(Frontera, 5.Mar.2020) — Frontera Energy Corporation released its Consolidated Financial Statements, Management Discussion and Analysis (“MD&A“), Annual Information Form (“AIF“) and Form 51-101 F1 – Statement of Reserves Data and Other Oil and Gas Information for the Company (the “F1 Report“) for the year ended December 31, 2019. These documents, among others, will be posted on the Company’s website at www.fronteraenergy.ca and SEDAR at www.sedar.com. All values in this news release and the Company’s financial disclosures are in United States dollars unless otherwise stated.

OPERATIONAL AND FINANCIAL HIGHLIGHTS

Operational

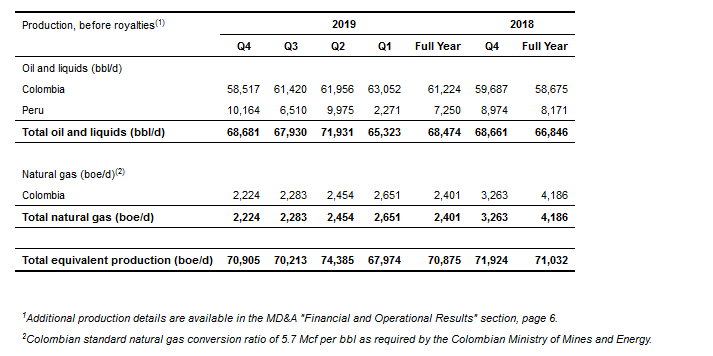

— Production remained stable averaging 70,905 boe/d in the fourth quarter of 2019 and 70,875 boe/d for the full year of 2019.

— As previously reported, 102% of gross 2P reserves and 112% of net 2P reserves were replaced in 2019 with 11% growth in Colombia gross PDP reserves, and gross 2P reserve life index for Colombia of over 7 years.

— Second testing period on the La Belleza exploration on the VIM-1 block yielded very encouraging results with stable production rates and lowering water cut. The Asai-1 exploration well on the Guama block is drilling at 7,400 feet towards a target depth of 12,500 feet on time and on budget.

— Oil production represented 97% of total Company production in the fourth quarter of 2019, compared to 97% in the third quarter of 2019 and 95% in the fourth quarter of 2018.

Financial

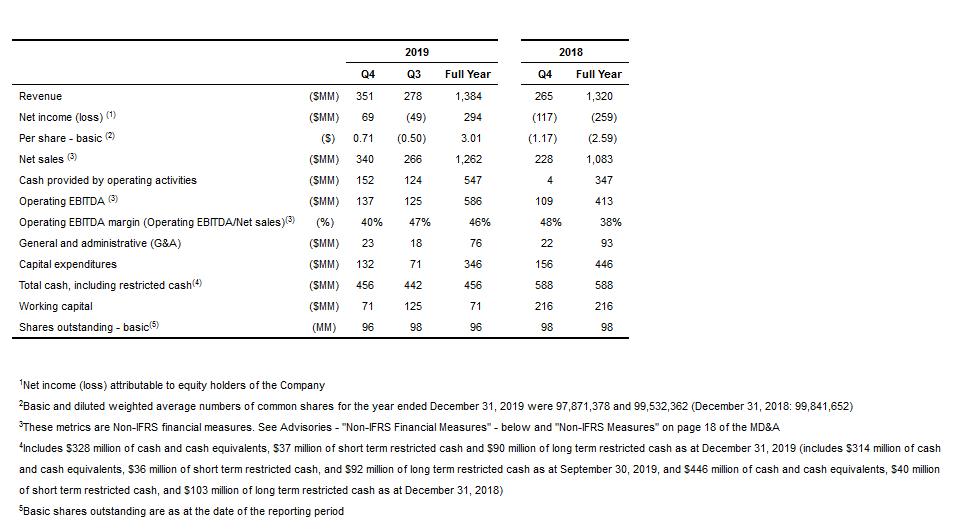

— Net income was $69 million ($0.71/share) in the fourth quarter of 2019 compared to a net loss of $49 million ($0.50/share) in the third quarter of 2019 and a net loss of $117 million ($1.17/share) in the fourth quarter of 2018.

