(Pemex, 23.Sep.2019) — Today, Petróleos Mexicanos (Pemex) successfully finalized an early debt payment operation. This operation was announced on September 12, and consisted on using the capital received from the Federal Government to issue an offer to repurchase bonds with maturity in the next few years for an amount of up to 5 billion dollars.

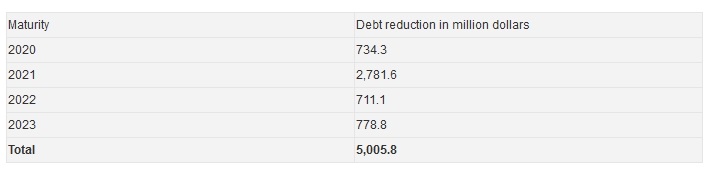

During the offering process, there was a great participation from the investors, which allowed Pemex to cancel its debt for an amount of 5. 0058 billion dollars on bonds with maturity between 2020 and 2023, an amount that was slightly higher than the previously-established goal. Pemex’s debt reduction is detailed in the table below, ordered by year of maturity:

With this operation, Petróleos Mexicanos has achieved a debt reduction of 5.0058 billion dollars, has increased the average term of its debt in U.S. dollars, and the short-term maturity profile has been reduced, which contributes to a stronger financial position for the company and reduces the risk of refinancing over the coming years.

This liability management exercise was completed as a complementary operation to the issuance of three new reference bonds, with maturity dates in 7, 10 and 30 years, which was completed on September 12.

The results of the bond exchange as part of the operation announced a few days ago will be publicly disclosed once the final terms and conditions established in these operations, in accordance with the corresponding legal requirements.

***