(Petrobras, 8.Feb.2024) — In 2023, Petrobras delivered an excellent upstream operational performance, meeting all production forecasts for the year. Total annual production of oil and natural gas, of 2.782 MMboed,...

(Hess, 31.Jan.2024) — Hess Corporation (NYSE: HES) reported net income of $413mn, or $1.34 per share, in the fourth quarter of 2023, compared with net income of $497mn, or $1.61...

(Woodside, 27.Dec.2023) — Woodside Energy has achieved another significant step forward for the Sangomar Project with the sail away from Singapore of the Léopold Sédar Senghor Floating Production Storage and Offloading...

(Suncor, 27.Nov.2023) — Suncor Energy (TSX: SU) (NYSE: SU) announced that the Terra Nova Floating, Production, Storage and Offloading vessel has safely restarted following the completion of the Terra Nova...

(SBM Offshore, 14.Nov.2023) — SBM Offshore announce that FPSO Prosperity has produced first oil as of 14 Nov. 2023 and is formally on hire. The FPSO Prosperity utilizes a design that largely replicates the...

(Petrobras, 9.Nov.2023) — Petrobras reported on its main financial achievements in the third quarter 2023. Highlights: Solid recurring EBITDA of US$13.7bnGross debt under control at US$61bn, even after the increase...

(SBM, 9.Nov.2023) — SBM Offshore and ExxonMobil Guyana Limited, an affiliate of ExxonMobil Corporation, have completed the transaction related to the purchase of FPSO Liza Unity, a few months ahead of...

(Equinor, 27.Sep.2023) — Equinor and Ithaca Energy have taken the final investment decision to progress Phase 1 of the Rosebank development on the UK Continental Shelf (UKCS), investing $3.8bn. The...

(IKM Testing, 23.May.2023) — Independent integrated solutions provider IKM Testing UK has secured a second contract with Bumi Armada to deliver a drone-based methane emissions survey on the Kraken Floating...

(SBM, 2.May.2023) — SBM Offshore has signed a 10-year Operations and Maintenance Enabling Agreement with Esso Exploration & Production Guyana Ltd (aka “ExxonMobil Guyana”) for the Operations and Maintenance of...

(Petrobras, 8.Feb.2023) — Petrobras commented on its production and sales in 4Q;22 and 2022. “In 2022, we delivered an excellent operational performance, meeting all production targets for the year, with...

(FPSO Network c/o Energy Analytics Institute, 31.Aug.2022) — Energy Analytics Institute (EAI) is proud to be a supporting partner for the upcoming FPSO Brazil Congress 2022. This event will be happening...

(Energy Analytics Institute, 25.Jul.2022) — Energy briefs including the government of the Brazilian state of Ceara teaming up with Enel Green Power Brasil to study the potential for development of...

(Energy Analytics Institute, 24.Jul.2022) — Energy briefs including BW Offshore Limited saying Mexico’s state-owned Pemex has assumed ownership and operation of the FPSO YÙUM K'AK'NÁAB. LATIN AMERICA AND THE CARIBBEAN...

(SBM, 5.Apr.2022) — SBM Offshore announced that Esso Exploration and Production Guyana Limited (EEPGL), an affiliate of Exxon Mobil Corporation, has confirmed the award of contracts for the Yellowtail development...

(Reuters, 3.Feb.2022) — An independent refiner has imported the first cargo of Guyanese crude oil into Brazil, according to tanker tracking data and a person familiar with the deal. Since...

(IHS Markit, 9.Dec.2021) — The following provides a brief overview of selected reports in the Upstream Costs and Technology, Latin America Costs and Technology Supply Chain Service from November 2021....

(Hess, 27.Oct.2021) — At the Stabroek Block (Hess – 30%), the corporation’s net production from the Liza Field was 32,000 bopd in the third quarter of 2021 compared with 19,000...

(DPI, 3.May.2021) — Minister of Natural Resources, Hon. Vickram Bharrat said ExxonMobil’s local subsidiary, Esso Exploration and Production Guyana Limited (EEPGL), will switch the manufacturer of the compressor equipment it...

