(Astra, 24.Jan.2022) — Astra Exploration Inc. (TSXV: ASTR) (formerly Momentous Capital Corp.) closed its qualifying transaction and will commence trading on the TSX Venture Exchange (the “TSX-V”) on 26 January 2022 under the symbol “ASTR”.

Company Highlights

- 25,056,753 shares outstanding (13,765,837 subject to escrow agreements)

- An expert technical team including the leaders of the following epithermal discoveries; El Peñon in Chile (Yamana Gold), Pingüino in Argentina (Austral Gold, formerly Argentex) and Panuco in Mexico (Vizsla Silver)

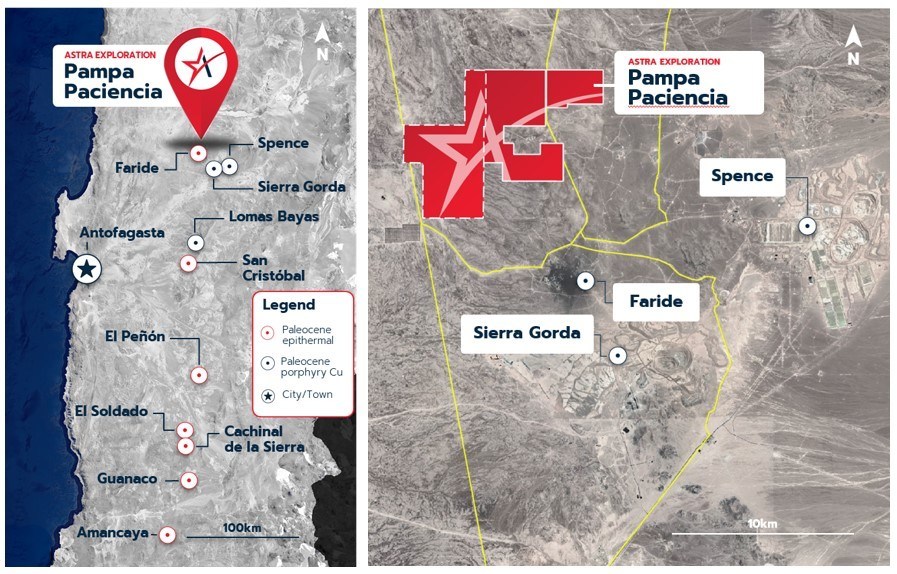

- The Pampa Paciencia project, our flagship asset with open high grade gold intercepts in northern Chile (Astra owns 80% interest in eastern claim group – see Figure 1)

- A fully-funded drilling program of 3,000 meters to commence at Pampa Paciencia in February, 2022

- The Cerro Bayo project (100% owned), a high-sulphidation epithermal (HSE) gold project in the world-class Maricunga belt of northern Chile

CEO Brian Miller commented: “Completion of the transaction and listing of Astra is the beginning of an exciting 2022 for the Company. Astra is well positioned with a very tight share structure and an exciting portfolio of epithermal gold projects. The team has a proven discovery track record and a deep understanding of exploration in Chile. The company’s philosophy is to apply our discovery expertise to epithermal projects in Chile which have been historically overlooked due to a focus on copper exploration in the country. We will start drilling immediately at Pampa Paciencia with a fully-funded program and are reviewing a pipeline of complimentary assets in the country.”

New Board and Management

On closing of the Transaction, all of the existing directors and officers of the company resigned and the following individuals were appointed as directors and officers of the Company:

Board Members

Brian Miller – Chief Executive Officer and Director

Charles Funk – Director

Darcy Marud – Director

David Caulfield – Director

Management

Brian Miller – Chief Executive Officer and Director

Mahesh Liyanage – Chief Financial Officer

Diego Guido – Exploration Director

Roberto Alarcon Bittner – VP & Country Manager (Astra Exploration Chile SpA)

