(GeoPark, 11.Apr.2024) — GeoPark Limited (NYSE: GPRK) has submitted a binding offer to acquire a non-operated working interest (WI) in unconventional blocks in the Neuquen Basin in Argentina. As of...

(YPF, 7.Mar.2024) — YPF SA reported total hydrocarbon production averaged 514 Kboe/d in 2023 (+2% vs. 2022) and 511 Kboe/d in 4Q23 (-2% q/q but +2% y/y), mainly boosted by...

(Energy Analytics Institute, 4.Dec.2023) — Argentina’s Vaca Muerta shale formation contains an estimated 308 trillion cubic feet (Tcf) of recoverable shale resources and is important for continued economic development of...

(Reuters, 9.Jul.2023) — Argentina inaugurated on Sunday the first stage of a gas pipeline that will carry natural gas from the Vaca Muerta formation in western Argentina to Santa Fe...

(Rystad Energy, 31.May.2023) — Crude oil production from Argentina’s burgeoning shale patch, Vaca Muerta, could surge in the coming years and top 1 million barrels per day (bpd) by the...

(Reuters, 24.May.2023) — The Argentine government has asked oil companies to finance their own imports for 90 days due to the shortage of foreign currency at the country's central bank,...

(Reuters, 8.May.2023) — Chilean state oil company National Petroleum Company (ENAP) said on Monday it has signed a temporary agreement with Argentine oil firm YPF (YPFD.BA) to import crude through the Trasandino...

(LatAm Investor, 20.Jan.2023) — Most international investors keep clear of Argentina. It has an unenviable record of default and expropriations while successive governments seem unable to manage the country’s incredible...

(IAPG, 27.Sep.2022) — Since its first wells more than ten years ago, Argentina’s Vaca Muerta has come a long way to become the most relevant shale play outside North America....

(Reuters, 6.Sep.2022) — Argentina is on track to hit record oil output this year from its massive shale deposits, which are already responsible for record natural gas production, a key...

(Energy Analytics Institute, 22.Jul.2022) — Energy briefs including Argentina’s state-owned oil and gas producer YPF reporting combined production of 504,000 boe/d in the 2Q:22. LATIN AMERICA AND THE CARIBBEAN Argentina...

(Reuters, 17.Jun.2022) — Argentine state company Energia Argentina signed a contract June 16 with pipeline producer Tenaris, a critical step toward completing a pipeline to transfer natural gas from Argentina's giant Vaca Muerta shale formation. The government says the pipeline...

(FT, 2.Jun.2022) — Can the EU’s ban this week on most Russian oil imports breathe new life into a dead cow in Patagonia? Argentina’s president Alberto Fernández thinks so. He...

(Reuters, 27.Apr.2022) — Argentina, battling a deep and costly energy deficit, is looking to attract some $10 billion in private investment to help it jump start exports of liquefied natural...

(Reuters, 11.Apr.2022) — Argentina's largest oil union called on the industry to restore jobs lost during the COVID-19 pandemic following a significant increase in production, the union's leader told Reuters....

(Energy Analytics Institute, 30.Mar.2022) — Gazprom expressed interest in supplying liquefied natural gas (LNG) to Argentina to replace market share lost due to sanctions imposed by the US and Europe...

(Energy Analytics Institute, 21.Feb.2022) — Crude oil and natural gas production from Argentina’s Neuquén Province grow in January 2022 owing to development of unconventional projects approved by the provincial government,...

(Offshore Technology, 18.Jan.2022) — Wintershall Dea Argentina has agreed to sell a 50% operated working stake in the unconventional Aguada Federal and Bandurria Norte blocks, in Argentina, to Vista Oil and Gas...

