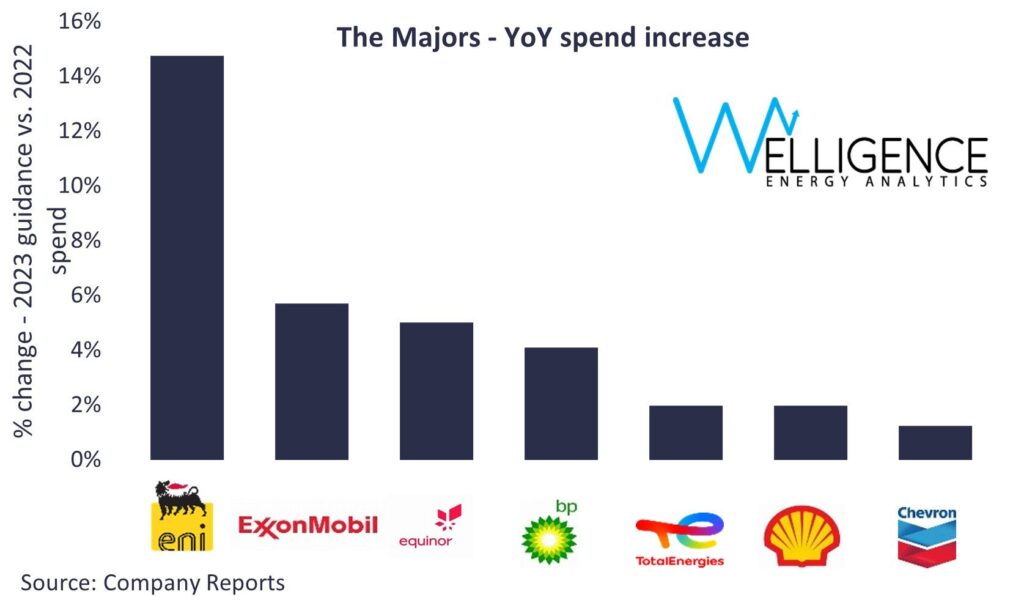

(Energy Analytics Institute, 23.Feb.2023) — “Despite bumper profits, the peer group is guiding towards $118bn in total investment in 2023, up just 4% on last year. This reflects the priorities of capital discipline, targeted investment in the best projects and shareholder returns – the group collectively returned $117bn to investors in 2022,” Welligence Energy Analytics reported 23 February 2023 in a post on LinkedIn.

“Strong oil & gas prices have also led to something of a rethink with regards to upstream investment, at least in the short to medium term. While US Majors ExxonMobil and Chevron never shied away from E&P, the EuroMajors put enormous emphasis on their energy transition credentials. There is now more public acknowledgment of the role that E&P will continue to play, with even bp committing to increasing upstream spend by $8bn over the remainder of this decade,” the consultancy said.

____________________

By Ian Silverman. © Energy Analytics Institute (EAI). All Rights Reserved.