Sheryl Dhillon – Corporate Secretary

Pampa Paciencia Project

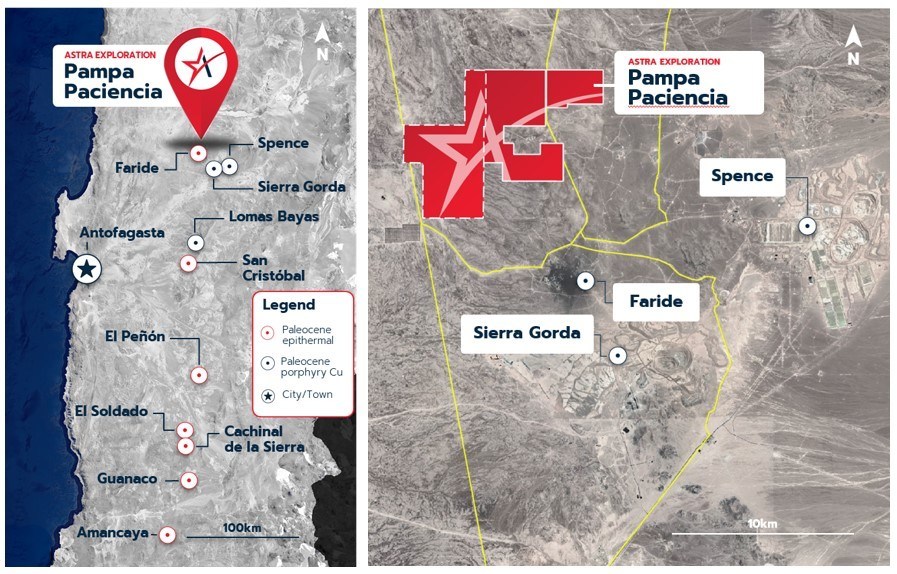

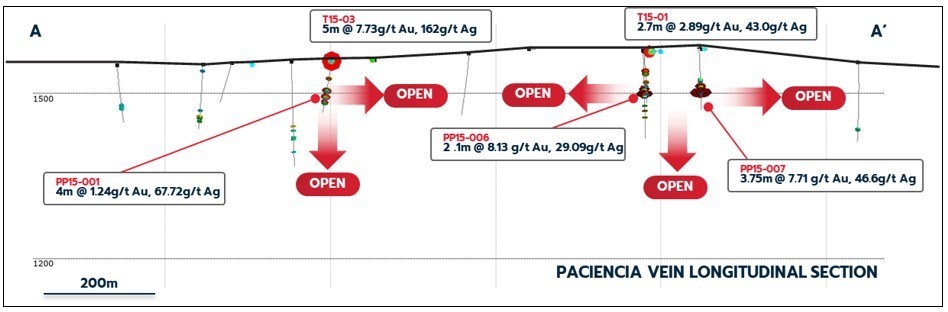

Pampa Paciencia is a drill ready low sulphidation epithermal (LSE) project located in Northern Chile. The property was previously explored by B2 Gold in a joint venture with Arena Minerals who discovered a northwest-trending vein (Paciencia Vein) in the North Zone (Figures 2 and 3) and completed a single drill program in 2015. This drill program returned a number of notable intercepts that Astra intends to expand upon:

- PP15-007: 3.75 meters grading 7.71 g/t (grams per tonne) gold and 46.6 g/t silver

- PP15-006: 2.1 meters grading 8.13 g/t gold and 29.1 g/t silver within a broader interval of 21 meters grading 1.69 g/t gold and 22.1 g/t silver

- PP15-001: 4.0 metres grading 1.24 g/t gold and 67.7 g/t silver

A longitudinal section along the Paciencia vein in the North zone (Figure 2) shows large gaps around mineralized intercepts and no drilling beneath them. Astra management believes these intercepts may be the discovery holes into mineralized shoots along the vein. The company will step out and underneath from these hits with a drill program commencing in February that aims to define larger panels of mineralization along the vein.

The company has also expanded the claim package with the acquisition of 1,700 hectares of 100% owned ground immediately west (Figure 1) of the outcropping veins. Pampa Paciencia is now a 3,840 hectare property and exploration by Astra in 2021 has defined a much larger vein field on the property.

A ground magnetic survey indicates the presence of a large magnetic low anomaly (Figure 3) at the North and Central zones (center of the project) interpreted as hydrothermal alteration related to the epithermal vein system, together with two more targets areas. The magnetic survey also defines structures with the same alignment as the historically mined Faride LSE deposit located five kilometres to the south.

