inadequate investment crippled the nation’s energy infrastructure. PDVSA cut its...

(Platts, 4.Nov.2021) — Any major easing of US oil sanctions against Venezuela remains off the table, but the country's Nov. 21 elections could provide a chance for relief around the...

(AP, 24.Sep.2021) — The latest round of negotiations between Venezuela’s government and the country’s opposition were suspended Friday when the government’s delegates failed to appear in Mexico City. Two sources...

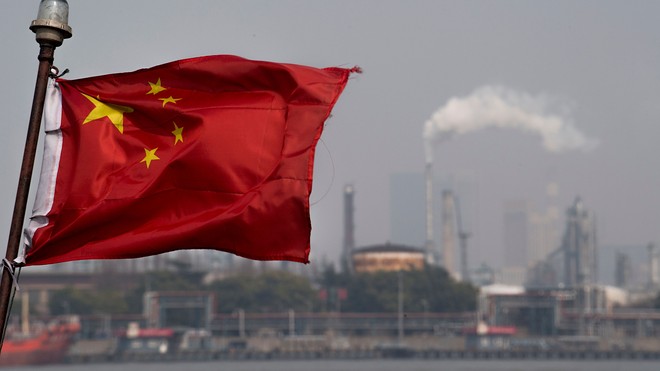

(Bloomberg, 1.Sep.2021) — China’s top oil producer is laying the groundwork to revive output in Venezuela as President Nicolas Maduro finalizes legislation to attract more international investment. Once a major...

(AS/COA, 12.Aug.2021) — A new round of negotiations is set to start on Friday, August 13, in Mexico between representatives of the de facto regime of Nicolás Maduro and the interim administration of Juan Guaidó. This is not...

(By Ft, Michael Stott, 10.Aug.2021) — Once Venezuela’s most famous political prisoner, he is best known for escaping from house arrest and appearing outside a Caracas military base in an...

(Noria Research, 31.Jul.2021) — For several years now, Venezuela has been plagued by an unprecedented combination of political, institutional, economic, social, health, and security crises. After losing control of the...

(Energy Analytics Institute, 29.Jun.2021) — The private sector must be reintegrated to increase production in Venezuela as it’s the only viable way the country could meet the optimistic production goals...

(US State Department, 25.Jun.2021) — The following statement was released by Secretary of State Antony J. Blinken, the EU High Representative for Foreign Affairs and Security Policy Josep Borrell, and...

(Bloomberg, 20.Jun.2021) — President Joe Biden’s administration rejected Nicolas Maduro’s call for relief from U.S. sanctions, saying the Venezuelan leader needs to do more toward restoring democracy before penalties would...

(S&P Global, 18.Jun.2021) — After Venezuelan President Nicolas Maduro outlasted the Trump administration's maximum sanctions pressure, US President Joe Biden will have to decide whether to offer Venezuela limited sanctions...

(Bloomberg, 18.Jun.2021) — Venezuelan President Nicolas Maduro spoke to Bloomberg TV’s Erik Schatzker in an exclusive interview in Caracas at the Miraflores presidential palace. The comments have been translated from...

(Reuters, 1.Jun.2021) — Venezuelan state oil company PDVSA is turning to local partners as it seeks to plug the gap left by Western companies in the OPEC nation's oil sector,...

(Miami Herald, 25.May.2021) — A recently approved Chinese tax might translate into a severe economic blow to the Nicolás Maduro regime by almost doubling the importing cost of the oil...

(Foreign Policy, 14.May.2021) — It isn’t uncommon to hear charges of “genocide” leveled at the government of Venezuelan President Nicolás Maduro due to the humanitarian disaster unfolding in his country...

(Energy Analytics Institute, 5.May.2021) — Energy briefs from the Latin America and Caribbean region including: Venezuela’s rising crude oil production and tactical hedges in place by Colombia’s Ecopetrol. Venezuela’s Oil...

(Argus, 4.May.2021) — Venezuela's government has incorporated the political opposition into its electoral board, another olive branch that puts pressure on the US administration to ease sanctions. But President Joe...

(Energy Analytics Institute, 5.Apr.2021) — Energy briefs from the Latin America and Caribbean region including: Venezuela’s President Nicolas Maduro announces the start of another 7+7 quarantine rotation and Peru eyes...

(Reuters, 28.Mar.2021) — Venezuelan President Nicolas Maduro on Sunday proposed paying for vaccines against the novel coronavirus with oil, though he provided few details about how such a scheme would...

(Bloomberg, 24.Mar.2021) — The oil tankers docking at the refinery in Baytown, Texas, look exactly like many others plying the waters of the Houston Ship Channel. But stashed inside their...

(Bloomberg, 11.Mar.2021) — Welcome to Venezuela’s new gasoline stations: They boast digital fuel pumps and high-end, imported liquor. They’re plastered in fresh coats of bright yellow and red paint. And...

(By Francisco Dallmeier and Cristina V. Burelli, 22.Feb.2021) — The political and economic ruin of Venezuela, once one of Latin America’s wealthiest countries, is by now a well-known story. Far...

(Council on Foreign Relations, Elliott Abrams, 18.Feb.2021) — As part of the broad economic sanctions against the Maduro regime in Venezuela and especially the petroleum sector, the Trump administration barred...

(Energy Analytics Institute, 13.Feb.2021) — China and Russia continue to push around their might in Venezuela. Thomas O’Donnell with the Hertie School of Governance & Freie Universität-Berlin weighs in briefly...

(Energy Analytics Institute, 30.Jan.2021) — Venezuelan sugarcane growers in the country’s central Portuguesa state are at risk of losing the opportunity to harvest an estimated 762 hectares of the cane...

(Bloomberg, 22.Jan.2021) — It may be the oil market’s worst-kept secret: Millions of barrels of Venezuelan heavy crude, embargoed by the U.S., have been surreptitiously going to China. The cat-and-mouse...

(Argus, 20.Jan.2021) — The new US administration is considering whether to reinstate Venezuelan crude-for-diesel swaps and ease a key sanctions waiver, but policy reversals alone would not be enough to...

(AP, 19.Jan.2021) — The Trump administration issued a parting shot at Venezuelan President Nicolás Maduro on Tuesday, announcing a sweeping round of stiff financial sanctions that target a network accused...

(US Treasury, 19.Jan.2021) — Today, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) designated three individuals, fourteen entities, and six vessels for their ties to a...

(Reuters, 18.Jan.2021) — Venezuelan authorities issued an arrest warrant for a new member of the board of directors of U.S.-based refining firm Citgo Petroleum Corp named by the opposition this...

![Venezuela’s Maduro Eyes 2 MMb/d Mark in 2022 [PDF Download]](https://energy-analytics-institute.org/wp-content/uploads/2022/01/nm-source-menpet-d-768x512.jpg)