(GeoPark, 11.Apr.2022) — GeoPark Limited announced its operational update for the three-month period ended March 31, 2022 (“1Q2022”).

All figures are expressed in US Dollars. Growth comparisons refer to the same period of the prior year, except when otherwise specified.

Highlights

Accelerating Production Growth

- Consolidated oil and gas production of 38,626 boepd – up 6% adjusting for divestments in Argentina

- Production in Colombia of 33,738 boepd, up 6% vs 4Q2021

- Indico oil field in the CPO-5 block (GeoPark non-operated, 30% WI) added over 8,000 bopd gross in 1Q2022 and is now producing over 19,000 bopd gross, ranking as one of the top 10 highest oil-producing fields1 in Colombia

Drilling and Finding Oil and Gas

- Consolidated Results: Put on production 13 gross new productive wells, including 2 successful exploration wells

- Llanos 34 block (GeoPark operated, 45% WI) – Llanos basin – Colombia:

- Drilled and put on production 7 gross development wells in the Tigana, Jacana and Tigui oil fields

- CPO-5 block – Llanos basin – Colombia:

- Put on production the Indico 4 development well, producing 4,200 bopd gross of light oil

- Drilled the Indico 5 development well, currently testing 4,000 bopd gross of light oil

- Drilling rig currently moving to spud the Urraca 1 exploration well in April 2022

- Platanillo block (GeoPark operated, 100% WI) – Putumayo basin – Colombia:

- Put on production two development wells, producing 690 bopd of light oil on aggregate

- Perico block (GeoPark non-operated, 50% WI) – Oriente basin – Ecuador:

- Two light oil discoveries – Jandaya and Tui oil fields, producing 2,000 bopd2 gross

- Espejo block (GeoPark operated, 50% WI)- Oriente basin – Ecuador:

- Ongoing 3D seismic, targeting to spud the first exploration well in 2H2022

- Fell block (GeoPark operated, 100% WI) – Magallanes basin – Chile:

- Drilled the Jauke Oeste 2 gas well, expected to be completed in 2Q2022

Expanding Growth Fairway and Strengthening Portfolio

- Colombia: Acquired the CPO-4-1 block (GeoPark non-operated, 50% WI), an attractive low-risk, low-cost exploration block3, approximately 50% covered with 3D seismic, and strategically located adjacent to the CPO-5, the Llanos 94 (GeoPark non-operated, 50% WI) and the Llanos 123 (GeoPark operated, 50% WI) blocks

- Brazil: GeoPark to maintain its 10% non-operated WI in the Manati gas field as deadline to complete the divestment expired on March 31, 2022

- Argentina: Completed the divestment of non-core Aguada Baguales, El Porvenir and Puesto Touquet blocks (GeoPark operated, 100% WI) on January 31, 2022

Giving Back to Shareholders and Reducing Debt

- Repurchased $28.2mn of the 2024 Notes during 1Q2022 and until April 8, 2022 in open market transactions at prices below the call option, reducing gross debt and providing financial cost savings

- Doubled Quarterly Dividend to $0.082 per share, or $5.0mn, paid on March 31, 2022

- Acquired 231,836 shares for $3.1mn under the company’s discretionary share buyback program while executing self-funded work programs and paying down debt

- $112mn of cash & cash equivalents at March 31, 20224

Work Program Generating Strong Cash Flow

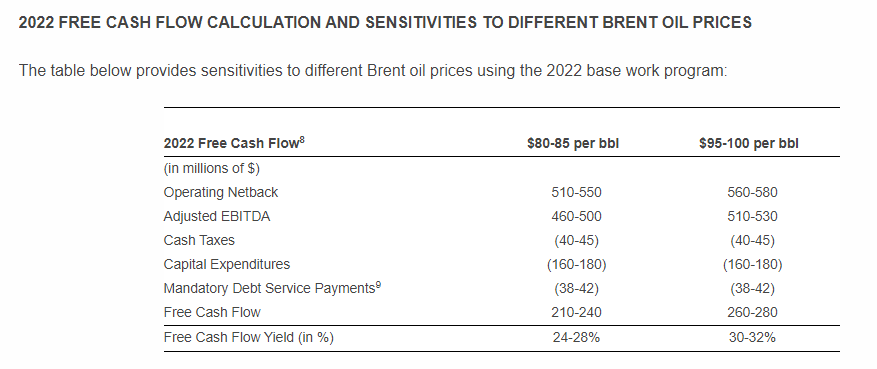

- Self-funded 2022 capital expenditures program of $160-180mn to drill 40-48 gross wells

- At $95-100/bbl Brent, the work program generates approximately $260-280mn free cash flow, a 30-32% yield

- Free cash flow use priorities include funding incremental organic capital projects, partial or total repayment of the 2024 Notes, increasing shareholder returns and other corporate purposes

- Drilling of 10-12 gross wells in 2Q2022, targeting development, appraisal, and exploration projects, including initiation of the exploration drilling campaign in the CPO-5 block