(Energy Analytics Institute, 30.Apr.2021) — ExxonMobil’s deepwater projects offshore Guyana and Brazil generate returns over 10% with an oil price below $35 per barrel, the company’s CEO Darren Woods told...

(Hess, 27.Apr.2021) — Hess Corporation (NYSE: HES) today announced another oil discovery offshore Guyana at the Uaru-2 well on the Stabroek Block, which will add to the previously announced gross...

(ExxonMobil, 27.Apr.2021) — ExxonMobil made an oil discovery at the Uaru-2 well in the Stabroek Block offshore Guyana. Uaru-2 will add to the previously announced gross discovered recoverable resource estimate...

(Argus, 16.Apr.2021) — Guyana is considering unspecified economic measures to cushion the impact of repeated production cuts from US major ExxonMobil's deepwater Stabroek block, the natural resources ministry said. Since...

(SBM Offshore, 25.Feb.2021) — SBM Offshore signed a Letter of Intent (LOI) together with Petróleo Brasileiro S.A. (Petrobras) for a 26.25 years lease and operate contract for the FPSO Almirante...

(Petrobras, 24.Feb.2021) — Petrobras today signed a letter of intent with SBM Offshore for the chartering and provision of services for the FPSO - floating production storage and offloading unit...

(Argus, 15.Feb.2021) — Guyana forecasts average crude production of 109,000 b/d in 2021, 46.7pc above last year but short of initial expectations because of a recurring technical glitch. The government...

(Hess, 27.Jan.2021) — Hess Corporation provided operational highlights from the fourth quarter of 2020 and its operations in the US Bakken, the US Gulf of Mexico, offshore Guyana and Malaysia....

(Energy Analytics Institute, 15.Jan.2021) — Texas-based ExxonMobil announced results of the Hassa-1 exploration well offshore Guyana in the Stabroek Block didn’t find hydrocarbons in the primary reservoir target. “The Hassa-1...

(SBM Offshore N.V., 23.Dec.2020) — SBM Offshore reports a contractual lease extension for FPSO Espirito Santo in Brazil and expects a potential increase in the lease duration for FPSOs in...

(Argus, 21.Dec.2020) — ExxonMobil reached targeted crude production of 120,000 b/d at the Liza 1 well on Guyana's deepwater Stabroek block, a milestone that had been delayed by an earlier...

(PetroRio, 21.Dec.2020) — PetroRio S.A., in accordance with best corporate governance practices and transparency, and in order to maintain informational equity in view of the possible share offering disclosed in...

(DPI, 20.Dec.2020) — The government of Guyana says it welcomes the announcement by US oil and gas company ExxonMobil that it has reached maximum production of 120,000 barrels of oil...

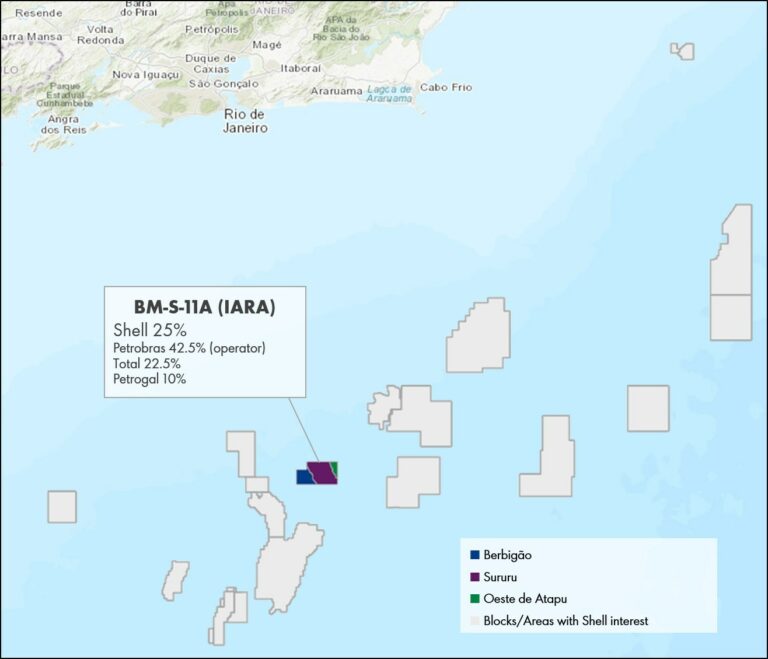

(Equinor, 10.Nov.2020) — Equinor has, on behalf of the partners ExxonMobil and Petrogal Brasil, awarded Baker Hughes, Halliburton and Schlumberger contracts for drilling and well services on the Bacalhau field...

