(Petrobras, 31.Dec.2023) — Petrobras put into production today the Sepetiba platform vessel, in the Mero field, Libra block, in the pre-salt Santos Basin. This is Mero's third production system, with the...

(Rafael Ramírez, 16.Nov.2023) — On 18 Oct., the US Office of Foreign Assets Control (OFAC)[1] issued Licenses 43 and 44,[2] lifting the sanctions on the Venezuelan oil and mining sector that had been in place...

(QatarEnergy, 20.Jun.2023) — QatarEnergy signed definitive agreements with China National Petroleum Corporation (CNPC), covering the long-term supply of LNG to China and partnership in the North Field East LNG expansion project (NFE)....

(KAPSARC, 6.Dec.2022) — On 6 December 2022, the King Abdullah Petroleum Studies and Research Center (KAPSARC), a leading Riyadh-based advisory think tank, signed a memorandum of understanding (MoU) with the...

(bp, 14.Nov.2022) — bp has successfully loaded the first LNG cargo from Mozambique’s offshore Coral Sul FLNG facility, the country’s first LNG project and first floating LNG facility ever deployed in the deep waters...

(Eni, 13.Nov.2022) — Eni, as Delegated Operator of the Coral South project on behalf of its Area 4 Partners (ExxonMobil, CNPC, GALP, KOGAS and ENH), informs that the first shipment...

(Reuters, 26.Aug.2022) — China has entrusted a defense-focused state firm to ship millions of barrels of Venezuelan oil despite U.S. sanctions, part of a deal to offset Caracas' billions of dollars...

(Eni, 18.Jun.2022) — Eni, as Upstream Delegated Operator of Area 4 on behalf of its partners ExxonMobil, CNPC, GALP, KOGAS and ENH, announces that the Coral South Project has safely...

(Shell Brasil, 2.May.2022) — Shell Brasil Petróleo Ltda., a subsidiary of Shell plc, announces the start of production of the FPSO Guanabara in the Mero field, offshore Santos Basin in Brazil....

(Energy Analytics Institute, 21.Apr.2022) — Venezuela’s oil production is expected to gradually rise to as much as 1. 3 million barrels per day by 2028, according details revealed by Wood...

(S&P Global Platts, 30.Nov.2021) — Oil production by Venezuela's state PDVSA and its foreign partners rose to 660,000 b/d in November, up 40,000 b/d from October, Nov. 30 PDVSA production...

(Bloomberg, 1.Sep.2021) — China’s top oil producer is laying the groundwork to revive output in Venezuela as President Nicolas Maduro finalizes legislation to attract more international investment. Once a major...

(Reuters, 1.Jun.2021) — Venezuelan state oil company PDVSA is turning to local partners as it seeks to plug the gap left by Western companies in the OPEC nation's oil sector,...

(Reuters, 26.Jan.2021) — Venezuelan state oil company PDVSA’s inventories of its main export crude grade dipped this week to their lowest levels since late November, internal company documents seen by...

(Bloomberg, 22.Jan.2021) — It may be the oil market’s worst-kept secret: Millions of barrels of Venezuelan heavy crude, embargoed by the U.S., have been surreptitiously going to China. The cat-and-mouse...

(Argus, 3.Jul.2020) — Venezuela kicked off July with only around 300,000 b/d of crude production and no oil rigs in operation, according to a series of internal operation reports from...

(Bloomberg, 20.Jun.2020) — Oil revenue, the financial lifeline of Venezuela, is quickly drying up, adding to the growing instability of Nicolas Maduro’s embattled regime. Crude exports that once accounted for...

(Argus, 10.Jun.2020) — Vessel tracking data shows a fleet of 44 international tankers on the water holding 40.5mn bl of Venezuelan oil as shipowners face growing risk of US sanctions...

(Argus, 2.Apr.2020) — Venezuela's crude production partially recovered to around 700,000 b/d at the end of March, but state-owned PdV and its foreign partners cannot afford to dismiss weaker price...

(Reuters, 30.Mar.2020) — Venezuela’s crude production ended last week at around 670,000 barrels per day (bpd), according to documents seen by Reuters and two people with access to output data,...

(Argus, 10.Mar.2020) — Venezuela's US-backed opposition is scrambling to stay relevant at home and abroad as the US and other foreign patrons turn inward to focus on slowing the spread...

