(Frontera, 3.Mar.2021) — Frontera Energy Corporation announced the results of its annual independent reserves assessment conducted by DeGolyer and MacNaughton (D&M). All dollar amounts in this news release and the Company’s financial disclosures are in United States dollars, unless otherwise noted.

Richard Herbert, Chief Executive Officer, commented:

“In 2020, Frontera safely and efficiently added 30.6 MMboe Proved plus Probable (“2P”) reserves including 6.4 MMboe from the exciting La Belleza discovery in the VIM-1 block. These strong reserves additions combined with reduced production resulted in 2P reserves replacement of 154% and extended Frontera’s Reserve Life Index to 10.3 years based on 2020 production. These results are a credit to the perseverance of our entire team given the difficult backdrop of COVID-19 induced restrictions and challenges, decreased capital spending that focused on our highest return production, limited exploration and development drilling and a significant decrease in oil prices during the year.”

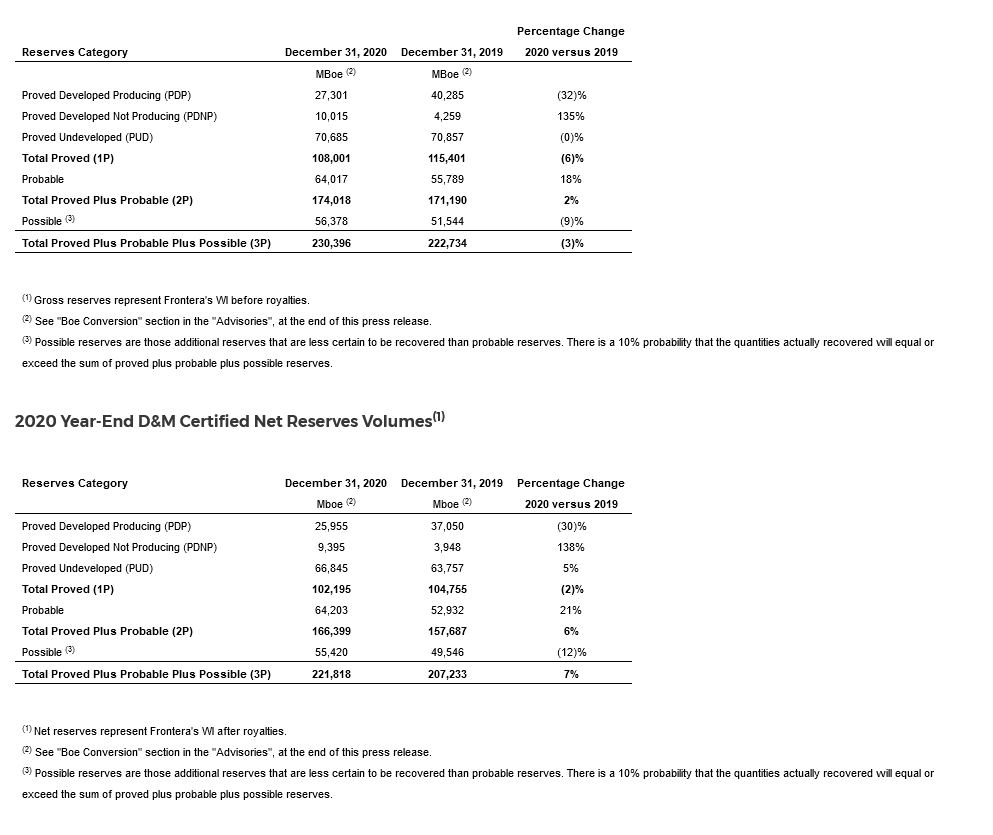

Frontera’s 2020 year-end 2P reserves additions of 30.6 MMboe were significantly driven by the La Belleza discovery in the VIM-1 block, reduction of in-kind royalty payments and reduction in high price participation (PAP) royalties related to the Quifa block and technical revisions. These additions were offset by 16.1 MMboe of 2020 production and the de-booking of 5.7 MMboe of reserves in Blocks 192 and Z-1 in Peru, and the Orito field in Colombia as Frontera pursues its exit from these areas. All of the company’s booked reserves for the year ended December 31, 2020 are located in Colombia.

