(Bloomberg, 15.Apr.2020) — Argentina registered to issue more than $50 billion in new debt as it prepares to make a painful restructuring offer to holders of its sovereign bonds.

The filing to the U.S. Securities and Exchange Commission gives an inkling of how much in new securities the country anticipates issuing in the restructuring. President Alberto Fernandez will meet provincial governors at 4pm Thursday at the presidential residence to discuss details of the debt plan, according to a person with direct knowledge of the matter. Earlier Wednesday, he told journalists who had asked for details on the plan that “tomorrow is the day.”

The sum of new securities registered with the SEC could be increased as talks with creditors go forward, according to Ramiro Blazquez, head of strategy at Banctrust & Co in Buenos Aires. The government has said that $68.8 billion in overseas notes are eligible for restructuring.

“The amount registered under the SEC is not a final number. This is going to be an initial offer as the negotiation is only beginning, though I’m sure it will be a pretty bad one,” Blazquez said. “They are probably going to sweeten the offer throughout the negotiation as I don’t see Alberto taking chances on a default, particularly since economic conditions are extremely fragile.”

Investors are already pricing in a brutal outcome, with most of Argentina’s overseas bonds trading at about 30 cents on the dollar. The economy is set to contract for a third year as the country copes with a currency that’s lost almost two-thirds of its value in the past 24 months and inflation that exceeded 50% in February. The challenge has only grown worse amid the coronavirus pandemic.

The SEC filing cites the pandemic as a possible risk factor that could affect the securities’ value in the future.

What’s Next?

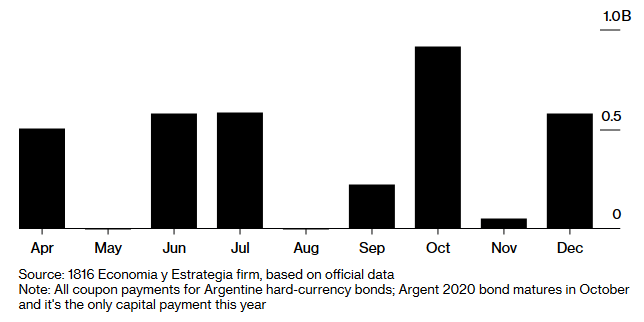

Argentina’s next hard currency bond payment is April 22

Last week, the government suspended all payments on foreign-currency securities issued in the domestic market for the rest of the year. For overseas bonds, Fernandez is seeking a negotiated settlement to avoid a hard default, allowing the country to shore up its finances as it embarks on an effort to bolster the economy. Argentina’s next coupon payment is for about $500 million on April 22.

“There’s a good chance the government will enter the 30-day grace period on the April 22 payments in order to speed up negotiations. The funds earmarked for debt payments are running out, and so far there been nothing said about new lending from international financial institutions,” Blazquez said.

The country’s gross domestic product will contract 5.7% in 2020, according to the International Monetary Fund.

Notes due in 2026 slipped 0.7 cent Wednesday to 27 cents on the dollar.

(Updates with President Fernandez’s comments on Thursday’s announcement in second paragraph)

By Jorgelina Do Rosario and Scott Squires

***