— Cash provided by operating activities of $152 million in the fourth quarter of 2019 was 22% higher than the prior quarter and over 100% higher than in the prior year quarter. During 2019, the Company delivered $131 million of excess cash provided by operating activities of $547 million, compared to cash used in investing activities of $416 million.

— Operating EBITDA of $137 million was 10% higher than the prior quarter and 25% higher than the prior year quarter.

— Capital expenditures of $132 million in the fourth quarter of 2019 were 87% higher than in the third quarter of 2019 and 15% lower than the fourth quarter of 2018, as anticipated, reflecting an increase in exploration activity during the quarter on the VIM-1 and CPE-6 blocks and the expansion of water treatment and disposal capacity at CPE-6.

— Total cash, including restricted cash, was $456 million as at December 31, 2019, up 3% from the third quarter of 2019 and down 23% compared to December 31, 2018, reflecting $123 million in cash returned to shareholders in 2019 via dividends and buybacks.

— Approximately 40% of expected 2020 net production after royalties was hedged, as of year-end, using a variety of financial instruments with an average Brent floor price of $58.44/bbl.

— General and administrative expenses (“G&A“) of $76 million in 2019 was down 18% compared to 2018, ahead of management’s expectations of 10% to 15% savings during the year.

Shareholder Initiatives

— During the fourth quarter of 2019, the Company repurchased for cancellation 1.5 million shares at a cost of $12 million (C$10.06/share) under its normal course issuer bid (“NCIB“). Since October 18, 2019 to date, under the renewed NCIB, the Company has repurchased for cancellation 2.9 million shares at a cost of $22 million (C$9.79/share).

— On March 4, 2020, the Company’s Board of Directors declared a dividend, payable on or about April 16, 2020 of C$0.205 (approximately $15 million in aggregate), to common shareholders of record on April 2, 2020.

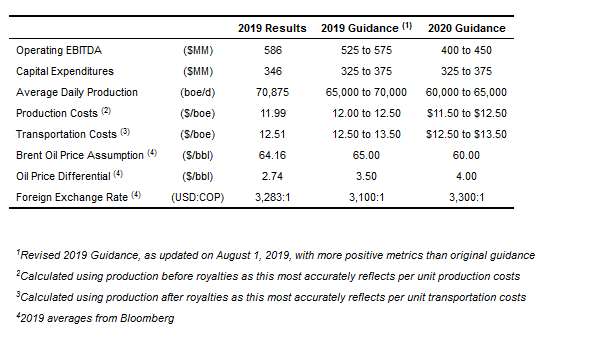

2019 and 2020 Guidance

The Company delivered 2019 results better than its upwardly revised guidance for Operating EBITDA and average daily production and at the bottom end of its guidance for production and transportation costs. EBITDA sensitivities for all the major inputs for 2020 Guidance can be found on page 7 of the Company’s corporate presentation available on its website.

Gabriel de Alba, Chairman of the Board of Directors of the Company, commented:

“The strong operational and financial results delivered by the Frontera team in 2019 enabled the Company to continue delivering significant returns to shareholders through dividends and buybacks while maintaining a strong balance sheet and a significant net cash position. Since announcing a dividend policy in December 2018, the Company has paid out C$1.645/share in dividends, a yield of over 13%. Additionally, since announcing our first share buyback program in July 2018, Frontera has bought back over 5.6 million shares or nearly 6% of the issued equity. Frontera is off to a positive start in 2020, with exploration success in Colombia and many additional opportunities to continue growing the business in 2020 and coming years.”

Richard Herbert, Chief Executive Officer of Frontera, commented:

“2019 was the year when Frontera repositioned its portfolio for growth, while maintaining stable production and growing reserves in its core assets. We added new exploration blocks in Colombia, Ecuador and offshore Guyana, while also executing a farm-in agreement with Parex Resources on the VIM-1 block in Colombia which has already delivered exploration success. During 2019 we increased production from the CPE-6 block by more than three times, while adding reserves on the block through successful near field exploration. Quifa production was also strong in 2019 following the expansion of water treatment and disposal capacity at the end of 2018. Overall our strategy is working, as we maintain our core areas of operation in Colombia and deliver new opportunities through exploration. Our teams executed on the implementation of cost savings initiatives, with G&A down 18% year over year, production costs down 4% on a boe basis, and transportation costs down 2% on a boe basis. These projects combined with solid production, enabled the Company to deliver cash provided by operating activities which was $131 million higher than cash used in investing activities.