2020 Reserves Report Highlights:

For the year ended 31 December 2020 the company:

- Added 18.9 MMboe of 2P reserves from its Colombia fields including Coralillo, Quifa SW, Hamaca, Jaspe, Ceibo and Copa.

- Added 6.4 MMBoe of 2P reserves and 17.5 MMBoe of Proved plus Probable plus Possible (“3P”) reserves from the exciting La Belleza gas condensate discovery.

- Added 24.8 MMboe of 2P reserves on a net basis, increasing the Company’s 2P net reserves to 166.4 MMboe, compared to 157.7 MMboe at 31 December 2019, an increase of 5.5%.

- Achieved a net 2P Reserve Replacement Ratio of 154% compared to 112% at December 31, 2019.

- Extended 2P reserves life index to 10.3 years compared to 6.7 years at December 31, 2019.

- Increased net 3P reserves by 14.6 MMboe to 221.8 MMboe, an increase of 7%, compared to 207.2 MMboe at 31 December 2019.

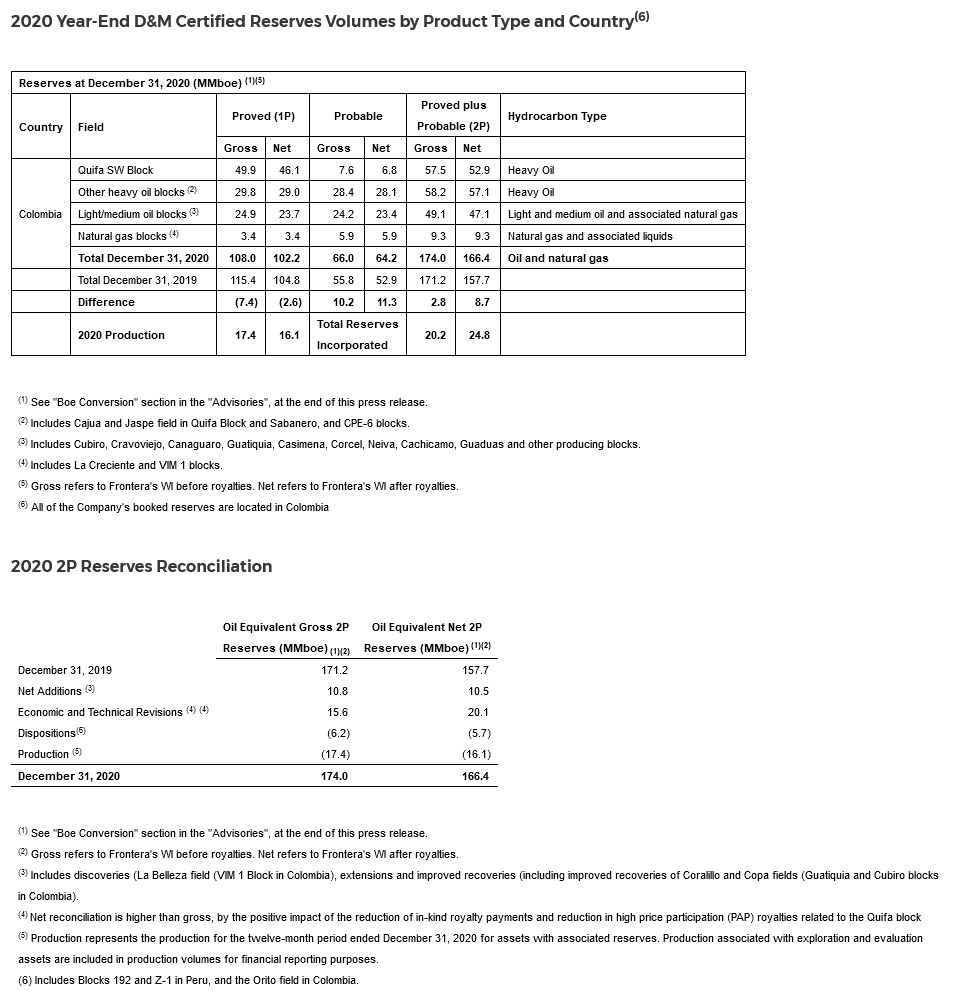

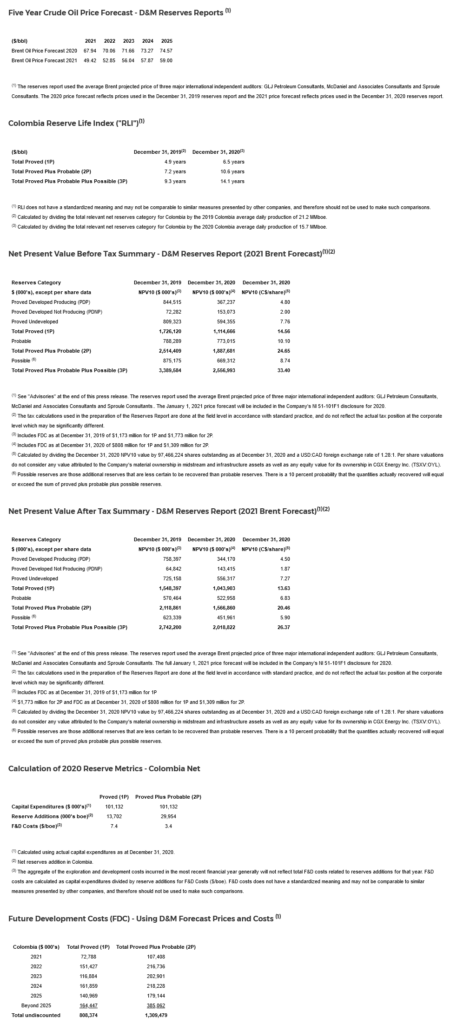

- Achieved a finding and development (F&D) cost of $3.38/boe in 2020 on a 2P basis ($11.53/boe in 2019) in Colombia with upstream reserves based capital expenditures of $101mn ($289mn in 2019) not including changes in future development costs (FDC). 1P F&D cost was $7.38/boe ($11.32/boe in 2019). F&D reductions in 2020 are due to reductions associated with future development cost, operating expenses and development plan optimizations.

- 2P reserves are comprised of 66% heavy oil, 30% light and medium oil and 4% natural gas.

- Increased 2P reserves on a gross working interest basis before royalties, by 2% to 174.0 MMboe compared to 171.2 MMboe at 31 December 2019. Increased 3P reserves on a gross working interest basis before royalties, by 3% in 2020 to 230.4 MMboe compared to 222.7 MMboe at December 31, 2019.

- The Net Present Value (NPV) for the net 2P reserves, discounted at 10% before tax, is $1.888bn at 31 December 2020, compared to $2.514bn at 31 December 2019. The decrease in NPV for the 2P reserves is primarily due to lower commodity prices at 31 December 2020. See the Net Present Value After Tax summary table below for more information.

