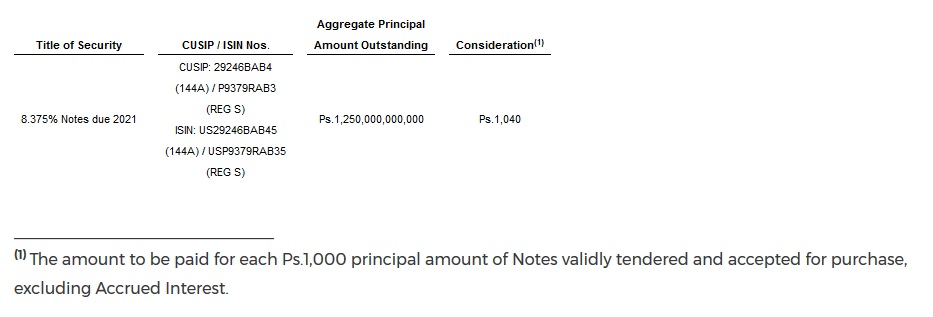

(EPM, 2.Jul.2019) — Empresas Públicas de Medellín E.S.P. (EPM) its offer to purchase for cash any and all of its outstanding 8.375% Notes due 2021 (CUSIP No.: 29246B AB4 (144A) / P9379R AB3 (Reg S) / ISIN No.: US29246BAB45 (144A) / USP9379RAB35 (Reg S)) (the “Notes”), from beneficial owners thereof (each, a “Holder” and collectively, the “Holders”), at the price set forth below, upon the terms and subject to the conditions set forth in the Offer to Purchase, dated July 2, 2019 (as it may be amended or supplemented from time to time, the “Offer to Purchase”) (the “Offer”). As of July 1, 2019, the aggregate principal amount of Notes outstanding was Ps.1,250,000,000,000. Capitalized terms not defined herein shall have the meaning ascribed to them in the Offer to Purchase.

Global Bondholder Services Corporation is acting as the tender agent (in such capacity, the “Tender Agent”) and as the information agent (in such capacity, the “Information Agent”) for the Offer. HSBC Securities (USA) Inc., J.P. Morgan Securities LLC and Scotia Capital (USA) Inc. are acting as Dealer Managers for the Offer (the “Dealer Managers”).

EPM’s obligation to purchase Notes in the Offer is conditioned on the satisfaction or waiver of certain conditions described in the Offer to Purchase, including the Financing Condition. The Offer is not conditioned upon the tender of any minimum principal amount of Notes. The consideration for each Ps.1,000 principal amount of Notes validly tendered and accepted for purchase pursuant to the Offer shall be the tender offer consideration as set forth in the table below (the “Consideration”). The Consideration will be payable in U.S. dollars and converted at the representative market rate for the purchase of U.S. dollars with Colombian pesos as calculated and published by the Superintendence of Finance of Colombia (Superintendencia Financiera de Colombia) at the end of the Business Day prior to the Expiration Date. In addition, Holders who validly tender and do not validly withdraw their Notes in the Offer will also be paid accrued and unpaid interest from, and including, the last interest payment date up to, but not including, the Settlement Date (as defined below) (“Accrued Interest”). In the event of a termination of the Offer with respect to the Notes, neither the Consideration nor any Accrued Interest will be paid or become payable to Holders and all Notes tendered pursuant to the Offer will be promptly returned to the tendering Holders.

