(Sempra, 30.Jun.2020) — Sempra Energy completed its business exit from South America, following the recently announced sale of its Chilean businesses, which generated approximately $2.23 billion in total cash proceeds, subject to post-closing adjustments.

The completion of the Chilean transactions concludes Sempra Energy’s sales of its South American businesses in both Chile and Peru, resulting in approximately $5.82 billion in combined total cash proceeds, subject to customary post-closing adjustments. The company’s investments are now focused in top-tier markets in North America.

“By successfully executing on a broad capital recycling program, the past two years have proven to be transformational for our company and have allowed us to efficiently concentrate our capital program on the most attractive markets in North America,” said Trevor I. Mihalik, executive vice president and chief financial officer of Sempra Energy.

Completion of Multi-Year Capital Recycling Program

The company is executing its mission to build North America’s premier energy infrastructure company by focusing on transmission and distribution (T&D) energy infrastructure in the most attractive markets in North America including California, Texas, Mexico and North America’s liquefied natural gas export market. Over the past two years, Sempra Energy has repositioned its infrastructure portfolio through the divestiture of non-core assets and is committed to invest a record $32 billion in capital over its 2020-2024 five-year plan with a focus on T&D investments in its Texas and California utilities.

In total, including the sale of the company’s South American businesses and the company’s U.S. renewables business and non-utility natural gas storage assets, which was completed in 2019, the company has generated approximately $8.3 billion in total cash proceeds from these divestitures.

“These proceeds are being used to support our growth initiatives, strengthen our balance sheet and return value to our owners,” said Mihalik.

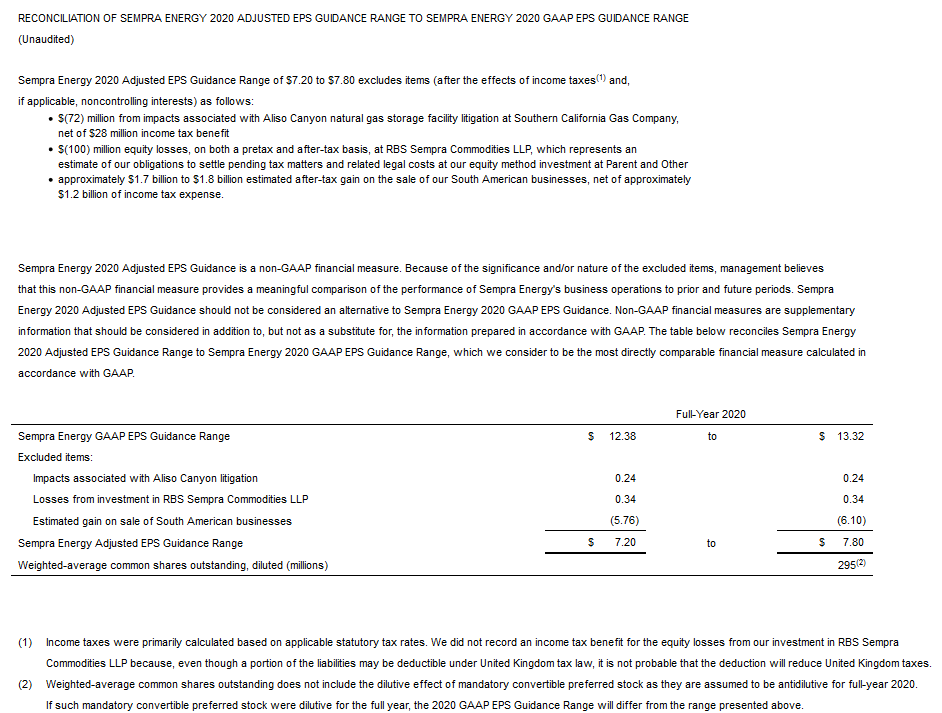

Company Raises 2020 EPS Guidance Ranges

As a result of enhanced visibility into earnings growth related to progress made on the company’s strategic plan, today Sempra Energy announced that it is raising its full-year 2020 GAAP earnings-per-share (EPS) guidance range to $12.38 to $13.32, from $11.88 to $13.02. The company’s full-year 2020 adjusted EPS guidance range also has been increased to $7.20 to $7.80, from $6.70 to $7.50.

Non-GAAP Financial Measure

Sempra Energy’s full-year 2020 adjusted EPS guidance is a non-GAAP financial measure (GAAP represents accounting principles generally accepted in the United States of America). For a reconciliation of this non-GAAP financial measure to its most comparable GAAP financial measure, refer to the table at the end of this document.

__________