(McDermott, 5.Nov.2020) — McDermott International, Ltd announced the second shipment of topside modules for a floating production storage and offloading (FPSO) unit for MODEC, Inc. (MODEC). It comes just weeks...

(Energy Analytics Institute, 16.Oct.2020) — Rio de Janeiro-based Petróleo Brasileiro SA or Petrobras, announced it has postponed the Integrated Project of Parque das Baleias by around a year; thus, pushing...

(Karoon Energy, 5.Oct.2020) — Karoon Energy Ltd provided the market with the following update on the status of the Baúna asset acquisition: -- Remaining Conditions Precedent: As previously announced, transaction...

(Exxon, 30.Sep.2020) — ExxonMobil made its final investment decision to proceed with the Payara field offshore development in Guyana after receiving government approvals. Payara is the third project in the...

(Hess, 30.Sep.2020) — Hess made a final investment decision to proceed with development of the Payara Field offshore Guyana after the development plan received approval from the government of Guyana....

(Petrobras, 14.Sep.2020) — Petrobras reports on the revision of the Exploration & Production (E&P) segment portfolio in face of the crisis caused by COVID-19. The revision aims to maximize the...

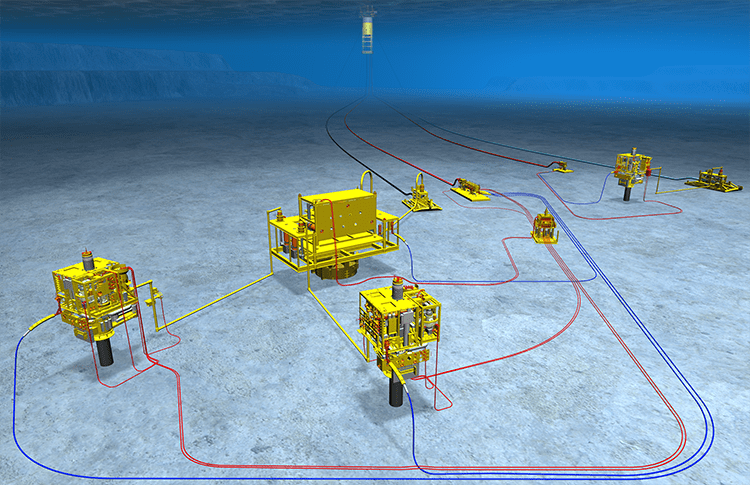

(TechnipFMC, 20.Aug.2020) — TechnipFMC has been awarded a large(1) contract for Engineering, Procurement, Construction and Installation (EPCI) through a competitive contracting process, by Petrobras, the leader and operator of the...

(Total, 17.Aug.2020) — Total and its partners have taken the investment decision for the third phase of the Mero project (Libra block), located deep offshore, 180 kilometers off the coast...

(Kaieteur News, 14.Aug.2020) — Even though the PPP/C government may be desirous of granting the approval for ExxonMobil’s third development project within a reasonable timeframe, it will not be rushing...

(Petrobras, 14.Aug.2020) — Petrobras signed a letter of intent with the company MISC Berhad for the chartering and services for FPSO (floating production storage and offloading unit) Marechal Duque de...

(Argus, 11.Aug.2020) — Nigeria's full compliance to the OPEC+ deal hangs on a key oil grade being treated as a condensate. Since OPEC+ allowed ultra-light oil to be exempt from...

(Petrobras, 24.Jul.2020) — Petrobras’ Executive Board approved the beginning of the contracting processes for three new Floating Production Storage and Offloading (FPSOs) platforms for the Búzios field, in the Santos...