Colombia Reserves Update

In Colombia, the company added 30.6 MMBoe of net 2P reserves significantly driven by 6.4 MMboe from the La Belleza discovery in the VIM-1 block, reduction of in-kind royalty payments, and reduction in high price participation (PAP) royalties related to the Quifa block and technical revisions of 18.9 MMboe from its Colombian fields including the Coralillo, Quifa SW, Hamaca, Jaspe, Ceibo and Copa fields. These additions were offset by 15.7 MMboe of 2020 production and the de-booking of the Orito field in Colombia. The Company achieved a 191% net 2P Reserves Replacement Ratio in Colombia.

In the VIM-1 block (Frontera 50% W.I. and Parex (Operator), 50% W.I.), the company added 6.4 MMBoe of 2P reserves and 17.5 MMBoe of “3P” reserves from the exciting La Belleza gas condensate discovery. Based on the company’s 3P estimates, Frontera believes there is significant upside potential in the reserves, which may be unlocked as the field is developed.

Frontera’s reserves evaluation is based upon the company’s assessment of the reservoir and fluid data obtained from the La Belleza-1 well, combined with the company’s mapping of the 3D seismic data over the field. This volumetric method of reserves estimation is one commonly used in the industry at this stage of evaluation. The joint venture expects to execute additional testing in 2021 to appraise the potential upside of the discovery and to gather more information to guide development plans for the field. The joint venture also plans to drill two exploration wells on the VIM-1 block in 2021 near La Belleza, on the Basilea and Planadas prospects. Frontera is excited about the upside potential of the La Belleza discovery and additional VIM-1 block exploration potential.

