(Reuters, 21.Mar.2024) — The government of Trinidad and Tobago has begun talks with the U.S. for a license that would allow the joint development of a natural gas project shared...

(Petrobras, 8.Feb.2024) — Petrobras, further to the announcement made on 27/12/2023, informs that it has concluded the acquisition of stakes in the 3 exploratory blocks 10, 11 and 13, in...

(Shell Plc, 1.Feb.2024) — Shell plc released its fourth quarter results and fourth quarter interim dividend announcement for 2023. q4-2023-quarterly-press-release-shellDownload q4-2023-slides-shellDownload q4-2023-qra-document-shellDownload ____________________

(Reuters, 23.Jan.2024) — BP expects the Calypso deepwater natural gas field off Trinidad and Tobago, which it shares with Woodside Energy to get the greenlight when a final investment decision (FID) is...

(Reuters, 22.Jan.2024) — Trinidad and Tobago has begun talks with some European countries on the supply of liquefied natural gas (LNG) produced from Venezuelan gas, Prime Minister Keith Rowley said...

(Petrobras, 27.Dec.2023) — Petrobras' Board of Directors has approved the company's operations in São Tomé and Príncipe, a country on the west coast of Africa, enabling the acquisition of stakes...

(Trinidad and Tobago Energy Chamber, 22.Dec.2023) — The Ministry of Energy and Energy Industries has announced that the Bolivarian Republic of Venezuela has granted the license for the Dragon Gas...

(Trinidad and Tobago Ministry of Energy and Energy Industries, 22.Dec.2023) — Historic and unprecedented energy deals for Trinidad and Tobago that provide us with positive outlooks for our future, the...

(Energy Analytics Institute, 20.Dec.2023) — The National Gas Company of Trinidad and Tobago (NGC) and Shell were granted a license for the exploration and exploitation of non-associated gas in the...

(Shell, 19.Dec.2023) — Shell Offshore Inc., a subsidiary of Shell plc, announced the Final Investment Decision (FID) for Sparta, a deep-water development in the U.S. Gulf of Mexico that represents our competitive...

(QatarEnergy, 15.Dec.2023) — QatarEnergy signed two Production Sharing Contracts (PSCs) for Suriname’s offshore Blocks 64 and 65, which it had won during a bid round held in June 2023. Pursuant...

(Petrobras, 13.Dec.2023) — Petrobras has acquired 29 blocks in the Pelotas basin in the 4th Permanent Concession Offer Cycle of the National Agency of Petroleum, Natural Gas and Biofuels (ANP). Petrobras...

(The Energy Chamber of Trinidad & Tobago, 6.Dec.2023) — The Energy Chamber of Trinidad & Tobago welcomes the news of the final signing of the Atlantic restructuring agreement. The Energy...

(WoodMac, 5.Dec.2023) — Oil and gas Majors have just an 8% market share of announced global net low-carbon hydrogen production capacity, which equates to 102.6 million tonnes per annum (Mtpa), according...

(Office of the Prime Minister of Trinidad and Tobago, 5.Dec.2023) — The government has secured a new unitized commercial structure for Atlantic LNG which allows the National Gas Company of...

(Reuters, 11.Nov.2023) — BP (BP.L), Edison (EDNn.MI) and Shell (SHEL.L) pressed a U.S.-EU energy group to intervene in a dispute with liquefied natural gas exporter Venture Global LNG over the U.S. firm's failure to deliver...

(Trinidad Guardian, 27.Oct.2023) — Prime Minister Dr Keith Rowley yesterday described the signing in early December of the agreements to restructure the shareholding in Atlantic LNG as one of the...

(WoodMac, 26.Oct.2023) — ExxonMobil’s and Chevron’s belief in the durability of upstream could hardly be better demonstrated by the game-changing acquisitions of two flagship US Independents. It’s a pivotal moment...

(Ecopetrol, 19.Oct.2023) — Ecopetrol S.A. (BVC: ECOPETROL; NYSE: EC) confirms that the Glaucus-1 well has verified the presence of natural gas in the deep waters of the southern Colombian Caribbean, underscoring the...

(Energy Chamber, 21.Sep.2023) — The Energy Chamber is extremely pleased to hear the news that Trinidad & Tobago and Venezuela have signed an agreement to work on the Dragon field...

