(Frontera Energy, 6.Dec.2018) — Frontera Energy Corporation announced full year 2019 plan and guidance information. All values in this news release and the company’s financial disclosures are in United States dollars, unless otherwise noted.

Gabriel de Alba, Chairman of the Board of Directors, said: “Frontera’s 2019 plan delivers on the company’s objectives of maximizing cash generation and delivering shareholder returns by establishing a long-term production path with the optimal amount of capital, while driving company-wide efficiencies. Frontera’s strong cash position, the potential to unlock value in non-core assets and a robust balance sheet provide the company with substantial opportunities to enhance the portfolio’s growth profile and accelerate returns to shareholders. The 2019 plan combined with the longer-term outlook for the Company has given the board the confidence to announce a new dividend policy, which includes an initial dividend of $25 million and targeted quarterly dividends of $12.5 million, as well as an increased share repurchase program.”

Richard Herbert, Chief Executive Officer, commented: “Frontera has a proven track record in Colombia and Peru, and we are confident that our robust portfolio of core assets can be developed to maintain base production for several years. At Quifa, the water handling expansion project is already coming on stream to sustain production for 2019 and beyond and enable the Company to optimize future drilling locations in the area. The Coralillo light and medium oil field on the Guatiquia block has been successfully appraised with production from multiple zones. New projects in Colombia include a pilot project on CPE-6 which is expected to more than double that block’s production throughout 2019, the initiation of a long-term test on the Acorazado discovery, and the implementation of waterflood pressure maintenance at Neiva. Offshore Peru, the company continues to evaluate the potential for natural gas on the block. We are also looking to enhance our portfolio of medium- to long-term opportunities. Yesterday we announced a farm-in with CGX Energy for a 33.3% working interest in two exploration blocks offshore Guyana in one of the most promising offshore basins in the world.”

Shareholder Value Enhancement Initiatives:

The company’s board of directors have declared an initial dividend of C$0.33 per common share. This dividend is payable on or about January 17, 2019 to holders of record on January 3, 2019.

The company’s board of directors has also adopted a dividend policy to implement a quarterly dividend of approximately $12.5 million during periods in which Brent oil prices sustain an average price of $60/bbl or higher. The declaration and payment of any specific dividend, the actual amount, the declaration date, the record date and the payment date of each quarterly dividend will be subject to the discretion of the board of directors.

The company intends to adopt a dividend reinvestment program (DRIP) that allows shareholders to automatically reinvest their dividends in new shares of the company. The DRIP is subject to the filing and approval by the TSX, and once adopted should be available for the January 3, 2019 dividend and all dividends going forward.

Additionally, the company intends to amend its current normal course issuer bid (NCIB), increasing from its current authorized level of approximately 3.5% of shares outstanding to 5% of shares outstanding. The amendment to the NCIB has been approved by the company’s board of directors; however, it is subject to approval by the TSX.

2019 Plan and Guidance:

Frontera’s2019 plan and guidance has been developed with the following four key objectives:

1) Delivering stable levels of production and reserves in Frontera’s core Colombian operations;

2) Ensuring that the capital expenditures in core operations have strong financial returns;

3) Pursuing continuous operational improvements and greater cost efficiencies;

4) Creating opportunities for future growth in production and reserves through new exploration and development activities.

These objectives will enable the company to maximize shareholder returns through flexible capital allocation. Annual budgets are developed and scrutinized throughout the year and changed if necessary in the context of project returns, product pricing expectations, and the balancing of project risks and time horizons.

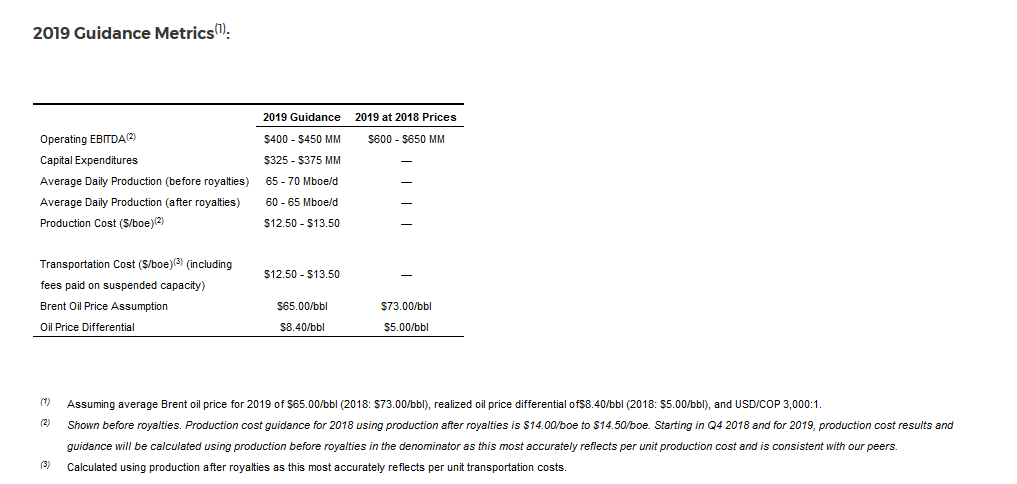

The company expects to deliver a 2019 Operating EBITDA guidance which is flat with 2018 guidance, despite an 11% decrease to its Brent oil price assumption of $65/bbl in 2019 compared to $73/bbl in 2018. The company has also used a more conservative oil price differential in 2019 of $8.40/bbl, up 60% compared to $5.00/bbl in 2018 due to pending International Marine Organization 2020 regulations. The Brent less WTI spread is estimated at $3.00/bbl for the purposes of estimating high priced royalties paid in kind at Quifa.

