(Reuters, 20.Jun.2024) — A contract arbitration panel that could block or green-light the $53 billion sale of Hess Corp to Chevron remains incomplete three months after the case was filed, stalling a decision...

(Chevron, 29.May.2024) — Chevron Corporation (NYSE: CVX) provided an overview of the company’s business performance and plans at its 2024 Annual Meeting of Stockholders. “Chevron continues to deliver strong operational performance, maintain...

(Hess Corporation, 28.May.2024) — Hess Corporation (NYSE: HES) has received the necessary approval of its stockholders for closing the company’s merger with Chevron Corporation. At the special meeting of Hess stockholders held...

(Bloomberg, 22.May.2024) — John Hess, the boss of the oil company that bears his family name, is talking to directly with shareholders in a last-ditch effort to ensure enough support...

(Hess, 20.May.2024) — Hess Corporation (NYSE: HES) announced that independent proxy voting and corporate governance advisory firm Glass, Lewis & Co. has recommended that Hess shareholders vote FOR the proposed merger with Chevron. In...

(Chevron, 26.Apr.2024) — Chevron Corporation (NYSE: CVX) reported earnings of $5.5bn ($2.97/share - diluted) for first quarter 2024, compared with $6.6bn ($3.46/share - diluted) in first quarter 2023. Foreign currency effects...

(Hess, 25.Apr.2024) — Hess Corporation reported that is net Guyana production was 190,000 b/d in the first quarter of 2024, up 70% from 112,000 b/d in the first quarter of...

(BTU Analytics, 23.Apr.2024) — Historically, more than half of Mexico’s heavy sour crude oil exports, mostly Maya blend, end up in the U.S., which is key for refining along the...

(Reuters, 15.Apr.2024) — The U.S. will not renew a temporary license set to expire on Thursday that widely eased sanctions on Venezuela's oil and gas sector, a State Department spokesperson...

(Chevron, 4.Apr.2024) — Chevron New Energies (CNE), a division of Chevron U.S.A. Inc., announced a lead investment in ION Clean Energy, a Boulder-based technology company that provides post-combustion point-source capture technology through its...

(AP, 23.Mar.2024) — A former fighter pilot jailed in Venezuela in February for his ties to a prominent human rights attorney is an employee of U.S. oil firm Chevron, The...

(Hess, 7.Mar.2024) — Today, ExxonMobil announced that it is filing for arbitration regarding the applicability of a right of first refusal (ROFR) / pre-emption provision in the Stabroek joint operating agreement....

(Reuters, 6.Mar.2024) — Exxon Mobil Corp on Wednesday said it filed a contract arbitration claim related to Hess Corp's proposed sale of its Guyana oil properties, and suggested it may counter...

(Chevron, 29.Feb.2024) — Chevron New Energies, a division of Chevron U.S.A. Inc., is developing a 5-megawatt hydrogen production project in California’s Central Valley. The project aims to create lower carbon...

(Reuters, 28.Feb.2024) — Exxon Mobil's surprise challenge to Chevron's acquisition of Hess through a dispute over a stake in a major Guyana oil field could prove fruitful for the U.S....

(Reuters, 28.Feb.2024) — Guyana's vice president Bharrat Jagdeo on Wednesday said the country will accept whatever is the result from discussions between Exxon Mobil Corp, Chevron Corp and Hess Corp regarding participation in...

(MarketWatch, 27.Feb.2024) — Chevron warned it may not complete its planned buyout of Hess as Exxon Mobil and the China National Offshore Oil Corporation are saying the planned deal would...

(The New York Times, 27.Feb.2024) — America’s two largest energy companies, Exxon Mobil and Chevron, are jousting over a prized new source of oil in the waters off Guyana, in...

(Energy Analytics Institute, 26.Feb.2024) — Chevron Corporation believes that the $53bn merger with Hess Corporation presents the California-based energy giant with the opportunity to diversify its portfolio by acquiring Hess’ 30%...

(Bloomberg, 15.Feb.2024) — Guyana has undergone a huge transformation in the near decade since a massive oil discovery off its shores. That’s on full display at the Georgetown Marriott hotel. By sundown,...

