(AP, 24.Apr.2024) — A company started by a Texas billionaire oilman announced a deal Wednesday with Venezuela’s state-owned oil company to rehabilitate five aging oil fields, days after the Biden...

(BTU Analytics, 23.Apr.2024) — Historically, more than half of Mexico’s heavy sour crude oil exports, mostly Maya blend, end up in the U.S., which is key for refining along the...

(Trinidad and Tobago Ministry of Energy and Energy Industries, 17.Apr.2024) — The Office of Foreign Assets Control (OFAC), Department of Treasury of the United States Government today issued General Licence 44A...

(Reuters, 17.Apr.2024) — The expiration of the widest U.S. license so far granted to Venezuela's oil and gas industry will put a ceiling on the South American country's slow crude production...

(Argus, 17.Apr.2024) — Bidders for Citgo's US refining assets have until 11 June to submit offers for the company's 805,000 b/d of refining capacity and associated assets, with a tentative...

(S&P Global, 17.Apr.2024) — A few hours before the expiration of a temporary oil and gas sanctions relief license, the governments of Venezuela and the United States continue to negotiate...

(Reuters, 15.Apr.2024) — The U.S. will not renew a temporary license set to expire on Thursday that widely eased sanctions on Venezuela's oil and gas sector, a State Department spokesperson...

(Energy Analytics Institute, 29.Feb.2024) — The mixed company Petrowarao, S.A. reactivated the A-162 gas condensate well in Zuila state in western Venezuela. The achievement was possible due to major maintenance work...

Energy Analytics Institute, 29.Feb.2024) — Executives with state-owned Petróleos de Venezuela, S.A. (PDVSA) and Chevron Venezuela supervised safety operations at the PDVSA Petropiar, S.A. joint venture as part of scheduled visits...

(Energy Analytics Institute, 18.Feb.2024) — Venezuela’s state-owned oil giant Petróleos de Venezuela (PDVSA), which has a total processing capacity of 1.303 million b/d from its six domestic refineries – Amuay,...

(Energy Analytics Institute, 16.Jan.2024) — The US Office of Foreign Assets Control (OFAC) authorized certain transactions related to state-owned Petróleos de Venezuela, S.A.'s 2020 8.5% bond on or after 16...

(Reuters, 8.Jan.2023) — A U.S. judge on Monday granted a large group of Venezuela-linked creditors rights to participate and receive proceeds from a coming auction of shares in the parent...

(Reuters, 3.Jan.2023) — Venezuela has agreed to give some oil to India's ONGC Videsh to help it recoup its pending $600 million dividend for a stake in a project in...

(Reuters, 3.Jan.2023) — Venezuela's oil exports increased 12% last year to almost 700,000 barrels per day (bpd) as the United States eased sanctions imposed since 2019 on the OPEC country's...

(Energy Analytics Institute, 20.Dec.2023) — The National Gas Company of Trinidad and Tobago (NGC) and Shell were granted a license for the exploration and exploitation of non-associated gas in the...

(Voice of America, 6.Dec.2023) — Venezuelan President Nicolas Maduro has ordered state-owned oil, gas and mining companies to “immediately” begin operations in a wide territory controlled by neighboring Guyana. Maduro...

(Reuters, 5.Dec.2023) — Venezuelan President Nicolas Maduro said on Tuesday he would authorize oil exploration in an area subject to a dispute with Guyana, which said it would report his...

(Energy Analytics Institute, 30.Nov.2023) — Energy briefs as well as others related to finance and projects during November 2023 including PDVSA and the French co. Maurel & Prom inking a...

(Reuters, 23.Nov.2023) — The suspension of U.S. sanctions on Venezuelan oil has rattled its biggest customers, China's independent refiners, who are now holding off on making new purchases amid wide...

(Reuters, 22.Nov.2023) — Venezuela is currently producing some 850,000 barrels per day (bpd) of oil and hopes to soon reach 1 million bpd, the country's deputy oil minister, Erick Perez,...

