(Bloomberg, 18.Jul.2024) — Exxon Mobil Corp. took the first step toward its seventh oil project in Guyana, a clear signal the supermajor intends to expand crude output from the South American...

(Reuters, 20.Jun.2024) — A contract arbitration panel that could block or green-light the $53 billion sale of Hess Corp to Chevron remains incomplete three months after the case was filed, stalling a decision...

(Reuters, 20.Jun.2024) — U.S. firm Fulcrum LNG was selected to help Guyana develop a plan to design, finance, construct and operate a natural gas processing facility in the South American...

(Hess Corporation, 28.May.2024) — Hess Corporation (NYSE: HES) has received the necessary approval of its stockholders for closing the company’s merger with Chevron Corporation. At the special meeting of Hess stockholders held...

(Hess, 20.May.2024) — Hess Corporation (NYSE: HES) announced that independent proxy voting and corporate governance advisory firm Glass, Lewis & Co. has recommended that Hess shareholders vote FOR the proposed merger with Chevron. In...

(Hess, 25.Apr.2024) — Hess Corporation reported that is net Guyana production was 190,000 b/d in the first quarter of 2024, up 70% from 112,000 b/d in the first quarter of...

(ExxonMobil, 12.Apr.2024) — ExxonMobil has made a final investment decision for the Whiptail development offshore Guyana, after receiving the required government and regulatory approvals. Whiptail, the sixth project on the...

(Hess, 7.Mar.2024) — Today, ExxonMobil announced that it is filing for arbitration regarding the applicability of a right of first refusal (ROFR) / pre-emption provision in the Stabroek joint operating agreement....

(Reuters, 6.Mar.2024) — Exxon Mobil Corp on Wednesday said it filed a contract arbitration claim related to Hess Corp's proposed sale of its Guyana oil properties, and suggested it may counter...

(Reuters, 28.Feb.2024) — Exxon Mobil's surprise challenge to Chevron's acquisition of Hess through a dispute over a stake in a major Guyana oil field could prove fruitful for the U.S....

(Reuters, 28.Feb.2024) — Guyana's vice president Bharrat Jagdeo on Wednesday said the country will accept whatever is the result from discussions between Exxon Mobil Corp, Chevron Corp and Hess Corp regarding participation in...

(MarketWatch, 27.Feb.2024) — Chevron warned it may not complete its planned buyout of Hess as Exxon Mobil and the China National Offshore Oil Corporation are saying the planned deal would...

(The New York Times, 27.Feb.2024) — America’s two largest energy companies, Exxon Mobil and Chevron, are jousting over a prized new source of oil in the waters off Guyana, in...

(Energy Analytics Institute, 26.Feb.2024) — Chevron Corporation believes that the $53bn merger with Hess Corporation presents the California-based energy giant with the opportunity to diversify its portfolio by acquiring Hess’ 30%...

(Bloomberg, 15.Feb.2024) — Guyana has undergone a huge transformation in the near decade since a massive oil discovery off its shores. That’s on full display at the Georgetown Marriott hotel. By sundown,...

(Hess, 31.Jan.2024) — Hess Corporation (NYSE: HES) reported net income of $413mn, or $1.34 per share, in the fourth quarter of 2023, compared with net income of $497mn, or $1.61...

(Enverus, 23.Jan.2024) — Enverus Intelligence Research (EIR), a subsidiary of Enverus, is releasing its summary of Q4 and full-year 2023 upstream merger and acquisition (M&A) activity. Q4 recorded a massive...