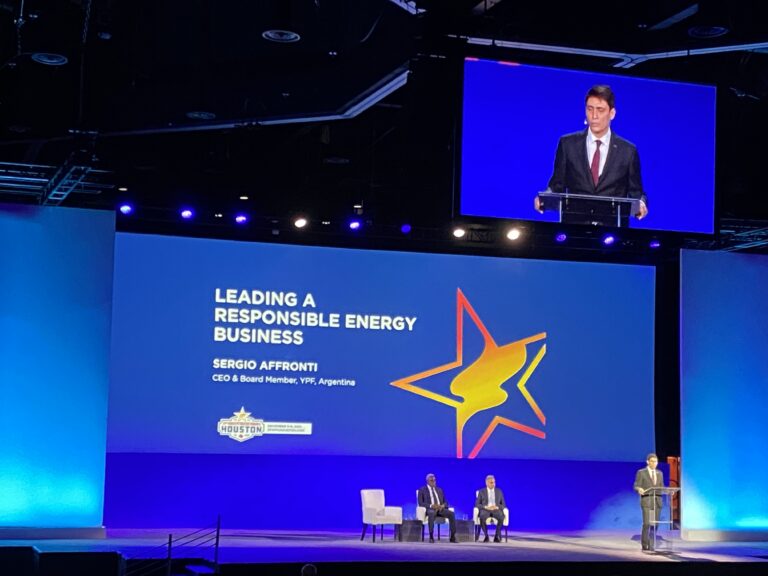

(Energy Analytics Institute, 8.Dec.2021) — YPF’s CEO Sergio Affronti said the state oil producer was looking at “unlocking the Vaca Muerta’s full shale gas potential,” during the 23rd World Petroleum...

(S&P Global, 10.Nov.2021) — YPF, the biggest oil producer in Argentina, expects to post higher-than-expected oil production growth this year as it steps up drilling in the Vaca Muerta shale...

(Energy Analytics Institute, 11.Oct.2021) — Energy briefs including Argentina looking to send Vaca Muerta gas to Brazil; US-based Talos Energy setting date for 3Q:21 conf. call; and more. LATIN AMERICA...

(Rystad, 29.Sep.2021) — Argentina’s Vaca Muerta shale play, having registered strong growth in oil and gas production and well activity levels in recent months, has emerged as the world’s fastest...

(Energy Analytics Institute, 1.Sep.2021) — Venezuela, home to the world’s largest oil reserves, still has an opportunity to capitalize on producing oil amid the energy transition, Ali Moshiri, head of...

(Energy Analytics Institute, 21.Aug.2021) — Energy briefs from the Latin America and Caribbean region including: Argentina pondering its allocation of energy subsidies, Ecopetrol closing on an earlier announced $3.7bn ISA...

(Reuters, 19.Aug.2021) — Brazil is negotiating with Argentina on the construction of a billion-dollar pipeline from the Vaca Muerta shale gas reserves, Brazilian President Jair Bolsonaro said on Thursday. Speaking...

(Baker Institute, 17.Aug.2021) — Shale oil’s short-cycle production protects foreign investors from the risk of expropriation — government taking private property for public use — providing an opportunity for the...

(Vista Oil, 28.Jun.2021) — Vista Oil & Gas, S.A.B. de C.V. (NYSE: VIST; BMV: VISTA) announced that its wholly-owned subsidiary Vista Oil & Gas Argentina S.A.U. established an un-incorporated joint...

(Argus, 28.Apr.2021) — Protesters in Argentina have lifted roadblocks that had crippled shale oil and gas activity and thwarted fuel distribution for almost three weeks. Healthcare workers started blocking roads...

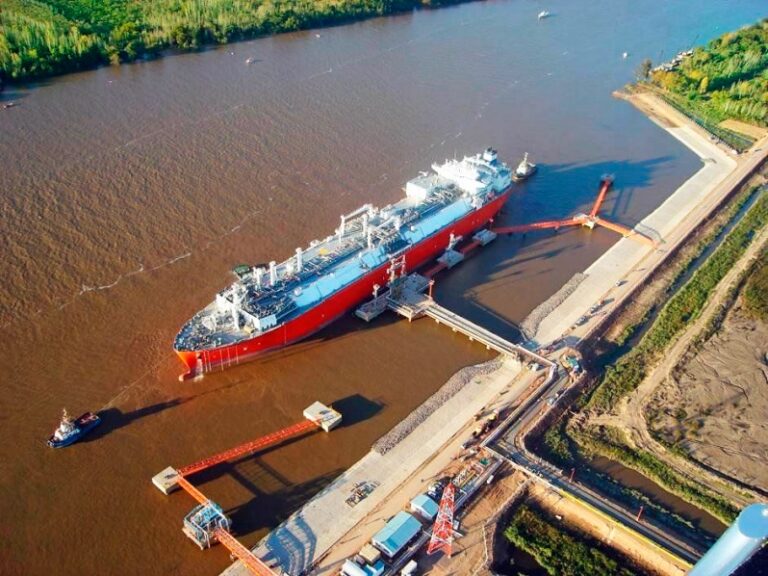

(Natural Gas Intelligence, 26.Apr.2021) — Argentina has commissioned a second floating storage and regasification unit (FSRU) to meet higher-than-expected natural gas demand this upcoming winter in the Southern Hemisphere. The...

(Argus, 21.Apr.2021) — Argentina's shale oil and gas production is starting to decline and fuel shortages are worsening because of prolonged roadblocks by healthcare workers in Argentina's southwestern province of...