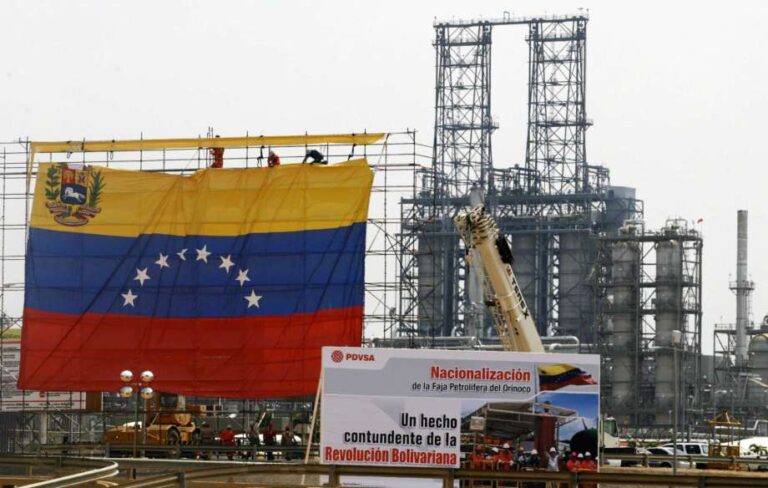

(Rafael Ramírez, 16.Nov.2023) — On 18 Oct., the US Office of Foreign Assets Control (OFAC)[1] issued Licenses 43 and 44,[2] lifting the sanctions on the Venezuelan oil and mining sector that had been in place...

(Citgo, 9.Nov.2023) — Citgo Petroleum Corporation reported its 2023 third quarter financial and operational results. Highlights: Net income of $567mn and EBITDA 1 of $895mn, compared to net income of $380 mn and EBITDA of $642mn for the second quarter...

(Citgo, 9.Nov.2023) — Citgo Petroleum concluded its highly successful Marketer Roundtable Meetings for 2023, bringing together marketers from across the country to discuss key industry trends, brand programs, and commercial...

(Sempra, 8.Nov.2023) — Maurel & Prom signed a set of agreements with Venezuela’s state owned PDVSA for the immediate restart of the activity of M&P’s mixed company in Venezuela. signing-of-a-set-of-agreements-with-pdvsa-for-the-maurel-promDownload...

(Energy Analytics Institute, 2.Nov.2023) — ConocoPhillips chairman and CEO Ryan Lance updated the analyst community on the company’s situation regarding Venezuela and recently started auction process for assets of Houston-based...

(Reuters, 2.Nov.2023) — China's PetroChina is proposing to buy up to 8 million barrels a month of Venezuelan crude from state-run oil company PDVSA, according to four people familiar with...

(Trinidad Express, 2.Nov.2023) — Decker Petroleum and Marketing Company Ltd (DPMCL), based in Trinidad and Tobago, has written the US District Court of Delaware officially expressing its interest in acquiring...

(S&P Global, 30.Oct.2023) — The Supreme Court of Justice (TSJ) in Venezuela ordered the suspension of the results of the opposition's primary elections which was claimed to be won by...

(S&P Global, 30.Oct.2023) — Asia may have little to cheer following the lifting of the sanctions on Venezuelan oil as increased competition for those Latin American cargoes could potentially make...

(Energy Analytics Institute, 26.Oct.2023) — Repsol SA CEO Josu Jon Imaz updated the analyst community on the Spanish company’s situation in Venezuela during a recent conference call. “In Venezuela, we...

(Barron’s, 23.Oct.2023) — The U.S. administration’s new oil sanctions relief toward Venezuela is broad-ranging and impactful. It’s unlikely to have any immediate effect on international oil prices, but it will likely realign...

(EIA, 23.Oct.2023) — The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) effectively lifted most U.S. sanctions on Venezuela’s energy sector on October 18 for six months, paving the...

(WoodMac, 20.Oct.2023) — Addressing the US Treasury Department’s partially lifted sanctions on Venezuela’s oil and gas sector, Adrian Lara, principal research analyst, Latin America Upstream Oil and Gas for Wood Mackenzie...

(Welligence, 19.Oct.2023) — Trinidad & Tobago (T&T) has received approval from the US government to pay PDVSA, the Venezuelan NOC, in cash for gas from Venezuela. The decision comes after a...

(Reuters, 19.Oct.2023) — Voters in Venezuela will on Sunday choose a unity candidate from among 10 hopefuls to represent the country's opposition in 2024 presidential elections, when President Nicolas Maduro is expected...

