(Reuters, 8.Jul.2024) — Exxon Mobil said on Monday lower natural gas prices and refining margins are expected to hit the oil major's second-quarter earnings. The oil major would be reporting its...

(ExxonMobil, 7.Jul.2024) — As we prepare for severe weather that may impact our Gulf of Mexico operations, our primary focus is the safety of our workforce and communities in the...

(ExxonMobil, 25.Jun.2024) — ExxonMobil signed a non-binding memorandum of understanding (MOU) with SK On, a global leading electric vehicle (EV) battery developer, that opens the door to secure a multiyear offtake...

(ExxonMobil, 24.Jun.2024) — ExxonMobil and Air Liquide announced an agreement to support the production of low-carbon hydrogen and low-carbon ammonia at ExxonMobil’s Baytown, Texas facility. The agreement will enable transportation of...

(Exxon, 20.Jun.2024) — The impressive field of Porsche 911 GT3 Cup racers competing in the Porsche Carrera Cup North America championship are now fueled by ExxonMobil’s Synergy Supreme+ premium gasoline –...

(Reuters, 20.Jun.2024) — A contract arbitration panel that could block or green-light the $53 billion sale of Hess Corp to Chevron remains incomplete three months after the case was filed, stalling a decision...

(Reuters, 20.Jun.2024) — U.S. firm Fulcrum LNG was selected to help Guyana develop a plan to design, finance, construct and operate a natural gas processing facility in the South American...

(Technip, 6.Jun.2024) — Technip Energies (PARIS:TE), in consortium with Turner Industries, has been awarded the Engineering, Procurement, and Construction (EPC) contract by ExxonMobil Low Carbon Solutions Onshore Storage LLC. Technip...

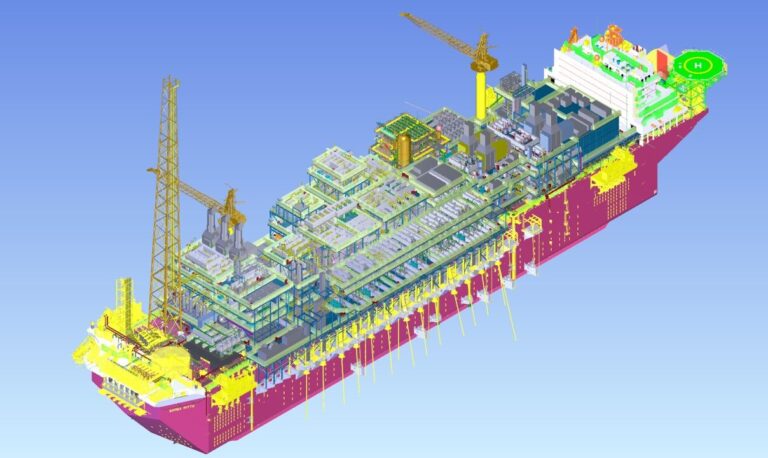

(Go Integrated Group, 26.May.2024) — MODEC recently announced that the keel laying for the FPSO Errea Wittu hull has been completed five weeks ahead of schedule. This is an important...

(Bloomberg, 22.May.2024) — John Hess, the boss of the oil company that bears his family name, is talking to directly with shareholders in a last-ditch effort to ensure enough support...

(Zachary, 21.May.2024) — Zachry Holdings, Inc. (ZHI) announced that ZHI and certain of its subsidiaries have initiated a voluntary court-supervised Chapter 11 process that provides them with time and flexibility...