(Energy Analytics Institute, 20.Apr.2021) — Oil and gas production from Argentina’s prolific Vaca Muerta formation have been impacted by nearly two weeks of protests and road blockages by health care...

(S&P Global, 15.Apr.2021) — Argentina's government is making advances on drafting a bill to provide incentives for ramping up the country's oil and natural gas production and exports, while more...

(Energy Analytics Institute, 14.Apr.2021) — Energy briefs from the Latin America and Caribbean region including: Argentina’s Labor Ministry issuing a mandatory conciliation between oil workers and companies, companies in Argentina...

(S&P Global, 14.Apr.2021) — Pampa Energia, the fifth-biggest natural gas producer in Argentina, is taking its first steps to produce oil from the Vaca Muerta shale play while also stepping...

(S&P Global, 12.Apr.2021) — Argentina's oil and natural gas output could begin to fall in the next few days if protesting health workers and truckers continue to block access to...

(Shell, 1.Apr.2021) — Shell provided details in its 2020 annual report related to its operations in South America from Argentina, Brazil and Bolivia. What follows is a summary from the...

(Energy Analytics Institute, 1.Apr.2021) — Energy briefs from the Latin America and Caribbean region including: halting the slide a Point Lisas in Trinidad and YPF inaugurating a new petrol station...

(Energy Analytics Institute, 31.Mar.2021) — Energy briefs from the Latin America and Caribbean region including: Argentine oil workers threaten to strike in Vaca Muerta over wages, and Argentine oil union...

(Energy Analytics Institute, 22.Mar.2021) — Argentina’s Neuquén province produced 178,349 barrels per day of oil in February 2021, up 3.22% sequentially and up 6.91% compared to February 2020. Approximately 80%...

(Argus, 16.Mar.2021) — YPF, the biggest oil producer in Argentina, said March 16 that it hiked diesel and gasoline pump prices by 7%, helping to finance a $2.7 billion investment...

(Bloomberg, 10.Mar.2021) — President Alberto Fernandez took to a makeshift stage in Argentina’s Vaca Muerta shale deposit in October to announce the nation was doubling down on fossil fuels. “Today...

(Bloomberg, 18.Feb.2021) — YPF SA, Argentina’s state-run oil company, needs to come up with more than $1 billion to spur drilling in Patagonia, where it’s leading development of the biggest...

(Reuters, 8.Feb.2021) — Argentine state energy giant YPF made a last-ditch improvement to its $6.2 billion debt restructuring offer to creditors late on Sunday and extended the deadline after the...

(Rystad, 3.Feb.2021) — The oil production decline that the Covid-19 pandemic brought to Argentina’s Vaca Muerta formation now seems like a distant memory. The reserve’s oil output has not only...

(S&P Global Platts, 1.Feb.2021) — A federal judge in Argentina has lifted a more than three-month suspension of the country's only floating storage and regasification unit (FSRU) after the government...

(Bloomberg, 26.Jan.2021) — Bonds of Argentine oil producer YPF SA climbed to a three-week high after the company improved a $6 billion restructuring offer. Stocks also jumped. YPF’s $540 million...

(Bloomberg, 19.Jan.2021) — In the 99 years since it was founded to pump the oil fields of Patagonia, Argentine energy driller YPF SA has been whipsawed by countless booms and busts. If...

(Argus, 3.Dec.2020) — Argentina received bids from 16 companies in a path-breaking auction to supply more than 70mn m3/d of natural gas at subsidized wellhead prices for power generation in...

(Energy Analytics Institute, 11.Nov.2020) — Argentina’s state-controlled YPF announced operating and financial results for the third quarter of 2020. What follows is a summary of key data. MAIN HIGHLIGHTS OF...

(Energy Analytics Institute, 22.Oct.2020) — Argentina’s Neuquén Province Governor Omar Gutiérrez said joint work by companies and workers will allow the region to achieve a growth path that will allow...

(Energy Analytics Institute, 15.Oct.2020) — Argentina’s President Alberto Fernández announced details of the country’s Gas Plan 4 during a visit to the Vaca Muerta formation. The gas plan aims to...

(Energy Analytics Institute, 3.Oct.2020) — Argentina’s Neuquén Ministry of Energy data reveal 11 drilling rigs have been reactivated in the province, and all targeting the Vaca Muerta formation. Of the...

(Oilprice.com, 19.Sep.2020) — Much ink has been spilled about the downfall and dubious recovery of the United States shale oil sector. The West Texas Intermediate (WTI) crude benchmark’s dramatic rock...

(Oilprice.com, 6.Sep.2020) — Latin America has a long history of resource nationalism, particularly when it comes to petroleum. Since the end of World War Two, this has acted as a...

