(Pampa Energía, 12.May.2021) — Pampa Energía S.A. (NYSE: PAM; Buenos Aires Stock Exchange: PAMP), the largest independent energy integrated company in Argentina, with active participation in the country’s electricity and gas value chain, announces the results for the quarter ended on 31 March 2021.

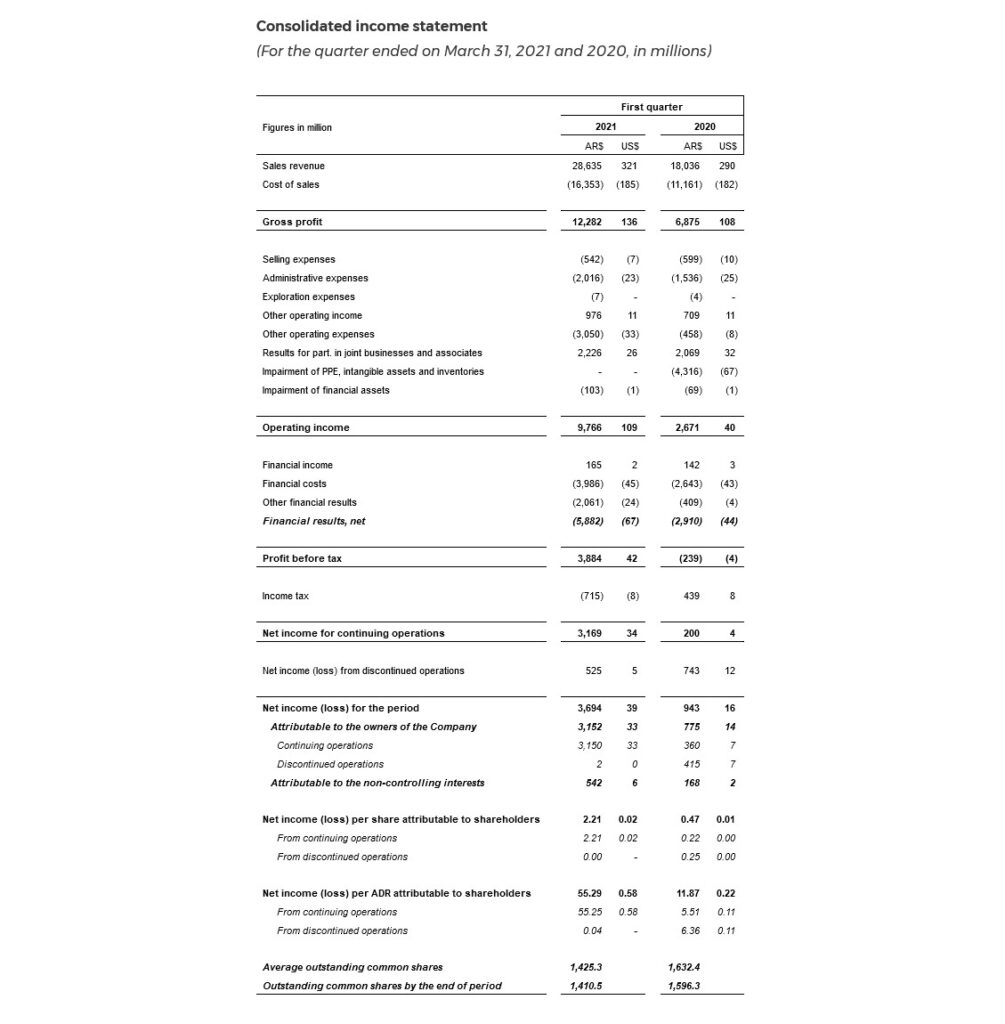

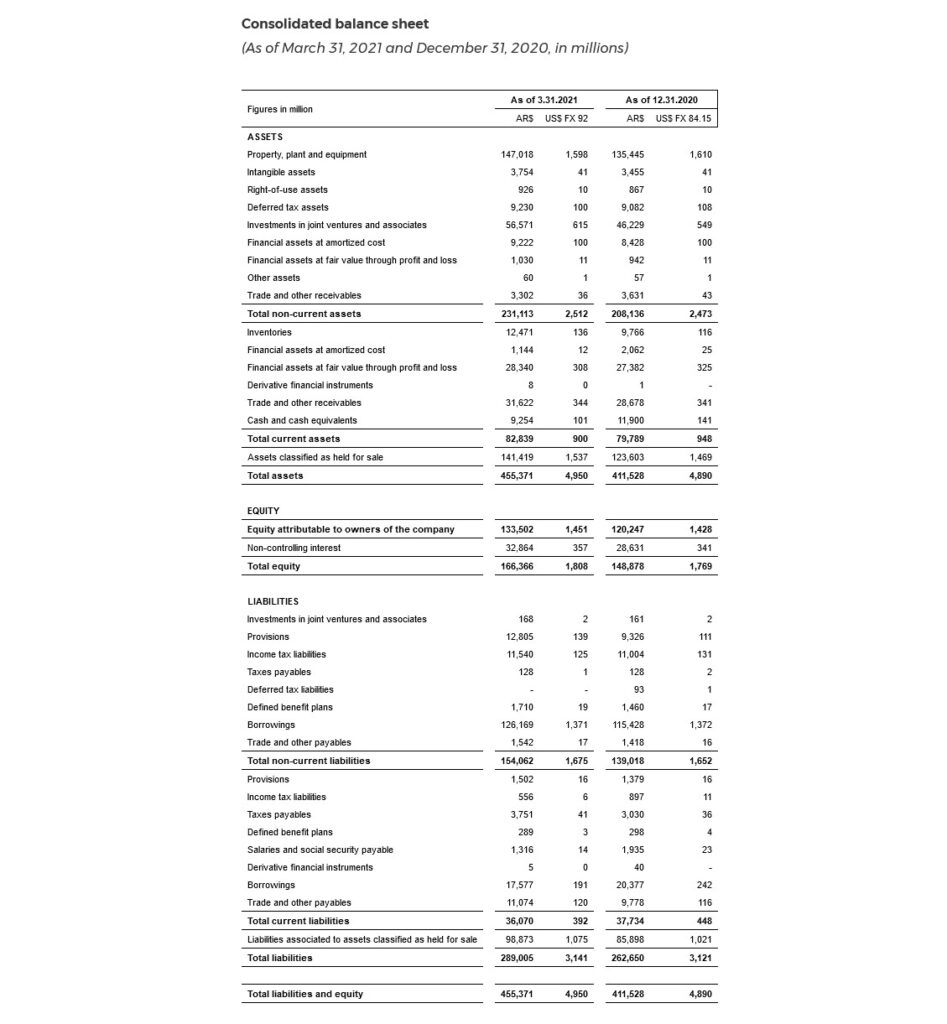

As of 1 January 2019, the company adopted US$ as functional currency for the reporting of its financial information. The presentation of this information in AR$ is converted at transactional nominal exchange rate (‘FX’).

However, Edenor (electricity distribution), Transener, TGS and Refinor (holding and others) record their operations in local currency. Thus, the Q1 21 figures are adjusted by inflation as of 31 March 2021 (6.1%), translated to US$ at closing FX of 92.00. Moreover, the Q1 20 figures are adjusted by inflation as of 31 March 2020 (3.8%), translated to US$ at closing FX of 64.47[1].

On 28 December 2020, it was announced the sale of the controlling stake in Edenor. Therefore, the electricity distribution segment is shown as a discontinued operation for the current and comparative periods. Its analysis is detailed in the Appendix of the Earnings Release.

Main results from the Q1 21[2]

Consolidated revenues from continuing operations of $321mn[3], 11% higher than the $290mn recorded in Q1 20, explained by the new combined cycle gas turbine at Genelba Thermal Power Plant (CTGEBA), thus higher own gas sales to cover said Power Purchase Agreement (‘PPA’), higher sale volumes and prices in petrochemicals and the recovery of oil and gas prices, partially offset by lower spot energy revenue and hydrocarbons volume sold.

- Power generation of 4,442 GWh from 15 power plants[4]

- Production of 43.7 thousand boe per day of hydrocarbons

- Sales of 98 thousand tons of petrochemical products

Consolidated adjusted EBITDA[5] from continuing operations of $204mn, 16% higher than the $175mn in Q1 20, mainly from petrochemicals, and to a lesser extent, from oil and gas, holding and others, and power generation.

Consolidated gain attributable to the owners of the company of $33mn, $19mn higher than Q1 20, mainly due to better operating margin and assets’ impairment loss in Q1 20 ($67mn), partially offset by higher losses from the holding of financial instruments and an income tax charge in Q1 21.

____________________