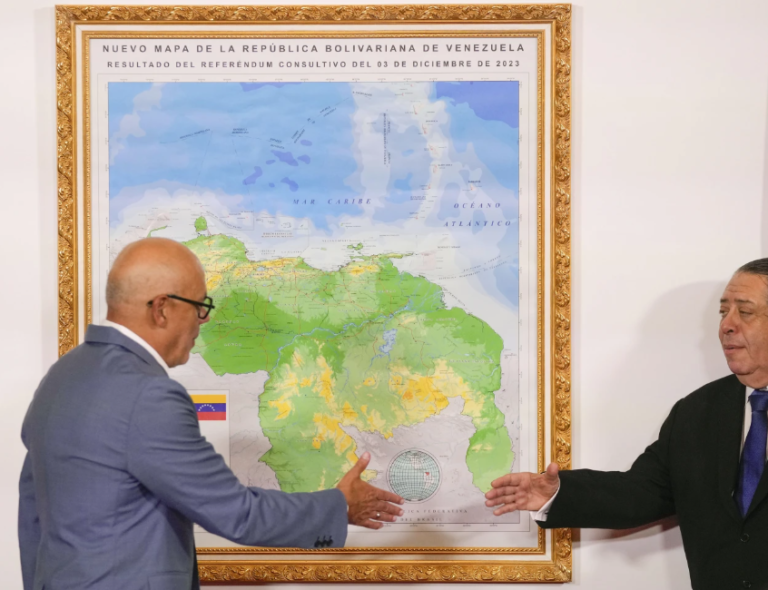

(AP, 9.Dec.2023) — A century-old territorial dispute deepened by the discovery of oil is boiling over between neighbors Guyana and Venezuela. Steeped in patriotism, the Venezuelan government is seizing on the fight...

(AFP, 27.Oct.2023) — The new find, as well as some of the drilling concessions, are in a disputed area whose possible annexation Venezuela is putting to a national referendum. Guyana, much smaller...

(Hess, 25.Oct.2023) — Hess Corporation (NYSE: HES) reported net income of $504mn, or $1.64 per share, in the third quarter of 2023, compared with net income of $515mn, or $1.67...

(Energy Analytics Institute, 23.Oct.2023) — US-based Chevron Corporation will acquire Hess Corporation for US$60bn (including net debt), the second giant transaction of Oct. 2023 following the $65bn move by ExxonMobil...

(Chevron, 23.Oct.2023) — Chevron Corporation (NYSE: CVX) has entered into a definitive agreement with Hess Corporation (NYSE: HES) to acquire all of the outstanding shares of Hess in an all-stock...

(Energy Analytics Institute, 30.Sep.2023) — Energy briefs as well as others related to finance and projects during Sep. 2023 including Petrobras saying that in regards the process of divestment of...