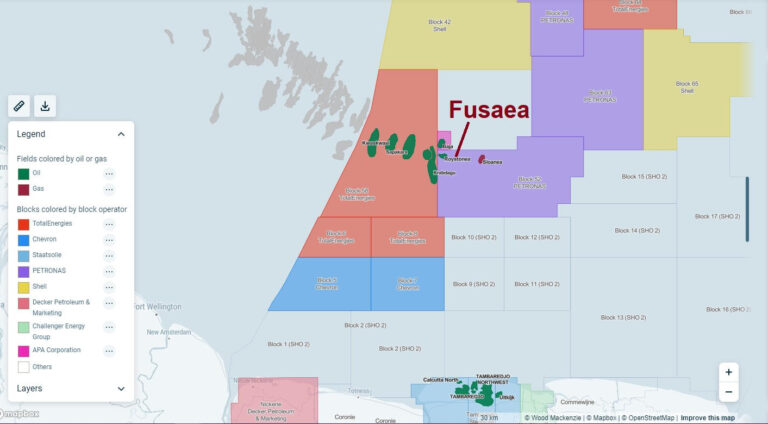

(Petronas, 16.May.2024) — Addressing the recent deepwater discovery by Petronas in Suriname, Mark Oberstoetter, Head of Americas (non-L48) Upstream, said “We understand Roystonea and Fusaea's recoverable resources are approaching 400...

(Petronas, 16.May.2024) — Petronas Suriname E&P B.V., a subsidiary of Petronas, has made a third hydrocarbon discovery in Block 52 at the Fusaea-1 exploration well in Suriname’s Block 52, located...

(Exxon, 26.Apr.2024) — Exxon Mobil Corporation announced first-quarter 2024 earnings of $8.2bn, or $2.06 per share assuming dilution. Capital and exploration expenditures were $5.8bn, consistent with the company's full-year guidance...

(Hess, 25.Apr.2024) — Hess Corporation reported that is net Guyana production was 190,000 b/d in the first quarter of 2024, up 70% from 112,000 b/d in the first quarter of...

(SBM, 12.Apr.2024) — SBM Offshore announced that ExxonMobil Guyana Limited (EMGL) has confirmed the award of contracts for the Whiptail development project located in the Stabroek Block in Guyana. Under...

(ExxonMobil, 12.Apr.2024) — ExxonMobil has made a final investment decision for the Whiptail development offshore Guyana, after receiving the required government and regulatory approvals. Whiptail, the sixth project on the...

(Hess, 7.Mar.2024) — Today, ExxonMobil announced that it is filing for arbitration regarding the applicability of a right of first refusal (ROFR) / pre-emption provision in the Stabroek joint operating agreement....

(Reuters, 6.Mar.2024) — Exxon Mobil Corp on Wednesday said it filed a contract arbitration claim related to Hess Corp's proposed sale of its Guyana oil properties, and suggested it may counter...

(Energy Analytics Institute, 29.Feb.2024) — Energy briefs as well as others related to finance and projects during Feb. 2024 including Exxon Mobil and CNOOC considering their pre-emption rights to Hess...

(Reuters, 28.Feb.2024) — Exxon Mobil's surprise challenge to Chevron's acquisition of Hess through a dispute over a stake in a major Guyana oil field could prove fruitful for the U.S....

(MarketWatch, 27.Feb.2024) — Chevron warned it may not complete its planned buyout of Hess as Exxon Mobil and the China National Offshore Oil Corporation are saying the planned deal would...

(The New York Times, 27.Feb.2024) — America’s two largest energy companies, Exxon Mobil and Chevron, are jousting over a prized new source of oil in the waters off Guyana, in...

(Energy Analytics Institute, 26.Feb.2024) — Chevron Corporation believes that the $53bn merger with Hess Corporation presents the California-based energy giant with the opportunity to diversify its portfolio by acquiring Hess’ 30%...

(Reuters, 20.Feb.2024) — Guyana will delay until 2025 its biggest effort to capitalize on its energy bounty, a $1.9 billion gas-to-power project that was to start this year, using untapped...

(Energy Analytics Institute, 15.Feb.2024) — Modec's profits increased significantly due to good progress in the construction work of new EPCI projects and improved asset integrity of old Brazil FPSO vessels, the...

DeepOcean, 14.Feb.2024) — Ocean services provider DeepOcean has been awarded a contract by ExxonMobil Guyana for the provision of subsea construction and IMR (inspection, maintenance, and repair) services offshore Guyana,...