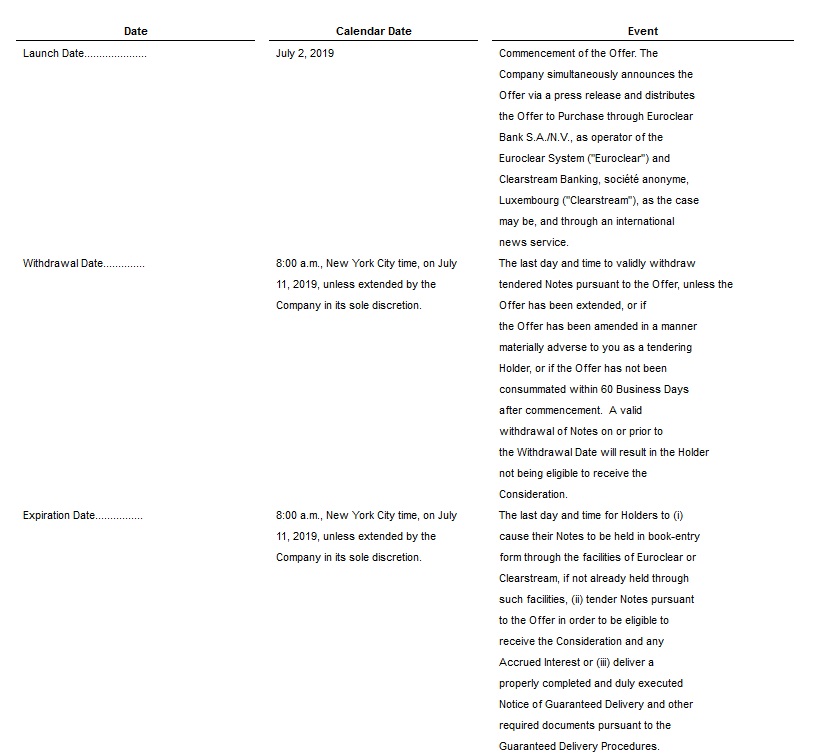

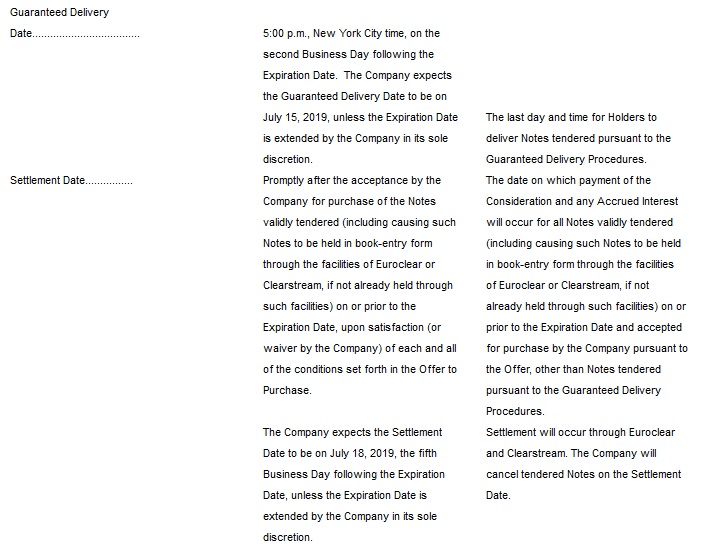

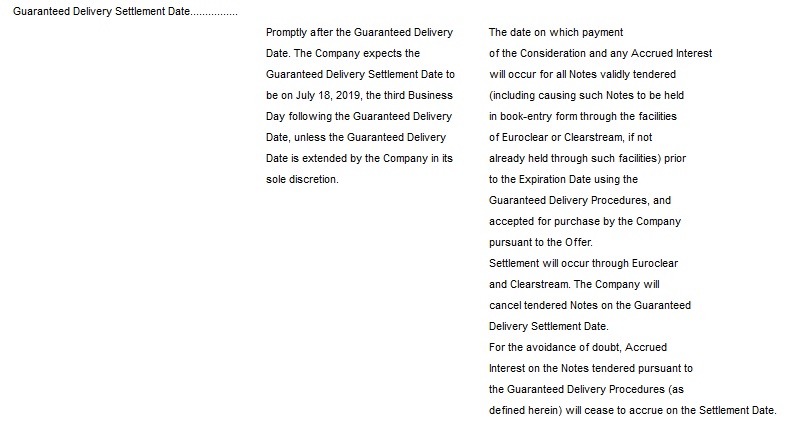

Subject to the terms and conditions of the Offer, EPM expects to accept for purchase and pay for, promptly following the Expiration Date, all of the Notes validly tendered pursuant to the Offer and not validly withdrawn. With respect to Notes accepted for purchase and delivered on or prior to the Expiration Date, if any, the Holders thereof will receive payment of the Consideration for such accepted Notes promptly following the Expiration Date, with the date on which EPM deposits with the clearing systems the aggregate Consideration for such Notes, together with an amount equal to Accrued Interest thereon, being referred to as the “Settlement Date.” With respect to accepted Notes delivered pursuant to the Guaranteed Delivery Procedures described in the Offer to Purchase, the Holders thereof will receive payment of the Consideration for such Notes on the third business day after the Guaranteed Delivery Date, together with an amount equal to the Accrued Interest to but not including the Settlement Date, such date being referred to as the “Guaranteed Delivery Settlement Date”. For the avoidance of doubt, Accrued Interest on the Notes tendered pursuant to the Guaranteed Delivery Procedures will cease to accrue on the Settlement Date. Under no circumstances will any interest be payable because of any delay in the transmission of funds to Holders by the Tender and Information Agent or the clearing systems.

Holders should take note of the following dates in connection with the Offer:

All of the Notes shall represent beneficial interests held in book-entry form through the facilities of Euroclear or Clearstream to be tendered in the Offer. All record holders whose Notes are not already held through the facilities of Euroclear or Clearstream shall cause their Notes to be held in book-entry form through the facilities of Euroclear or Clearstream prior to the Expiration Date to be able to participate in the Offer. Such record holders are advised to check with any bank, securities broker or other intermediary (each, a “Nominee”) through which they hold Notes in the facilities of the Depository Trust Company (“DTC”) as to when such intermediary and DTC would need to receive instructions from a record holder in order for that record owner to be able to cause its Notes to be held in book-entry form through the facilities of Euroclear or Clearstream prior to the Expiration Date and be to participate in, or withdraw its instruction to participate in, an Offer before the deadlines specified in the Offer to Purchase.

