(Rystad, 17.Oct.2023) — A reported deal between the US and Venezuela to ease sanctions on the South American country’s oil industry could pave the way for a medium-term increase in production of 200,000 barrels per day (bpd).

The deal, reported by US media on Monday, would see the US ease sanctions on Venezuela in return for a fair and competitive presidential election in the beleaguered Latin American producer next year.

News of the apparent deal took around $1 off the price of a barrel of Brent crude in early trading on Tuesday.

If sanctions are lifted, Venezuelan oil output could increase from 2024.

However, the potential expansion is hindered by the prolonged lack of investments in the industry.

In the short term – six months after sanctions are lifted – production could only ramp up by a maximum of 200,000 bpd; a relative drop in the ocean on the global stage.

An increase in global oil production would be much needed after a turbulent 2023 for supplies, which saw the reshuffling of trade flows following Russia’s invasion of Ukraine, voluntary production cuts from Saudi Arabia of 1 million bpd until December this year, and the recent outbreak of the Israel-Hamas conflict.

Assuming sanctions on Venezuela are lifted, however, it is unlikely that a production boost from the country would be able to bring significant relief to oil markets in the short term.

Easing of sanctions

Appetite for easing sanctions on Venezuela has increased following the onset of war in Ukraine and the consequent mounting pressure on global energy supplies.

The US government started to ease the sanctions under the administration of current President Joe Biden.

In May 2022, oil-for-debt licenses were issued to Eni and Repsol to support European partners during the energy crisis, which was particularly acute in Europe last winter on account of the war and resulting loss of Russian supplies to the continent.

However, Venezuelan oil volumes received by Europe were modest, with the concession from the US effectively proving only symbolic.

In November 2022, Chevron received a six-month license from the Treasury authorizing the company to produce petroleum or petroleum products in Venezuela.

Chevron’s production of Venezuelan crude peaked at almost 100,000 bpd in 2016, but this was halved after 2019.

The easing of sanctions came after the resumption of political talks in Mexico City, mediated by Norway, between the Maduro government and the opposition, including the faction backed by the US and led by Guaidó.

The parties signed a broad ‘social accord’ to create a United Nations (UN)-administered fund to provide humanitarian aid to the Venezuelan people; however, the talks stalled.

Latest developments

Progress in talks between Venezuela and the US were made earlier this month, with the Caracas government set to approve a return to Mexico-based negotiations with the country’s political opposition.

The Biden administration is demanding the Maduro government removes bans on opposition candidates ahead of next year’s presidential elections and, as part of previous informal talks held in Qatar, the US would in return be willing to lift some oil and banking sanctions on Venezuela.

According to recent informal talks, the deal could allow the Venezuelan government to re-engage with financial institutions and recover around $3bn of assets frozen in accounts in Europe.

Additionally, the US administration would lift some oil sanctions via authorizations that would allow foreign energy companies to take Venezuelan crude for debt repayment.