(Reuters, 8.Jul.2020) — Petrobras is preparing to launch a tender to build Brazil's largest-ever oil platform, according to two people with knowledge of the matter, as the state-controlled oil firm...

(Stabroek News, 26.Jun.2020) — The Ministry of the Presidency this morning said that nineteen companies have been shortlisted for the marketing of Guyana’s oil from the Liza Destiny FPSO. A...

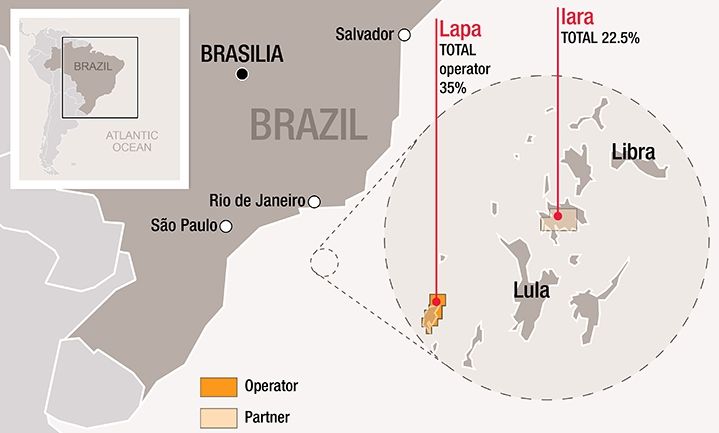

(Total, 25.Jun.2020) — Total and its partners announce the start-up of the Floating Production Storage and Offloading (FPSO) P-70 of the Iara cluster (Block BM-S-11A), located in the deepwater Santos...

(Stabroek News, 7.Jun.2020) — Production at Exxon-Mobil’s Liza-1 project in the Stabroek Block, offshore Guyana, has plummeted from 80,000 barrels per day (bpd) to now between 25,000 and 30,000 bpd...

(Stabroek News, 23.May.2020) — Guyana has lifted its second one-million barrel cargo of crude oil entitlement from ongoing offshore production and the oil tanker Sonangol Namibe departed these shores yesterday...

(DOE, 4.May.2020) — Good morning ladies and gentlemen I am coming to you at a very interesting time in our country’s history given the furore over our national and regional...

(Petrobras, 17.Apr.2020) — Petrobras, following up on the press release disclosed on 3 February 2020, announces that it has started the binding phase referring to the sale of its entire...

(Reuters, 17.Apr.2020) — Brazilian state-run oil firm Petrobras plans to restart operations in the coming days at two ships used in offshore oil production that suffered coronavirus outbreaks, an executive...

(FPSO Network, 18.Feb.2020) — Following 2 successful events since 2018, the FPSO Brasil Congress, taking place on 25 – 27 May 2020 is returning to Rio de Janerio. It will...

(Modec, 30.Jan.2020) — Modec Inc. has signed a Sales and Purchase Agreement (SPA) with Equinor Brasil Energia Ltda, a subsidiary of Equinor ASA, to supply a Floating Production Storage and...

(MODEC, 30.Jan.2020) — MODEC, Inc. ("MODEC," head office: Chuo-ku, Tokyo; President & CEO: Yuji Kozai), Mitsui & Co., Ltd. ("Mitsui," head office: Chiyoda-ku, Tokyo; President & CEO: Tatsuo Yasunaga), Mitsui...

(Equinor, 30.Jan.2020) — Equinor has, on behalf of the partners ExxonMobil and Petrogal Brasil entered into Front End Engineering and Design (FEED) contracts with early commitments and pre-investments for phase...

(Jamaica Observer, 19.Jan.2020) — The Marshall Islands registered crude oil tanker, Yannis P , has arrived here as the country will soon lift the first one million barrels of crude...

(Stabroek News, 16.Jan.2020) — A Guyanese offshore laboratory technician will go down in history as the person to test the first sample of Guyanese crude oil as it came through...

(Total, 15.Nov.2019) — France’s Total announced first oil from the Iara license (Block BM-S-11A), located in the deepwater Santos Basin pre-salt. This marks the start-up of the FPSO P-68, the...