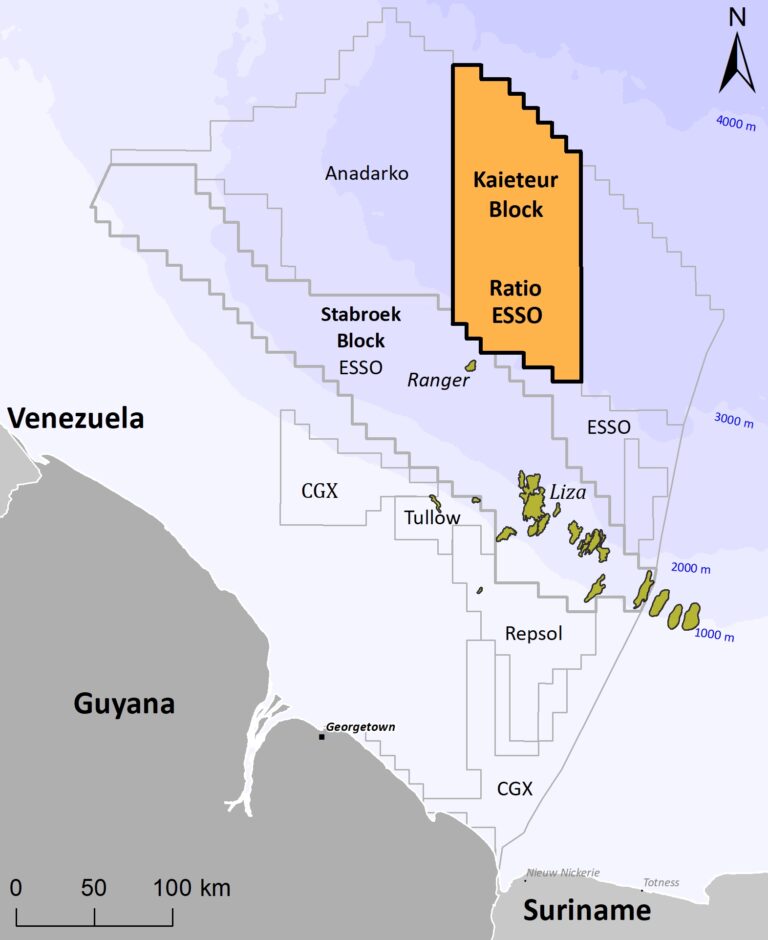

(Reuters, 28.Sep.2023) — U.S. oil producers Exxon Mobil (XOM.N) and Hess Corp (HES.N) have withdrawn from exploring the Kaieteur block in Guyana’s deepwaters, Exxon said on Thursday, after disappointing exploration results. The exit comes...

(Hess, 15.Sep.2023) — Hess Corporation announced that the special limited Collector's Edition Ocean Explorer toy, commemorating Hess Corporation's 90th anniversary, is now on sale exclusively at HessToyTruck.com for $59.99 with free standard shipping and Energizer® batteries...

(Reuters, 13.Sep.2023) — Guyana has received offers for eight of 14 offshore oil and gas blocks in a bidding round, including from consortiums of oil majors like Exxon Mobil, Hess...

(Reuters, 23.Aug.2023) — Guyana has gained a larger share of Europe's oil market this year, vessel monitoring data showed, driven by rising output by a consortium led by Exxon Mobil (XOM.N) and strong...

(WoodMac, 27.Jun.2023) — French major TotalEnergies has been named the upstream industry’s most-admired explorer and received the Discovery of the Year award in Wood Mackenzie’s industry-leading annual Exploration Survey. Dr....

(WoodMac, 27.Jun.2023) — French major TotalEnergies has been named the upstream industry’s most-admired explorer and received the Discovery of the Year award in Wood Mackenzie’s industry-leading annual Exploration Survey. Dr. Andrew Latham,...

(Reuters, 26.Jun.2023) — Nascent oil producer Guyana is not interested in joining the Organization of the Petroleum Exporting Countries (OPEC), Guyanese Vice-President Bharrat Jagdeo said on Monday, as the South American country...

(Energy Analytics Institute, 31.Dec.2022) — Energy briefs as well as others related to finance and politics during December 2022 including Washington’s easing of sanctions on Venezuela resulting in increased US...

(Hess, 26.Oct.2022) — Hess Corporation (NYSE: HES) reported net income of $515mn, or $1.67 per common share, in the third quarter of 2022, compared with net income of $115mn, or...

(Hess, 13.Sep.2022) — The Llano-6 well in the Gulf of Mexico delivered first production on 4 Augustm 2022. The well is a tieback to Shell’s Auger facility. This latest achievement...

(Hess, 3.Aug.2022) — Hess, ExxonMobil and CNOOC – co-venture partners on the Stabroek Block – recently finalized an agreement with the Government of Guyana for a Gas to Energy project....

(Forbes, 28.Jul.2022) — As the Biden administration focuses on its efforts to end new leasing and drilling for oil and gas in the Gulf of Mexico and other U.S. offshore...

(Reuters, 25.Jul.2022) — Guyana's government expects that an upcoming auction for oil and gas blocks will attract new companies to its energy industry, President Irfaan Ali said on Monday, following...

(Energy Analytics Institute, 25.Jul.2022) — Energy briefs including Hess Corporation (NYSE: HES) announcing publication of its annual sustainability report; and Frontera Energy Corporation (TSX: FEC) revealing that its 2Q:22 results will...

(Hess, 11.Jul.2022) — His Excellency Dr Irfaan Ali announced a national healthcare initiative in collaboration with the Mount Sinai Health System, an internationally recognized healthcare provider, and Hess Corporation to...

