(Kosmos, 9.Sep.2020) — Kosmos Energy has entered into an agreement with B.V. Dordtsche Petroleum Maatschappij (Shell), a wholly-owned subsidiary of Royal Dutch Shell PLC, to farm down interests in a portfolio of frontier exploration assets for approximately $100mn, plus future contingent payments of up to $100mn.

Under the terms of the agreement, Shell will acquire Kosmos’ participating interest in blocks offshore São Tomé & Príncipe, Suriname, Namibia, and South Africa (the Assets). The consideration consists of an upfront cash payment of approximately $100mn, plus contingent payments of $50mn payable upon each commercial discovery from the first four exploration wells drilled across the Assets, capped at $100mn in aggregate. Three of the four wells are currently planned for 2021.

Kosmos plans to use up to one-third of the initial proceeds to test two high-quality infrastructure-led exploration prospects in the Gulf of Mexico, each offering hub scale potential with a low-cost, lower-carbon development scheme. The company expects to use the remainder of the proceeds to reduce borrowings outstanding under its credit facilities.

Andrew G. Inglis, Kosmos Energy’s chairman and chief executive officer said: “With this transaction, we are continuing to focus our exploration portfolio on proven basins that offer superior returns with shorter payback and significant resource potential. The proceeds enable Kosmos to accelerate high graded exploration opportunities while strengthening the balance sheet, positioning Kosmos to create additional shareholder value. The contingent payments locked into the agreement with Shell ensure we retain upside from frontier exploration with no further investment.”

Post completion of the transaction, Kosmos retains a focused exploration portfolio with over six billion barrels of gross resource potential in the Gulf of Mexico and West Africa. Kosmos also expects to realize approximately $125mn in total savings across capital expenditures and general and administrative expenses over the next two years as a result of the transaction.

Closing of the transaction is expected in the fourth quarter of 2020 with an effective date of 1 September and is subject to customary conditions including government approvals.

Kosmos will present at the virtual Barclays CEO Energy-Power Conference on Wednesday, 9 September and an updated slide presentation has been posted to Kosmos’ website this morning.

Kosmos Interests

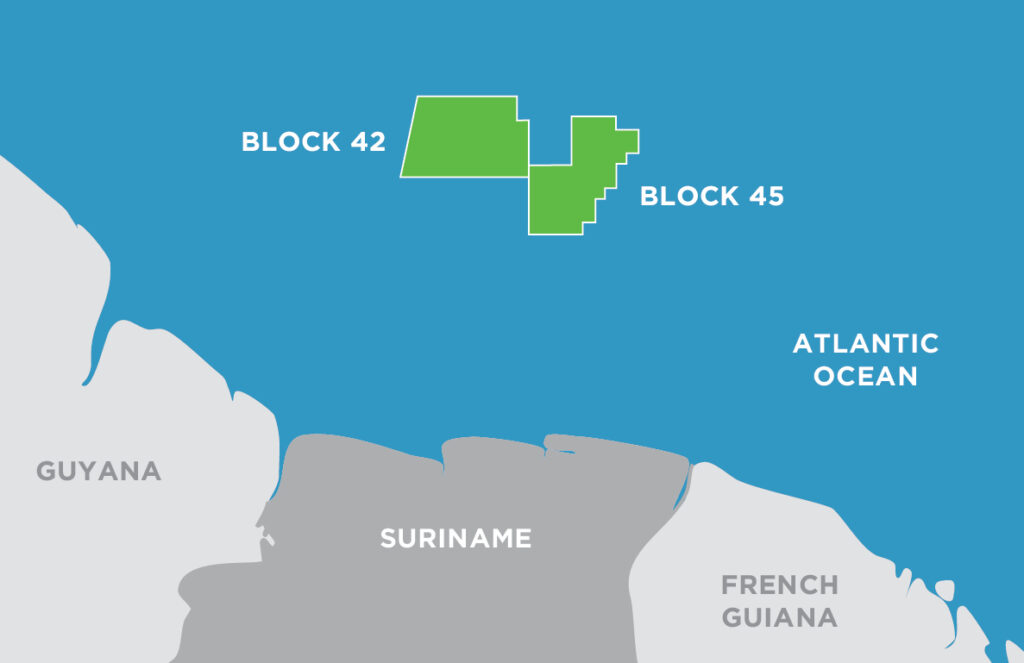

Kosmos In Suriname

In December 2011, Kosmos secured a position offshore Suriname, marking our first portfolio expansion beyond Africa. This position provides an exciting opportunity to explore the Upper Cretaceous stratigraphic play type along the northeast margin of South America. Industry results in the same geographic region, the Suriname-Guyana Basin, have proven the potential for significant hydrocarbon discovery.