(Reuters, 18.Oct.2023) — A broad easing of U.S. oil sanctions on Venezuela will not quickly expand its output but could boost profits by returning some foreign companies to its oilfields and providing...

(Reuters, 18.Oct.2023) — Exemptions to sanctions on Venezuelan oil exports that the U.S. is mulling should not result in a large crude production surge in the OPEC country, instead taking barrels...

(Reuters, 17.Oct.2023) — The United States has granted an amendment requested by the government of Trinidad and Tobago to a license allowing the joint development of an offshore gas project...

(Reuters, 16.Oct.2023) — Oil futures fell on Monday on reports that the U.S. had agreed a deal to ease sanctions on Venezuela, while investors continued to mull the potential impact...

(Reuters, 25.Sep.2023) — Chevron Corp (CVX.N) plans to add 65,000 barrels per day (bpd) of Venezuelan oil output by the end of 2024 through its first major drilling campaign in the nation...

(Energy Chamber, 21.Sep.2023) — The Energy Chamber is extremely pleased to hear the news that Trinidad & Tobago and Venezuela have signed an agreement to work on the Dragon field...

(Energy Analytics Institute, 20.Sep.2023) — The governments of Trinidad and Tobago and Venezuela signed a deal related to energy and bilateral trade. “As good neighbors and brothers, we have taken...

(Bloomberg, 20.Sep.2023) — President Nicolás Maduro said Venezuela and Trinidad and Tobago have signed a profit-sharing agreement to export gas from the PDVSA-owned Dragon offshore project. The project, which was...

(Contributor, Adaelizabeth Omaira Guerrero Rodríguez, 18.Sep.2023) — The hydrocarbons industry constitutes the main resource of Venezuela, therefore, the study of this area should be the main interest of Venezuelans, in...

(Citgo, 14.Sep.2023) — Citgo Petroleum Corporation has priced $1.10bn aggregate principal amount of 8.375% senior secured notes due 2029 in a private offering exempt from the registration requirements of the Securities Act...

(Reuters, 12.Sep.2023) — Venezuela-owned oil refiner Citgo Petroleum has been valued by its parent company at between $32 billion and $40 billion, according to a court official during a hearing...

(Reuters, 12.Sep.2023) — A U.S. judge in Delaware on Tuesday will set the procedure for an upcoming auction of shares in a parent of Venezuela-owned oil refiner Citgo Petroleum to...

(Reuters, 5.Sep.2023) — Shell (SHEL.L) and Trinidad and Tobago's National Gas Company (NGC) are close to agreeing to credit Venezuela's state-run oil firm for its $1 billion investment in a gas field...

(USA Today, 17.Aug.2023) — The transnational Exxon Mobil, along with 19 other creditors, registered their claims against Venezuela before a court in the United States, as part of the actions...

(Reuters, 15.Aug.2023) — Negotiators and officials representing Venezuela are opposing a court-ordered auction of shares in a parent of oil refiner Citgo Petroleum to pay creditors claiming more than $10...

(Reuters, 19.Jul.2023) — The U.S. on Wednesday approved a three-month extension to a license protecting Citgo Petroleum from creditors seeking to seize the oil refiner's assets. The document comes as a negotiation team representing...

(Bloomberg, 18.Jul.2023) ) — Opposition frontrunner María Corina Machado said she would seek to roll Venezuela’s massive debt pile into a single bond as part of her plan to overhaul the country’s economy. ...

(Reuters, 7.Jul.2023) — Venezuela's opposition is crafting a proposal for the country to redirect about 200,000 barrels per day of its oil exports to a trustee to pay creditors with claims on...

(PDV Holding, 26.Jun.2023) — PDV Holding, Inc. successfully recovered a stock certificate representing 49.9% of the outstanding shares of stock in its subsidiary CITGO Holding Inc. from an arm of...

(Reuters, 7.Jun.2023) — Daily power cuts have returned to west-central Venezuela, shutting air conditioners during a heat wave and hitting factories, households and utilities as poorly maintained thermal plants fail to...

(Reuters, 7.Jun.2023) — Trinidad and Tobago aims to restart an idled liquefied natural gas (LNG) unit by the first quarter of 2027 after agreeing to restructure the facility's ownership and negotiate new gas...