(Hess, 31.Jan.2024) — Hess Corporation (NYSE: HES) reported net income of $413mn, or $1.34 per share, in the fourth quarter of 2023, compared with net income of $497mn, or $1.61...

(Enverus, 23.Jan.2024) — Enverus Intelligence Research (EIR), a subsidiary of Enverus, is releasing its summary of Q4 and full-year 2023 upstream merger and acquisition (M&A) activity. Q4 recorded a massive...

(WoodMac, 14.Dec.2023) — A total of 193 blocks were auctioned in Brazil’s December 13 oil and gas licensing round, 192 under concession and one under production sharing agreement, signaling strong...

(Reuters, 14.Dec.2023) — Guyana and Venezuela on Thursday agreed to avoid any use of force and to not escalate tensions in their long-running dispute over the oil-rich Esequibo area after...

(Chevron, 6.Dec.2023) — Chevron Corporation (NYSE: CVX) announced an expected organic capital expenditure range of $15.5bn to $16.5bn for consolidated subsidiaries (capex) and an affiliate capital expenditure (affiliate capex) budget...

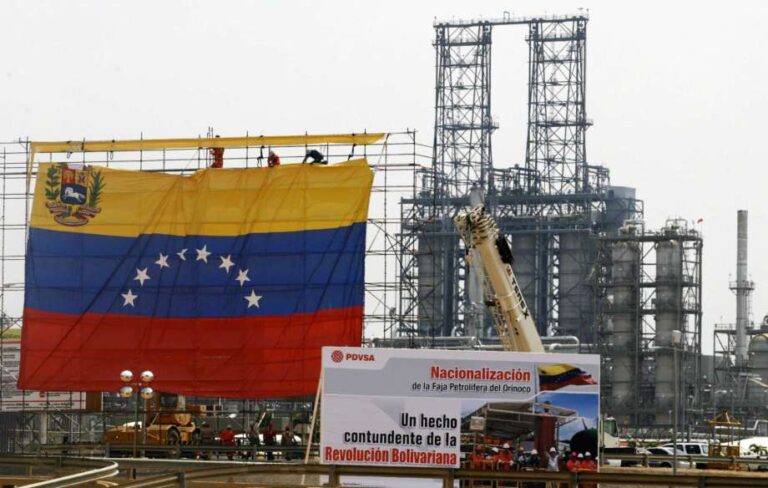

(CSIS, 29.Nov.2023) — Over the last month, the Biden administration has presided over a sea change in U.S. policy toward Venezuela. The recent lifting of sanctions on the Maduro regime is the...

(Reuters, 22.Nov.2023) — Venezuela is currently producing some 850,000 barrels per day (bpd) of oil and hopes to soon reach 1 million bpd, the country's deputy oil minister, Erick Perez,...

(Reuters, 2.Nov.2023) — Venezuela's oil exports declined in October to less than 700,000 barrels per day (bpd) amid operational hiccups at the country's main production region, in a sign any...

(S&P Global, 30.Oct.2023) — The Supreme Court of Justice (TSJ) in Venezuela ordered the suspension of the results of the opposition's primary elections which was claimed to be won by...

(Chevron, 30.Oct.2023) — Cabinda Gulf Oil Company Limited (CABGOC), a Chevron’s subsidiary in Angola, hosted in Luanda a signature of a Memorandum of Understanding (MOU) between Chevron New Energies, a...

(AFP, 27.Oct.2023) — The new find, as well as some of the drilling concessions, are in a disputed area whose possible annexation Venezuela is putting to a national referendum. Guyana, much smaller...

(WoodMac, 26.Oct.2023) — ExxonMobil’s and Chevron’s belief in the durability of upstream could hardly be better demonstrated by the game-changing acquisitions of two flagship US Independents. It’s a pivotal moment...

(Barron’s, 23.Oct.2023) — The U.S. administration’s new oil sanctions relief toward Venezuela is broad-ranging and impactful. It’s unlikely to have any immediate effect on international oil prices, but it will likely realign...

(Energy Analytics Institute, 23.Oct.2023) — US-based Chevron Corporation will acquire Hess Corporation for US$60bn (including net debt), the second giant transaction of Oct. 2023 following the $65bn move by ExxonMobil...

(EIA, 23.Oct.2023) — The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) effectively lifted most U.S. sanctions on Venezuela’s energy sector on October 18 for six months, paving the...