(Argus, 4.Sep.2020) — Argentina's state-controlled YPF will resume drilling activity in the country's Vaca Muerta shale formation after an almost six-month pause resulting from pandemic restrictions. YPF will begin operating...

(S&P Global Platts, 28.Aug.2020) — Argentina's new energy secretary Dario Martinez plans to promote oil and natural gas production with a view to increasing exports as part of a strategy...

(Argus, 25.Aug.2020) — Argentina's Vaca Muerta shale patch will take 12-18 months to resume pre-Covid-19 activity because of lagging demand, according to Alejandro Monteiro, energy minister of Neuquen province. "We...

(Zacks Equity Research, 19.Aug.2020) — Exxon Mobil Corporation was recently granted concession by the Neuquen provincial government for exploratory activities in another block, Los Toldos II Oeste, in the prolific...

(Argus, 14.Aug.2020) — ExxonMobil has been awarded a 35-year concession for another block in Vaca Muerta, a massive shale play that has been driving the company's growth in oil and...

(Energy Analytics Institute, 4.Aug.2020) — Shell Argentina President Sean Rooney discussed his company’s operations in Argentina amid the Covid-19 pandemic, including commenting on continued and future development of the Vaca...

(FT.com, 19.Jul.2020) —Alberto Fernández, Argentina’s president, has made an impassioned appeal for the world to accept that — with an economy devastated by coronavirus — he cannot budge from his...

(Energy Analytics Institute, 15.Jul.2020) — The Vaca Muerta gas pipeline, one of the most ambitious projects of the government of Argentina’s former President Mauricio Macri, was suspended indefinitely by Energy...

(Oilprice.com, 6.Jul.2020) — Throughout the 2010s Argentina’s shale deposits were universally listed alongside the US shale gale, denoting the many similarities Vaca Muerta shares with Eagle Ford in particular and...

(GlobalData, 29.Jun.2020) — Adrian Lara, Senior Oil & Gas Analyst at GlobalData, commented on announcements from Argentina’s government to implement a new plan for subsidizing oil and gas production in...

(S&P Global Platts, 26.Jun.2020) — Argentina has extended a 99-day-old economic lockdown for three more weeks to try to contain a surge in coronavirus cases, including by tightening restrictions on...

(Reuters, 26.Jun.2020) — Belgian shipping company Exmar has said that it had received a force majeure notice from Argentine oil company YPF SA under charter and services deals for the...

(WoodMac, 24.Jun.2920) — Gas pricing and market regulation are again under discussion in Argentina. The coronavirus pandemic has weakened an already vulnerable economy, with the impact felt in the gas...

(Reuters, 7.Jun.2020) — Oil company Royal Dutch Shell Plc said it has suspended operations at its Bajada de Añelo site in Argentina’s Vaca Muerta area after seismic activity in the...

(Reuters, 19.May.2020) — Argentina's government set the local crude oil reference price at $45 per barrel on Tuesday in a bid to protect the country's hard-hit sector from the impact...

(S&P Global Platts, 18.May.2020) — Argentina's move to set a $45/b domestic crude oil reference price this week has brought cheer to some oil producers, but analysts say it may...

(IHS, 12.May.2020) — The year 2020 has been filled with surprises as the COVID-19 pandemic spreads worldwide, leaving many homebound, resulting in a negative impact for many industries and ultimately...

(Bloomberg, 7.May.2020) — West Texas Intermediate has been gaining since its history-making crash in the U.S. last month, trading at around $25. Brent crude has been practically soaring, touching $30...

(Upstream, 1.May.2020) — Argentine oil company YPF has appointed industry veteran Sergio Affronti as chief executive, replacing Daniel Gonzalez, amid headwinds from the coronavirus pandemic and the collapse in oil...

(TGS, 29.Apr.2020) — Transportadora de Gas del Sur S.A. today it filed its annual report on Form 20-F for the fiscal year ended December 31, 2019 (the "2019 Annual Report")...

(Reuters, 23.Apr.2020) — Argentina plans to issue a decree setting a higher local oil barrel price to protect the domestic industry from being further decimated by a collapse in global...

![Argentina’s Vaca Muerta Formation: Fact Box [Videos]](https://energy-analytics-institute.org/wp-content/uploads/2019/11/vaca-muerta-nov-768x432.jpg)

![NRGBriefs: YPF Produces 504,000 boe/d in 2Q:22 [PDF Downloads]](https://energy-analytics-institute.org/wp-content/uploads/2022/08/argentina-2q22-source-ypf-768x206.jpg)