(Reuters, 6.Jun.2023) — Holders of bonds issued by Venezuelan state-owned oil company Petroleos de Venezuela that are backed by a majority stake in refiner Citgo Petroleum urged New York state's highest court to...

(Energy Analytics Institute, 31.May.2023) — Energy briefs as well as others related to finance and politics during May 2023 including Venezuela planning to issue a license next month to Eni...

(Citgo, 10.May.2023) — Citgo Petroleum Corporation reported its 2023 first quarter financial and operational results. Favorable refining margins and product yields combined with strong asset reliability contributed to first quarter...

(Energy Analytics Institute, 30.Apr.2023) — Energy briefs as well as others related to finance and politics during April 2023 including the US not blocking the court-ordered sale of shares of Citgo...

(Reuters, 19.Apr.2023) — President Joe Biden will discuss Venezuela in wide-ranging talks with Colombian President Gustavo Petro on Thursday, including U.S. willingness to further ease sanctions on the OPEC nation...

(Citgo, 9.Mar.2023) Citgo Petroleum Corporation today reported its 2022 fourth quarter and year-end financial results. Highlights: Fourth quarter net income of $806mn and EBITDA[1] of $1.2bn Fourth quarter total refinery crude throughput of 797,000...

(Reuters, 24.Feb.2023) — Trinidad and Tobago expects to formally begin negotiations next month with Venezuela on a promising offshore natural gas project, the Caribbean nation's energy minister said on Feb....

(Energy Analytics Institute, 23.Feb.2023) — Energy briefs as well as others related to finance and politics during February 2023 including Repsol commenting on improvement of prospects for operations in Venezuela;...

(Reuters, 6.Feb.2023) — State firms from Iran and Venezuela will start in the coming weeks a 100-day revamp of the South American nation's largest refining complex to restore its crude...

(WSJ, 3.Feb.2023) — Caribbean countries battered by high energy costs are turning to Venezuela for oil and gas as the U.S. eases sanctions that have kept its supplies off limits for years. Trinidad...

(Reuters, 30.Jan.2023) — Venezuela's state oil firm PDVSA is toughening terms for buyers after a month-long halt to most exports of crude and fuel, demanding prepayment ahead of loadings in...

(Reuters, 24.Jan.2023) — The U.S. Treasury Department has granted a license to Trinidad and Tobago to develop a major gas field located in Venezuelan territorial waters, a senior Biden administration...

(Reuters, 30.Dec.2022) — U.S. oil company Chevron Corp (CVX.N) is sending two oil tankers to Venezuela, one of which will load the first cargo of crude destined for the United States in...

(Investor’s Business Day, 29.Dec.2022) — U.S. diesel prices hit all time highs in 2022 as demand surged and supplies of the critical heating and transportation fuel tightened. However, analysts expect...

(Canaima Fund Lux, 28.Dec.2022) — Canaima Fund Lux ("Issuer"), a securitization fund governed by the Luxembourg Law of 22 March 2004 on securitization undertakings, registered under number O27, and more precisely for and...

(Forbes, 2.Dec.2022) — A video that state-owned oil giant Petróleos de Venezuela posted to its Twitter feed this week shows a jovial meeting between Oil Minister Tarek El Aissami and...

(Reuters, 1.Dec.2022) — Chevron Corp is unlikely to add investment in Venezuela in the next six months despite a recent U.S. license to allow it to expand its operations in...

(Welligence, 1.Dec.2022) — Chevron Corporation has recently secured a license to renew limited operations within the country and source critical inputs necessary for processing crude, Welligence announced 1 December 2022...

(Anadolu Agency, 1.Dec.2022) — Venezuelan President Nicolas Maduro said Wednesday that licenses and authorizations granted so far by the US to ease sanctions it imposed on Venezuela are "headed in...

![The Lifting of Sanctions and the Oil Collapse of Venezuela [PDF Download]](https://energy-analytics-institute.org/wp-content/uploads/2020/09/Venezuela-requests-the-extradition-of-former-PDVSA-president-Rafael-Ramirez.jpg)

![Maurel & Prom Inks Deal in Venezuela [PDF Download]](https://energy-analytics-institute.org/wp-content/uploads/2023/11/mp-pdvsa-768x325.png)