Oil production signals

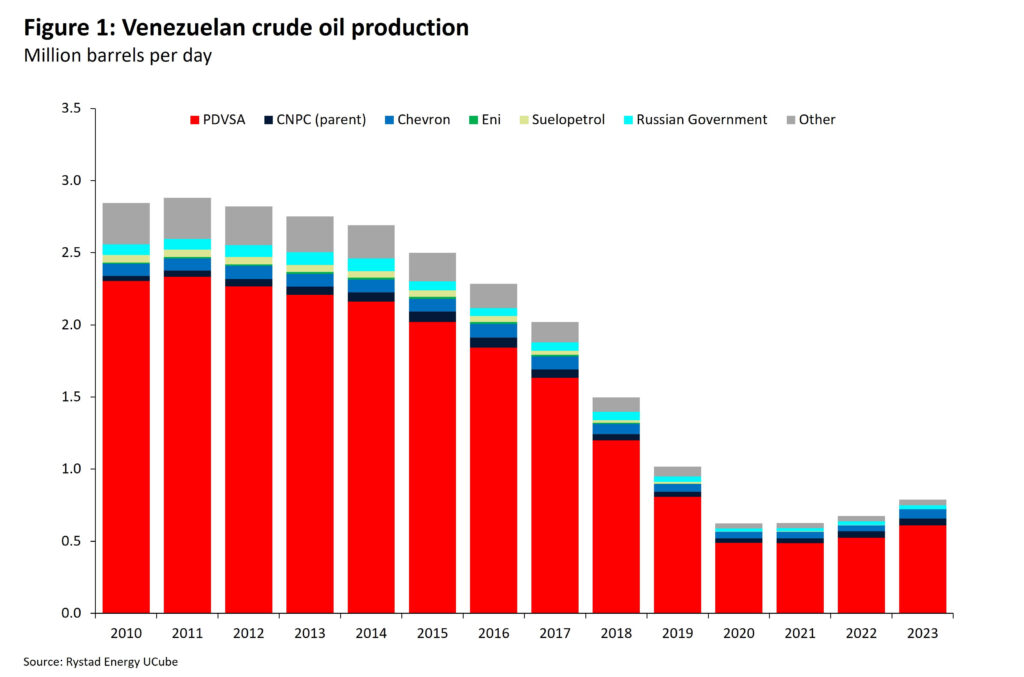

Before the sanctions were imposed, Venezuela produced almost 3 million bpd of crude oil.

Production then fell to just above 600,000 bpd in 2020, since when output has gradually recovered to 824,000 bpd in September this year.

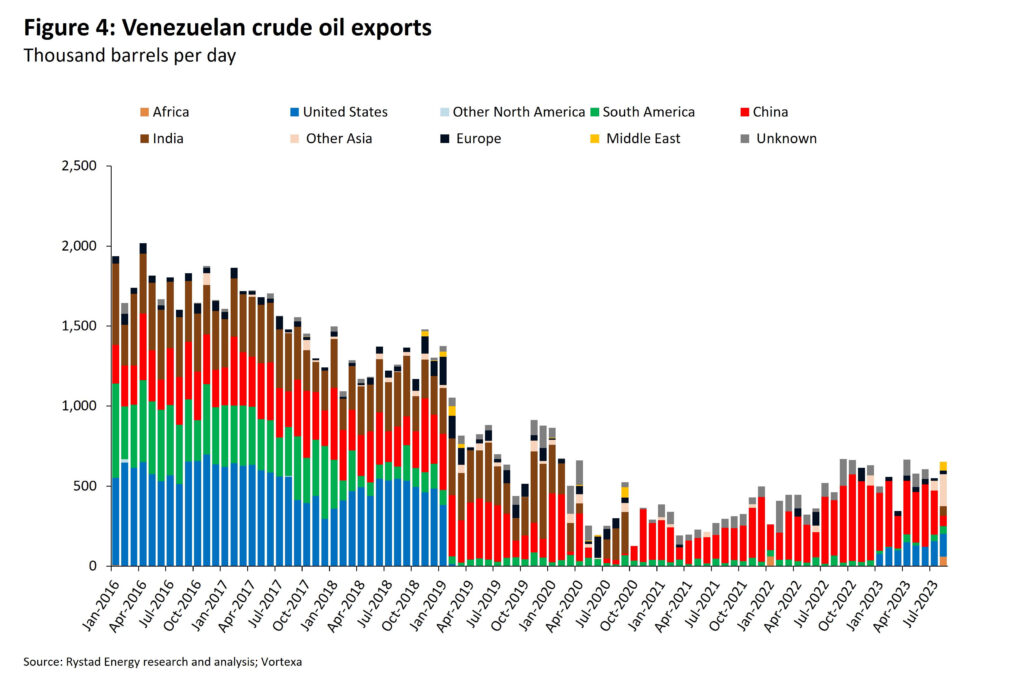

In line with the observed marginal increase in production in the last couple of years, crude oil exports have increased since 2022, with flows primarily directed to mainland China, which took 340,000 bpd in 2022 as against 200,000 bpd the previous year.

Overall, exports have reached an average of 560,000 bpd in 2023 as of August, a 250,000 bpd increase since 2021.

The latest figures are, however, still shy of the historical pre-embargo export levels above 1.5 million bpd.

The export rise responded mainly to the re-activation of extra-heavy crude upgraders in the eastern Orinoco Belt and new imports of Iranian condensate and US heavy naphtha, shipped by Chevron – shipments that were not allowed prior to November 2022 and that are crucial for refining and crude blending operations.

A further increase in exports will, however, depend on an extension of diplomatic relations in the region on top of the continued availability of crude.

____________________

By Sofia Guidi Di Sante, Senior Oil Market Analyst – Rystad Energy