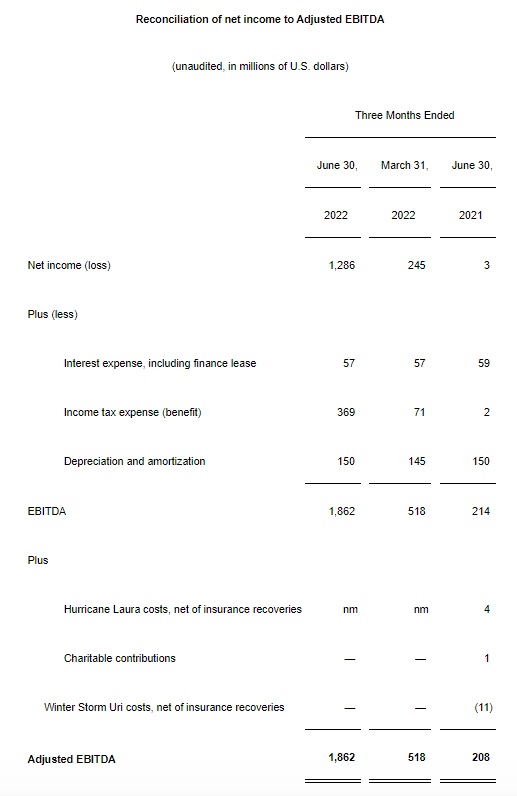

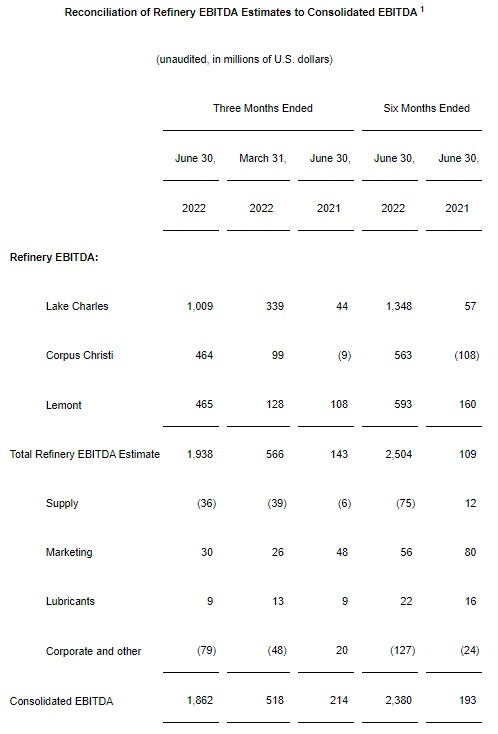

(Citgo, 11.Aug.2022) — Citgo Petroleum reported a second quarter net income of $1.29bn and EBITDA of $1.86bn compared to net income of $245mn and EBITDA of $518mn in the first quarter of 2022.

Highlights:

- Reported second quarter net income of $1.29bn and EBITDA 1 of $1.86bn

- Exceptional health, safety and environmental performance

- Record-setting refinery utilization and throughput

- Received two AFPM Safety Achievement awards

- Received ILTA Safety Excellence award

“Reliable and safe operations helped us capitalize on favorable market conditions that were supported by excellent product cracks, high refinery utilization and lean global inventories,” said Citgo President and CEO Carlos Jordá. “I am enormously proud of what we accomplished this quarter; not only has our work produced outstanding financial results thanks in large part to exceptional reliability and utilization rates at our refineries, our Health, Safety and Environmental performance was similarly excellent, as evidenced by multiple safety awards at Citgo refineries and terminals.”

Q2 2022 Highlights:

Strategic and Operational

- Throughput – Total throughput for the second quarter of 2022 was 837,000 barrels-per-day (bpd), of which crude runs were 776,000 bpd and intermediate feedstocks were 61,000 bpd. Refinery assets delivered strong reliability results – the best quarterly results in the last five years – with overall crude runs exceeding nameplate capacity and resulting in 101% utilization, marking three consecutive quarters above 94%. The Lake Charles refinery set a new quarterly crude throughput record of 436,000 bpd, significantly surpassing the previous record of 411,000 bpd set in third quarter of 2018.

- Operational Excellence – Health, Safety and Environmental (HSE) performance was exceptional, and the Company is on pace for record-setting occupational safety, process safety and environmental performance for 2022. Citgo was also recognized during the quarter with AFPM’s Safety Achievement Award for both the Lemont and Corpus Christi refineries, and ILTA’s Safety Excellence Award for terminals.

- Commercial Excellence – We continued growing our exposure into South America, with refined product exports increasing to an average of 195,000 bpd from 157,000 bpd in the first quarter of 2022.

RELATED STORY: Citgo Reveals Offer to Acquire $286mn of its 2024 Notes

Financial

- For capital spending, we invested $76mn on turnarounds and catalysts and another $59mn on capital projects.

- Under the Citgo Holding debt agreements, certain Excess Cash Flow (ECF) offers are required to be made to the Citgo Holding Term Loan B lenders and the Citgo Holding noteholders based on 50% of excess cash flow. Citgo Petroleum intends to dividend to Citgo Holding the amounts necessary to make prepayments of Citgo Holding debt pursuant to the ECF offers. Further details regarding the ECF offers are contained in the separate press release issued today, which is available here.

1 EBITDA/Adjusted EBITDA are non-GAAP financial measures. See page 3 of this release for additional information regarding EBITDA and Adjusted EBITDA and the reconciliations to the most directly comparable GAAP financial measure included with this release.

“Our second quarter results are the best in the history of the company,” continued Jordá, “and the opportunity to reduce our debt will help us further strengthen the company as we continue supplying our customers through safe, reliable and responsible operations.”

____________________