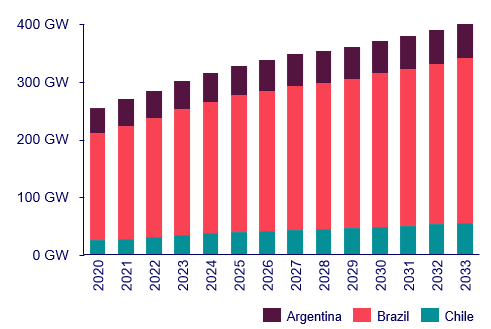

(WoodMac, 30.Nov.2023) — Driven by advances in batteries and lower costs, solar will outpace wind growth rates and become the leading technology for expansion over the next ten years in Argentina, Brazil, and Chile. The total solar market is set to add 48 gigawatts (GW) of utility and distributed projects, while wind will add 31 GW of onshore projects through 2033, with the total investment in new power supply leading to a cumulative capacity of 400 GW by 2033, based on a new analysis from Wood Mackenzie.

According to Wood Mackenzie’s “Southern Cone Investment Horizon Outlook” report, free market expansion will be one of the main drivers of renewables growth. Brazil stands out, adding 46 GW in the non-regulated market in “the upcoming decade.

“Challenges to boost demand and develop transmission capacity will be the main obstacles to further power market growth,” said Marina Azevedo, senior power analyst for Wood Mackenzie. “Grid congestion issues are being addressed in different ways.”

In Argentina, the government incentivises the private sector to invest in new lines and infrastructure reinforcement for guaranteed priority dispatch for its power plants. Brazil is increasing the frequency of transmission auctions, and a boom in infrastructure investments that will come online by 2030 has already been announced. Finally, in addition to transmission, Chile is advancing in regulation to spur battery storage in an attempt to find faster solutions to deal with the high levels of curtailments that are creating economic hurdles for renewable projects.

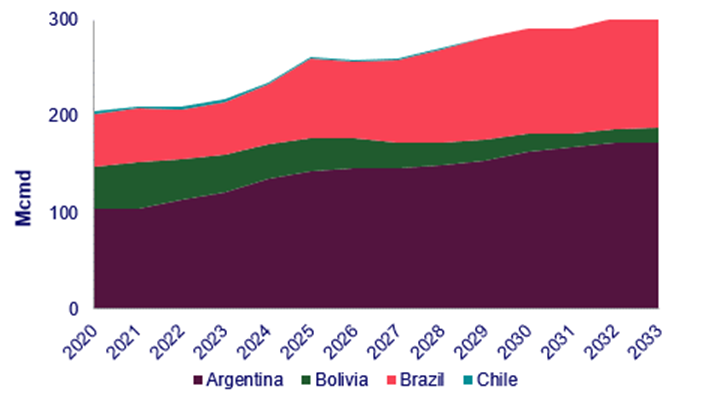

With investments in the power sector focused on renewables, gas-to-power demand will decrease in the region. Backed by policies to use natural gas to increase industrial activity, Brazil and Bolivia will depend on developing new major industrial projects to drive gas demand growth. In Argentina, macroeconomic uncertainties remain a challenge to investments.

The gas production decline in Bolivia, along with the increasing gas production in Brazil and Argentina, will reshape the regional dynamics in the next ten years, said Eduardo Seraphim, gas research analyst for Wood Mackenzie.

Added Seraphim, “The region will evolve from the current state of Bolivia balancing Brazil and Argentina and Argentina exporting seasonally to Chile to a state in 2033 where Argentina and Chile will be integrated, Bolivia will be producing only for its internal market and Brazil will be supplied by domestic production and by firm LNG offtake. However, developing domestic infrastructure in Brazil and Argentina in the following years is pivotal to enable this gas production increase.”

____________________