Significant vein float has been identified across the property coinciding with these structural corridors. Company geologists believe they represent excellent potential for additional veins beneath thin cover that have never been systematically explored. Previous work has produced surface rock chip samples up to 93 g/t gold and 301 g/t silver (#187423) from the project.

Pampa Paciencia is a located in the Paleocene epithermal gold-silver belt of northern Chile. The region is heavily explored for copper, but to a much lesser extent for precious metals. A broad but relatively shallow alluvial cover reduces or all together eliminates the surface expression of mineralized systems in the region. This creates the opportunity to discover world-class epithermal gold-silver deposits like Yamana’s El Peñon deposit (200 kilometers south) which has a total known endowment of over 7 million ounces of gold and 207 million ounces of silver1. Like El Peñon, Pampa Paciencia is located in the well-defined Paleocene belt, similar in age, and hosts the same style of mineralization concealed by shallow cover.

Cerro Bayo Project

Cerro Bayo is a 4,480 hectare project located approximately 120 kilometers east of Copiapó in the Maricunga Belt of northern Chile, a prolific gold region with a known endowment of +90Moz of gold2. The project is road accessible with nearby infrastructure and is approximately 25 kilometers northeast of the Norte Abierto project (Figure 5) co-owned by Newmont and Barrick. Norte Abierto has proven and probable reserves of 23.2 million ounces of gold and 5.8 billion pounds of copper and measured and indicated resources of 26.6 million ounces of gold and 6.7 billion pounds of copper3.

Cerro Bayo was drilled in 1990 and only limited to the Cerro Bayo hill. 8 RC holes totalling 1,660 meters were completed and tested a very discrete area to a depth of approximately 200 meters below surface.

Mapping and a geochemical grid in the same area showed open high sulphidation (HSE) mineralization outcropping at surface, with anomalous gold.

Astra is encouraged by its current understanding of Cerro Bayo and is evaluating multiple avenues for advancing the project.

Transaction, Capital Structure and Escrow Details

Astra has closed its qualifying transaction previously announced in the company’s news releases dated 7 June 2021, 9 July 2021 and 17 November 2021 and more particularly set out in its filing statement dated 12 November 2021. The company’s common shares will commence trading on the TSX-V under the symbol “ASTR” on January 26, 2022.

In connection with the Transaction, Astra Exploration Limited also completed a private placement financing, the last tranche of which closed on 23 November 2021, pursuant to which an aggregate of 7,354,667 common shares were issued at a price of $0.30 per share for aggregate gross proceeds of $2,206,400.

Following the closing of the Transaction, the company has a total of 25,056,753 common shares issued and outstanding. An aggregate of 12,265,836 common shares of the company are subject to Tier 2 Value Security Escrow and will be released from escrow as follows: 10% of the escrowed shares will be released from escrow on the issuance of the final exchange bulletin confirming the completion of the Transaction by the TSXV, and 15% will be released on each of 6 months, 12 months, 18 months, 24 months, 30 months and 36 months thereafter. An additional 1,500,001 common shares of the company are subject to the terms of an existing CPC escrow agreement and will be released in accordance with the terms thereof.

Corporate Update

The company has engaged the marketing and IR services of G8 Strategies, led by Ira M. Gostin in Reno, Nevada. He was the founding IR officer at Tahoe Resources and helped build the company’s investment base, created strong relationships with analysts and institutional shareholders, and built a significant retail base which remained through Tahoe’s eventual acquisition.

The company has a contract with G8 Strategies through March 2022 and pays a cash-only remuneration of US$5,500 per month for the services.

Qualified Person Statement

The technical data and information as disclosed in this report has been reviewed and approved by Darcy Marud. Mr. Marud is a Practicing Member of the Association of Professional Geoscientists of Ontario and is a qualified person as defined under the terms of National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

____________________

1Source: S&P Global, Yamana Gold Site Visit Presentation, 2017

www.yamana.com

2Source: Goldfields AME Roundup 2017 Presentation

https://www.goldfields.com/pdf/investors/presentation/2017/New%20folder/presentation.pdf

3Source: Norte Abierto Website

https://norteabierto.com/nosotros/?lang=en