(TotalEnergies, 18.Sep.2023) — Following the devastating floods in Libya last week, TotalEnergies answered Libya's National Oil Corporation's call for support from the very first hours of the tragedy. The Company...

(TotalEnergies, 9.Jun.2023) — TotalEnergies confirms its commitment to the energy transition in Kazakhstan with the signature of a Power Purchase Agreement (PPA) for the Mirny project. This will be the first PPA...

(TotalEnergies, 20.Jan.2023) — In line with its growth strategy in gas and LNG, a fuel contributing to the energy transition, TotalEnergies announces the start of gas production from onshore Block...

(Oman LNG, 27.Dec.2022) — Oman LNG announced today the signing of binding sheet agreements with three (3) Japanese firms for the delivery of LNG, starting in 2025. ITOCHU Corporation, JERA...

(TotalEnergies, 31.Mar.2022) — TotalEnergies and Sempra are expanding their North American strategic alliance with the signing of two Memorandums of Understanding (MoU): one for the Vista Pacífico LNG export project in Mexico...

(Energy Analytics Institute, 28.Dec.2021) — Argentina’s Energy Secretariat authorized six companies -- YPF, Total, PAE, Vista, Pampa and Tecpetrol -- to carryout gas exports from the Neuquén basin to Chile...

(S&P Global, 19.Aug.2021) — The presidents of Guyana and Suriname said Aug. 19 their countries will craft a joint strategy to develop their natural gas reserves to fuel their economic...

(S&P Global, 29.Jun.2021) — In the second half of the year, Venezuela's state-owned PDVSA will restart the drilling of oil wells while intensifying work to open 3,700 shuttered wells and...

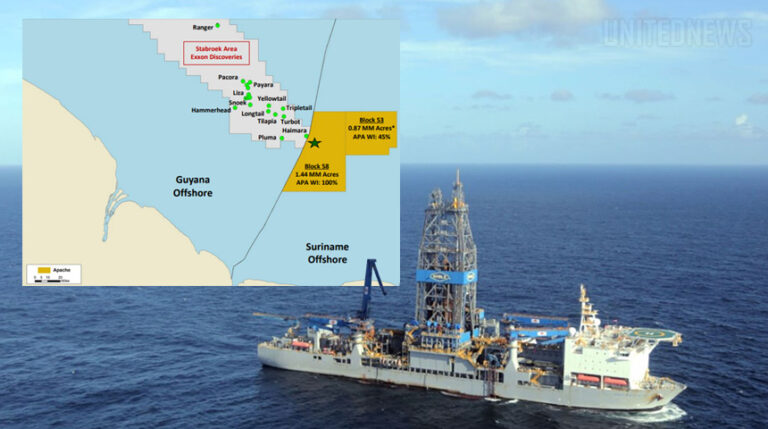

(Westmount Energy, 7.June.2021) — Westmount Energy Limited (UK AIM: WTE.L, USA OTCQB: WMELF) noted the announcement by the Maritime Administration Department, Guyana, that the Stena Carron drillship will re-commence exploration...