(AP, 7.Feb.2024) — ExxonMobil said it plans to explore for oil and gas in a disputed area off South America’s coast where the Venezuelan military had previously expelled two U.S....

(Exxon, 2.Feb.2024) — Exxon Mobil Corporation announced fourth-quarter 2023 earnings of $7.6bn, or $1.91 per share assuming dilution. Fourth-quarter results included unfavorable identified items of $2.3bn including a $2bn impairment...

(Enverus, 23.Jan.2024) — Enverus Intelligence Research (EIR), a subsidiary of Enverus, is releasing its summary of Q4 and full-year 2023 upstream merger and acquisition (M&A) activity. Q4 recorded a massive...

(Reuters, 23.Jan.2024) — BP expects the Calypso deepwater natural gas field off Trinidad and Tobago, which it shares with Woodside Energy to get the greenlight when a final investment decision (FID) is...

(Reuters, 22.Jan.2024) — Exxon Mobil (XOM.N), opens new tab is trying to banish a climate activist proposal in a Texas court. The $385 billion oil giant would be better off leaving its own...

(Reuters, 16.Jan.2024) — Mexico Pacific said on Tuesday it had reached a deal to supply Exxon Mobil with an additional 1.2 million tonnes per annum of liquefied natural gas, clearing...

(Mexico Pacific, 16.Jan.2024) — Mexico Pacific signed a third long-term Sales and Purchase Agreement (SPA) with ExxonMobil LNG Asia Pacific (EMLAP) for an additional 1.2 million tonnes per annum (MTPA)...

(WoodMac, 10.Jan.2024) — Geopolitical tensions, a record year for elections and economic uncertainty will define the backdrop to the upstream industry in 2024. Wood Mackenzie recently released its What to Look...

(Energy Analytics Institute, 31.Dec.2023) — Energy briefs as well as others related to finance and projects during Dec. 2023 including why Venezuela wants to annex the Essequibo; Petrobras acquiring 29...

(Reuters, 14.Dec.2023) — Guyana and Venezuela on Thursday agreed to avoid any use of force and to not escalate tensions in their long-running dispute over the oil-rich Esequibo area after...

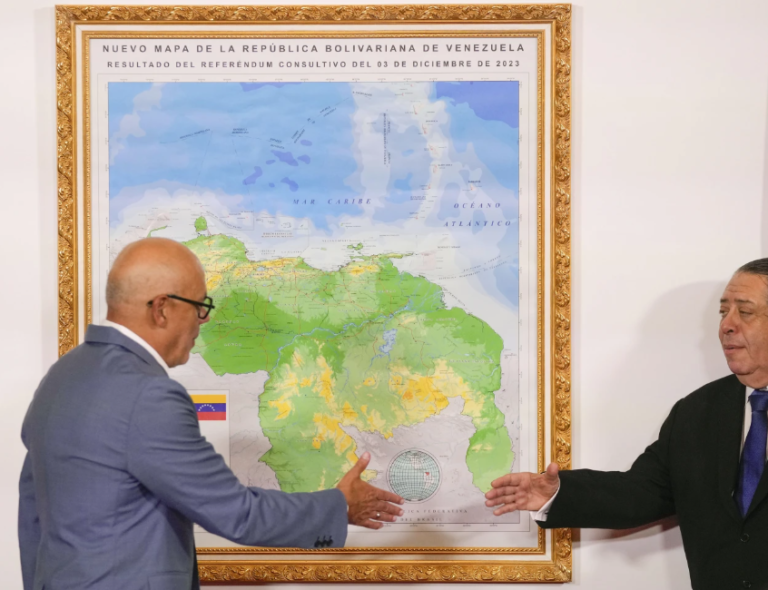

(AP, 9.Dec.2023) — A century-old territorial dispute deepened by the discovery of oil is boiling over between neighbors Guyana and Venezuela. Steeped in patriotism, the Venezuelan government is seizing on the fight...

