(Mandalay, 9.Nov.2023) — Mandalay Resources Corporation (TSX: MND) (OTCQB: MNDJF) is pleased to announce its financial results for the quarter ended 30 Sep. 2023.

Third Quarter 2023 Highlights:

- Generated consolidated quarterly revenue of $40.9mn;

- Björkdal had its strongest quarter since Q1 2022 generating revenue of $21.8mn and adjusted EBITDA1 of $9mn for 2023;

- Consolidated quarterly adjusted EBITDA of $15.4mn; and

- Consolidated net income was $4.1mn ($0.04 or C$0.06 per share).

Frazer Bourchier, President, and CEO commented:

“Mandalay delivered solid financial performance during the third quarter, resulting in the Company’s thirteenth consecutive quarter of profitability. Characterized by stable production and improving grades, the strategic initiatives undertaken at Björkdal are yielding encouraging results allowing the site to achieve its highest revenue and EBITDA in the past six quarters. At Costerfield, milled gold head grades improved to 9.6 g/t gold in Q3 2023 and, as earlier 2023 underground mining delays are progressively overcome, we expect these underground grades to further improve in Q4 2023.

“As we look ahead to the final quarter this year, with anticipated further improvements at Costerfield with higher-grade areas at Youle and improved mill throughput, as well as another consistent quarter of production at Björkdal underpinned by higher-grade Eastern Extension ore, the Company expects to achieve the lower end of its production guidance range of 88,000 – 100,000 gold equivalent ounces.”

| _________________________ |

| 1 Adjusted EBITDA, adjusted net income, cash costs and all-in sustaining costs are not standardized financial measures under IFRS and might not be comparable to similar financial measures disclosed by other issuers. Refer to “Non-IFRS Measures” at the end of this press release for further information. |

Nick Dwyer, CFO commented:

“Our consolidated cash costs and all-in sustaining costs1 per saleable gold equivalent ounce produced during Q3 2023 were $1,084 and $1,436, respectively. These figures represent a decrease from the previous quarter mainly due to higher metal production and lower capital expenditure.

“As at the end of Q3 2023, the company maintained a healthy balance sheet, closing with $21.7mn in cash on hand and a net debt position of $2.4mn. Our financial stability was further supported by $40.9mn in revenue and $15.4mn in adjusted EBITDA1, resulting in net income of $4.1mn.

“The month end cash balance and temporary dip into a net debt position, were negatively influenced by a delayed receipt of $5.5mn at Björkdal due to a shipment which was received after quarter end. Cash was also impacted during the quarter by an expected one-off reclamation increased bonding requirement at Costerfield of $3.5mn.”

Mr. Bourchier concluded: “As we move forward, our primary focus remains delivering operating cashflow and executing our growth plan to become a mid-tier gold producer. We are steadfast on our path to transformational growth, and every step we take is aligned with this strategic objective while also delivering optimal performance to our valued shareholders and stakeholders.”

Third Quarter 2023 Financial Summary

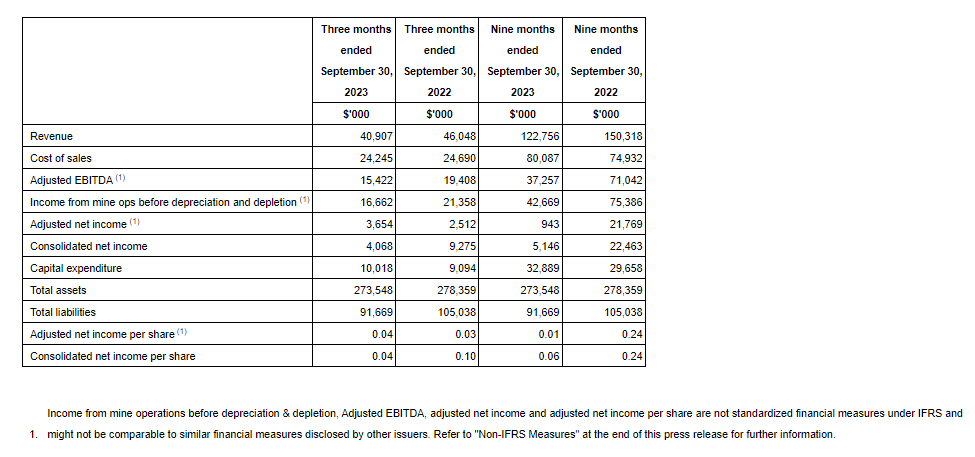

The following table summarizes the company’s consolidated financial results for the three months and nine months ended 30 Sep. 2023 and 2022:

In Q3 2023, Mandalay generated consolidated revenue of $40.9mn, 11% lower than the $46mn in the third quarter of 2022. The decrease in revenue was due to lower gold equivalent ounces produced and therefore sold at Costerfield. The company’s realized gold price in the third quarter of 2023 increased by 15% compared to the third quarter of 2022, and the realized price of antimony decreased by 9%. In Q3 2023, Mandalay sold 5,983 fewer gold equivalent ounces than in Q3 2022.

Consolidated cash cost per ounce of $1,084 was higher in the third quarter of 2023 compared to $846 in the third quarter of 2022. Cost of sales during the third quarter of 2023 versus the third quarter of 2022 were $1.4mn lower at Costerfield and $1mn higher at Björkdal. Consolidated general and administrative costs were $0.7mn lower compared to the prior year quarter.

Mandalay generated adjusted EBITDA of $15.4mn in the third quarter of 2023, 21% lower than adjusted EBITDA of $19.4mn in the third quarter of 2022, the decrease in adjusted EBITDA was due to lower revenue in the current quarter. Adjusted net income was $3.7mn in the third quarter of 2023, which excludes a $0.4mn unrealized gain on financial instruments, compared to an adjusted net income of $2.5mn in the third quarter of 2022.

Consolidated net income was $4.1mn for the third quarter of 2023, versus $9.3mn in the third quarter of 2022. Mandalay ended the third quarter of 2023 with $21.7mn in cash and cash equivalents.

Third Quarter Operational Summary

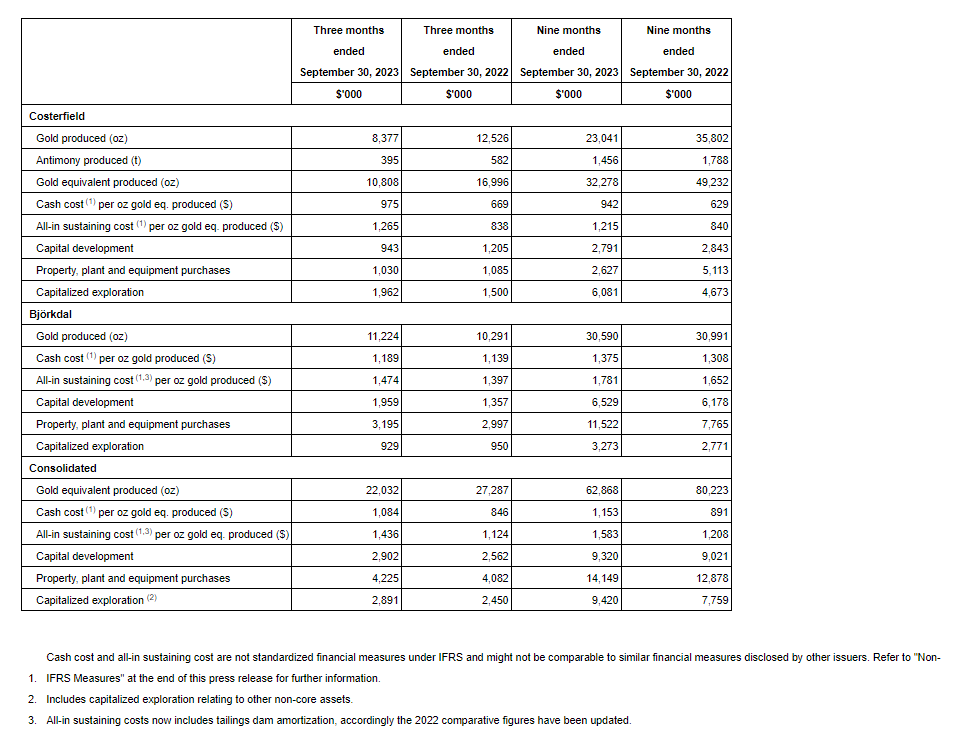

The table below summarizes the company’s operations, capital expenditures and operational unit costs for the three months and nine months ended September 30, 2023, and 2022:

Costerfield gold-antimony mine, Victoria, Australia

Costerfield produced 8,377 ounces of gold and 395 tonnes of antimony for 10,808 gold equivalent ounces in the third quarter of 2023. Cash and all-in sustaining costs at Costerfield of $975/oz and $1,265/oz, respectively, compared to cash and all-in sustaining costs of $669/oz and $838/oz, respectively, in the third quarter of 2022.

During Q3 2023, Costerfield generated $19.1mn in revenue and $7.7mn in adjusted EBITDA, which resulted in net income of $3.5mn. Head grades during Q3 2023, which averaged 9.6 g/t gold and 2.2% antimony, were below expectations as processed grades were adversely affected by a delay in stope progression into the higher-grade core of the Youle orebody and lower throughput which was due to temporary challenges encountered with the hardness of the ore during transition from the Youle to the Shepherd zone.

Björkdal gold mine, Skellefteå, Sweden

Björkdal produced 11,224 ounces of gold in the third quarter of 2023 with cash and all-in sustaining costs of $1,189/oz and $1,474/oz, respectively, compared to cash and all-in sustaining costs of $1,139/oz and $1,397/oz, respectively, in the third quarter of 2022.

Björkdal continues to show improvement in production and sales figures with $21.8mn, $9mn and $2.1mn in revenue, adjusted EBITDA and net income, respectively, in Q3 2023. Production of 11,224 ounces was higher than the 10,291 ounces produced in the third quarter of 2022 due to the higher processed head grade.

Lupin, Nunavut, Canada

Care and maintenance spending at Lupin was less than $0.1mn during the third quarter of 2023, which was same as in the third quarter of 2022. Reclamation spending at Lupin was $0.1mn during the third quarter of 2023 compared to $1.2mn in the third quarter of 2022. The majority of this reclamation work is expected during 2024 as Lupin is currently in the process of final closure and reclamation activities which are mainly funded by progressive security reductions held by the Crown Indigenous Relations and Northern Affairs Canada.

La Quebrada, Chile

No work was carried out on the La Quebrada development property during Q3 2023.

CFO Transition

Mandalay also announces today that Nick Dwyer will be leaving the company in the first quarter of 2024 as a result of his decision to resign and relocate to Australia for personal reasons. Mr. Dwyer will continue to serve as Mandalay’s CFO in a full-time capacity until then in order to ensure an orderly completion of the company’s 2023 year end reporting and a smooth transition of duties. The Company will be commencing a search for Mr. Dwyer’s successor.

Commenting on Mr. Dwyer’s departure, Frazer Bourchier said, “Nick has been a key part of Mandalay’s management team for over eight years, including as CFO since 2018. He played a significant role in Mandalay’s 2019 financing transaction that was crucial to the Company’s turnaround that followed, and the refinancing of various senior credit arrangements while leading the finance function over his tenure. On behalf of Mandalay’s board, management and shareholders, I’d like to thank Nick for his invaluable contributions and wish him every success in his future endeavours.”

Conference Call

Analysts and interested investors may join by using the following dial-in number:

| Participant Number (North America toll free): | 1-877-270-2148 |

| Conference ID: | 10183607 |

Alternatively, please register for the webcast here.

A replay of the conference call will be available until 11:59 PM (Toronto time), 16 Nov. 2023, and can be accessed using the following dial-in numbers:

| Encore Number (Canada Toll free): | 855-669-9658 |

| Encore Replay Code: | 3729475 |

____________________