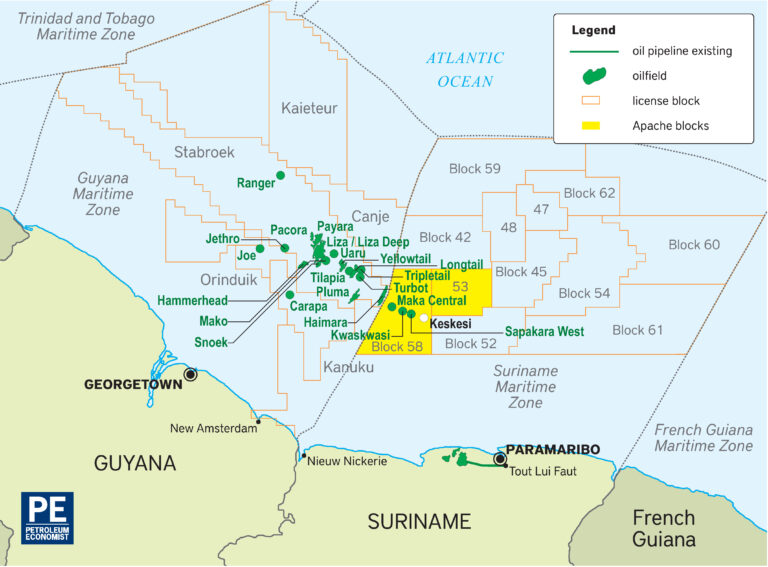

(Energy Analytics Institute, 1.Jun.2021) — Select highlights from 1 June 2021 from the Suriname Energy, Oil and Gas Summit or SEOGS2021, and speakers from President Chandrikapersad Santokhi to Staatsolie CEO...

(Total, 1.Jun.2021) — Total’s Ordinary and Extraordinary Meeting of Shareholders decided on 28 May 2021 to change the company’s name to TotalEnergies SE. The name and ticker symbol of TotalEnergies...

(Total, 6.May.2021) — Total (Paris: FP) (LSE: TTA) (NYSE: TOT), operator of Block 17 in Angola, together with the Angolan National Oil, Gas and Biofuels Agency, announce the start of...

(Total, 5.May.2021) — A meeting took place on 3rd of May between Patrick Pouyanné, Chairman and CEO of Total, and a Delegation of Papua New Guinea (PNG) led by the...

(Total, 13.Apr.2021) — Total and Siemens Energy signed a Technical Collaboration Agreement to study sustainable solutions for CO2 emissions reduction. The collaboration will focus on natural gas liquefaction facilities and...

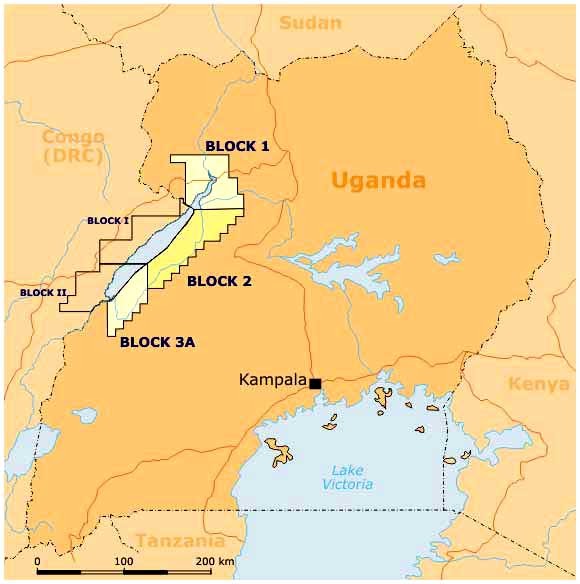

(Reuters, 12.Apr.2021) — French major Total said on Monday and its partners have concluded final agreements to launch the Lake Albert resources development project in Uganda and Tanzania. Total and...

(Energy Advance, 12.Apr.2021) — The Suriname Energy, Oil & Gas Summit (SEOGS) will be hosted virtually from 1-3 June 2021. The inaugural SEOGS hosted by Staatsolie is the official event for Suriname’s nascent hydrocarbons sector...

(JHI, 16.Mar.2021) — Bulletwood-1, the first well in the Canje Block, was safely drilled in 2,846 meters (9,337 ft) of water by the Stena Carron drillship to its planned target...

(Argus, 10.Mar.2021) — Total and Apache Corp. will continue their oil exploration program offshore of Suriname after ceasing drilling in one key test well upon facing "substantial pressure increases," but...

(Westmount Energy, 4.Mar.2021) — Westmount Energy Limited, the AIM-quoted oil and gas investing company focused on the Guyana-Suriname Basin reports that, further to its announcement on 2 March 2021, it...

(Energy Analytics Institute, 26.Feb.2021) — Apache Corporation provided an update in its annual 10-K report (thru year-end 2020) on its operations in Suriname in South America where it is active...