(Reuters, 6.Dec.2023) — Venezuela's attorney general on Wednesday said there are arrest warrants for three people involved in the campaign of opposition presidential nominee Maria Corina Machado, for crimes including...

(ExxonMobil, 6.Dec.2023) — ExxonMobil gave an update to its Corporate Plan through 2027, reflecting continued execution of its strategy to provide the products society needs and to lower emissions, both its own...

(CNBC, 4.Dec.2023) — Venezuelans on Sunday voted to claim sovereignty over a large swathe of their oil-rich neighbor Guyana, marking the latest escalation in a long-standing territorial dispute between the...

(SBM Offshore, 14.Nov.2023) — SBM Offshore announce that FPSO Prosperity has produced first oil as of 14 Nov. 2023 and is formally on hire. The FPSO Prosperity utilizes a design that largely replicates the...

(Exxon Mobil, 14.Nov.2023) — ExxonMobil started production today at Payara, Guyana’s third offshore oil development on the Stabroek Block, bringing total production capacity in Guyana to approximately 620,000 barrels per...

(Exxon Mobil, 13.Nov.2023) — Making a global impact on climate change isn’t easy. Reducing emissions on a global scale requires multiple solutions, and we believe biofuels can play a big...

(Exxon Mobil, 13.Nov.2023) — Exxon Mobil Corporation (NYSE: XOM) announced plans to become a leading producer of lithium, a key component of electric vehicle (EV) batteries. Work has begun for...

(ExxonMobil, 2.Nov.2023) — Exxon Mobil Corporation (NYSE: XOM) has closed its acquisition of Denbury Inc. (NYSE: DEN) in an all-stock transaction valued at $4.9bn, or $89.45 per share, based on...

(AFP, 27.Oct.2023) — The new find, as well as some of the drilling concessions, are in a disputed area whose possible annexation Venezuela is putting to a national referendum. Guyana, much smaller...

(ExxonMobil, 27.Oct.2023) — Exxon Mobil Corporation announced third-quarter 2023 earnings of $9.1bn, or $2.25 per share assuming dilution. Cash flow from operations was $16bn, up $6.6bn versus the second quarter....

(WoodMac, 26.Oct.2023) — ExxonMobil’s and Chevron’s belief in the durability of upstream could hardly be better demonstrated by the game-changing acquisitions of two flagship US Independents. It’s a pivotal moment...

(Energy Analytics Institute, 23.Oct.2023) — US-based Chevron Corporation will acquire Hess Corporation for US$60bn (including net debt), the second giant transaction of Oct. 2023 following the $65bn move by ExxonMobil...

(WoodMac, 12.Oct.2023) — Addressing ExxonMobil’s purchase of Pioneer Natural Resources, Tom Ellacott, senior vice president of Corporate Research for Wood Mackenzie said, “We predicted several years ago that Big Oil...

(ExxonMobil, 11.Oct.2023) — ExxonMobil Corporation (NYSE: XOM) and Pioneer Natural Resources (NYSE: PXD) jointly announced a definitive agreement for ExxonMobil to acquire Pioneer. The merger is an all-stock transaction valued at...

(Reuters, 8.Oct.2023) — The head of Exxon Mobil's shale oil and gas business, a unit involved in merger talks with rival Pioneer Natural Resources, was arrested at a Texas hotel last week...

(Energy Analytics Institute, 30.Sep.2023) — Energy briefs as well as others related to finance and projects during Sep. 2023 including Petrobras saying that in regards the process of divestment of...

(Reuters, 28.Sep.2023) — U.S. oil producers Exxon Mobil (XOM.N) and Hess Corp (HES.N) have withdrawn from exploring the Kaieteur block in Guyana’s deepwaters, Exxon said on Thursday, after disappointing exploration results. The exit comes...

(Reuters, 13.Sep.2023) — Guyana has received offers for eight of 14 offshore oil and gas blocks in a bidding round, including from consortiums of oil majors like Exxon Mobil, Hess...