(Bloomberg, 20.Sep.2023) — President Nicolás Maduro said Venezuela and Trinidad and Tobago have signed a profit-sharing agreement to export gas from the PDVSA-owned Dragon offshore project. The project, which was...

(Reuters, 5.Sep.2023) — Shell (SHEL.L) and Trinidad and Tobago's National Gas Company (NGC) are close to agreeing to credit Venezuela's state-run oil firm for its $1 billion investment in a gas field...

(Morocco World News, 14.Jul.2023 ) — has entered into a 12-year agreement to provide the country with 0.5 billion cubic meters (bcm) of liquefied natural gas (LNG) annually. The deal was...

(Petrobras, 31.May.2023) — Petrobras signed the Production Sharing Contracts (PSC) of the 1st Cycle of the Permanent Offer Bidding Round, held through a public session on 12/16/2022, for the blocks of (i) Água...

(QatarEnergy, 16.May.2023) — QatarEnergy announces the award of the engineering, procurement, and construction (EPC) contract for the North Field South (NFS) project, which comprises two LNG mega trains with a...

(Westwood, 4.Apr.2023) — When Shell announced final investment decision (FID) on its Prelude floating liquefaction natural gas (FLNG) unit in May 2011, it was meant to be the start of...

(Shell, 15.Mar.2023) — Shell Offshore Inc., a subsidiary of Shell plc, announced the Final Investment Decision (FID) for Dover, a planned subsea tieback to the Shell-operated Appomattox production hub in...

(Petrobras, 9.Mar.2023) — Petrobras announces that its CEO Jean Paul Prates, and Wael Sawan, Shell's CEO, signed today a Memorandum of Understanding, during CERAWeek, in Houston, in order to encourage...

(Reuters, 24.Feb.2023) — Trinidad and Tobago expects to formally begin negotiations next month with Venezuela on a promising offshore natural gas project, the Caribbean nation's energy minister said on Feb....

(Shell, 16.Feb.2023) — Shell Offshore Inc., a subsidiary of Shell plc, announced that production has started at the Shell-operated Vito floating production facility in the US Gulf of Mexico (GoM)....

(Shell, 16.Feb.2023) — Europe’s increased need for liquefied natural gas (LNG) looks set to intensify competition with Asia for limited new supply available over the next two years and may...

(Trinidad Express, 25.Jan.2023) — Energy expert Anthony Paul is not convinced that T&T has its ducks lined up to deliver the various sub-projects required to bring that gas to shore...

(The Office of the PM of Trinidad and Tobago, 23.Jan.2023) — Prime Minister of the Republic of Trinidad and Tobago Dr. Hon. Keith Rowley gave a keynote address at the...

(TotalEnergies, 20.Jan.2023) — In line with its growth strategy in gas and LNG, a fuel contributing to the energy transition, TotalEnergies announces the start of gas production from onshore Block...

(TotalEnergies, 16.Jan.2023) — TotalEnergies approved the final investment decision of the Lapa South-West oil development located in the Santos Basin, 300 km off the coast of Brazil. This development represents...

(Reuters, 28.Dec.2022) — Trinidad and Tobago is preparing to reject four offshore exploration bids by BP Plc (BP.L) and Shell Plc (SHEL.L), according to people familiar with the matter, because they failed to...

(ANCAP, 26.Dec.2022) — As a result of the Open Uruguay Round process approved by Decree 111/019, three bids for the exploration and production of hydrocarbons for two offshore areas of...

(Welligence, 16.Dec.2022) — Brazil bid round alert! The first PSC Permanent Offer round was held today, with 4 of the 11 blocks on offer in the Santos and Campos basins...

(The Energy Chamber of Trinidad & Tobago, 6.Dec.2022) — The Energy Chamber of Trinidad & Tobago warmly welcomes today’s signing of agreements between bp, Shell, The National Gas Company of...

(bpTT, 6.Dec.2022) — bpTT President David Campbell speaks about the deal between BP Plc, Shell Plc, The National Oil Company of Trinidad and Tobago (NGC) and Chinese Investment Corporation (CIC)....