(Chevron, 23.Oct.2023) — Chevron Corporation (NYSE: CVX) has entered into a definitive agreement with Hess Corporation (NYSE: HES) to acquire all of the outstanding shares of Hess in an all-stock...

(Rystad, 17.Oct.2023) — A reported deal between the US and Venezuela to ease sanctions on the South American country’s oil industry could pave the way for a medium-term increase in...

(Reuters, 16.Oct.2023) — Oil futures fell on Monday on reports that the U.S. had agreed a deal to ease sanctions on Venezuela, while investors continued to mull the potential impact...

(The Washington Post, 16.Oct.2023) — The Biden administration and the government of Venezuelan President Nicolás Maduro have agreed to a deal in which the U.S. would ease sanctions on Venezuela’s...

(Reuters, 25.Sep.2023) — Chevron Corp (CVX.N) plans to add 65,000 barrels per day (bpd) of Venezuelan oil output by the end of 2024 through its first major drilling campaign in the nation...

(Chevron, 12.Sep.2023) — Chevron U.S.A. Inc., through its Chevron New Energies division, announced it has closed a transaction with Haddington Ventures to acquire 100% of Magnum Development, LLC and thus...

(Equinor, 28.Aug.2023) — Equinor has acquired a 25% interest in Bayou Bend CCS LLC, positioned to be one of the largest US carbon capture and storage projects located along the...

(Bunge, 5.Jul.2023) — Bunge (NYSE: BG) and Chevron’s Renewable Energy Group Inc., a subsidiary of Chevron Corporation (NYSE: CVX), acquired Chacraservicios S.r.l., based in Argentina, from the Italian-based Adamant Group. This latest investment in novel seeds...

(Energy Analytics Institute, 31.May.2023) — Energy briefs as well as others related to finance and politics during May 2023 including Venezuela planning to issue a license next month to Eni...

(Reuters, 25.May.2023) — Chevron (CVX.N) has launched a sale process for its oil and gas assets in Congo as the U.S. energy giant continues to focus operations on newer and more profitable...

(Chevron, 22.May.2023) — Chevron Corporation (NYSE: CVX) announced today that it has entered into a definitive agreement with PDC Energy, Inc. (NASDAQ: PDCE) to acquire all of the outstanding shares of...

(Westwood, 4.Apr.2023) — When Shell announced final investment decision (FID) on its Prelude floating liquefaction natural gas (FLNG) unit in May 2011, it was meant to be the start of...

(AP, 3.Apr.2023) — The new representative of Venezuela’s opposition in the U.S. is urging the Biden administration to relax crippling oil sanctions on Nicolas Maduro’s government or risk seeing the...

(Loop, 8.Mar.2023) — Energy Minister Stuart Young says he has had successful discussions at CERAWeek in Houston where a number of important engagements with key stakeholders in the energy industry at...

(Chevron, 28.Feb.2023) — At its annual investor meeting, Chevron Corporation (NYSE: CVX) reported on its progress to leverage its strengths to safely deliver lower carbon energy to a growing world....

(Energy Analytics Institute, 23.Feb.2023) — "Despite bumper profits, the peer group is guiding towards $118bn in total investment in 2023, up just 4% on last year. This reflects the priorities...

(Energy Analytics Institute, 9.Feb.2023) — California-based energy giant Chevron Corporation released its 2022 methane report, which it said builds on its climate change-related reporting and provides detailed information on its...

(Reuters, 30.Jan.2023) — Venezuela's state oil firm PDVSA is toughening terms for buyers after a month-long halt to most exports of crude and fuel, demanding prepayment ahead of loadings in...

(Welligence Energy Analytics, 25.Jan.2023) — The U.S. Department of the Treasury has granted a license to the government of T&T to receive gas from the multi-Tcf offshore Dragon gas field in Venezuela....

(Reuters, 24.Jan.2023) — The U.S. Treasury Department has granted a license to Trinidad and Tobago to develop a major gas field located in Venezuelan territorial waters, a senior Biden administration...

(LatAm Investor, 20.Jan.2023) — Most international investors keep clear of Argentina. It has an unenviable record of default and expropriations while successive governments seem unable to manage the country’s incredible...