(Energy Analytics Institute, 31.Aug.2023) — Energy briefs as well as others related to finance and projects during August 2023 including Petrobras commenting on divestment process related to the LUBNOR refinery;...

(Reuters, 23.Aug.2023) — Guyana has gained a larger share of Europe's oil market this year, vessel monitoring data showed, driven by rising output by a consortium led by Exxon Mobil (XOM.N) and strong...

(Reuters, 21.Aug.2023) — Exxon Mobil Corp (XOM.N) and partners plan to spend $12.93 billion to develop their sixth offshore oil project in Guyana, according to a filing published on Monday by the...

(USA Today, 17.Aug.2023) — The transnational Exxon Mobil, along with 19 other creditors, registered their claims against Venezuela before a court in the United States, as part of the actions...

(Reuters, 26.Jun.2023) — Nascent oil producer Guyana is not interested in joining the Organization of the Petroleum Exporting Countries (OPEC), Guyanese Vice-President Bharrat Jagdeo said on Monday, as the South American country...

(Reuters, 16.Jun.2023) — Guyana will postpone by about one month its first offshore oil blocks auction as the country finalizes new terms of the country's oil and gas regulatory framework, Vice President...

(Nucor, 1.Jun.2023) — Nucor Corporation (NYSE: NUE) signed an agreement with ExxonMobil to capture, transport, and store carbon from the company's direct reduced iron (DRI) plant in Convent, Louisiana. ExxonMobil will capture...

(MODEC, 8.May.2023) — MODEC, Inc. will proceed with engineering, procurement, and construction on the Uaru Floating Production, Storage, and Offloading (FPSO) vessel following a final investment decision on the Uaru project by...

(SBM, 2.May.2023) — SBM Offshore has signed a 10-year Operations and Maintenance Enabling Agreement with Esso Exploration & Production Guyana Ltd (aka “ExxonMobil Guyana”) for the Operations and Maintenance of...

(Reuters, 1.May.2023) — Exxon Mobil Corp (XOM.N) is not giving up on oil exploration in Brazil, the company's country chief Alberto Ferrin said on Monday during the Offshore Technology Conference (OTC) in...

(ExxonMobil, 27.Apr.2023) — ExxonMobil made a final investment decision for the Uaru development offshore Guyana after receiving required government and regulatory approvals. The company expects Uaru, the fifth project on...

(Sintana Energy, 18.Apr.2023) — Sintana Energy Inc. (TSXV: SEI OTCQB: SEUSF) reports that ExxonMobil sent Patriot Energy Oil and Gas Inc., a subsidiary of the company, a notice stating that,...

(Energy Analytics Institute, 23.Feb.2023) — "Despite bumper profits, the peer group is guiding towards $118bn in total investment in 2023, up just 4% on last year. This reflects the priorities...

(Reuters, 7.Feb.2023) — Mexico Pacific said that a unit of Exxon Mobil Corp had agreed to buy liquefied natural gas from the Mexican company's proposed Saguaro Energia LNG export plant...

(Energy Analytics Institute, 31.Jan.2023) — Energy briefs as well as others related to finance and politics during January 2023 including Trinidad and Tobago Prime Minister Dr. Hon. Keith Rowley said...

(ExxonMobil, 30.Jan.2023) — ExxonMobil announced the next step in the development of the world’s largest low-carbon hydrogen production facility with a contract award for front-end engineering and design (FEED). A...

(Exxon, 11.Jan.2023) — ExxonMobil has reached an agreement with Bangchak Corporation to sell its interest in Esso Thailand that includes the Sriracha Refinery, select distribution terminals, and a network of...

(Foreign Policy, 16.Dec.2022) — Most South American economies have grown sluggishly this year. But Guyana has been an outlier—both in the region and the world at large. The small country...

(Saipem, 15.Dec.2022) — Saipem has been awarded new contracts in Guyana and Egypt for a total amount of approximately $1.2bn. In Latin America: Guyana The first contract has been awarded by...