For the year ended 31 December 2020, the company’s reserves were independently evaluated by D&M, in accordance with the definitions, standards and procedures contained in the Canadian Oil and Gas Evaluation Handbook maintained by the Society of Petroleum Evaluation Engineers (Calgary Chapter) (“COGEH”) and National Instrument 51-101 Standards for Disclosure of Oil and Gas Activities (“NI 51-101”) and are based on the company’s 2020 year-end estimated reserves as evaluated by D&M in their reserves report dated 18 February 2021 with an effective date of 31 December 2020 (the “Reserves Report”). Additional reserve information as required under NI 51-101 will be included in the company’s NI 51-101F1 Form which is expected to be filed on SEDAR on 3 March 2021. See “Advisory Note Regarding Oil and Gas Information” section in the “Advisories“, at the end of this news release. Numbers in tables may not add due to rounding differences.

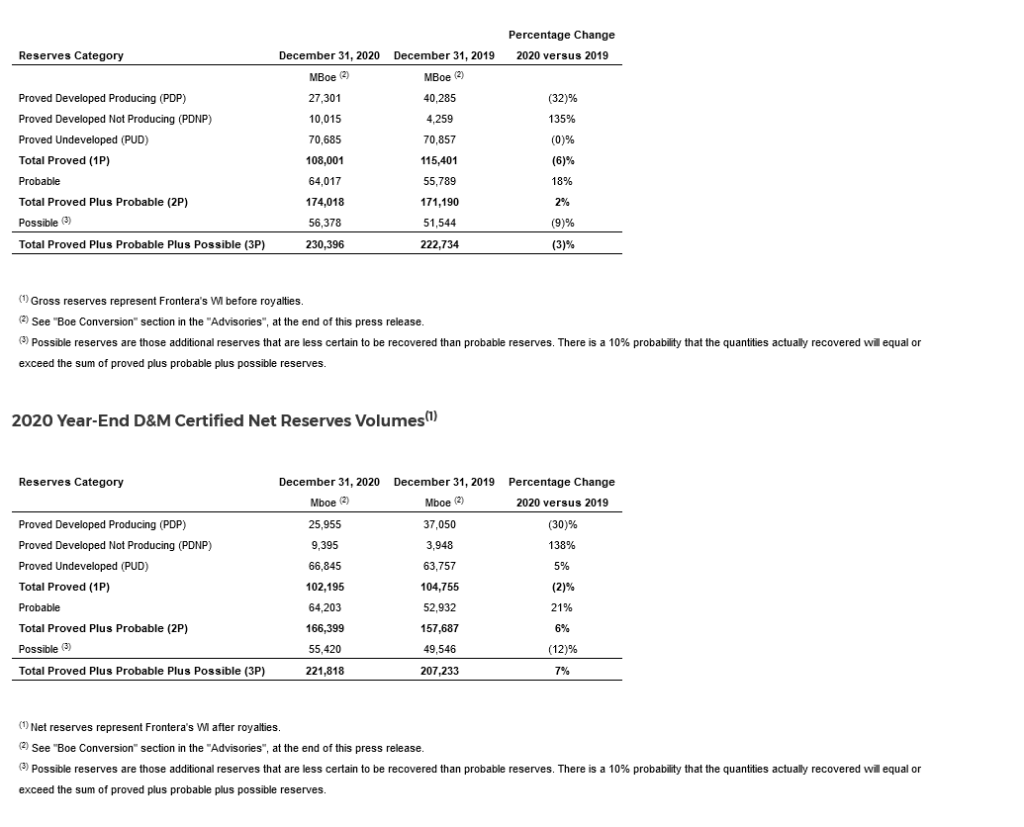

2020 Year-End D&M Certified Gross Reserves Volumes(1)

The following tables provide a summary of the company’s oil and natural gas reserves based on forecast prices and costs effective 31 December 2020 as applied in the Reserves Report. The company’s net reserves after royalties at 31 December 2020 incorporate all applicable royalties under Colombia fiscal legislation based on forecast pricing and production rates evaluated in the Reserves Report, including any additional participation interest related to the price of oil applicable to certain Colombian blocks, as at year-end 2020.

____________________