(FT, 7.Mar.2020) — There have been enough false dawns in Venezuela to deter any confident predictions but a series of developments — all energy related — suggest that 2020 could...

(Reuters, 19.Feb.2020) — Washington’s move this week to sanction a trading unit of Russian oil giant Rosneft for its ties with Venezuela’s state-run PDVSA escalated threats facing non-U.S. firms and...

(Bloomberg, 27.Jan.2020) — Facing economic collapse and painful sanctions, the socialist government of Venezuelan President Nicolas Maduro has proposed giving majority shares and control of its oil industry to big...

(Oilprice.com, 19.Jan.2020) — There’s only one path to rebuilding Venezuela, and it’s paved with oil. For the time being, that path leads nowhere. The key to controlling everything now lies...

(Reuters, 15.Jan.2020) — The Trump administration’s envoy on Venezuela said China appears to be scaling back economic support for President Nicolas Maduro, and Beijing acknowledged a diminishing role largely due...

(Reuters, 15.Jan.2020) — The Trump administration’s envoy on Venezuela said China appears to be scaling back economic support for President Nicolas Maduro, and Beijing acknowledged a diminishing role largely due...

(Reuters, 13.Jan.2020) — Venezuela, its oil exports decimated by U.S. sanctions, is testing a new method of getting its crude to market: allocating cargoes to joint-venture partners including Chevron Corp,...

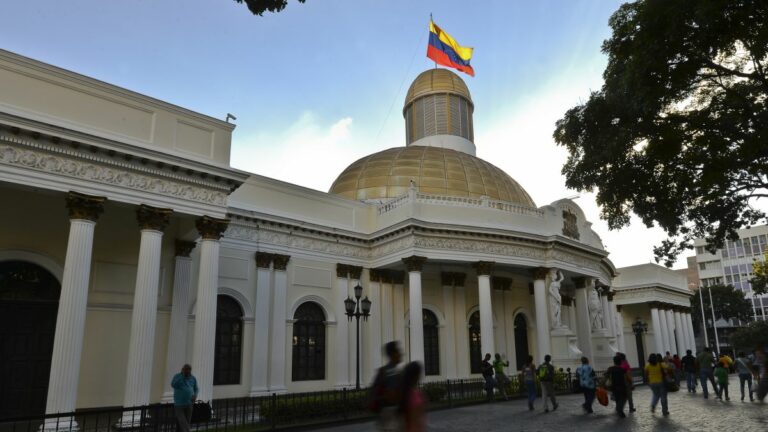

(Reuters, 8.Jan.2020) — Venezuela’s ruling Socialist Party hopes legislators it recently declared to be in charge of congress will approve changes to ownership of some crucial state oil assets, five...

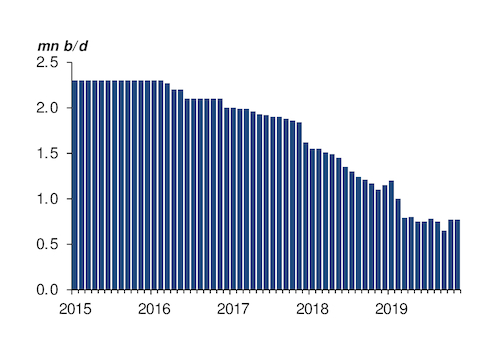

(Reuters, 7.Jan.2020) — Venezuela’s oil exports plummeted 32% last year to 1.001 million barrels per day, according to Refinitiv Eikon data and state-run PDVSA’s reports, as a lack of staff...

(Reuters, 3.Jan.2020) — Venezuelan state company PDVSA is letting some joint venture partners take over the day-to-day operation of oilfields as its own capacity dwindles due to sanctions and a...

(S&P Global Platts, 24.Dec.2019) — US sanctions on PDVSA shut down roughly 500,000 b/d of crude flows from Venezuela to Gulf Coast refineries within a matter of weeks after being...

(Argus, 20.Dec.2019) — PdV is leaning on joint-venture partners as it looks to continue a nascent crude output revival and live up to an improved economic outlook for 2020 The...

(Petrobras, 18.Dec.2019) — Petrobras has completed the economic feasibility study regarding the completion of the Comperj refinery construction, together with the Chinese company CNPC and its affiliates, under the agreements...

