(Energy Metal News, 14.Sep.2018) — Speaking of high grade lithium, NRG Metals just put out a press release (OCT 3, 2018) that states, “NRG Reports High Lithium Grades For Measured And Indicated Resource……“) so I don’t need to tell you how significant this news is in a world where almost every other junior Lithium company doesn’t even have a resource, they are simply trying to find one… This is not the case here with NRG Metals, and the potential in this energy starved World is absolutely massive! – REVIEW THEIR RECENT PRESS FROM OCTOBER 3, 2018 HERE – It’s truly just a matter of time for NRG Metals.

As most investors already know, lithium is the crucial white powder for revolutionizing the future of energy in the form of Lithium-ion batteries. It’s in record high demand thanks to automakers like Tesla and others who are looking to double or even triple EV (Electric Vehicle) production over the next few years.

In fact, majors like Tesla and Volkswagen will more than just double or triple their EV production in the next few years, upon starting from a small base. Tesla hopes to sell 500k in 2018 and 1 million EVs in 2020. Volkswagen expects 2-3 million sales in 2025. [1]

In March of 2016, Tesla CEO Elon Musk stated, “In order to produce half a million cars a year… we would basically need to absorb the entire world’s lithium- ion production.” [2]

The Wall Street Journal backed this too stating, “Tesla and other electric-vehicle makers are swallowing up lithium for its use in lithium-ion batteries that power electric cars.”

Goldman Sachs took things even further in their detailed report on Lithium declaring that lithium is the “new gasoline,” according to Bob Koort, head of Industrials and Materials research, Goldman Sachs Research who stated, “We think Lithium ion batteries will help fuel a dramatic increase in electric vehicle penetration.” [3]

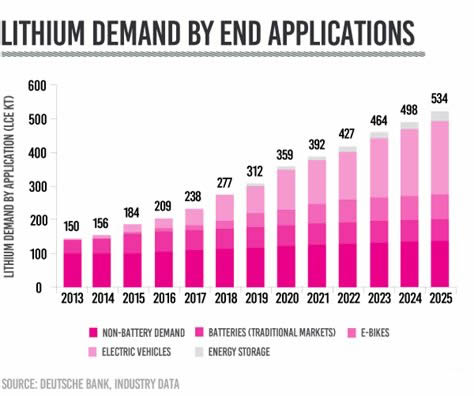

The Demand For Lithium WILL Continue To Grow Year After Year, As An Example, Take A Look At The Chart Below To Get An Idea Of Where We Are Headed.

NRG Metals Inc. (OTCQB: NRGMF / TSX: NGZ) looks to be that diamond in the rough we’ve all been waiting for. All star management with a proven track record (Read below), located in the World’s TOP mining region for Lithium, and base priced at pennies on the dollar, we could be in store for some major gains with this company.

Large lithium players are up on recent rising demand. Among our surveyed group, our leading two selections had a three-year performance for investors of 64.59% and 50.82% respectively.

Take note: the leading lithium producers are on the ground in South America – the world’s leading hot spot for lithium production.

Leading Junior Lithium Players Show Bigger Gains – Up 340%+ Since Making Major Lithium Advances.

We diligently sifted through the field and came across three junior lithium players whose price increased as much as 529% + since announcing significant advances in lithium deals, while one junior company (NRG Metals) made significant advances, but has yet to be impacted or justly acknowledged by the market. We think this stock looks like an easy double or triple, at the very least.

We sampled a group of early lithium participants, all of which are junior exploration or mining companies advancing lithium projects. Each of them saw major gains after structuring financing and advancing interests in lithium:

Lithium X – 529% gain – after announcing acquisitions next to Albemarle Corp. (the world’s leading producer) and advancing two projects in Argentina.

Nemaska Lithium – 329% gain – after announcing capital raises and making headway on lithium plant operations in Quebec.

Millennial Lithium – 345% gain – after entering reaching option agreements on Argentinean lithium operations and capital structuring.

Between all three, that’s an average gain of over 400%.

We used this model an applied it to identify a similar player with the same profile at the pre-discovery stage: NRG Metals Inc.

NRG Metals Inc. — Breaking Ground in South America

Argentina is already one of the world’s top lithium producing countries, however, now more than ever, it has significant additional potential. The country contains several mineralized salars or salt fields including the Hombre Muerto and Salar Olaroz properties producing lithium. Also, it is a country with a longstanding and successful mining history.