(Energy Analytics Institute, 24.Feb.2021) — Apache Corporation announced it is targeting a final investment decision (FID) by year-end and first oil flows by 2025 from its project offshore Suriname on...

(Citgo, 12.Feb.2021) — The Citgo Petroleum Corporation Board of Directors announced today that Jose R. Pocaterra has been elected Chairman of the Board of Directors. Mr. Pocaterra brings more than...

(Total, 12.Feb.2021) — Total has inaugurated France’s largest filling station exclusively dedicated to Natural Gas for Vehicle (NGV) and bioNGV, with the onsite presence of Jean-Baptiste Djebbari, French Minister Delegate...

(Motley Fool, 9.Feb.2021) — Executives with France’s Total participated in the company’s fourth quarter 2020 earnings call on 9 February 2021. What follows is the transcript of the call. Contents:...

(Total, 4.Feb.2021) — Total joins today the Mærsk Mc-Kinney Møller Center for Zero Carbon Shipping as a strategic partner and accelerates its R&D program for carbon neutral shipping solutions in...

(Reuters, 20.Jan.2021) — Italian prosecutors asked a Milan Court on Wednesday for documents sourced from U.S. bank JPMorgan to be filed as part of a corruption trial over the acquisition...

(The New York Times, 20.Jan.2021) — The small South American country has become a hot prospect for oil companies looking to produce fossil fuels while spending less. The Atlantic waters...

(Total, 11.Jan.2021) — Total announces the acquisition of Fonroche Biogaz, a company that designs, builds and operates anaerobic digestion units in France. With close to 500 gigawatt-hours (GWh) of installed...

(Offshore Engineer, 5.Jan.2021) — U.S. oil major ExxonMobil has reportedly started drilling at the Bulletwood-1 well site on the Canje Block, offshore Guyana. The news was shared Tuesday by Westmount...

(Arab News, 3.Jan.2021) — The Egyptian Ministry of Petroleum and Mineral Resources has signed nine new petroleum agreements to search for petroleum and natural gas in the Mediterranean and the...

(Total, 3.Jan.2020) — An international consortium led by Total (Total 35% Operator, Shell 30%, KUFPEC 25%, Tharwa 10%) and the Egyptian Natural Gas Holding company (EGAS) have signed an exploration...

(Bloomberg, 1.Jan.2021) — Total SE asked some staff to vacate its $20 billion Mozambique liquefied natural gas project as Islamist militants are staging attacks increasingly closer to the site. Fighters...

(Bloomberg, 15.Dec.2020) — Tropical rains have washed away most outward traces of the oil spill that ravaged Rio Seco this fall. But the fishing village in the shadow of Venezuela’s...

(Argus, 3.Dec.2020) — Argentina received bids from 16 companies in a path-breaking auction to supply more than 70mn m3/d of natural gas at subsidized wellhead prices for power generation in...

(Petroleum Economist, 2.Dec.2020) — Crumbling oil prices and volatile energy demand have tipped Latin America into a sharp recession, exacerbated by one of the world’s worst Covid-19 mortality rates. But...

(Total, 12.Nov.2020) — Total signed a strategic framework agreement with the Abu Dhabi National Oil Company (ADNOC), to explore joint research, development and deployment partnership opportunities in the areas of...

(Apache, 4.Nov.2020) — Apache Corporation announced its financial and operational results for the third quarter 2020, highlighting activities in Suriname and Egypt. Key Takeaways -- Upstream capital investment significantly below...

(Sungrow, 28.Oct.2020) — Sungrow, the global leading inverter solution supplier for renewables, announced that the Company hit 1 GW PV inverter cumulative shipment to Chile and took first place in...