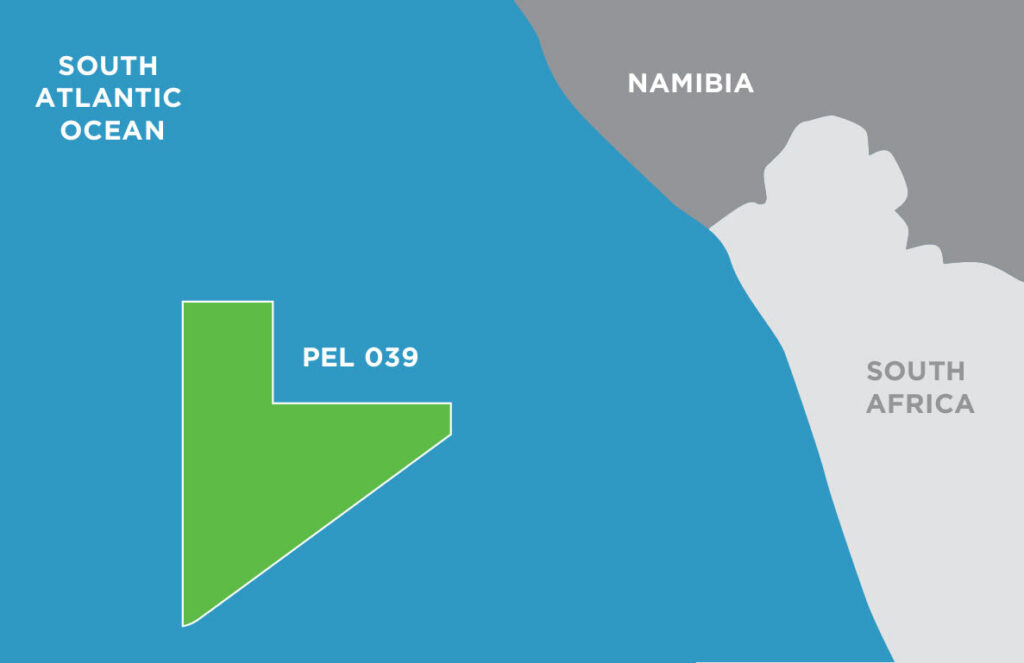

Kosmos In Namibia

In October 2018, Kosmos entered into a strategic exploration alliance with Shell Exploration Company to jointly explore in Southern West Africa. Initially the alliance is focusing on Namibia, where Kosmos has acquired interest in Shell-operated block PEL 39. As part of the alliance, the two companies will also jointly evaluate opportunities in adjacent geographies. This alliance is consistent with Kosmos’ strategy of partnering with supermajors to leverage complimentary skill sets. Shell has deep expertise in carbonate plays, while Kosmos brings significant knowledge of the Cretaceous in West Africa. Furthermore by working with Shell, Kosmos has a partner with the expertise to move exploration successes through the development stage efficiently.

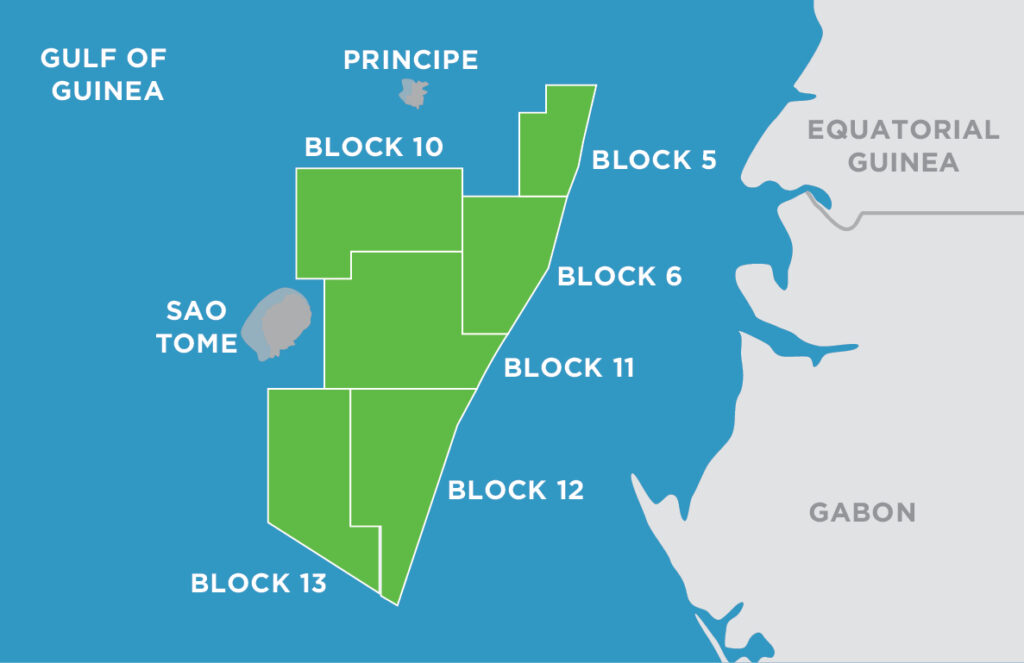

Kosmos In São Tomé and Príncipe

From 2015-2018, Kosmos took advantage of the industry’s downturn to build its exploration portfolio. Kosmos’ acquisition of acreage offshore Sao Tome marked a strategic re-entry into the Gulf of Guinea, an area we know very well and which provides an opportunity to pursue the core Cretaceous theme that was successful for us in Ghana. Our exploration team has extensive experience working in the basin.

Kosmos In South Africa

In early 2019, Kosmos executed a farm-in agreement with OK Energy to acquire a non-operated interest in the Northern Cape Ultra-Deep block offshore the Republic of South Africa. The acquisition was part of the strategic exploration alliance with Shell Exploration Company to jointly explore in Southern West Africa, and reaffirms the Kosmos strategy of capturing large acreage positions as first movers in a frontier basin. In conjunction with PEL39 in Namibia, Kosmos has established a leading, contiguous position with play diversity and exploration upside in the highly-anticipated Orange Basin.

__________