(Shell, 28.Nov.2022) — Shell Petroleum NV, a wholly owned subsidiary of Shell plc, has reached an agreement with Davidson Kempner Capital Management LP, Pioneer Point Partners and Sampension to acquire...

(TotalEnergies, 16.Sep.2022) — TotalEnergies, along with its partners, has signed an Exploration and Production Sharing Agreement (EPSA) with the Ministry of Energy and Minerals (MEM) of the Sultanate of Oman...

(Trinidad and Tobago Newsday, 13.Sep.2022) — The Prime Minister is warning that unless investments are secured, declining natural gas levels could have dire consequences for the future of TT's economy....

(Trinidad Express, 13.Sep.2022) — Prime Minister Dr Keith Rowley says if Trinidad and Tobago’s natural gas prospects do not improve in the next few years, this will have far-reaching consequences...

(Hess, 13.Sep.2022) — The Llano-6 well in the Gulf of Mexico delivered first production on 4 Augustm 2022. The well is a tieback to Shell’s Auger facility. This latest achievement...

(Office of the PM of Trinidad and Tobago, 12.Sep.2022) — Ministerial interaction with oil, gas and petrochemical majors (Proman, BP & Shell) based in Europe. Proman – Zurich and Düsseldorf...

(Maersk Drilling, 8.Sep.2022) — Shell has exercised an option to extend the provisioning of the 7th generation drillship Maersk Voyager for drilling services offshore Mexico. The contract extension is expected to...

(Equinor, 29.Aug.2022) — Northern Lights, a JV owned by Equinor, Shell and TotalEnergies, signed the world’s first commercial agreement on cross border CO2 transportation and storage with Yara. This is an...

(Ecopetrol, 10.Aug.2022) — Ecopetrol S.A. (BVC: ECOPETROL;NYSE: EC) announces that the Gorgon-2 well proved the presence of gas in ultra-deep waters in the southern Colombian Caribbean, confirming the importance of this...

(QatarEnergy, 5.Jul.2022) — QatarEnergy announced the selection of Shell plc. as partner in the North Field East (NFE) expansion project, the single largest project in the history of the LNG...

(Shell, 5.Jul.2022) — Shell has been selected by QatarEnergy as a partner in the North Field East expansion project in Qatar, the single largest project in the history of the...

(Strohm, 28.Jun.2022) — Strohm has supplied Shell with a static Thermoplastic Composite (TCP) Riser to support operations at one of its Southern North Sea assets. The availability of TCP through...

(Exxon, 27.Jun.2022) — ExxonMobil, Shell, CNOOC, and Guangdong Provincial Development & Reform Commission signed a Memorandum of Understanding to evaluate the potential for a world-scale carbon capture and storage project...

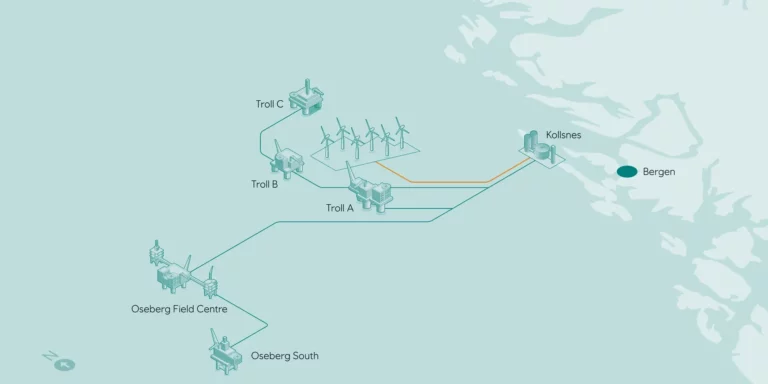

(Equinor, 17.Jun.2022) — Equinor and its partners Petoro, TotalEnergies, Shell and ConocoPhillips in the Troll and Oseberg fields, have initiated a study and are looking into possible options for building...

(Shell, 13.Jun.2022) — The Board of Shell plc announced the pounds sterling and euro equivalent dividend payments in respect of the first quarter 2022 interim dividend, which was announced on...

(Reuters, 8.Jun.2022) — Italian producer Eni (ENI.MI) has been picked, along with another four oil majors, by Qatar as partners in the near $30 billion expansion of the world's largest liquefied natural gas (LNG) project, people with...