(Reuters, 30.Dec.2022) — U.S. oil company Chevron Corp (CVX.N) is sending two oil tankers to Venezuela, one of which will load the first cargo of crude destined for the United States in...

(Investor’s Business Day, 29.Dec.2022) — U.S. diesel prices hit all time highs in 2022 as demand surged and supplies of the critical heating and transportation fuel tightened. However, analysts expect...

(Chevron, 7.Dec.2022) — Chevron Corporation today announced 2023 organic capital expenditure budgets of $14bn for consolidated subsidiaries (capex) and $3bn for equity affiliates (affiliate capex), which total near the high...

(Forbes, 2.Dec.2022) — A video that state-owned oil giant Petróleos de Venezuela posted to its Twitter feed this week shows a jovial meeting between Oil Minister Tarek El Aissami and...

(Reuters, 1.Dec.2022) — Chevron Corp is unlikely to add investment in Venezuela in the next six months despite a recent U.S. license to allow it to expand its operations in...

(Welligence, 1.Dec.2022) — Chevron Corporation has recently secured a license to renew limited operations within the country and source critical inputs necessary for processing crude, Welligence announced 1 December 2022...

(FT.com, 30.Nov.2022) — The ports of the US Gulf of Mexico coast will soon resume shipments that have been absent for more than three years: tankers full of Venezuela’s heavy...

(Energy Analytics Institute, 30.Nov.2022) — Energy briefs as well as others related to finance and politics during November 2022 including Brazilian oil giant Petrobras launching its strategic plan for 2023-27;...

(AFP, 30.Nov.2022) — Venezuelan President Nicolas Maduro said the easing of an oil embargo on his country by the United States was not enough, and called Wednesday for the total...

(Al Jazeera, 26.Nov.2022) — The Biden administration on Saturday eased some oil sanctions on Venezuela after the government of Nicolas Maduro and the opposition signed a broad ‘social accord’ to...

(Chevron, 17.Nov.2022) — Chevron U.S.A. Inc., a subsidiary of Chevron Corporation (NYSE: CVX), announced today it signed a definitive agreement to acquire full ownership of Beyond6, LLC (B6) and its...

(Rystad, 24.Oct.2022) — As the supply side of the oil business continues to tighten globally, calls within the US to ease sanctions on what was once one of Latin America’s...

(Chevron, 26.Sep.2022)— Chevron New Energies International Pte, Ltd., and Mitsui Oil Exploration Co., Ltd (MOECO) announced the signing of a Joint Collaboration Agreement to explore the technical and commercial feasibility...

(Chevron, 21.Sep.2022) — Air Liquide, Chevron, Keppel Infrastructure and PetroChina (1) signed a memorandum of understanding to form a consortium which will aim to evaluate and advance the development of...

(Reuters, 1.Sep.2022) — Chevron Corp has asked the U.S. government to expand its license to operate in Venezuela after the oil major agreed with state-run PDVSA to revamp joint ventures in the...

(Energy Analytics Institute, 27.Jul.2022) — Energy briefs including US Vice President Kamala Harris speaking with Guyana's President Mohamed Irfaan Ali about energy and other issues; the board of directors of...

(AP, 27.Jun.2022) — Senior U.S. government officials have quietly traveled to Caracas in the latest bid to bring home detained Americans and rebuild relations with the South American oil giant...

(Cheniere Energy, 22.Jun.2022) — Cheniere Energy, Inc. (NYSE American: LNG) announced that two of its subsidiaries, Sabine Pass Liquefaction, LLC (“SPL”) and Cheniere Marketing, LLC, have each entered into long-term...

(QatarEnergy, 8.Jun.2022) — QatarEnergy and Chevron Phillips Chemical Company (CPChem) have announced awarding the early site works contract for the Ras Laffan Petrochemical Project (RLPP), marking the commencement of execution...

![Hess Reports 4Q:23 Results, Updates on Payara [PDF Download]](https://energy-analytics-institute.org/wp-content/uploads/2023/04/guyana-fpso-prosperity-arrival-to-stabroek-source-sbm-1b-768x443.jpg)

![Chevron Drops Its 2022 Methane Report [PDF Download]](https://energy-analytics-institute.org/wp-content/uploads/2024/02/california-chevron-methane-report.png)