You are advised further to check with the Nominee through which you hold your Notes as to the deadlines by which such Nominee would require receipt of instructions from you to participate in the Offer in accordance with the terms and conditions of the Offer as described in the Offer to Purchase in order to meet the deadlines set out above. The deadlines set by Euroclear, Clearstream or any such intermediary for the submission of tenders of Notes may be earlier than the relevant deadlines specified in the Offer to Purchase. You may only submit tenders through Euroclear or Clearstream. You will NOT be able to submit tenders through DTC.

Notes may be tendered and accepted for purchase only in principal amounts equal to minimum denominations of Ps. 20 million and integral multiples of Ps.2 million in excess thereof. No alternative, conditional or contingent tenders will be accepted. All references in the Offer to Purchase to (i) “Ps.” are to Colombian pesos and (ii) “U.S.$” are to U.S. dollars.

If the conditions to the Offer are not satisfied or if the company chooses to delay, extend, terminate or modify the terms of the Offer, it will notify the Tender and Information Agent in writing and make a public announcement as promptly as practicable. In the case of a termination, all Notes tendered pursuant to the terminated Offer and not accepted for purchase will be returned promptly to the tendering Holders.

The minimum period during which the Offer will remain open following material changes in the terms of the Offer or in the information concerning the Offer will depend upon the facts and circumstances of such change, including the materiality of the changes. If any of the terms of the Offer are amended in a manner determined by the Company to constitute a material change adversely affecting any Holder, the Company will (i) promptly disclose any such amendment in a manner reasonably calculated to inform Holders of such amendment, (ii) extend the Offer for a period that the Company deems appropriate, subject to applicable law, depending upon the significance of the amendment and the manner of disclosure to Holders, if the Offer would otherwise expire during such period, and (iii) extend withdrawal rights for a period that the Company deems appropriate to allow tendering Holders a reasonable opportunity to respond to such amendment.

Without limiting the manner in which any public announcement may be made in relation to the Offer, EPM shall have no obligation to publish, advertise or otherwise communicate any such public announcement other than by issuing a press release through a widely disseminated news or wire service disclosing the basic terms of the Offer and otherwise consistent with the no-action letter of the staff of the Division of Corporation Finance of the United States Securities and Exchange Commission (the “SEC”), relating to abbreviated tender or exchange offers for non-convertible debt securities.

Any Notes that are tendered may be withdrawn at any time prior to the Expiration Date (such time and date, as it may be extended, the “Withdrawal Date”).

***