(Energy Analytics Institute, 22.Jun.2022) — The Liza Unity floating production storage and offloading vessel, where oil can be processed, stored and transferred to tankers, is the first in the world...

(FT.com, 2.May.2022) —The president of Guyana, the world’s fastest-growing economy, is inviting investors to back his ambitious vision to transform the small South American country into a regional health, education...

(Hess, 26.Apr.2022) — The Stabroek Block, located approximately 120 miles offshore Guyana, is 6.6 million acres. The block is equivalent in size to 1,150 Gulf of Mexico blocks and contains...

(Exxon, 26.Apr.2022) — ExxonMobil has made three new discoveries offshore Guyana and increased its estimate of the recoverable resource for the Stabroek Block to nearly 11 billion oil-equivalent barrels. The...

(Energy Analytics Institute, 4.Apr.2022) — Energy briefs including ExxonMobil, Hess and CNOOC taking a final investment decision (FID) for their fourth development offshore Guyana called Yellowtail, cos.’ biggest yet w/...

(Hess, 4.Apr.2022) — Hess Corporation (NYSE: HES) it has made a final investment decision to proceed with development of Yellowtail offshore Guyana after receiving government and regulatory approvals. Yellowtail, the...

(Hess, 1.Feb.2022) — Hess Corporation (NYSE: HES) achieved a top score of 100% on the Human Rights Campaign’s (HRC) Corporate Equality Index for 2022 and earned the designation as one of...

(Energy Analytics Institute, 4.Jan.2022) — Energy briefs including presidential elections in Brazil and Colombia this yr could see showdowns between Lula da Silva and Jair Bolsonaro as well as Gustavo...

(Energy Analytics Institute, 28.Oct.2021) — Energy briefs including Hess Corp. confirming that production from its Liza Phase 2 development in Guyana is on track to startup in early 2022; Avino...

(Energy Analytics Institute, 27.Oct.2021) — Energy briefs including the Liza Unity FPSO reaching Guyana’s prolific Stabroek Block; liquefied petroleum gas (LPG) reaching approximately 12mn users across Colombia; and more. LATIN...

(Hess, 11.Oct.2021) — Hess Corporation (NYSE: HES) received a AAA rating in the MSCI environmental, social and governance (ESG) ratings for 2021 after earning AA ratings from MSCI ESG for...

(Energy Analytics Institute, 28.Jul.2021) — Energy briefs from the Latin America and Caribbean region including: rising Brazilian imports of US LNG, Ecopetrol’s electric vehicles fleet, Hess reports 2Q:21 results, Trinidad...

(Energy Advance, 1.Jun.2021) — The first day at SEOGS 2021 saw an incredible 454 unique viewers tuning in from over 170 different companies to hear from the President, government of...

(Energy Analytics Institute, 1.Jun.2021) — Energy briefs from the Latin America and Caribbean region including: Ofac extending Chevron’s operating license in Venezuela; Microsoft founder, Bill Gates, participating in the Innovating...

(Hess 28.Apr.2021) — Hess reported net income of $252mn, or $0.82 per common share, in the first quarter of 2021, compared with a net loss of $2,433mn, or $8.00 per...

(Stabroek News, 26.Apr.2021) — December 20th marked the one-year anniversary of oil being lifted from Guyana’s ocean floor. Who has benefitted the most from our oil? Is it the people...

(Hess, 27.Jan.2021) — Hess Corporation provided operational highlights from the fourth quarter of 2020 and its operations in the US Bakken, the US Gulf of Mexico, offshore Guyana and Malaysia....

(Hess, 27.Jan.2021) — Hess Corporation reported a net loss of $97mn, or $0.32 per common share, in the fourth quarter of 2020, compared with a net loss of $222mn, or...

(Hess, 25.Jan.2021) — Hess today announced a 2021 Exploration & Production capital and exploratory budget of $1.9bn, of which more than 80% will be allocated to Guyana and the Bakken....