Finally, although the price of oil is off to a challenging start in 2020, Frontera is disciplined and we will manage our capital program and cost structure to weather weaker commodity prices. For 2020, the Company has hedged approximately 40% of net production at Brent oil prices above $58/bbl, and we are committed to maintaining a strong balance sheet through this period. We have also acted swiftly to the recent downward movement in oil prices. In addition to cutting all non essential travel and reducing contractor headcount, we have evaluated all our 2020 capital projects and have identified between $50 million to $75 million in capital projects that can be deferred depending on the price of oil.”

Financial Results

The average Brent oil benchmark price increased in the fourth quarter of 2019 to an average of $62.42/bbl, up 1% from $62.03/bbl in the third quarter of 2019. Brent oil benchmark price averaged $68.60/bbl in the fourth quarter of 2018. The Company’s net realized sales price of $56.22/bbl in the fourth quarter of 2019 was 6% higher than the prior quarter and 14% higher than in the fourth quarter of 2018.

In 2019, net income attributable to equity holders of the Company was $294 million ($3.01/share), compared to a net loss of $259 million in 2018. During the fourth quarter of 2019, net income attributable to equity holders of the Company was $69 million ($0.71/share), compared with net losses in each of the prior quarter and prior year quarter. In addition to operational execution net income growth was driven by the booking of additional deferred tax assets resulting from the growth in the Company’s reserves during 2019 and a reduction in presumptive tax rates in Colombia.

For the fourth quarter of 2019, net sales of $340 million were 28% higher in the third quarter of 2019 and 49% higher than in the fourth quarter of 2018 driven by higher net sales realized price of $56.22/boe and additional sales volumes in Peru during the quarter.

Cash provided by operating activities was $547 million in 2019, 58% higher than in 2018 reflecting higher net realized sales price, stable production, higher sales volumes and lower costs. In the fourth quarter of 2019 cash provided by operating activities was $152 million in the fourth quarter compared to cash provided by operating activities of $124 million in the third quarter of 2019, reflecting higher sales volumes and oil prices. During the fourth quarter of 2019 the Company generated cash provided by operating activities that was $19 million higher than capital expenditures of $132 million.

Operating EBITDA of $137 million in the fourth quarter of 2019 increased 10% in comparison with the third quarter of 2019 and was 25% higher than in the fourth quarter of 2018 as a result of a reduction of inventory in Peru and stronger realized prices.

For 2019, production costs were 4% lower than in 2018 on a boe basis as a result of a weaker peso and cost savings initiatives implemented in the second half of the year. Production costs during the fourth quarter of 2019 of $13.76/boe were 19% higher compared to the third quarter of 2019 and 8% higher than in the fourth quarter of 2018 reflecting a higher amount of work over and well service activity in Colombia and costs associated with increased sales from Peru.

In 2020 we will drill meaningful exploration wells in Colombia, Ecuador and offshore Guyana. We will continue to manage our capital exposure and our risk when it comes to exploration. Our new asset teams are looking to start delivering more cost savings and efficiency improvements throughout the portfolio as they move through 2020.

On a boe basis, transportation costs were 2% lower in 2019 compared to 2018. In the fourth quarter of 2019 transportation costs were $12.84/boe, 7% higher than in the third quarter of 2019 and flat compared to the fourth quarter of 2018.

G&A costs were 18% lower in 2019 compared to 2018 as a result of ongoing cost savings initiatives, lower employee-related costs and lower office lease costs due to the adoption of IFRS 16. G&A costs were $23 million during the fourth quarter of 2019, 24% higher than the third quarter of 2019 and 5% higher than the fourth quarter of 2018, primarily as a result of a short-term employee incentive plan implemented in the fourth quarter of 2019.