- The company plans to review its current 35,500-37,500 boepd production guidance in May 2022, jointly with releasing its 1Q2022 financial results, to reflect ongoing drilling results, incremental work program underway, and adding back production from the Manati gas field in Brazil5

Oil and Gas Production Update

Consolidated:

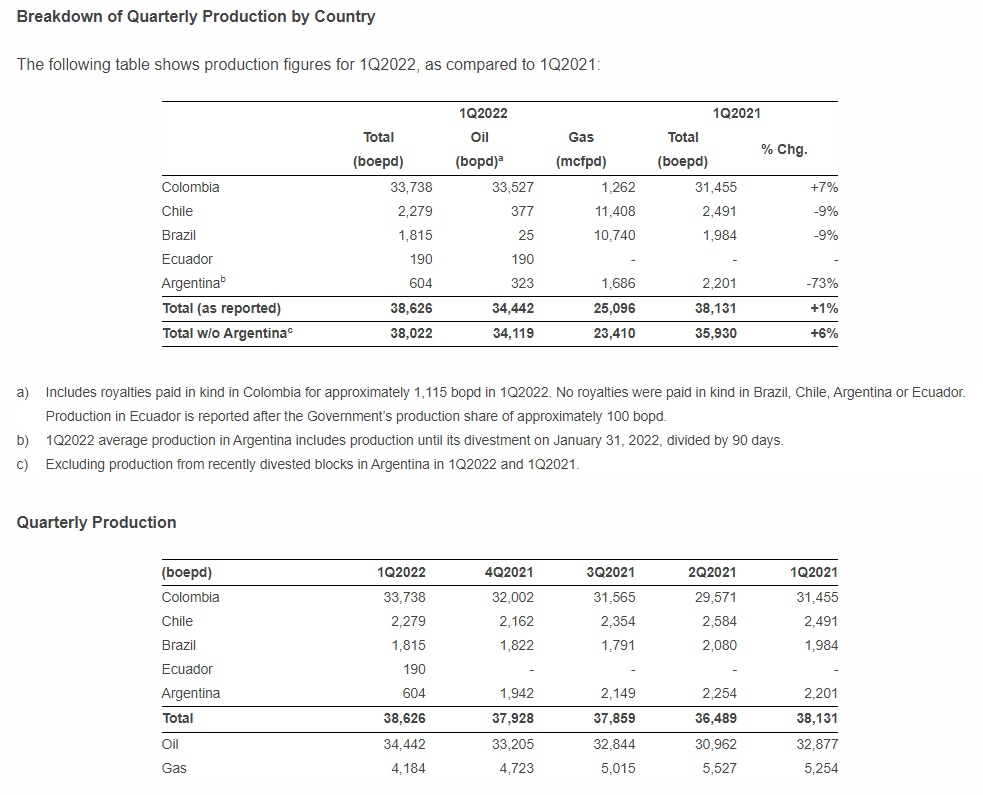

Oil and gas production in 1Q2022 was 38,626 boepd. Adjusting for recent divestments in Argentina, consolidated oil and gas production increased by 6% compared to 1Q2021, due to higher production in Colombia and recent exploration successes in Ecuador, partially offset by lower production in Chile and Brazil.

Oil represented 89% and 86% of total reported production in 1Q2022 and 1Q2021, respectively.

Colombia:

Average net oil and gas production in Colombia increased by 7% to 33,738 boepd in 1Q2022 compared to 31,455 boepd in 1Q2021 resulting from increased production in the Llanos 34, CPO-5 and Platanillo blocks.

Oil and gas production highlights in main blocks in Colombia:

- Llanos 34 block net average production in 1Q2022 increased by 6% to 26,469 bopd (or 58,818 bopd gross), compared to 24,866 bopd (or 55,258 bopd gross) in 1Q2021

- CPO-5 block net average production in 1Q2022 increased by 15% to 4,545 bopd (or 15,150 bopd gross), compared to 1Q2021, or 87% up compared to production prior to GeoPark’s acquisition in January 2020

- The Indico oil field in the CPO-5 block, currently producing over 19,000 bopd gross by natural flow and from just four wells, ranks as one of Colombia’s top 10 highest-producing oil fields6

- The Indico field (discovered in December 2018) continues showing strong reservoir performance, as shown by the Indico 1 well that is still producing 5,200 bopd by natural flow with a 0.1% water cut, and has accumulated production of over 5.5 mn barrels of oil

- Platanillo block average production in 1Q2022 increased by 11% to 2,329 bopd, compared to 2,100 bopd in 1Q2021. The block is currently producing 2,600 bopd

Ongoing Drilling Activities in the CPO-5 block

- Put on production the Indico 4 development well (spudded in December 2021), currently producing 4,200 bopd gross of light oil with 0.1% water cut

- Drilled the Indico 5 development well, currently being tested, producing 4,000 bopd (on a restricted 34/64 inch choke) of light oil with 0.1% water cut

- Drilling rig currently moving to spud the Urraca 1 exploration well in April 2022, testing an exploration prospect in the northern part of the block, next to the Llanos 34 block