(S&P Global Platts, 17.Dec.2019) — Production levels by Venezuelan state-owned PDVSA and its international partners in the Orinoco Belt rose to 500,000 b/d, or 38.5% of its 1.3 million b/d...

(Demerara Waves, Denis Chabrol, 16.Dec.2019) — The Ministry of the Presidency’s Department of Energy denied breaching the procurement process for sale of Guyana’s first three million barrels of oil aimed...

(Reuters, 10.Dec.2019) — Venezuela’s crude output in November jumped more than 20% from the prior month to the highest level since the United States tightened sanctions on state oil company...

(Reuters, Luc Cohen, Deisy Buitrago, Mayela Armas, 6.Dec.2019) — Venezuela’s government and opposition have discussed allowing private companies in joint ventures with state oil company PDVSA to operate oil fields...

(Argus, 7.Nov.2019) — Brazil's pre-salt auction today mirrored the lackluster results from yesterday's much-hyped Transfer of Rights offer, raising questions about bonus pricing, the appeal of the country's production-sharing terms...

(Bloomberg, Sabrina Valle, Peter Millard, and Luiza Ferraz, 6.Nov.2019) — Brazil’s largest-ever auction of oil deposits flopped, sending the real tumbling, after state-controlled Petroleo Brasileiro SA did most of the...

(WoodMac, 6.Nov.2019) — Brazil’s largest-ever auction of oil licences – the Transfer of Rights round – saw state-controlled Petrobras walk away with the biggest prizes, the Búzios and Itapu blocks....

(S&P Global Platts, Brian Scheid and Rosemary Griffin, 17.Oct.2019) — Chevron is pushing back against the Trump administration's plans to let the company's Venezuela sanctions waiver expire, arguing such a...

(Tass, 16.Oct.2019) — The government of Venezuela is ready to hand over full control over its state-run oil company PDVSA (Petroleos de Venezuela) to Russia’s Rosneft, El Nacional newspaper said...

(Reuters, Nidhi Verma and Marianna Parraga, 15.Oct.2019) — India's Nayara Energy has been using Russian giant Rosneft as an intermediary to acquire Venezuelan oil, paying it in fuel rather than...

(S&P Global Platts, Brian Scheid, 14.Oct.2019) — Venezuelan oil production, already averaging a historic low near 600,000 b/d, could quickly plummet below 300,000 b/d if the Trump administration allows a...

(Chron, Sergio Chapa, 7.Oct.2019) — Frequent power outages, theft of equipment, a political tug-of-war and billions of dollars in losses would seem to signal to businesses that it’s time to...

(Argus, 7.Oct.2019) — Senior managers of Venezuelan state-owned PdV's heavy crude-blending joint venture with Chinese state-owned CNPC were arrested late last week, days after the blending plant halted operations. PetroSinovensa...

(Reuters, Jonathan Saul and Collin Eaton, 4.Oct.2019) — Exxon Mobil Corp this week banned the use of vessels linked to oil flows from Venezuela in the last year, according to...

(Argus, 3.Oct.2019) — At least three Venezuelan fuel tankers are heading towards Cuba today, part of a flotilla meant to free up domestic storage space while defying a US campaign...

(Bloomberg, Peter Millard and Kelly Gilblom, 30.Sep.2019) — It was supposed to be BP’s big Brazilian breakthrough after years of setbacks in one of the world’s top destinations for offshore...

(Reuters, 30.Sep.2019) — Fourteen companies have been officially approved by Brazilian authorities to participate in an oil bidding round in November, in which total signing bonuses are expected to be the...

(US Treasury, 24.Sep.2019) — Today, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) designated four entities that operate in the oil sector of the Venezuelan economy...

(FT.com, Michael Stott and Henry Foy, 24.Sep.2019) — Threats of military invasion, sweeping economic sanctions, people power, recognition of a rival government, even an attempted uprising — the US has...

(Miami Herald, Nora Gámez Torres and Michael Wilner, 24.Sep.2019) — Moscow has maintained communication with members of the Venezuelan opposition even as the Cuban government plans on “going down with...

(Reuters, Chen Aizhu, 10.Sep.2019) — China National Petroleum Corp (CNPC), a leading buyer of Venezuelan oil, will skip cargo loadings for a second month in September as the state oil...

