(Cheniere, 12.Dec.2022) — Cheniere Energy, Inc. (NYSE American: LNG) announced today the expiration of its cash tender offer to purchase any and all of the $1.25bn aggregate principal amount of the outstanding 7.000% Senior Secured Notes due 2024 issued by Cheniere Corpus Christi Holdings, LLC (“CCH”).

The tender offer described herein was made on the terms and conditions set forth in the Offer to Purchase, dated 5 December 2022 and the related Notice of Guaranteed Delivery. Capitalized terms used but not defined in this announcement have the meanings given to them in the Offer to Purchase.

The Offer to Purchase expired at 5:00 p.m., New York City time, on 9 December 2022 (the “Expiration Date”). The settlement date for the Offer will be 14 December 2022 (the “Settlement Date”).

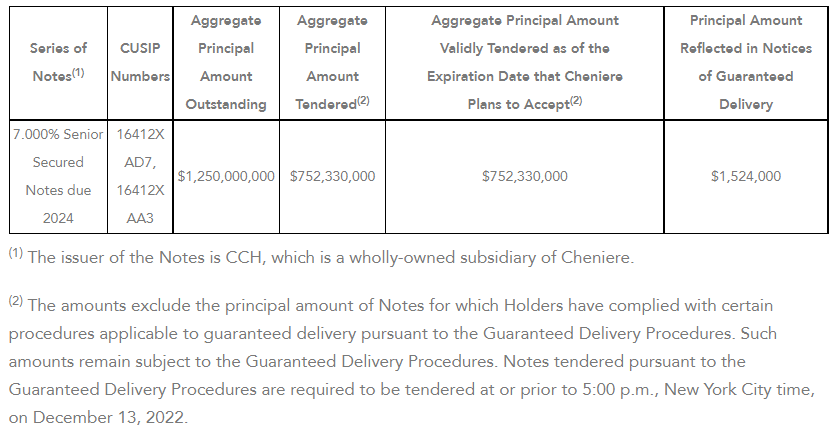

According to information provided by D.F. King & Co., Inc., $752,330,000 aggregate principal amount of the Notes were validly tendered prior to or at the Expiration Date and not validly withdrawn. In addition, $1,524,000 aggregate principal amount of the Notes were tendered pursuant to the guaranteed delivery procedures set forth in the Offer to Purchase (the “Guaranteed Delivery Procedures”) and remain subject to the Holders’ performance of the delivery requirements under such procedures. The table below provides certain information about the tender offer, including the aggregate principal amount of the Notes validly tendered and not validly withdrawn prior to the Expiration Date and the aggregate principal amount of Notes reflected in Notices of Guaranteed Delivery delivered at or prior to the Expiration Date.

Overall, Cheniere plans to accept for purchase $752,330,000 combined aggregate principal amount of Notes under the tender offer (excluding Notes delivered pursuant to the Guaranteed Delivery Procedures).

Holders of Notes must validly tender and not validly withdraw their Notes, or submit a Notice of Guaranteed Delivery and comply with the related procedures, prior to the Expiration Date in order to be eligible to receive the Consideration for each $1,000 principal amount of the Notes in cash on the Settlement Date. In addition to the Consideration, Holders whose Notes are accepted for purchase will receive a cash payment representing the accrued and unpaid interest on such Notes from the last interest payment date up to, but not including, the Settlement Date. Interest will cease to accrue on the Settlement Date for all accepted Notes, including those tendered through the Guaranteed Delivery Procedures.

For holders who delivered a Notice of Guaranteed Delivery and all other required documentation at or prior to the Expiration Date, upon the terms and subject to the conditions set forth in the Offer to Purchase and Notice of Guaranteed Delivery, the deadline to validly tender Notes using the Guaranteed Delivery Procedures will be 5:00 p.m., New York City time, on 13 December 2022.

Cheniere has retained BofA Securities to act as the dealer manager and D.F. King & Co., Inc. to act as the tender and information agent for the tender offer. For additional information regarding the terms of the tender offer, please contact BofA Securities at (980) 388 3646, (888) 292 0070, or debt_advisory@bofa.com. Requests for copies of the Offer to Purchase and questions regarding the tendering of Notes may be directed to D.F. King & Co., Inc. at (212) 269-5550 (for banks and brokers) or (888) 280-6942 (all others, toll-free) or email cheniere@dfking.com. The Offer to Purchase, and the related Notice of Guaranteed Delivery can be accessed at the following link: www.dfking.com/cheniere.

____________________