Strategic Acreage Expansion in Llanos basin

- GeoPark and Parex Resources executed an agreement by which GeoPark will obtain, subject to final signature of the contracts, a 50% WI in the CPO-4-1 block, in exchange for funding its 50% pro-rata share of existing commitments, with no carry

- The CPO-4-1 block is strategically located adjacent to Llanos 94 (GeoPark non-operated, 50% WI), Llanos 123 (GeoPark operated, 50% WI) and the CPO-5 blocks

- The block covers an area of 148,263 acres (600 sq km), with nearly 50% of the block covered with 3D seismic

- Existing commitments require drilling one exploration well during the first exploration phase, representing a firm investment commitment of $5-7mn ($2.5-3.5mn net to GeoPark) over the next three years

Chile:

Average net production in Chile decreased by 9% to 2,279 boepd in 1Q2022 compared to 2,491 boepd in 1Q2021, resulting from lower gas production due to limited drilling activities and the field’s natural decline. The production mix was 83% natural gas and 17% light oil in both 1Q2022 and 1Q2021.

During 1Q2022 drilling activity in the Fell block included the successful drilling of the Jauke Oeste 2 well, which is expected to be completed and tested in 2Q2022 after drilling of the Jauke 3 gas well.

Brazil:

Average net production in Brazil decreased by 9% to 1,815 boepd in 1Q2022 compared to 1,984 boepd in 1Q2021. The production mix was 99% natural gas and 1% oil and condensate in both 1Q2022 and 1Q2021.

Manati Gas Field Divestment Process Update

- In November 2020, GeoPark signed an agreement to sell its 10% non-operated WI in the Manati gas field in Brazil to Gas Bridge S.A. for a total consideration of R$144.4mn ($~29mn at an exchange rate of R$5 per dollar), including a fixed payment of R$124.4mn plus an earn-out of R$20.0mn, subject to obtaining certain regulatory approvals

- Closing of the transaction was subject to several conditions that should have been met before March 31, 2022 and that were not met. Upon expiry, GeoPark decided not to extend this deadline

- Manati gas field is a low-risk, fully developed and profitable upstream asset and GeoPark will continue evaluating alternatives to maximize the value of the field

Ecuador:

The Perico block is currently producing approximately 2,000 bopd gross, or 1,000 bopd net from the recent Jandaya and Tui discoveries, before government’s production share. Net production after the government’s production share equals 650-700 bopd. The government’s production share varies with the different oil prices and is approximately 30-40% with an Oriente crude oil price7 of $70-100 per bbl.

In 1Q2022 the average net oil production in Ecuador reached 290 bopd before the government’s production share or 190 bopd after the government’s share, with the quarter only partially reflecting production from recent Jandaya and Tui discoveries that took place in late January and late March 2022, respectively.

Perico block

During 1Q2022 the operator put on production two exploration wells, Jandaya 1 and Tui 1:

- The Jandaya 1 exploration well is currently producing 800 bopd gross of light oil with 1% water cut

- The Tui 1 exploration well is currently producing 1,200 bopd gross of light oil with 1% water cut

- Production from Jandaya and Tui is already being delivered to a nearby access point on Ecuador’s main pipeline system for sale to export markets

- GeoPark and its partner are currently evaluating subsequent activities in the Perico block, including a potential development drilling plan for both the Jandaya and Tui fields

- For further details, please refer to the releases published on January 24 and March 28, 2022

Espejo block

In the Espejo block, GeoPark is currently carrying out the acquisition of 60 sq km of 3D seismic, targeting to spud the first exploration well in 2H2022.

The Espejo and Perico blocks are attractive, low-risk exploration blocks located in the Sucumbios Province in the Oriente basin in northeastern Ecuador. The blocks are adjacent to multiple discoveries and producing fields and have access to existing infrastructure with spare capacity and a well-developed service industry.

Argentina:

Completion of the Divestment Process

- In November 2021, GeoPark accepted an offer from Oilstone Energía S.A. to purchase GeoPark’s 100% WI in the Aguada Baguales, El Porvenir and Puesto Touquet blocks for $16 mn

- Closing of the transaction occurred on January 31, 2022, and GeoPark no longer reports production from these blocks since that date

____________________

| 1 Based on current production in the Indico oil field compared to latest available information on Colombia’s oil production per field during December 2021 published by the ANH. |

| 2 Before the Government’s production share. |

| 3 Subject to final signature of the contract. |

| 4 Unaudited. |

| 5 Manati gas field divestment process was not completed before the March 31, 2022 deadline. |

| 6 Based on current production in the Indico oil field compared to latest available information on Colombia’s oil production per field during December 2021 published by the ANH. |

| 7 As of March 31 2021, the Oriente/Brent discount was $5.48/bbl. |

| 8 Brent oil price assumptions refer to April-December 2022 and consider a $3-4 Vasconia/Brent differential. Free cash flow excludes changes in working capital. |

| 9 Excluding potential and voluntary prepayments on existing financial debt. |