(Argus, 6.Sep.2019) — Venezuela's national oil company PdV has lost almost all capacity to refine crude, with only a sliver of the 635,000 b/d Amuay plant currently in operation, according...

(Reuters, Marianna Parraga, Mircely Guanipa, 3.Sep.2019) — Venezuela’s oil exports fell in August to their lowest level in 2019, internal reports and Refinitiv Eikon data showed, hurt by a halt...

(Argus, 20.Aug.2019) — The Chinese government is so far showing no sign of curtailing its oil ties to Venezuela, despite state-owned PetroChina's rescheduling of Merey crude loadings in August. Argus...

(Reuters, Chen Aizhu and Marianna Parraga, 18.Aug.2019) — China National Petroleum Corp, a leading buyer of Venezuelan oil, has halted August loadings following the latest U.S. sanctions on the South...

(Oilprice.com, Julianne Geiger, 16.Aug.2019) — Russia and China have stuck with Venezuela during its most recent time of need, but at least one of their loyalties may soon come to...

(Reuters, Luc Cohen, 14.Aug.2019) — Foreign joint venture partners with Venezuelan state-owned oil company PDVSA are concerned the latest set of U.S. sanctions on the South American country could disrupt...

(Reuters, Matt Spetalnick and Roberta Rampton, 5.Aug.2019) — U.S. President Donald Trump imposed a freeze on all Venezuelan government assets in the United States on Monday, sharply escalating an economic...

(Reuters, 29.Jul.2019) — Venezuelan state-run oil company PDVSA said on Monday the Petropiar extra-heavy crude upgrader, part-owned by U.S. oil company Chevron Corp, had begun operations as a blending facility....

(Reuters, 26.Jul.2019) — The administration of United States President Donald Trump said on Friday that it has renewed Chevron Corp's licence to drill for oil and gas in Venezuela despite...

(Petroleum Economist, 18.Jul.2019) — Latin America's economically troubled oil giant faces the difficult task of significantly raising Asian crude grades. Venezuela's upgraders have been forced to stop upgrading extra-heavy crude...

(Energy Analytics Institute, Piero Stewart, 20.May.2019) — Heard on the street and LatAmNRG briefs related to the Petroamazonas EP and contracts for $78.1 million with China’s CNPC And Sinopec, optimized...

(Argus, 10.Apr.2019) — Peru’s natural gas reserves declined after the energy ministry reclassified the potential of Chinese state-owned CNPC’s block 58 from proven/probable reserves to contingent resources. The ministry said...

(Argus, 14.Mar.2019) — Venezuela’s political opposition is proposing a comprehensive oil reform that would allow foreign investors to own up to 100pc of oil assets from the wellhead to the...

(Petroleum Economist, Charles Waine, 22.Feb.2019) — Despite severe US sanctions, President Maduro is standing firm. But how long can the political impasse last while oil production continues to decline? Venezuela...

(Energy Analytics Institute, Piero Stewart, 15.Dec.2018) — The mixed company Petrolera Sinovensa is currently producing 130,000 barrels per day of crude oil in Venezuela. “I am pleased that we have...

(Rosneft, 29.Nov.2018) — The first Russian-Chinese energy business forum is successfully finished in Beijing. The format of the event was established in July 2018, upon instruction of Russian President Vladimir...

(Hydrocarbon Engineering, Alex Hithersay, 18.Oct.2018) — Petrobras has announced that it has signed an integrated project business model agreement (IPBMA) with China National Oil and Gas Exploration and Development Co....

(Aker Solutions, 5.Oct.2018) — Aker Solutions has signed a contract with Petrobras to provide a subsea production system and related services for the Mero 1 project within the Mero field...

(AP, 20.Sep.2018) — Venezuelan President Nicolas Maduro said Tuesday that new investments from China will help his country dramatically boost its oil production, doubling down on financing from the Asian...

(Energy Analytics Institute, Jared Yamin, 12.Sep.2018) — The decline is consistent and constant as well as consistently and constantly bad, writes Caracas Capital Market in a research note emailed to...

![The Lifting of Sanctions and the Oil Collapse of Venezuela [PDF Download]](https://energy-analytics-institute.org/wp-content/uploads/2020/09/Venezuela-requests-the-extradition-of-former-PDVSA-president-Rafael-Ramirez.jpg)