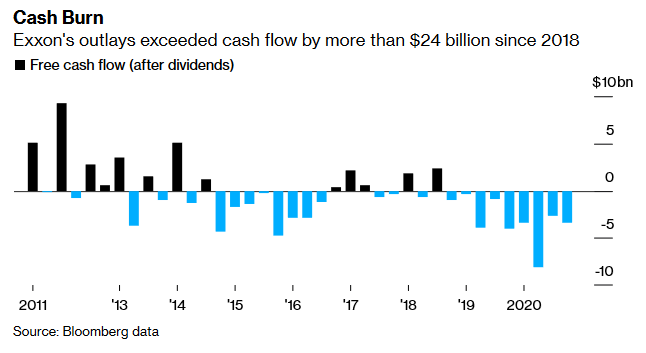

(Bloomberg, 3.Mar.2021) — Exxon Mobil Corp. pledged to boost the S&P 500 Index’s third-largest dividend and end two years of cash burn by bringing on high-profit oil and chemical projects while trimming expenses.

Exxon’s developments in Guyana and the U.S. Permian Basin will generate 10% returns even if crude dips below $35 a barrel, the company said in a statement Wednesday, ahead of its annual investor day presentation. Operational cash flow will rise 20% over the next five years under a more optimistic scenario of $50 oil, according to the company’s projections.

The stock was little changed at $56.15 in pre-market trading in New York on a day when the international crude benchmark rose as much as 2.4% to more than $64.

Follow Exxon’s annual strategy session for analysts on Bloomberg‘s live blog.

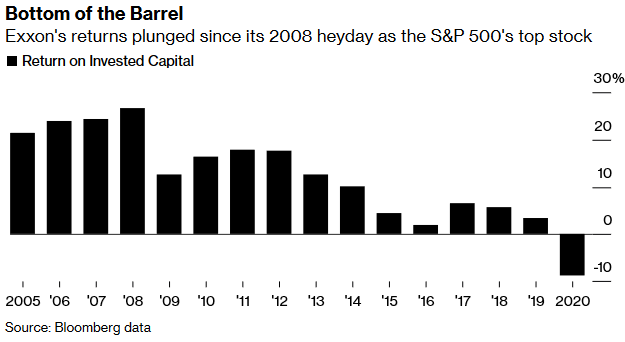

Chief Executive Officer Darren Woods is seeking to resuscitate Exxon’s reputation as a financial powerhouse and technological innovator while convincing investors that Exxon can play a role in the transition away from fossil fuels.

During a torrid 2020 in which Exxon shed more than $100 billion in market value, Woods reduced headcount, costs and long-term capital spending through the middle of the decade in a bid to boost near-term returns.

With the latest plan, Woods is seeking to firm up the company’s financial footing after a three-year period in which it burned through more than $24 billion in cash. The 30% cut to capital spending means Exxon’s production in 2025 will be about flat with 2021 — around 3.7 million barrels a day, on an energy-equivalent basis. By contrast Woods’ previous plan, first laid out to Wall Street three years ago, would have resulted a huge increase in output.

Exxon’s investments in carbon capture, sequestration and storage are expected to increase, more than doubling capacity over the next decade. This is likely to see the company continuing to support a carbon tax wherever it operates, says Bloomberg Intelligence analyst Fernando Valle

Key targets announced Wednesday include:

— Reiterated 700,000 barrels-a-day forecast for Permian Basin by 2025

– Pre-Covid-19, the plan was to reach 1 million barrels a day by 2024

– 7-10 rigs will be active on Exxon’s Permian wells this year, down from 10-12 at year-end 2020

– Permian production to be about 400,000 barrels a day in 2021, slightly down from 4Q 2020

— $3.5 billion of cash flow from Guyana and $4 billion from the Permian by 2025, assuming $50 crude

— $15 billion-a-year dividend can be maintained at $35 oil and “average” refining, chemical margins

Exxon has a lot of work still to do to restore its reputation as one of Wall Street’s most-reliable cash cows. The company posted its worst annual loss in four decades last year as low oil prices hit at a time when Exxon was in the middle of a costly investment plan. The oil giant now has to deal with record debt of nearly $70 billion, nearly double the level at the end of 2018.

Buoyed by a rally in oil prices to over $60 a barrel, Exxon’s shares have increased 36% this year.

____________________