Cash and cash equivalents including restricted cash totaled $456 million as at December 31, 2019, an increase of $14 million compared to September 30, 2019 reflecting $67 million of cash provided by operating activities in excess of cash used in investing activities offset by $15 million in dividends paid, $12 million used to repurchase common shares and $17 million used in the payment of interest on long term debt.

During the fourth quarter of 2019 the Company paid a regular dividend of C$0.205/share. In addition, the Company paid its regular quarterly dividend of C$0.205/share on January 17, 2020 and on March 4, 2020, announced a regular quarterly dividend of C$0.205 to be paid on or about April 16, 2020 to shareholders of record on April 2, 2020.

In October 2019 the Company announced the renewal of its normal course issuer bid, pursuant to which the Company may repurchase up to 6,532,400 shares of the Company, representing 10% of the public float, during a 12 month period between October 18, 2019 and October 17, 2020. To date, under the renewed NCIB, the Company repurchased for cancellation 2,941,128 shares at an average price of C$9.79, at a cost of $22 million.

The Company has hedged approximately 40% of net production during the first three quarters of 2020, and about 15% of net production for the fourth quarter of 2020 using a combination of Brent oil price linked purchased put options, zero cost collars, put spreads and three-way collars to protect the Company’s balance sheet and capital program within hedging limits set by the Board of Directors.

Operational Results

Production in the fourth quarter of 2019 averaged 70,905 boe/d, in-line with 70,213 boe/d in the third quarter of 2019 as a result of stable production levels in Peru during the quarter and natural declines and temporary production shut-ins in Colombia as water handling capacity was added in the CPE-6 block.

Company production was 97% oil-weighted in the fourth quarter of 2019 compared to 97% in the third quarter of 2019 and 95% in the fourth quarter of 2018. The higher oil mix as a percentage of total production results in better realized prices given stronger Brent oil prices and narrow price differentials during the fourth quarter of 2019.

During the fourth quarter of 2019, capital expenditures were $132 million up 87% compared to $71 million in the previous quarter and down 15% from the fourth quarter of 2018. The increase reflects additional planned exploration drilling in the fourth quarter of 2019 on the VIM-1 block in the Lower Magdalena Valley and on the CPE-6 block in the Llanos basin, combined with a water handling and disposal expansion project on the CPE-6 block. Additionally, the Company incurred costs associated with the 3D seismic acquisition on the Corentyne block offshore Guyana.

The Company drilled 21 wells during the fourth quarter of 2019, including 18 development wells and three exploration wells. Three previously disclosed exploration wells on the Sabanero block were subsequently reclassified as development wells of which two were drilled during the fourth quarter of 2019. During the first quarter of 2020, Frontera expects to drill 28 development wells (21 at Quifa, six at CPE-6, and one at Canaguaro), and commence drilling one exploration well (Asai-1 on the Guama block), targeting liquids and natural gas.

In December 2019, the Company began drilling the Canaguay-3 development well on Canaguaro block. On February 20, 2020, the well reached target depth with a measured depth of 15,193 feet, encountering a combined 55 feet of net oil pay over three separate Mirador formations. The well will be tested and is expected to be put on production in the coming weeks using existing infrastructure on the Canaguaro block.

On February 6, 2020, the Company (50% WI), along with its joint venture partner, Parex Resources Inc. (50% WI, operator), announced the results of the successful La Belleza-1 exploration well on the VIM-1 block in the Lower Magdalena Valley. The second well test yielded similar results as the first test with average production of 4,800 boe/d (2,670 bbl/d of 43 degree API oil, and 12.6 mmcf/d of natural gas), with a 14% draw down, well head flowing pressure of 3,770 psi and a lower water cut of 6%. The well remains shut-in for a pressure build up test which will help determine next steps. More drilling is expected on the block during 2020 as part of the ongoing evaluation and planning phase for commercial development.

In February 2020, the Company spud the Asai-1 exploration well on the Guama block in the Lower Magdalena Valley (Frontera 100% WI, operator), targeting a primary objective oil, natural gas condensate and natural gas structure in the Porquero formation at approximately 12,000 feet. The well is currently drilling at over 7,400 feet and has encountered natural gas shows in shallow, secondary objectives as expected. The well is expected to complete drilling in the middle of April 2020 with results in May 2020.

***