(Shell, 14.Nov.2019) — New, deep-water production has come online from the Brazilian pre-salt Santos Basin. Shell Brasil Petróleo Ltda. (Shell Brasil) and its consortium partners today announced the start of...

(Petrobras, 15.Oct.2019) — Petrobras signed letters of intent (LoI) with the Japanese company Modec (Marlim Unit 1) and the Malaysian company Yinson (Marlim Unit 2), for the chartering of two...

(Exxon, 9.Sep.2019) — Finding the next big discovery is only a small part of the story when it comes to energy. Delivering that new energy source to those who need...

(Argus, 2.Sep.2019) — Guyana received its first floating, production, storage and offloading unit (FPSO) Liza Destiny in anticipation of ExxonMobil's production launch in March 2020. Liza Destiny. Source: ExxonMobil The...

(Zacks, 30.Aug.2019 ) — Hess Corporation recently announced the arrival of Liza Destiny — an oil production vessel — at the Stabroek Block, offshore Guyana. Notably, this is Guyana’s first...

(Energy Analytics Institute, Aaron Simonsky, 29.Aug.2019) — LatAmNRG briefs related to the Liza Destiny FPSO reaching Guyana, PDVSA investigating recent LPG plant explosion in Los Valles del Tuy, Dos Bocas...

(Petrobras, 28.Aug.2019) — Petrobras, following up on the release disclosed on Aug. 26, reports that Modec has informed the company that the FPSO Cidade do Rio de Janeiro, located in...

(Siemens, 9.Jul.2019) — Siemens will provide MODEC with three 34-megawatt (MW) SGT-A35 gas turbine power generation packages that will power MODEC's floating production, storage, and offloading (FPSO) vessel. Rendering of...

(Chron.com, Jordan Blum, 12.Jun.2019) — The Libra Consortium led by Petrobras, Royal Dutch Shell and Total said they've authorized construction of the multibillion-dollar Mero 2 project offshore of Brazil. The...

(Shell, 11.Jun.2019) — Libra Consortium announced the final investment decision to contract the Mero-2 floating production, storage and offloading (FPSO) vessel to be deployed at the Mero field offshore Santos...

(MAN Energy, 16.May.2019) — MODEC has commissioned MAN Energy Solutions to supply a total of six compressor trains for a new FPSO vessel in the Gulf of Mexico. “We are...

(McDermott, 14.May.2019) — McDermott International, Inc. announced the award of a significant* contract by Petrobras for engineering, procurement, construction and installation of subsea risers and flowlines for the first phase...

(Hess, 3.May.2019) — Hess Corporation today announced it has received regulatory approval from the government of Guyana and has made a final investment decision to proceed with the second phase...

(Amsterdam News, Bert Wilkinson, 25.Apr.2019) — As Guyana, the Caribbean Community’s largest and most resource-rich nation, prepares to become an oil producer by the end of this year, American supermajor...

(Petrobras, 19.Mar.2019) — Petrobras reports that it has started today the production of oil and natural gas of P-77, the fourth platform to be put into production in the Búzios...

![Petrobras Highlights 4Q:23 Production and Sales [PDF Download]](https://energy-analytics-institute.org/wp-content/uploads/2024/02/fpso-sepetiba-source-petrobras-768x462.png)

![Hess Reports 4Q:23 Results, Updates on Payara [PDF Download]](https://energy-analytics-institute.org/wp-content/uploads/2023/04/guyana-fpso-prosperity-arrival-to-stabroek-source-sbm-1b-768x443.jpg)

![Petrobras Reports 3Q:23 Financials [PDF Downloads]](https://energy-analytics-institute.org/wp-content/uploads/2023/11/petrobras-3q23.png)

![Rosebank Field to Progress in the UK [Video]](https://energy-analytics-institute.org/wp-content/uploads/2023/09/norway-petrojarl-source-equinor-768x384.webp)

![Petrobras: Highlights on 4Q:22 Production, Sales [PDF Download]](https://energy-analytics-institute.org/wp-content/uploads/2023/02/brazil-p71-itapu-field_4q22-sales-rpt-source-petrobras.png)