NRG Metals is a Canadian-based mining company, but its lithium interests are in Argentina. The company’s projects are all strategically located within the Lithium Triangle, in close proximity to one of the largest known lithium deposits in Argentina. Their real estate reside within the Puna Region, an elevated plateau, which lies on the eastern side of the Andes Mountains.

While maintaining its headquarters within Canada’s respected mining community, we like how NRG has attracted strong management hailing from many of Argentina’s most well-known lithium mining companies.

In fact, Chief Operating Officer Jose de Castro was the man responsible for identifying and building the world’s most recent lithium brine project, the Salar de Olaroz Lithium Facility, for Orocobre. Project Manager Fernando Villarroel also has a solid background in Argentine lithium, with experience that includes designing the pilot plant for Lithium Americas.

Often in this business, management above the ground is as important as what lies beneath the ground. We will get to that point next.

Two Ways to Win

Exploration stage companies live and die on their drill results—as the old saying goes, “two shots are better than one.”

NRG Metals Inc. is advancing two lithium brine projects in the heart of this key Argentinian region. Its “big exploration shot” is the 29,000-hectare Salar Escondido lithium project, which just received drilling approval from the Province of Catamarca.

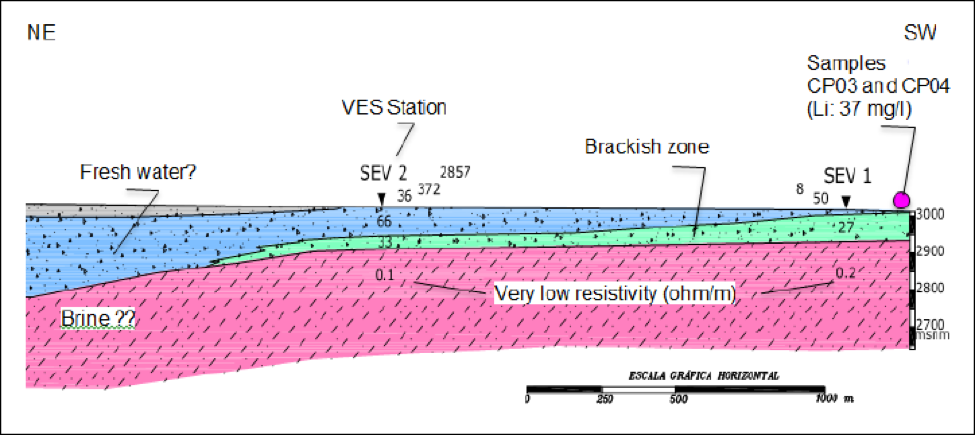

To date, NRG has completed sampling work at surface that returned anomalous lithium values. More importantly, they completed a Vertical Electric Sounding geophysical program at surface, which identified a zone deeper down that appears to be a brine zone. The all-important “highly conductive with low resistivity zone,” is depicted on the cross sectional below…

V.E.S. is a proven technology that measures the resistivity of zones, and has led to the discovery of many lithium deposits in South America—In short, it identifies potential brine zones that are the host for lithium deposits.

NRG’s next stage is to drill up to six test wells to confirm the expectation that the conductive zone within this large basin contains lithium. Management has now signed off a drill contract and expects to be drilling in the very near future.

Location, Location, Location

The Hombre Muerto North Lithium Project (or ‘HMNL’) sits right beside FMC’s lithium-producing Fenix Mine, and Galaxy Resources’ Sal de Vida Lithium Project, both in the province of Salta. Location here is everything as the Hombre Muerto Salar is one of the most explored in Argentina. Work by Galaxy Resources, a big Australian lithium player right next door, has confirmed that the higher-grade areas of the salar are trending north, towards the NRG land package. A drill hole released by Galaxy in this area returned lithium values from 564 mg/L Li to 895 mg/L Li—(IMPORTANT NOTE: that hole is only 750 meters south of the NRG claim border).

Recent sampling on the NRG claim blocks returned even higher lithium values. So based on the available data, NRG has applied for permission to drill up to six exploration test wells, six pumping wells, and complete initial evaporation test pond construction. This should be easy work with potentially really good results. They should get permission to drill shortly.

The NRG land package is currently 3,287 hectares, and can still likely become significantly larger.

There is a lot more going on behind the scenes for NRG, but these two projects show a balanced company approach. By drilling both a high-risk, high-reward exploration shot, and also balancing the risk with work within a known exploration area, there should be very interesting news flow from NRG in the immediate future.

***