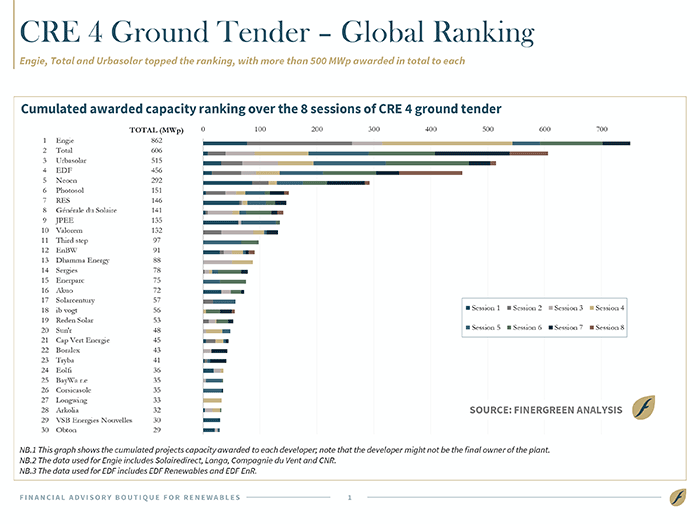

(Total, 27.Oct.2020) — Total, through Total Quadran, a wholly-owned affiliate dedicated to developing and producing renewable energy in France, was awarded 67 megawatt-peak (MWp) of solar projects representing 20% of...

(Tullow, 21.Oct.2020) — Tullow Oil plc announced the government of Uganda and the Ugandan Revenue Authority have executed a binding Tax Agreement that reflects the pre-agreed principles on the tax...

(Apache, 14.Sep.2020) — Apache Corporation and Total S.A. provided an update to the technical evaluation of the Kwaskwasi-1 discovery well offshore Suriname. As previously announced, Kwaskwasi-1 discovered hydrocarbons in multiple...

(Total, 7.Sep.2020) — Total notified its partners on 19 August 2020 about its resignation from its role of operator for five exploration blocks, located in the Foz do Amazonas Basin,...

(Oilprice.com, 7.Sep.2020) — Suriname is one of Latin America’s poorest countries. Up until July 2020, the former Dutch colony was mired in a political crisis that emerged from the hotly...

(Energy Analytics Institute, 1.Sep.2020) — Stena Drilling inked a new contract with Tullow Suriname BV for the Stena Forth drillship to drill one well offshore Suriname in Block-47. Block 47...

(Oilprice.com, 30.Aug.2020) — Angola, Africa’s second-largest oil producer after Nigeria, will need foreign and government investments to discover up to 57 billion barrels of crude oil by 2025, according to...

(Energy Analytics Institute, 24.Aug.2020) — Neighboring Guyana and Suriname in South America have been well off investor’s radars until recently. The countries are now regular headlines due to offshore crude...

(Total, 17.Aug.2020) — Total and its partners have taken the investment decision for the third phase of the Mero project (Libra block), located deep offshore, 180 kilometers off the coast...

(Petrobras, 14.Aug.2020) — Petrobras signed a letter of intent with the company MISC Berhad for the chartering and services for FPSO (floating production storage and offloading unit) Marechal Duque de...

(Argus, 12.Aug.2020) — The Brazilian government's plan to sell state-owned pre-salt marketing company PPSA has stalled amid congressional foot-dragging over a change in pre-salt contract terms. Addressing reporters late yesterday,...

(Reuters, 11.Aug.2020) — Mexico's president has given officials until late September to craft a plan to reassert state control over the energy industry as an alternative to constitutional change to...

(Petroleum Economist, 11.Aug.2020) — The small Latin American nation of Suriname is poised for profound change. Revenues from major offshore oil discoveries announced this year could transform the country’s long-term...

(Total, 6.Aug.2020) — Following the regulatory approvals and the agreement of partners, Total closed the sale of UK North Sea non-core assets to NEO Energy. "As announced on May 20,...

(Total, 30.Jul.2020) — Total’s Board of Directors met on 29 July 2020, and declared the distribution of the second 2020 interim dividend at €0.66/share, stable compared to the first 2020...

(Total, 30.Jul.2020) — Total announces that its 58% owned affiliate Total Gabon has signed an agreement with Perenco to divest its interests in seven mature non-operated offshore fields, along with...

(Apache, 29.Jul.2020) — Apache Corporation and Total S.A. announced a major oil discovery at the Kwaskwasi-1 well drilled offshore Suriname in Block 58. The well was drilled using the Noble...

