BOGOTA, COLOMBIA (By Ana Sanches, Energy Analytics Institute, 12.Nov.2025, Words: 372) — G Mining Ventures Corp. (GMIN) reported its financial and operational results for the three and nine months ended 30 Sep. 2025.

“The third quarter marked a defining period for GMIN. Tocantinzinho is now operating at steady state—delivering record production, free cash flow, and margins that position us among the lowest-cost producers in the Americas,” said Louis-Pierre Gignac, president and CEO on 12 Nov. 2025 in an official statement.

“With the Oko West permits, financing, and formal construction decision now secured, we are entering the next phase of disciplined, self-funded growth—demonstrating the strength of our operating team and the consistency of our execution model. As we transition to a multi-asset producer with Oko West under construction and Gurupi advancing through permitting and exploration, our focus remains on building long-life, low-cost operations that generate sustainable returns and long-term value for our shareholders. Our ability to advance growth responsibly—while maintaining strong safety, environmental, and community performance—remains central to how we build long-term value,” Gignac said.

Other highlights include:

— gold production was 46,360 ounces (“oz”) (YTD – 124,525 ounces), representing a 9% increase over Q2 2025, reflecting continued strong throughput and recoveries at Tocantinzinho Gold Mine (“TZ”),

— robust financial results: revenues of $161.7mn (YTD – $389.3mn) supported by record average realized gold price of $3,292 per ounce (YTD – $3,124 per ounce),

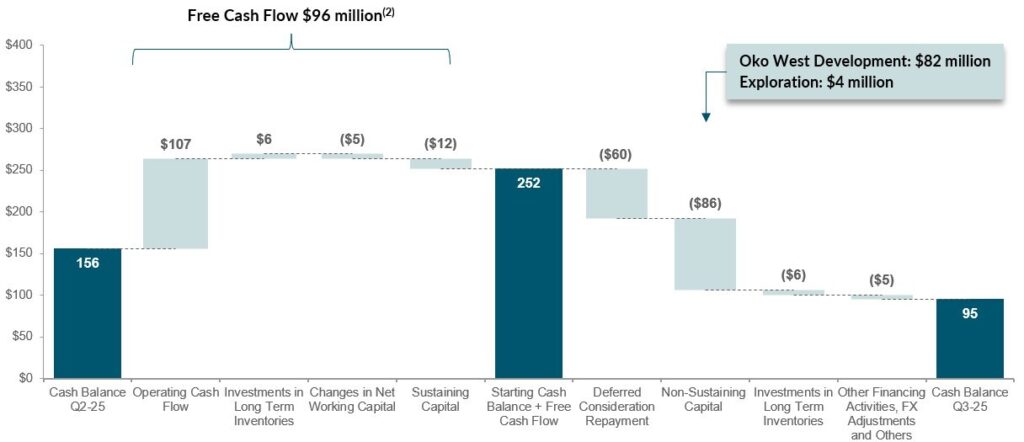

— record free cash flow: generated $95.8mn in free cash flow (YTD – $190.7mn), representing a 59% increase from Q2 2025,

— strong Earnings before Interest, Taxes, Depreciation and Amortization (EBITDA): generated adjusted EBITDA of $122.6mn (YTD – $283.6mn), a 32% increase from Q2 2025,

— strong quarterly net income: reported net income of $123.8mn (YTD – $196.8mn), or $0.55 per share (YTD – $0.87 per share),

— low-cost operations: reported all-in sustaining cost (“AISC“) per ounce of gold sold of $1,046 in Q3 2025 (YTD – $1,121 per ounce), compared to an average gold price received (2)(4) of $3,114 per ounce (YTD – $2,916 per ounce), implying a robust AISC margin(2) of $2,068 per ounce (YTD – $1,795 per ounce),

— Oko West gold project capital advancing: invested $93mn in project capital in Q3 (YTD – $156mn), with full construction now underway.

____________________

By Ana Sanches reporting from Bogota. © 2025 Energy Analytics Institute (EAI). All Rights Reserved.