(Energy Analytics Institute, 23.Oct.2023) — US-based Chevron Corporation will acquire Hess Corporation for US$60bn (including net debt), the second giant transaction of Oct. 2023 following the $65bn move by ExxonMobil to acquire Pioneer Natural Resources Company, both in all-stock transactions, Welligence Energy Analytics wrote 23 Oct. in a social media post.

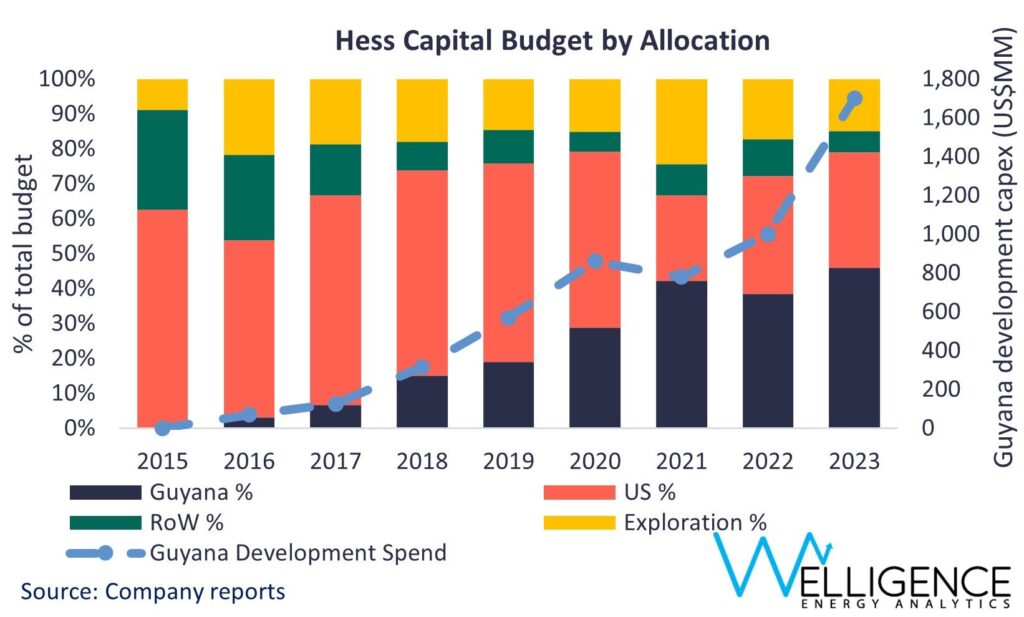

“The value in this deal is underpinned by Hess’ Bakken and Guyana portfolios, its two core positions. Chevron has no exposure to either. The Major will also acquire incremental production in US GoM, and a gas-producing portfolio in Malaysia/Thailand,” Welligence said.

Welligence continued:

“Sector consolidation has been on the agenda in recent years, and is becoming a reality. Interestingly, while ExxonMobil doubled down on the Permian, with its short-cycle resource base, Chevron is building out more conventional exposure. The company has relatively weak exposure to the deepwater Atlantic Margin compared to majority of its peers – taking Hess’ 30% in the ExxonMobil-operated world-class Stabroek project in Guyana will address this gap in the portfolio. Year on year, the Guyana Basin has been absorbing a greater portion of Hess’ spend. We anticipate further consolidation, particularly in the North American independents’ space.”

____________________

By Piero Stewart. © Energy Analytics Institute (EAI). All Rights Reserved.