WASHINGTON, DC (S&P Global Commodity Insights, 8.May.2025, Words: 583) — The US, which currently supplies half of Europe’s liquefied natural gas (LNG) imports and roughly 15% of the continent’s total gas supply, would be disproportionately impacted if current restrictions on Russian gas and LNG were to change, a new S&P Global Commodity Insights study finds.

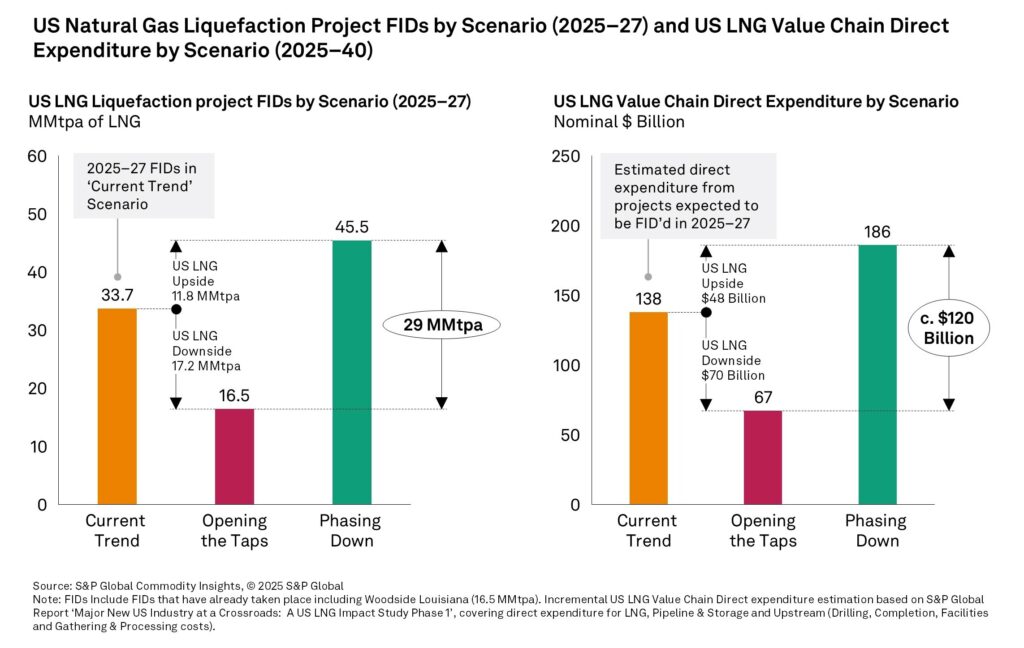

The report, U.S. LNG Exports at Risk: Potential Unwinding of Sanctions on Russian Natural Gas found that, under an “Opening the Taps” scenario where U.S. sanctions on Russian natural gas pipeline and LNG exports are withdrawn and new volumes of Russian gas flow to Europe, more than 17 million metric tons per annum (MMtpa) in new US LNG projects—representing $70bn in related investment—would be curtailed compared to a “Current Trend” scenario.

Conversely, a scenario with Europe increasingly “Phasing Down” Russian LNG and most piped gas, largely consistent with the EU Commission’s REPowerEU Roadmap published on 6 May 2025 would result in an additional 12 MMtpa in US LNG projects reaching final investment decision—representing an additional $48bn in related investment.

The outcomes between the “Opening the Taps” and “Phasing Down” scenarios represent 29 MMtpa in US LNG project final investment decisions and nearly $120bn in related investment impact.

“Any changes to restrictions on Russian gas flows to Europe would dramatically impact US LNG in market share and investment,” said Carlos Pascual, Senior Vice President, Global Energy, S&P Global Commodity Insights. “On the downside, unwinding Russia sanctions would reduce the market for US LNG, curtailing investment in future US projects and simultaneously undermining European efforts to diversify gas imports.”

US LNG is disproportionately impacted across the scenarios given its nature as the balancing supply for global LNG markets. Its contractual structures and US market liquidity mean that it reacts more quickly to price signals.

Given the volatility seen in policy on gas exports and imports, European policy decisions could evolve over time depending on wider political circumstances in Europe and globally thus validating all three potential scenario outcomes.

Scenario 1: “Current Trend”:

US LNG Liquefaction project FIDs (2025-2027): 33.7 MMtpa

US LNG Value Chain Direct Expenditure (2025-2040): $138bn

S&P Global Commodity Insights expects new contracts for LNG to be critical to closing a growing European gas supply gap that is driven by demand recovery, declining domestic production and piped imports and LNG contract expiry. Addressing the supply gap, along with the need for energy security and preferences to reduce exposure to volatile spot markets provides space for additional LNG contract signings and thus potential for additional financing for liquefaction projects in the United States and elsewhere.

- Russian pipeline gas to Europe continues via TurkStream

- Russian LNG still purchased by some European countries

- Sanctions continue to limit new Russian LNG projects

- Russia’s Power of Siberia-2 pipeline to China launches in the 2030s

Scenario 2: “Opening the Taps”:

US LNG Liquefaction project FIDs (2025-2027): 16.5 MMtpa

US LNG Value Chain Direct Expenditure (2025-2040): $67bn

- Additional 2.7 Bcf/d Russian pipeline gas to Europe via the remediation of an existing pipeline route from Jul. 2025

- Sanctions on Russian LNG are lifted, adding 9 MMtpa Russian export capacity by 2035 versus the Base Case

- Development of existing and future Russian LNG projects accelerates

Alternate Scenario 3: “Phasing Down”:

US LNG Liquefaction project FIDs (2025-2027): 45.5 MMtpa

US LNG Value Chain Direct Expenditure (2025-2040): $186bn

- Complete ban on Russian LNG to Europe from January 2026

- Arctic-2 LNG ramp-up delayed and Yamal LNG deliveries effected by shipping and trade-route logistical challenges

- Pipeline flows continue to Southeast Europe via Turkey, as per the Base Case

____________________