(Argus, 19.May.2020) — A new decree in Argentina that establishes above-market prices for domestic crude obliges oil companies to maintain production, payrolls and investment and prevents them from repatriating profits.

The decree sets a minimum price of $45/bl for domestic sales of light sweet Medanito crude. Export taxes for crude and refined products have been cut to zero from 8pc, as long as the Brent price remains below $45/bl. If the price surpasses that threshold, export taxes would be gradually reinstated, and then fully reimposed at a Brent price above $60/bl.

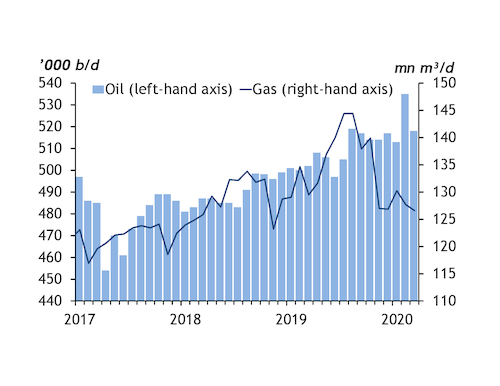

While the decree remains in effect, all oil producers must maintain activity and output at 2019 levels. But the act provides some leeway, emphasising that the government will consider reduced domestic and international demand caused by Covid-19 restrictions. Producers are also required to maintain existing service contracts and keep the same number of workers they had on 31 December 2019. Any company that fails to fulfill its annual investment plan could be fined. Fines range from the equivalent of 22m³ (138 bl) of crude at the domestic price to a maximum of 2,200m³ for each infraction.

And while the minimum price is in effect, producing companies are limited in their access to the foreign exchange market — unless necessary for their daily operations — effectively barring them from sending profits outside Argentina. Refiners are obliged to purchase all crude from domestic producers and are prohibited from importing any products that are available at home. As part of the measure, the government has vowed not to raise fuel taxes until 1 October — a move meant to thwart pump price increases.

Independent producers such as Vista and Pluspetrol and refiners such as Trafigura and Raizen are most affected by the new decree. State-controlled YPF, Argentina’s top producer and refiner, is less exposed because of its integrated operations, and falling demand stemming from coronavirus restrictions means it has suspended third-party crude purchases.

The decree marks a big win for oil-producing provinces seeking to protect tax revenue. “This new scheme gives predictability, security and trust. It puts forward clear agreed-upon rules to develop hydrocarbon activity,” Neuquen province governor Omar Gutierrez says. Neuquen is home to the key Vaca Muerta shale.

It takes two to tango

And YPF’s overhaul this month of its senior management team, under new chief executive Sergio Affronti, points to a renewed focus on shale, supported by the imposition of the domestic crude price controls. Affronti has eliminated the position of upstream vice-president, formerly held by Pablo Bizzotto, splitting the role in two. Gustavo Astie takes charge of the conventional upstream, with Pablo Iuliano responsible for the unconventional side. Iuliano has broad experience developing shale gas projects at YPF and at local independent Tecpetrol. “We have reorganised the team to grow again,” Affronti says.

Affronti’s predecessor, Daniel Gonzalez, had become downbeat about domestic shale, given the global crude price collapse. YPF has halved output at its flagship Loma Campana block — Argentina’s largest producing shale asset — because of storage constraints. Hydraulic fracturing completely halted at Vaca Muerta in April.

But Buenos Aires’ market intervention and shale revival hopes come as Argentina faces a possible sovereign debt default. The government hopes investors will accept an offer to restructure $66bn in bonds, arguing that the country will need time to recover from the effects of Covid-19. It will be forced to default if there is no deal or if it fails to make a $500mn coupon payment by the end of 22 May.

— Daniel Politi

***