(Reuters, 28.Jul.2020) — French oil company Total said on Tuesday that, along with its partners BP and ENI, it had made a gas discovery at a well off the coast...

(Energy Analytics Institute, 14.Jul.2020) — Suriname elected Progressive Reform Party (VHP) front man Chan Santokhi as the country’s president and Ronnie Brunswijk, leader of the General Liberation and Development Party...

(The New York Times, 13.Jul.2020) — Desi Bouterse has cast a long shadow over Suriname since its independence. Once a dictator, he returned as a populist, but fell in the...

(Stabroek News, 10.Jul.2020) — Having gone almost entirely unnoticed in the global oil & gas industry for decades, both Guyana and neighbouring Suriname are now claiming their respective shares of...

(Reuters, 8.Jul.2020) — French oil major Total has secured $15.8 billion in funding for its massive liquefied natural gas (LNG) project in northern Mozambique, according to South African lender FirstRand's...

(Energy Analytics Institute, 4.Jul.2020) — Suriname, the small Dutch-speaking South America country looking to emulate the success of its immediate neighbor to the north, Guyana, is awaiting drilling results of...

(Fitch Ratings, 2.Jul.2020) — Fitch Ratings has downgraded Suriname's Long-Term Foreign Currency Issuer Default Rating (IDR) to 'C' from 'CCC'. KEY RATING DRIVERS The downgrade of Suriname's Long-Term Foreign Currency...

(Eni, 1.Jul.2020) — Eni has successfully drilled the first exploration well in the North El Hammad license, in the conventional Egyptian waters of the Nile Delta, on the prospect called...

(Oilprice.com, 30.Jun.2020) — Exxon is moving to rapidly expand its exploration footprint in this little-known venue, French Total SA is spudding its first well here, small-cap Eco Atlantic - of...

(Total, 25.Jun.2020) — Total and Sonatrach have signed an agreement to renew their partnership in the field of liquefied natural gas (LNG). This agreement notably allows to extend the existing...

(Total, 25.Jun.2020) — Total and its partners announce the start-up of the Floating Production Storage and Offloading (FPSO) P-70 of the Iara cluster (Block BM-S-11A), located in the deepwater Santos...

(Petrobras, 25.Jun.2020) — Petrobras reports that it started today the production of oil and natural gas from the shared deposit of Atapu, through platform P-70, in the eastern portion of...

(Oilprice.com, 20.Jun.2020) — Paths to economic development might vary, ranging all the way from ruthless dictatorships hewing their way with an iron fist to established democracies laboring towards the well-being...

(Total, 8.Jun.2020) — Total has joined the Getting to Zero Coalition to support the maritime industry's decarbonisation by collaborating with companies across the maritime, energy, infrastructure and finance sectors. The...

(Total, 3.Jun.2020) — Total has entered into an agreement with SSE Renewables, to acquire a 51% stake in the Seagreen 1 offshore wind farm project for an upfront payment at...

(Total, 3.Jun.2020) — Total has entered into an agreement with SSE Renewables, to acquire a 51% stake in the Seagreen 1 offshore wind farm project for an upfront payment at...

(Argus, 28.May.2020) — Brazil's state-controlled Petrobras is opening its natural gas-processing plants to third parties, another step toward opening the country's gas market to greater competition. Petrobras has started offering...

(Total, 18.May.2020) — In August 2019, Total and Occidental Petroleum entered into a Purchase and Sale Agreement (PSA) in order for Total to acquire Anadarko’s assets in Africa. Under this...

(Total, 18.May.2020) — In August 2019, Total and Occidental Petroleum entered into a Purchase and Sale Agreement (PSA) in order for Total to acquire Anadarko’s assets in Africa. Under this...

(Cameron LNG, 22.Apr.2020) — Sempra LNG, a subsidiary of Sempra Energy, announced that Cameron LNG has entered the final commissioning stage for the Phase 1, three-train liquefaction-export project in Hackberry,...