(Shell, 7.Jun.2022) —Shell announced the launch of the Shell Energy brand into the residential power market in the United States. Through Shell Energy Solutions the company now offers 100% renewable electricity...

(FT, 2.Jun.2022) — Can the EU’s ban this week on most Russian oil imports breathe new life into a dead cow in Patagonia? Argentina’s president Alberto Fernández thinks so. He...

(WoodMac, 30.May.2022) — Shell has sanctioned the development of the Crux gas field in Australia’s Bonaparte Basin. Wood Mackenzie research analyst Michael Song said: “The development is expected to cost...

(Reuters, 19.May.2022) — Shell and Brazil's Porto do Açu have agreed to jointly build a green hydrogen plant, executives told Reuters, a deal that could result in the debut of...

(Bloomberg, 16.May.2022) — Expensive offshore exploration setbacks for international oil majors including Shell Plc and Exxon Mobil Corp. are throwing cold water on their plans to turn Brazil into a...

(Petrobras, 27.Apr.2022) — Petrobras signed the Production Sharing Contract for the Surplus Volumes to the Transfer of Rights of Atapu in partnership with Shell Brasil Petróleo Ltda (25%) and TotalEnergies...

(Energy Analytics Institute, 21.Apr.2022) — Energy briefs including Vista Oil & Gas, S.A.B. de C.V. planning to have an extraordinary shareholders' meeting on 26 April 2022; Argentina’s Energy Secretariat Dario...

(Shell, 5.Apr.2022) — Shell plc published its 2021 Sustainability Report, its 2022 Industry Associations Climate Review Update and its 2021 Payments to Governments Report. Shell has been formally reporting on...

(Energy Analytics Institute, 31.Mar.2022) — Energy briefs including the US Energy Department saying it is ready to execute the president of the United States’ authorization of an immediate release of...

(Shell Trinidad and Tobago, 31.Mar.2022) — Shell Trinidad and Tobago (through BG International, a subsidiary of Shell plc), announces that production has started on Block 22 and NCMA-4 in the North Coast...

(KTRK, 21.Mar.2022) — The University of Houston is establishing a new institute focused on clean energy, and it's all thanks to a donation from Shell.UH announced on Monday that it...

(Trinidad Guardian, 23.Feb.2022) — The Keith Rowley administration has quietly walked away from any hope of salvaging Atlantic LNG Train 1 and has instead signed an agreement with Royal Dutch...

(Reuters, 14.Feb.2022) — Exxon Mobil Corp has bet billions of dollars on offshore drilling in Brazil, an area it once abandoned and now sees as key to its future. But...

(The New York Times, 18.Jan.2022) — Two giant murals, on storage tanks at an oil refinery here, depict the rebels led by Sam Houston who secured Texas’ independence from Mexico...

(NGC, 5.Jan.2022) — NGC signed a Heads of Agreement (HOA) with Shell to start the pre-Front End Engineering Design (pre- FEED) phase for the processing of Manatee gas via NGC's...

(AFP, 5.Jan.2022) — Thousands marched Tuesday along the beaches of Argentina's Mar del Plata to protest an oil exploration project off the Atlantic coast. Carrying placards reading, "Oil is death",...

(Energy Analytics Institute, 31.Dec.2021) — Trinidad and Tobago’s Minister of Energy and Energy Industries Stuart Young commented in an annual video update from Port of Spain on key oil, gas...

(Petrobras, 30.Dec.2021) — Petrobras was notified, on this date, of preliminary decisions rendered by the Court of Justice of the State of Rio de Janeiro that determined the maintenance of...

(Rystad Energy, 23.Dec.2021) — Colombia, Latin America’s third-largest oil producer after Brazil and Mexico, is in danger of losing its energy self-sufficiency and a significant part of its gross domestic...

![Shell Plc Posts Year End 2023 Results [PDF Downloads]](https://energy-analytics-institute.org/wp-content/uploads/2023/12/Shell_Upstream_Americas_Gulf_of_Mexico_Platform__Ursa-source-shell-768x513.jpg)

![Shell LNG 2023 Outlook [PDF Downloads]](https://energy-analytics-institute.org/wp-content/uploads/2023/02/uk-lng-outlook-2023-source-shell-768x429.png)