(Hess, 8.Jan.2021) — Hess will hold a conference call on Wednesday 27 January 2021 at 10 a.m. Eastern Time to discuss its fourth quarter 2020 earnings release. To phone into...

(Westmount, 17.Nov.2020) — Westmount Energy Ltd., further to the announcement by Ratio Petroleum Energy Limited Partnership dated today, that the Tanager-1 well, offshore Guyana, has been reported as an oil...

(Hess, 28.Oct.2020) — Hess Corporation reported a net loss of $243 million, or $0.80 per common share, in the third quarter of 2020, compared with a net loss of $212...

(BHP, 6.Oct.2020) — BHP signed a Membership Interest Purchase and Sale Agreement with Hess Corporation (Hess) to acquire an additional 28% working interest in Shenzi, a six-lease development in the...

(Hess, 5.Oct.2020) — Hess entered into an agreement to sell its 28% working interest in the Shenzi Field in the deepwater Gulf of Mexico to BHP Billiton, the field’s operator,...

(Hess, 30.Sep.2020) — Hess made a final investment decision to proceed with development of the Payara Field offshore Guyana after the development plan received approval from the government of Guyana....

(Hess Corp., 4.Sep.2020 — Hess announced that John Hess, Chief Executive Officer, will present at the Barclays CEO Energy-Power Conference in New York on 9 September 2020 at 8:25 a.m....

(Energy Analytics Institute, 1.Sep.2020) — Stena Drilling inked a new contract with Tullow Suriname BV for the Stena Forth drillship to drill one well offshore Suriname in Block-47. Block 47...

(Oilprice.com, 25.Aug.2020) — The deeply impoverished South American country of Guyana in recent years was heralded as the hottest new oil boom in the Americas. A series of large offshore...

(Stabroek News, 13.Aug.2020) — On the heels of President Irfaan Ali’s announcement on Tuesday that the Payara project approval will have to wait on an international oil expert’s assessment and...

(Forbes, 1.Aug.2020) — Hess Corp. reported more good news from its joint development of Guyana’s Stabroek Block with ExxonMobil and CNOOC on Thursday. The company announced that recently-completed appraisal drilling...

(Oilprice.com, 22.Jul.2020) — After a series of major offshore oil discoveries since 2015, with the largest ever made earlier this year, the tiny South American country of Guyana has become...

(Argus, 9.Jul.2020) — Changes are coming to the management and policy of Guyana's fledgling oil sector, after a regional court cleared the way for declaring a victory for the opposition...

(Oilprice.com, 20.Jun.2020) — Paths to economic development might vary, ranging all the way from ruthless dictatorships hewing their way with an iron fist to established democracies laboring towards the well-being...

(Argus, 9.Jun.2020) — Guyana's crude production has plunged by 65pc to 27,500 b/d from early May because of technical problems with compression equipment. "We do not know how long this...

(Hess, 7.May.2020) — Hess Corporation reported a net loss of $2,433 million, or $8.00 per common share, in the first quarter of 2020, including impairment and other after-tax charges of $2,251...

(Reuters, 21.Apr.2020) — More than 30 companies, including commodities traders like Gunvor and Vitol as well as units of oil majors like Exxon Mobil and Royal Dutch Shell, submitted expressions...

(Reuters, 7.Apr.2020) — Exxon Mobil Corp said on Tuesday the start of production at its Payara project in Guyana, its third major development in the world's newest offshore oil hotspot,...

![Hess Reports 4Q:23 Results, Updates on Payara [PDF Download]](https://energy-analytics-institute.org/wp-content/uploads/2023/04/guyana-fpso-prosperity-arrival-to-stabroek-source-sbm-1b-768x443.jpg)

![NRGBriefs: Hess’ Sustainability Report; Frontera Earnings [PDF Download]](https://energy-analytics-institute.org/wp-content/uploads/2022/07/sustainability-reports-source-hess-768x432.jpg)