Average annual production before royalties in 2019 is expected to be in the range of 65,000 to 70,000 boe/d. This reflects improved statistical analysis of the impact of seasonality and potential social disruptions to the company’s operations. The decrease also takes into account the relinquishment of Block 192 in Peru in September 2019, which impacts the annual average by approximately 600 bbl/d or 1% compared to 2018.

The 2019 plan is expected to position the company to maintain stable total company production over a three year period, despite the risk of not executing a new contract on Block 192 in Peru during 2019, as core assets in Colombia which include Quifa, Guatiquia, and Cubiro, make up for lost production.

For 2019, the company has hedged approximately 7.5% of expected production before royalties with put options at a strike price of $55/bbl Brent between January and September 2019. The company will target to hedge oil prices using put options on a go-forward basis sufficient to protect the company’s capital program, financing costs, as well as potential future dividends.

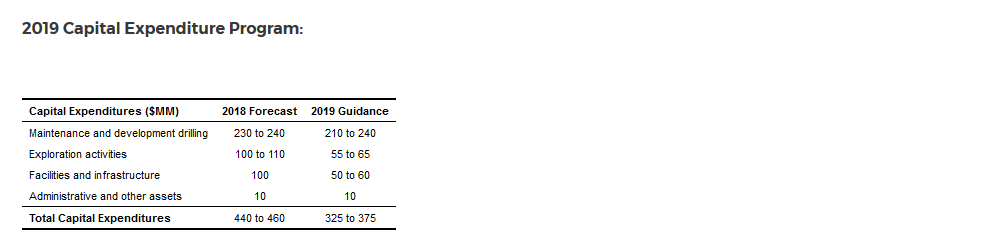

Capital expenditures in 2019 are down 22% at the midpoint from 2018 levels as a result of decreased levels of planned exploration and facilities and infrastructure spending in 2019 compared to 2018, which included high impact exploration wells in Colombia and Peru and the Quifa water handling expansion project. The company plans to drill between 110 and 120 development wells in 2019, of which 95 to 105 will be targeting heavy oil fields and 12 to 16 wells will be targeting light and medium oil fields. Exploration activities in 2019 include 10 exploration wells, half of which are near field exploration where the company had over 90% success rate in 2018, and include wells in Quifa, Sabanero and CPE-6. The other exploration wells are commitment wells on blocks including Mapache, Cordillera 15 and Guama. Infrastructure spending will decrease in 2019 as a result of the completion of the Quifa water handling project. In 2019, approximately 50% of the facilities and infrastructure spending will be projects that were deferred during the period of restructuring, a similar amount was spent in 2018.

Development Drilling Projects:

— Completion, testing, ramp up and stabilization of the Quifa water handling expansion project by year-end 2018 providing more than 400,000 bbl/d of water processing and injection capacity from four wells. The project will enable the Company to add between 2,000 and 3,000 bbl/d of oil production net to Frontera from the reactivation of 60 to 80 suspended wells while optimizing the horizontal drilling campaign in 2019 and beyond.

— Reduction in Quifa drilling costs by changing well designs and increasing drilling efficiency.

— Commencement of a multilateral drilling pilot project at Quifa to increase recovery efficiency.

— Production growth pilot project at CPE-6, targeting a doubling of production by the end of 2019.

— Continued development of Coralillo field on the Guatiquia block with recent Coralillo appraisal drilling confirming the presence of two reservoir intervals.

— Drilling in the Zopilote field acreage extension recently added to the Cravo Viejo block has proven a southerly extension to the field following the drilling of the Zopilote Sur well. New development locations have been identified and will be drilled in 2019.

— Expansion of the waterflood pressure maintenance project in Copa, which is expected to improve recovery and assist with mitigation of production decline. Additional production response is expected in 2020.

— Expansion of the waterflood pressure maintenance project at Neiva.

— Proving up of natural gas resources offshore Peru on block Z-1 for a potential future natural gas development.

Exploration Projects:

— Farm-in to two shallow water offshore blocks in Guyana with the drilling of the Utakwaaka -1 exploration on the Corentyne block well expected to be drilled in 2019.

— Continued testing and evaluation of commerciality at the Jaspe heavy oil accumulation near Quifa.

— Exploration drilling at Mapache, if successful, would result in an additional two to four development locations in 2019.

— Exploration drilling at Sabanero, if successful, would result in additional development opportunities in 2019 and beyond.

Production Reporting

In order to improve the comparability of reported operational and financial results amongst its Canadian, Colombian and Latin American focused peer group, Frontera will be changing its methodology of reporting production volumes to a company working interest before royalty basis from the current practice of reporting net production volumes after royalties. The change will be effective starting with results presented for the fourth quarter of 2018 and is also reflected in our 2019 guidance metrics. Production will be calculated as total amount of the company’s working interest production (before royalties) and volumes produced from service contracts. The company believes that reporting production on this new basis will result in greater alignment with its industry peers and will be more reflective of daily production activity and operational cost drivers.

***

#LatAmNRG

Related Stories

https://energy-analytics-institute.org/frontera-energy-announces-dividend/