(SSR Mining, 23.Feb.2022) — SSR Mining Inc. (NASDAQ: SSRM) (TSX: SSRM) (ASX: SSR) reports consolidated financial results in accordance with U.S. GAAP for the full year ended 31 December 2021. In addition, the Board of Directors declared a quarterly cash dividend of US$0.07 per common share, an increase of 40% over the third quarter dividend, payable on April 4, 2022 to holders of record at the close of business on 7 March 2022. This dividend qualifies as an ‘eligible dividend’ for Canadian tax purposes.

Rod Antal, President and CEO said, “SSR Mining ended 2021 with another strong quarter, rounding out a year of operational outperformance, strong free cash flow generation and peer-leading capital returns. We delivered full-year gold equivalent production at the top-end of our 2021 guidance range and full-year AISC * below our previously lowered guidance range despite pervasive inflationary pressures across the industry. Subsequently, last month we announced our inaugural three-year operating outlook and increased our base dividend by 40%.

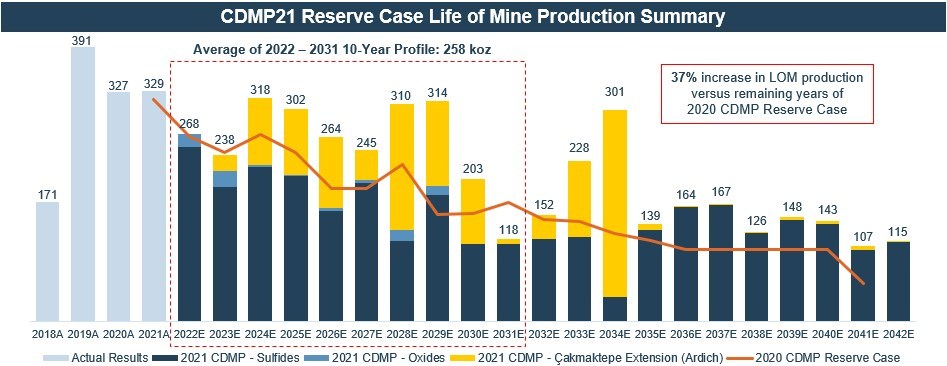

Accompanying today’s strong fourth quarter and full year financial results, we announced our updated Mineral Reserves and Resources for year-end 2021, including a 14% or 1.1 million ounce increase in total gold Mineral Reserves as compared to year-end 2020. Additionally, we have filed SK1300 Technical Report Summaries (“TRS”) for all four of our producing assets. The Çöpler District Master Plan TRS (“CDMP21”) includes a Mineral Reserve Case incorporating maiden Mineral Reserves from Çakmaktepe Extension (Ardich), and an Initial Assessment Case (“IAC”) which contemplates the construction of a copper concentrator to process Çöpler Copper-Gold (“C2”) sulfide ore beginning in 2025 at an IRR of ~60%.

Together, the four TRS reports outline an improved production platform and reaffirm our ability to sustain a +700koz production profile through the end of the decade. This is further supported by the consideration that Seabee and Marigold TRS do not yet fully incorporate the ongoing exploration efforts including the recent positive drill results issued late last year, and are based exclusively on existing Mineral Reserves. Overall, the new TRS reports provide refreshed base case production scenarios with no significant capital requirements that we will continue to improve into the future.”

____________________